Answered step by step

Verified Expert Solution

Question

1 Approved Answer

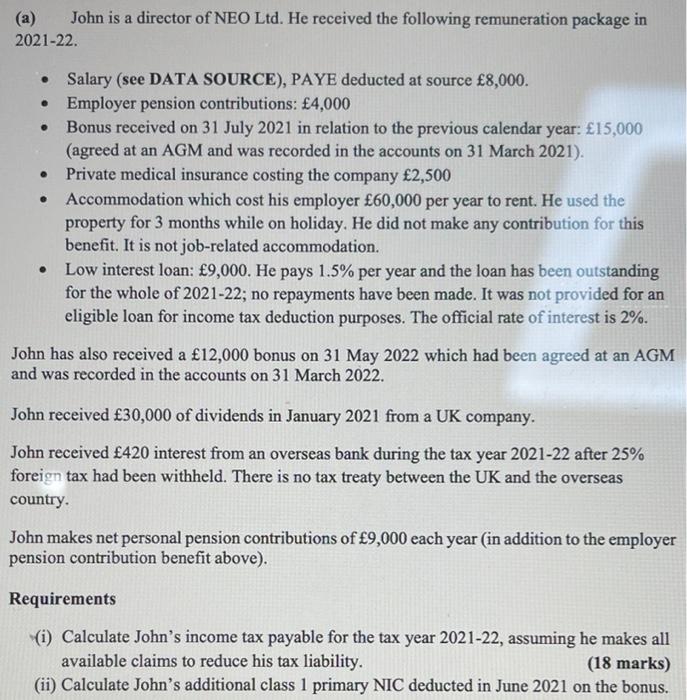

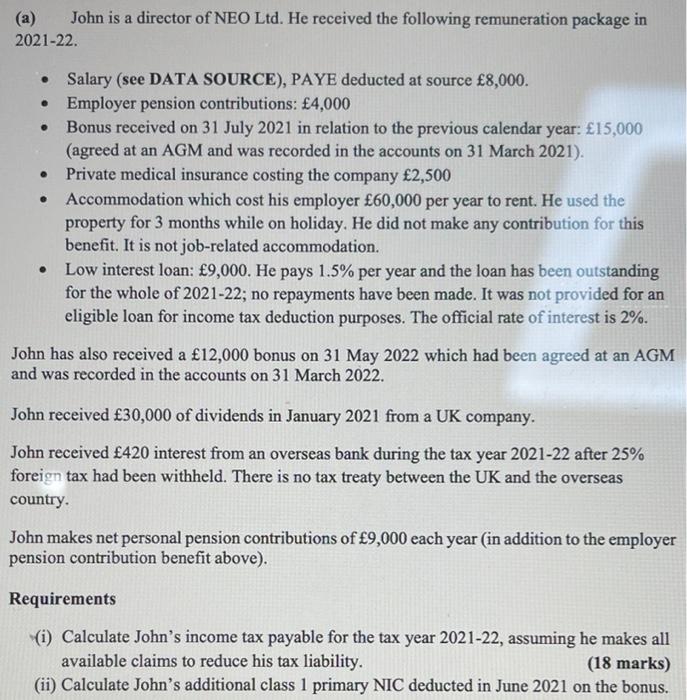

John's annual salary is 37200 (a) John is a director of NEO Ltd. He received the following remuneration package in 2021-22. - Salary (see DATA

John's annual salary is 37200

(a) John is a director of NEO Ltd. He received the following remuneration package in 2021-22. - Salary (see DATA SOURCE), PAYE deducted at source 8,000. - Employer pension contributions: 4,000 - Bonus received on 31 July 2021 in relation to the previous calendar year: 15,000 (agreed at an AGM and was recorded in the accounts on 31 March 2021). - Private medical insurance costing the company 2,500 - Accommodation which cost his employer 60,000 per year to rent. He used the property for 3 months while on holiday. He did not make any contribution for this benefit. It is not job-related accommodation. - Low interest loan: 9,000. He pays 1.5% per year and the loan has been outstanding for the whole of 2021-22; no repayments have been made. It was not provided for an eligible loan for income tax deduction purposes. The official rate of interest is 2%. John has also received a 12,000 bonus on 31 May 2022 which had been agreed at an AGM and was recorded in the accounts on 31 March 2022. John received 30,000 of dividends in January 2021 from a UK company. John received 420 interest from an overseas bank during the tax year 2021-22 after 25% foreign tax had been withheld. There is no tax treaty between the UK and the overseas country. John makes net personal pension contributions of 9,000 each year (in addition to the employer pension contribution benefit above). Requirements -(i) Calculate John's income tax payable for the tax year 2021-22, assuming he makes all available claims to reduce his tax liability. (18 marks) (ii) Calculate John's additional class 1 primary NIC deducted in June 2021 on the bonus. (a) John is a director of NEO Ltd. He received the following remuneration package in 2021-22. - Salary (see DATA SOURCE), PAYE deducted at source 8,000. - Employer pension contributions: 4,000 - Bonus received on 31 July 2021 in relation to the previous calendar year: 15,000 (agreed at an AGM and was recorded in the accounts on 31 March 2021). - Private medical insurance costing the company 2,500 - Accommodation which cost his employer 60,000 per year to rent. He used the property for 3 months while on holiday. He did not make any contribution for this benefit. It is not job-related accommodation. - Low interest loan: 9,000. He pays 1.5% per year and the loan has been outstanding for the whole of 2021-22; no repayments have been made. It was not provided for an eligible loan for income tax deduction purposes. The official rate of interest is 2%. John has also received a 12,000 bonus on 31 May 2022 which had been agreed at an AGM and was recorded in the accounts on 31 March 2022. John received 30,000 of dividends in January 2021 from a UK company. John received 420 interest from an overseas bank during the tax year 2021-22 after 25% foreign tax had been withheld. There is no tax treaty between the UK and the overseas country. John makes net personal pension contributions of 9,000 each year (in addition to the employer pension contribution benefit above). Requirements -(i) Calculate John's income tax payable for the tax year 2021-22, assuming he makes all available claims to reduce his tax liability. (18 marks) (ii) Calculate John's additional class 1 primary NIC deducted in June 2021 on the bonus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started