Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnny commenced business on 1 st January 2020 with a capital of RM20,000. On 31 st December 2020, the following balances were extracted from his

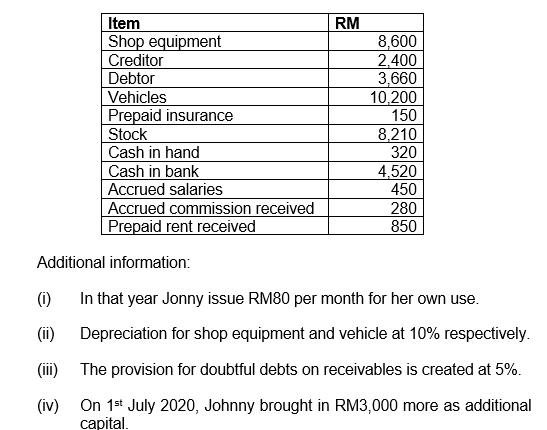

Johnny commenced business on 1st January 2020 with a capital of RM20,000. On 31st December 2020, the following balances were extracted from his books.

(a) Statement of profit and loss statement for the year ended 31st December 2020. (15 marks)

(b) Explain FIVE (5) reasons why incomplete records occur. (10 marks)

Item Shop equipment Creditor Debtor Vehicles Prepaid insurance Stock Cash in hand Cash in bank Accrued salaries Accrued commission received Prepaid rent received RM 8,600 2.400 3,660 10,200 150 8,210 320 4,520 450 280 850 Additional information: (0) In that year Jonny issue RM80 per month for her own use. (i) Depreciation for shop equipment and vehicle at 10% respectively. (iii) The provision for doubtful debts on receivables is created at 5%. (iv) On 1st July 2020, Johnny brought in RM3,000 more as additional capitalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started