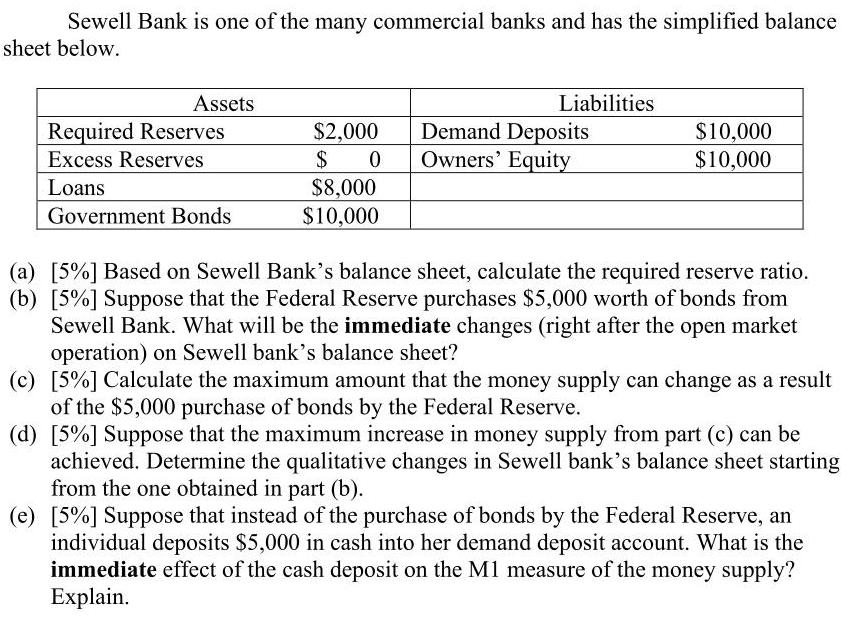

Sewell Bank is one of the many commercial banks and has the simplified balance sheet below. Assets Required Reserves Excess Reserves Loans Government Bonds

Sewell Bank is one of the many commercial banks and has the simplified balance sheet below. Assets Required Reserves Excess Reserves Loans Government Bonds $2,000 $ 0 $8,000 $10,000 Liabilities Demand Deposits Owners' Equity $10,000 $10,000 (a) [5%] Based on Sewell Bank's balance sheet, calculate the required reserve ratio. (b) [5%] Suppose that the Federal Reserve purchases $5,000 worth of bonds from Sewell Bank. What will be the immediate changes (right after the open market operation) on Sewell bank's balance sheet? (c) [5%] Calculate the maximum amount that the money supply can change as a result of the $5,000 purchase of bonds by the Federal Reserve. (d) [5%] Suppose that the maximum increase in money supply from part (c) can be achieved. Determine the qualitative changes in Sewell bank's balance sheet from the one obtained in part (b). (e) [5%] Suppose that instead of the purchase of bonds by the Federal Reserve, an individual deposits $5,000 in cash into her demand deposit account. What is the immediate effect of the cash deposit on the M1 measure of the money supply? Explain.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The reserve ratio set by the central bank is the percentage of a commercial banks depo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started