Answered step by step

Verified Expert Solution

Question

1 Approved Answer

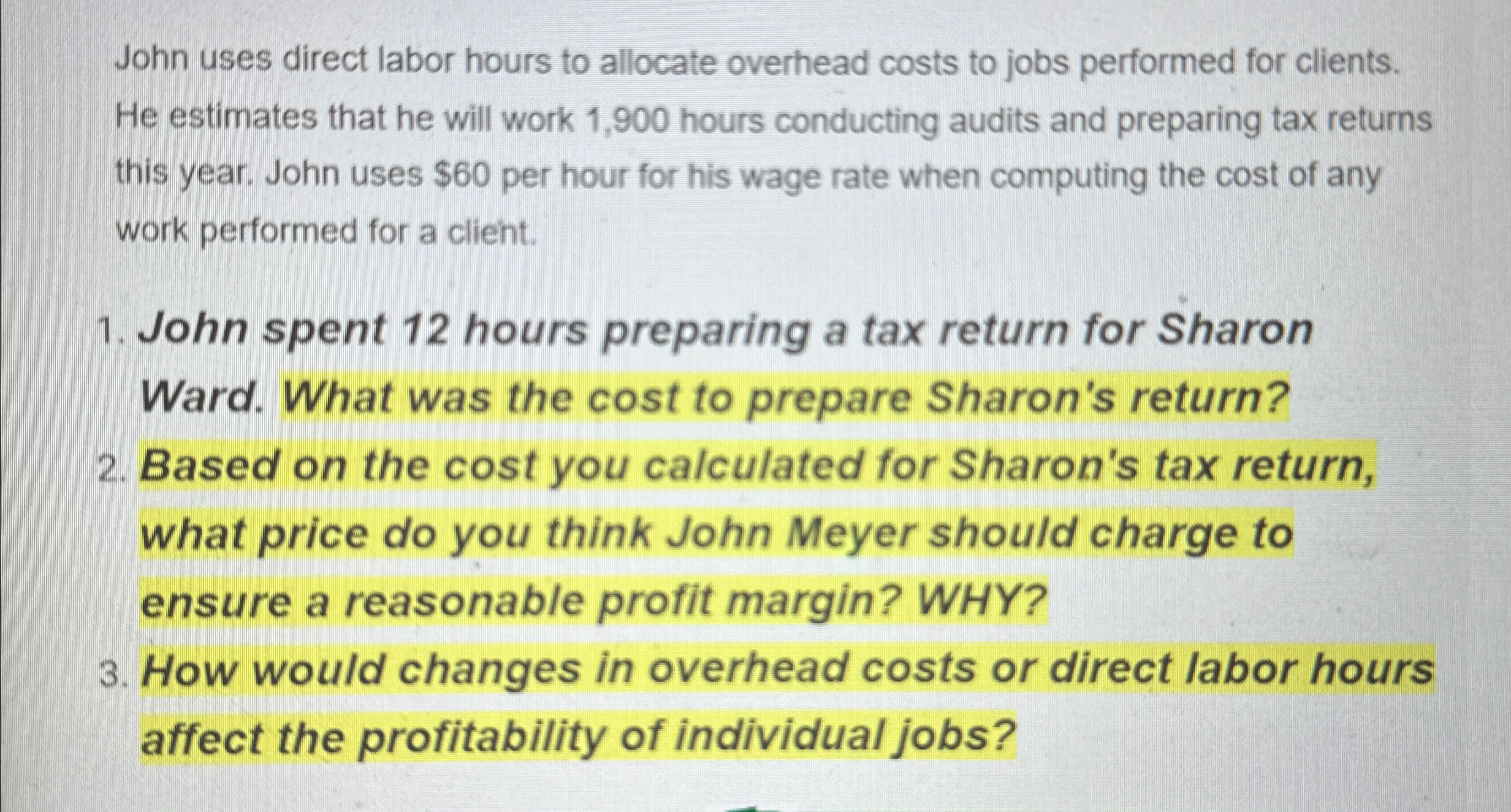

John uses direct labor hours to allocate overhead costs to jobs performed for clients. He estimates that he will work 1 , 9 0 0

John uses direct labor hours to allocate overhead costs to jobs performed for clients.

He estimates that he will work hours conducting audits and preparing tax returns

this year. John uses $ per hour for his wage rate when computing the cost of any

work performed for a client.

John spent hours preparing a tax return for Sharon

Ward. What was the cost to prepare Sharon's return?

Based on the cost you calculated for Sharon's tax return,

what price do you think John Meyer should charge to

ensure a reasonable profit margin? WHY?

How would changes in overhead costs or direct labor hours

affect the profitability of individual jobs?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started