Question

John's Car Care Centre specializes in providing car tune-ups, brake jobs, and tire replacements for most vehicle makes and models. John's charges customers for materials

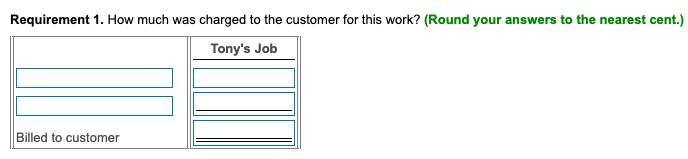

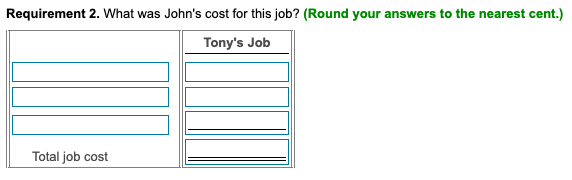

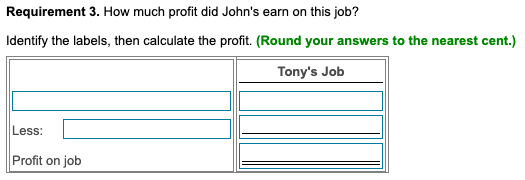

John's Car Care Centre specializes in providing car tune-ups, brake jobs, and tire replacements for most vehicle makes and models. John's charges customers for materials "at cost" but charges labour at a rate of $88 per hour. The labour rate is high enough to cover actual mechanic wages ($27 per hour), and shop overhead (allocated at a cost of $14 per hour), and to provide a profit. Tony recently had a 75,000 km service performed on his SUV.

Materials used on the job included $13.50 for oil and filter, $69.45 for transmission fluid exchange, $22.00 for the air filter, and $33.75 for the cabin filter. The mechanic spent 1.75 hours on the job.

Requirements

1. How much was charged to the customer for this work?

2. What was John's cost for this job?

3. How much profit did John's earn on this job?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started