Question

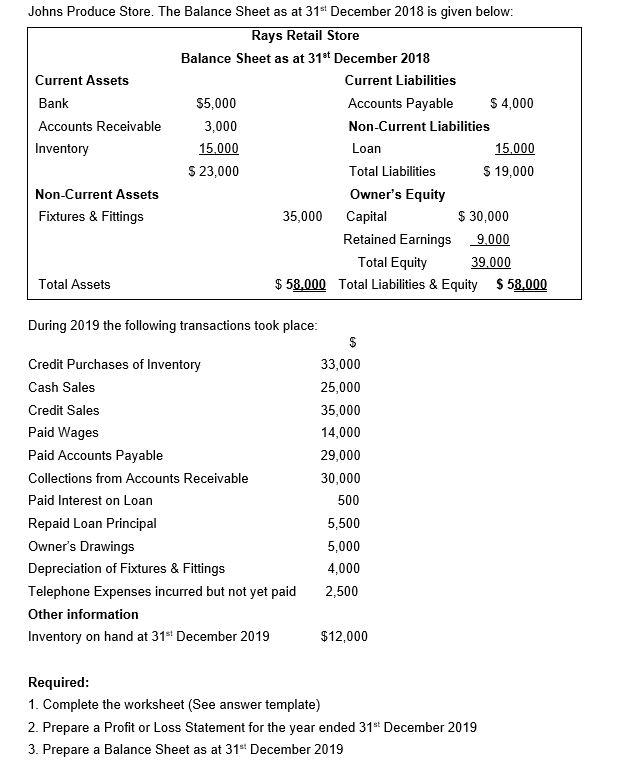

Johns Produce Store. The Balance Sheet as at 31 st December 2018 is given below: Rays Retail Store Balance Sheet as at 31 st December

Johns Produce Store. The Balance Sheet as at 31st December 2018 is given below:

| Rays Retail Store Balance Sheet as at 31st December 2018 Current Assets Current Liabilities Bank $5,000 Accounts Payable $ 4,000 Accounts Receivable 3,000 Non-Current Liabilities Inventory 15,000 Loan 15,000 $ 23,000 Total Liabilities $ 19,000 Non-Current Assets Owners Equity Fixtures & Fittings 35,000 Capital $ 30,000 Retained Earnings 9,000 Total Equity 39,000 Total Assets $ 58,000 Total Liabilities & Equity $ 58,000 |

During 2019 the following transactions took place:

$

Credit Purchases of Inventory33,000

Cash Sales25,000

Credit Sales35,000

Paid Wages14,000

Paid Accounts Payable29,000

Collections from Accounts Receivable30,000

Paid Interest on Loan 500

Repaid Loan Principal5,500

Owners Drawings5,000

Depreciation of Fixtures & Fittings4,000

Telephone Expenses incurred but not yet paid 2,500

Other information

Inventory on hand at 31st December 2019 $12,000

Required:

1. Complete the worksheet (See answer template)

2. Prepare a Profit or Loss Statement for the year ended 31st December 2019

3. Prepare a Balance Sheet as at 31st December 2019

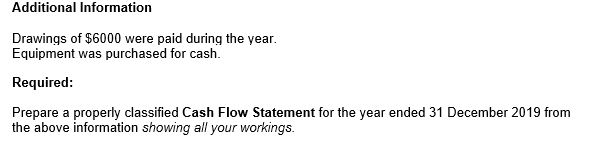

Additional Information

Drawings of $6000 were paid during the year.

Equipment was purchased for cash.

Required:

Prepare a properly classified Cash Flow Statement for the year ended 31 December 2019 from the above information showing all your workings.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started