Apollo Limited commenced trading on 1st January 2020, issuing 471,000 1 ordinary shares at par. On the same day, the funds raised were used

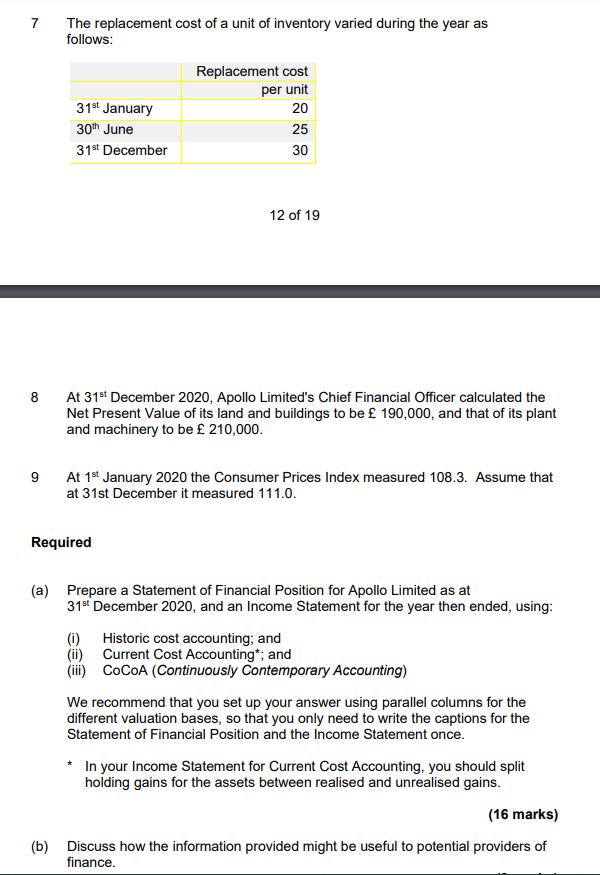

Apollo Limited commenced trading on 1st January 2020, issuing 471,000 1 ordinary shares at par. On the same day, the funds raised were used to purchase freehold land and buildings of 175,000, plant and machinery of 200,000 and 4,800 units of inventory for 20 each. Notes 1 2 3 5 6 During the year ended 31st December 2020, Apollo Limited sold three-quarters of the inventories for cash of 40 each. These sales occurred evenly throughout the year, with the selling price remaining unchanged and no other purchases were made during the year. Operating expenses (except for cost of sales and depreciation) amounted to 44,000. The freehold land and buildings are maintained to a high standard such that they will endure; accordingly, zero depreciation is recognised in Apollo Limited's financial statements. At 31st December 2020, equivalent premises would have cost Apollo Limited 184,730 to buy. At that date it could have sold the premises for 204,000. The plant and machinery have an anticipated useful economic life of ten years, with zero residual value expected. At 31st December 2020, replacing the plant and machinery with new (ie. unused) equivalents would have cost Apollo Limited 205,000. At that date it could have sold the plant and machinery for 184,000. 7 8 9 The replacement cost of a unit of inventory varied during the year as follows: 31st January 30th June 31st December Replacement cost per unit 20 25 30 12 of 19 At 31st December 2020, Apollo Limited's Chief Financial Officer calculated the Net Present Value of its land and buildings to be 190,000, and that of its plant and machinery to be 210,000. Required At 1st January 2020 the Consumer Prices Index measured 108.3. Assume that at 31st December it measured 111.0. (a) Prepare a Statement of Financial Position for Apollo Limited as at 31st December 2020, and an Income Statement for the year then ended, using: (i) Historic cost accounting; and Current Cost Accounting*; and CoCoA (Continuously Contemporary Accounting) We recommend that you set up your answer using parallel columns for the different valuation bases, so that you only need to write the captions for the Statement of Financial Position and the Income Statement once. In your Income Statement for Current Cost Accounting, you should split holding gains for the assets between realised and unrealised gains. (16 marks) (b) Discuss how the information provided might be useful to potential providers of finance.

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Historic cost accounting Statement of financial position as at 31 December 2020 Assets Noncurrent assets Freehold land and buildings 175000 Plant and ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started