Johnson, an ICAEW Chartered Accountant working as a sole practitioner, acts for Sue, completing her income tax returns. Johnson has recently seen information proving

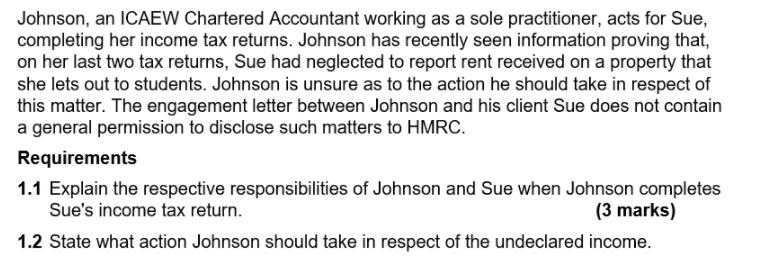

Johnson, an ICAEW Chartered Accountant working as a sole practitioner, acts for Sue, completing her income tax returns. Johnson has recently seen information proving that, on her last two tax returns, Sue had neglected to report rent received on a property that she lets out to students. Johnson is unsure as to the action he should take in respect of this matter. The engagement letter between Johnson and his client Sue does not contain a general permission to disclose such matters to HMRC. Requirements 1.1 Explain the respective responsibilities of Johnson and Sue when Johnson completes Sue's income tax return. (3 marks) 1.2 State what action Johnson should take in respect of the undeclared income.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer IN case of Johnson an ICAEW Chartered Accountant working as a sole practitioner acts for Sue completing her income tax returns Johnson has recently seen information proving that on her last two ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started