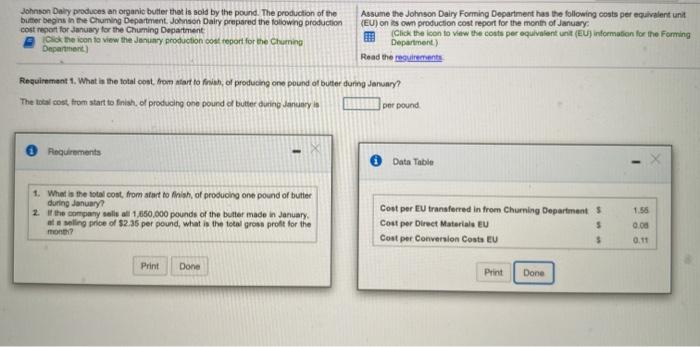

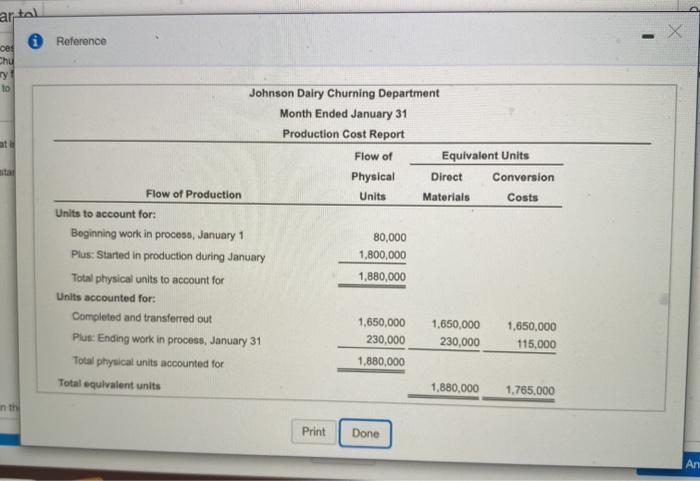

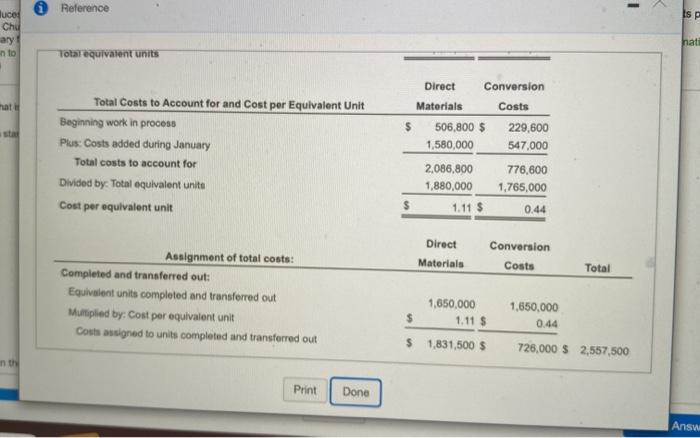

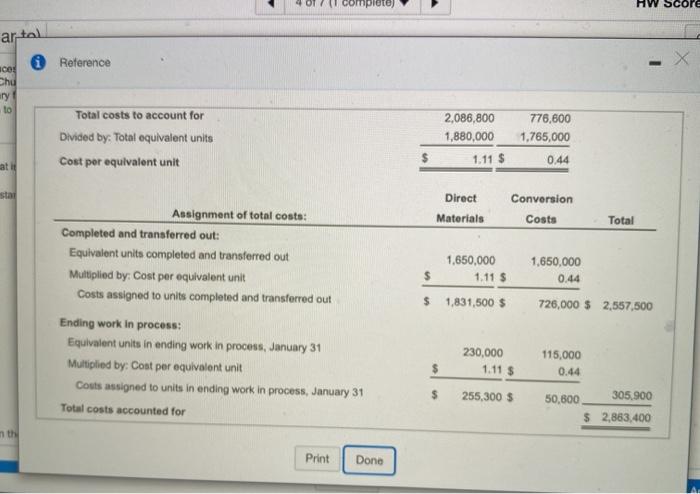

Johnson Dalty produces an organic butter that is sold by the pound. The production of the butter begins in the Chuming Department. Johnson Dairy prepared the following production cost report for January for the Chumning Department Click the icon to view the January production cost report for the Churing Department) Assume the Johnson Dairy Forming Department has the following costs per equivalent unit (EU) on its own production cost report for the month of January (Click the icon to view the costs per equivalent (EU) information for the Forming Department) Read the requirements Requirement 1. What is the total cost from start to finish, of producing one pound of butter during January The total cost from start to finish of producing one pound of butter during January per pound Requirements Data Table 1. What is the total cost from start to finish of producing one pound of butter during January? 2 the company salsal 1,650,000 pounds of the butter made in January aling price of $2.35 per pound, what is the total gross profit for the mo Cost per EU transferred in from Chumning Departments Cost per Direct Materials EU 5 Cost per Conversion Costa EU $ 1.56 0.00 0.11 Print Done Print Done artal X 1 Reference ce Chu ry 10 at Johnson Dairy Churning Department Month Ended January 31 Production Cost Report Flow of Equivalent Units Physical Direct Conversion Flow of Production Units Materials Costs Units to account for: Beginning work in process, January 1 80,000 Plus: Started in production during January 1,800,000 Total physical units to account for 1,880,000 Units accounted for: Completed and transferred out 1,650,000 1.650.000 1.650,000 Plus: Ending work in process, January 31 230,000 230,000 115,000 Total physical units accounted for 1,880,000 Total equivalent units 1,880,000 1.765.000 in the Print Done Reference Isp luce Cha ary no nati Total equivalent units Conversion Direct Materials mat $ Total Costs to Account for and Cost per Equivalent Unit Beginning work in process Plus: Costs added during January Total costs to account for Divided by: Total equivalent units Cost per equivalent unit 506,800 $ 1,580,000 2,086,800 1,880,000 1.11 $ Costs 229,600 547,000 776,600 1,765,000 0.44 $ Direct Materials Conversion Costs Total Assignment of total costs: Completed and transferred out: Equivalent units completed and transferred out Multiplied by: Cost per equivalent unit Corts andigned to units completed and transferred out 1,650,000 1.11 $ 1,831,500 $ 1,650,000 0.44 726,000 $ 2,557,500 1 Print Done Answ compiute) W Score ar tal Reference CO Chu ary to Total costs to account for Divided by: Total equivalent units 2,086,800 1,880,000 1.11 $ 776,600 1,765,000 0.44 att Cost per equivalent unit sta Direct Conversion Materials Costs Total Assignment of total costs: Completed and transferred out: Equivalent units completed and transferred out Multiplied by: Cost per equivalent unit Costs assigned to units completed and transferred out Ending work in process: Equivalent units in ending work in process, January 31 Multiplied by: Cost per equivalent unit Couts assigned to units in ending work in process, January 31 Total costs accounted for 1,650,000 $ 1.11 $ $ 1,831,500 $ 1,650,000 0.44 726,000 $ 2,557,500 230,000 1.11 $ 255,300 $ 115,000 0.44 50.800 305.900 $ 2,863,400 th Print Done