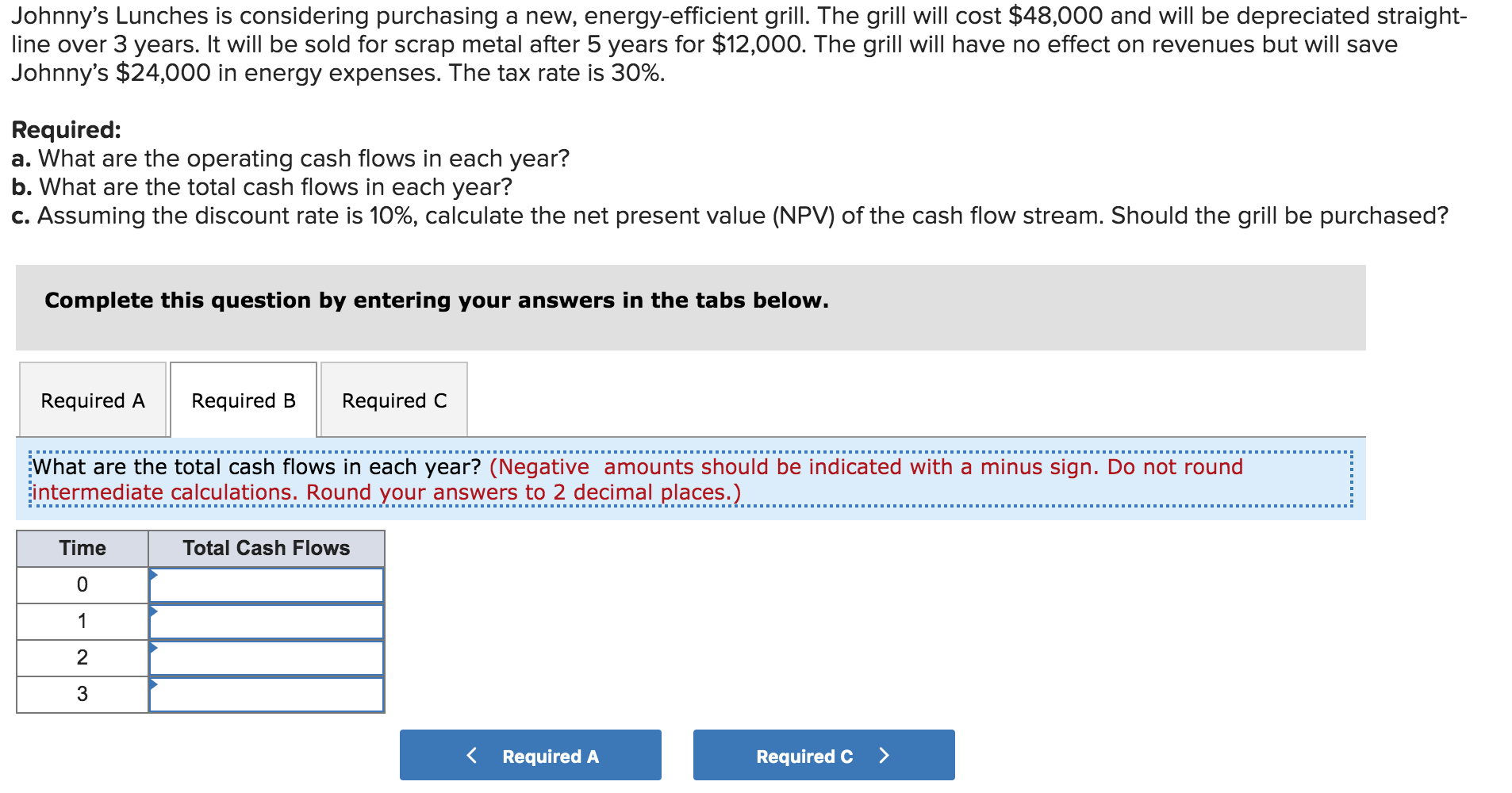

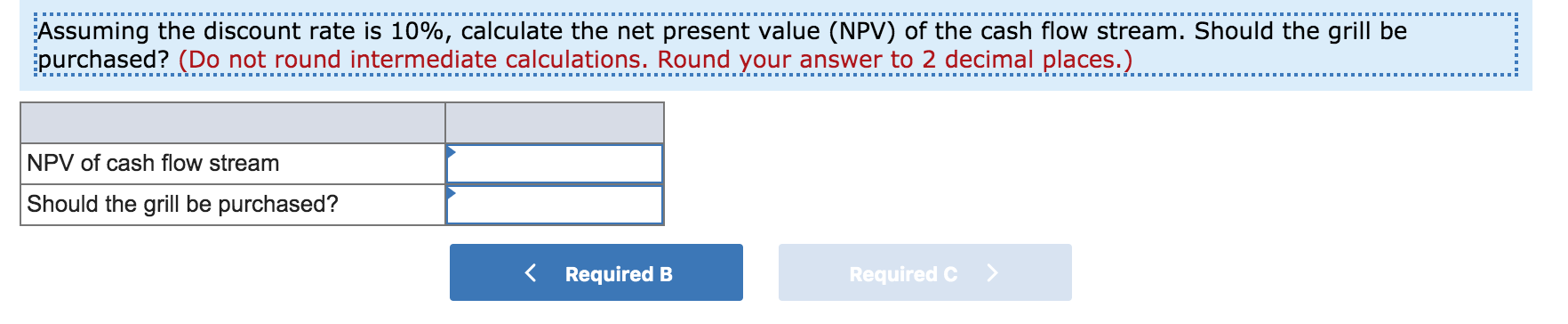

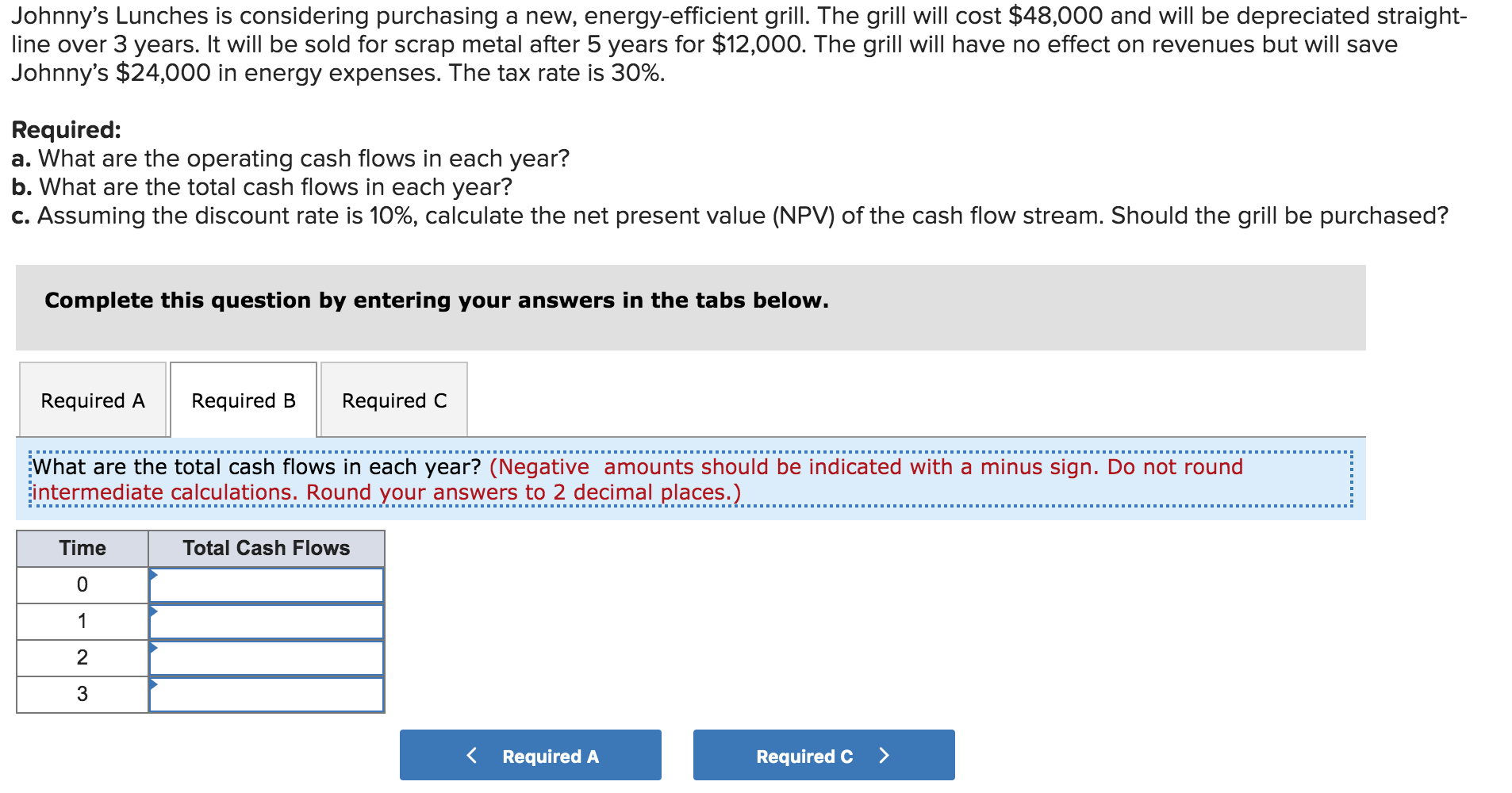

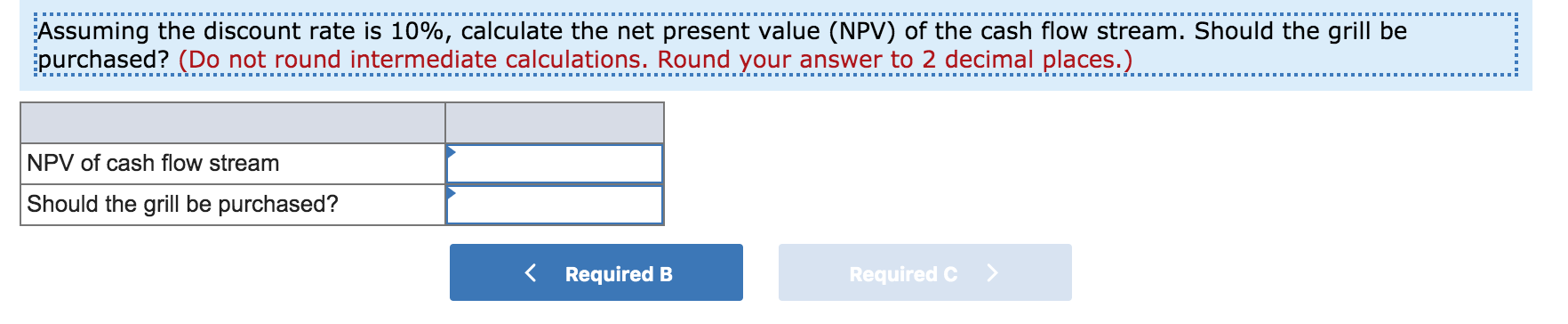

Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $48,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $12,000. The grill will have no effect on revenues but will save Johnny's $24,000 in energy expenses. The tax rate is 30% Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 10%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the total cash flows in each year? (Negative amounts should be indicated with a minus sign. Do not round intermediate calculations. Round your answers to 2 deci mal places.) Time Total Cash Flows 0 1 2 3 Required A Required C Assuming the discount rate is 10%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV of cash flow stream Should the grill be purchased? KRequired B Required C Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $48,000 and will be depreciated straight- line over 3 years. It will be sold for scrap metal after 5 years for $12,000. The grill will have no effect on revenues but will save Johnny's $24,000 in energy expenses. The tax rate is 30% Required: a. What are the operating cash flows in each year? b. What are the total cash flows in each year? c. Assuming the discount rate is 10%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? Complete this question by entering your answers in the tabs below. Required A Required B Required C What are the total cash flows in each year? (Negative amounts should be indicated with a minus sign. Do not round intermediate calculations. Round your answers to 2 deci mal places.) Time Total Cash Flows 0 1 2 3 Required A Required C Assuming the discount rate is 10%, calculate the net present value (NPV) of the cash flow stream. Should the grill be purchased? (Do not round intermediate calculations. Round your answer to 2 decimal places.) NPV of cash flow stream Should the grill be purchased? KRequired B Required C