Answered step by step

Verified Expert Solution

Question

1 Approved Answer

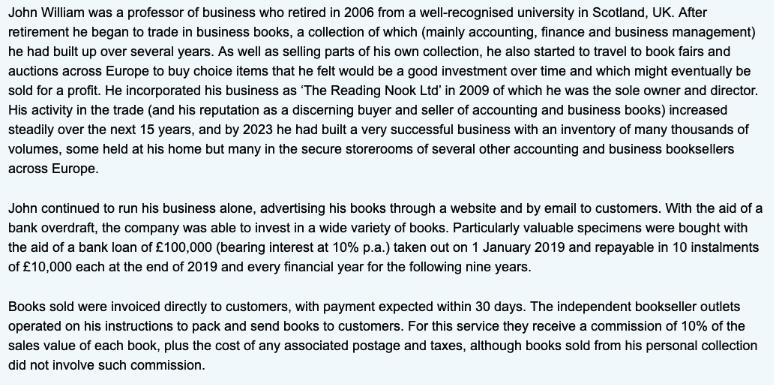

John William was a professor of business who retired in 2006 from a well-recognised university in Scotland, UK. After retirement he began to trade

John William was a professor of business who retired in 2006 from a well-recognised university in Scotland, UK. After retirement he began to trade in business books, a collection of which (mainly accounting, finance and business management) he had built up over several years. As well as selling parts of his own collection, he also started to travel to book fairs and auctions across Europe to buy choice items that he felt would be a good investment over time and which might eventually be sold for a profit. He incorporated his business as 'The Reading Nook Ltd' in 2009 of which he was the sole owner and director. His activity in the trade (and his reputation as a discerning buyer and seller of accounting and business books) increased steadily over the next 15 years, and by 2023 he had built a very successful business with an inventory of many thousands of volumes, some held at his home but many in the secure storerooms of several other accounting and business booksellers across Europe. John continued to run his business alone, advertising his books through a website and by email to customers. With the aid of a bank overdraft, the company was able to invest in a wide variety of books. Particularly valuable specimens were bought with the aid of a bank loan of 100,000 (bearing interest at 10% p.a.) taken out on 1 January 2019 and repayable in 10 instalments of 10,000 each at the end of 2019 and every financial year for the following nine years. Books sold were invoiced directly to customers, with payment expected within 30 days. The independent bookseller outlets operated on his instructions to pack and send books to customers. For this service they receive a commission of 10% of the sales value of each book, plus the cost of any associated postage and taxes, although books sold from his personal collection did not involve such commission. By 2022, John's health was starting to fail and he decided that he could no longer continue to devote himself full-time to this business. In particular, he could no longer spend the time and energy travelling around Europe to buy books. He understood that the business had a reputation that was valuable - many of his customers had been with him for some years, and they could be relied upon to provide a significant proportion of his annual sales for several years to come and up to 2021 it had always been profitable. One of his European bookseller partners (Page Turning Book Shop) had indicated that they would be willing to buy the company and all of its inventory and remaining business assets and liabilities with effect from 1 January 2023, provided they could continue to use his name and employ him as a consultant to stay in touch with his major customers and bookseller partners for the next three years. Apart from these obligations, John would resign as the sole director and have no further responsibility for the running of the company, which would henceforth be managed by an employee of Page Turning Book shop. John was asked to organise the transfer of all inventory to Page Turning Book Shop storerooms before 1 January 2023 and to agree to pay all associated costs incurred by the partner booksellers. From that date, all commission and associated arrangements came to an end. John found all of this acceptable and a contract was signed accordingly. It is now early 2024 and you are the manager of The Reading Nook Ltd. Your line manager (from Page Turning Bookshop) has indicated that she is concerned about the business's performance (profitability) and financial health (working capital and cash management) and has asked you to review the financial statements of the company for 2023 and 2022 and: 1. identify the particular elements of performance (profitability) and financial health (working capital and cash management) that might be regarded as problematic 2. make recommendations to improve the business's future performance and financial health.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Review of The Reading Nook Ltds Financial Statements 1 Elements of Performance and Financial Health in 2023 and 2022 Profitability Revenue Trends Comp...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started