Answered step by step

Verified Expert Solution

Question

1 Approved Answer

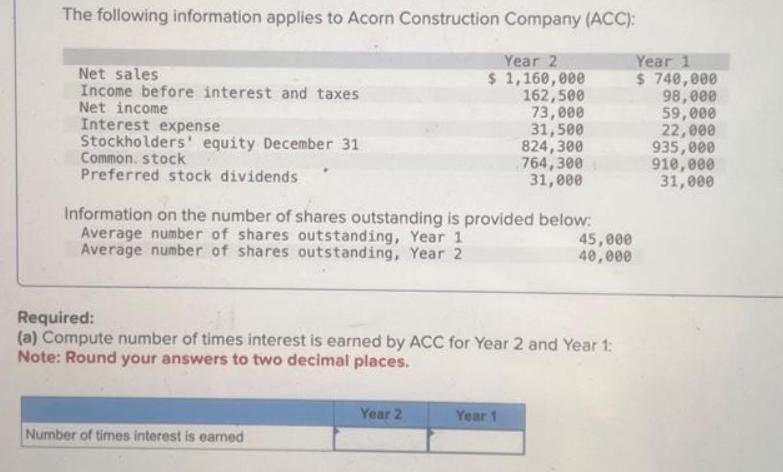

The following information applies to Acorn Construction Company (ACC): Year 1 $740,000 Net sales Income before interest and taxes Net income Interest expense Stockholders'

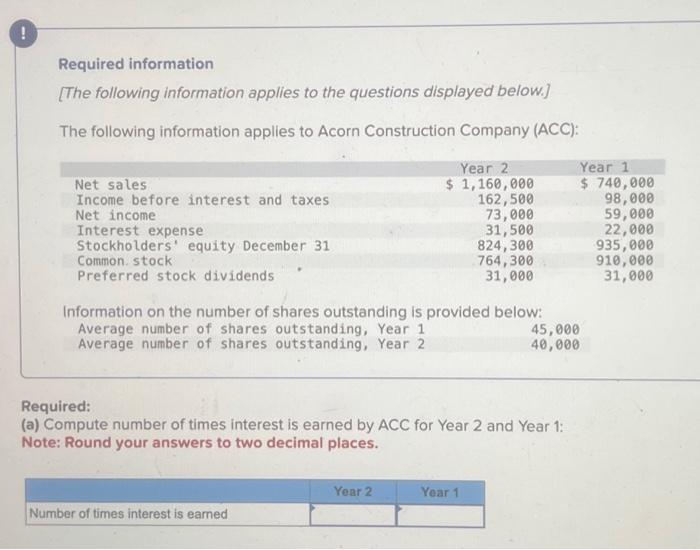

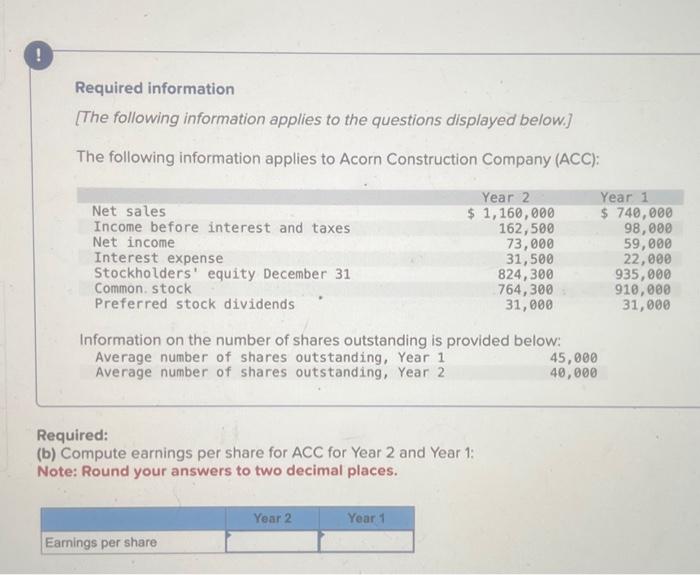

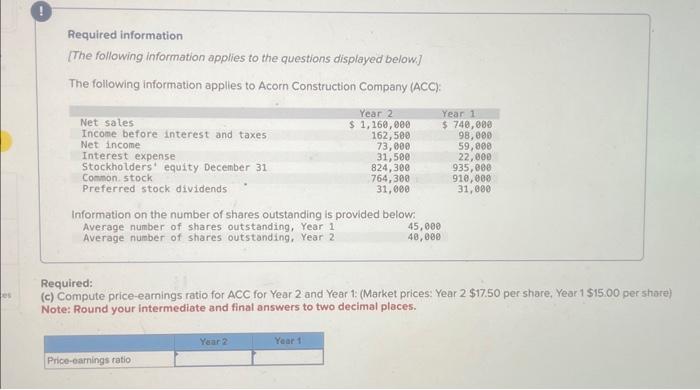

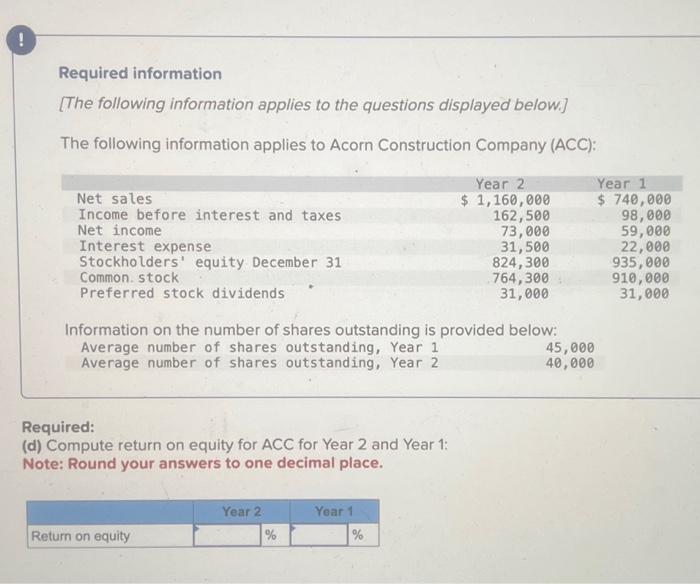

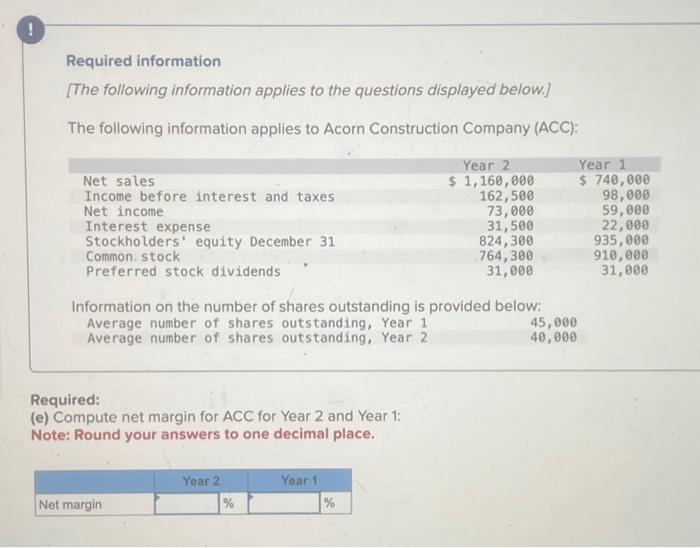

The following information applies to Acorn Construction Company (ACC): Year 1 $740,000 Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common stock Preferred stock dividends Year 2 $ 1,160,000 162,500 98,000 73,000 59,000 31,500 22,000 824,300 935,000 764,300 910,000 31,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 45,000 40,000 Required: (a) Compute number of times interest is earned by ACC for Year 2 and Year 1: Note: Round your answers to two decimal places. Number of times interest is earned Year 2 Year 1 Required information [The following information applies to the questions displayed below.] The following information applies to Acorn Construction Company (ACC): Year 1 Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common, stock Preferred stock dividends Year 2 $ 1,160,000 $ 740,000 162,500 98,000 73,000 59,000 31,500 22,000 824,300 935,000 764,300 910,000 31,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 45,000 40,000 Required: (a) Compute number of times interest is earned by ACC for Year 2 and Year 1: Note: Round your answers to two decimal places. Number of times interest is earned Year 2 Year 1 ! Required information [The following information applies to the questions displayed below.] The following information applies to Acorn Construction Company (ACC): Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common. stock Preferred stock dividends Year 1 $740,000 98,000 Year 2 $ 1,160,000 162,500 73,000 59,000 31,500 22,000 824,300 935,000 764,300 910,000 31,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 Required: (b) Compute earnings per share for ACC for Year 2 and Year 1: Note: Round your answers to two decimal places. Earnings per share Year 2 Year 1 45,000 40,000 Required information [The following information applies to the questions displayed below.] The following information applies to Acorn Construction Company (ACC): Year 1 Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common stock Preferred stock dividends Year 2 $ 1,160,000 162,500 73,000 $ 740,000 98,000 59,000 31,500 22,000 824,300 935,000 764,300 31,000 910,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 Required: 45,000 40,000 es (c) Compute price-earnings ratio for ACC for Year 2 and Year 1: (Market prices: Year 2 $17.50 per share, Year 1 $15.00 per share) Note: Round your intermediate and final answers to two decimal places. Price-earnings ratio Year 2 Year 1 Required information [The following information applies to the questions displayed below.] The following information applies to Acorn Construction Company (ACC): Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common. stock Preferred stock dividends Year 2 $ 1,160,000 162,500 Year 1 $ 740,000 98,000 73,000 59,000 31,500 22,000 824,300 935,000 764,300 910,000 31,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 45,000 40,000 Required: (d) Compute return on equity for ACC for Year 2 and Year 1: Note: Round your answers to one decimal place. Return on equity Year 2 Year 1 % % ! Required information [The following information applies to the questions displayed below.] The following information applies to Acorn Construction Company (ACC): Net sales Income before interest and taxes Net income Interest expense Stockholders' equity December 31 Common. stock Preferred stock dividends Year 2 $ 1,160,000 162,500 Year 1 $ 740,000 98,000 73,000 59,000 31,500 22,000 824,300 935,000 764,300 910,000 31,000 31,000 Information on the number of shares outstanding is provided below: Average number of shares outstanding, Year 1 Average number of shares outstanding, Year 2 45,000 40,000 Required: (e) Compute net margin for ACC for Year 2 and Year 1: Note: Round your answers to one decimal place. Net margin Year 2 Year 1 % %

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started