Answered step by step

Verified Expert Solution

Question

1 Approved Answer

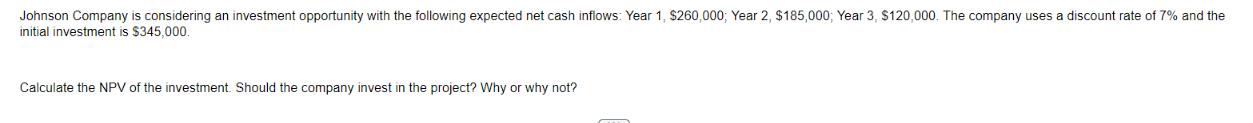

Johnson Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $260,000; Year 2, $185,000; Year 3, $120,000. The

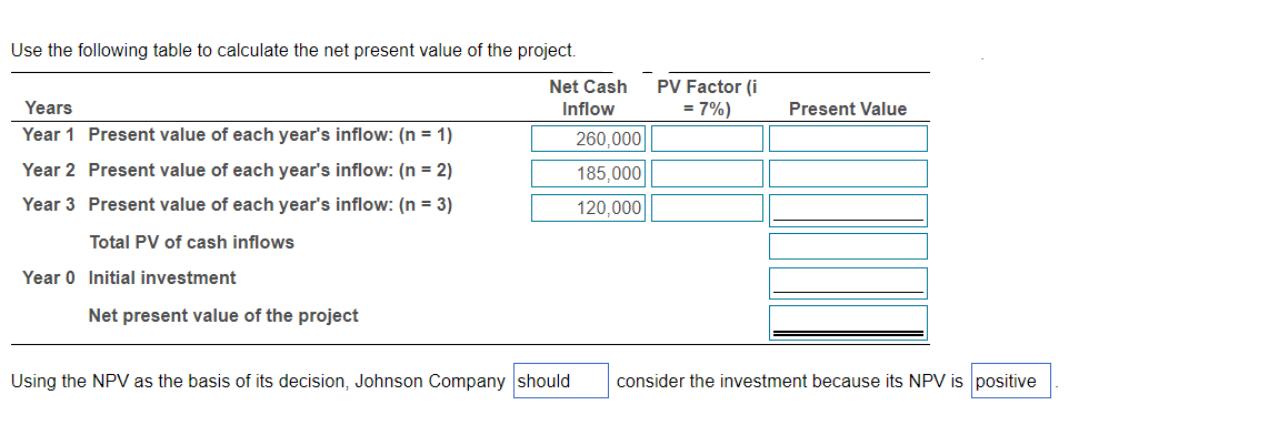

Johnson Company is considering an investment opportunity with the following expected net cash inflows: Year 1, $260,000; Year 2, $185,000; Year 3, $120,000. The company uses a discount rate of 7% and the initial investment is $345,000. Calculate the NPV of the investment. Should the company invest in the project? Why or why not? Use the following table to calculate the net present value of the project. Years Year 1 Present value of each year's inflow: (n = 1) Year 2 Present value of each year's inflow: (n = 2) Year 3 Present value of each year's inflow: (n = 3) Total PV of cash inflows Year 0 Initial investment Net present value of the project Inflow Net Cash PV Factor (i = 7%) Present Value 260,000 185,000 120,000 Using the NPV as the basis of its decision, Johnson Company should consider the investment because its NPV is positive

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer To calculate the Net Present Value NPV of the investment opportunity we need to discount each ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

661e8207116d2_880717.pdf

180 KBs PDF File

661e8207116d2_880717.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started