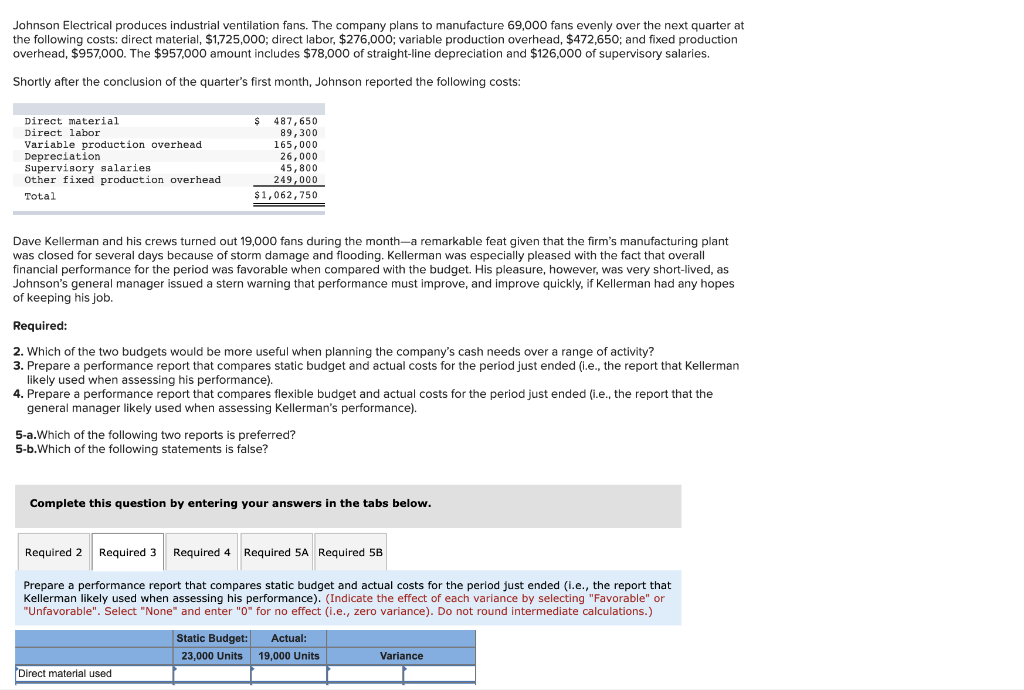

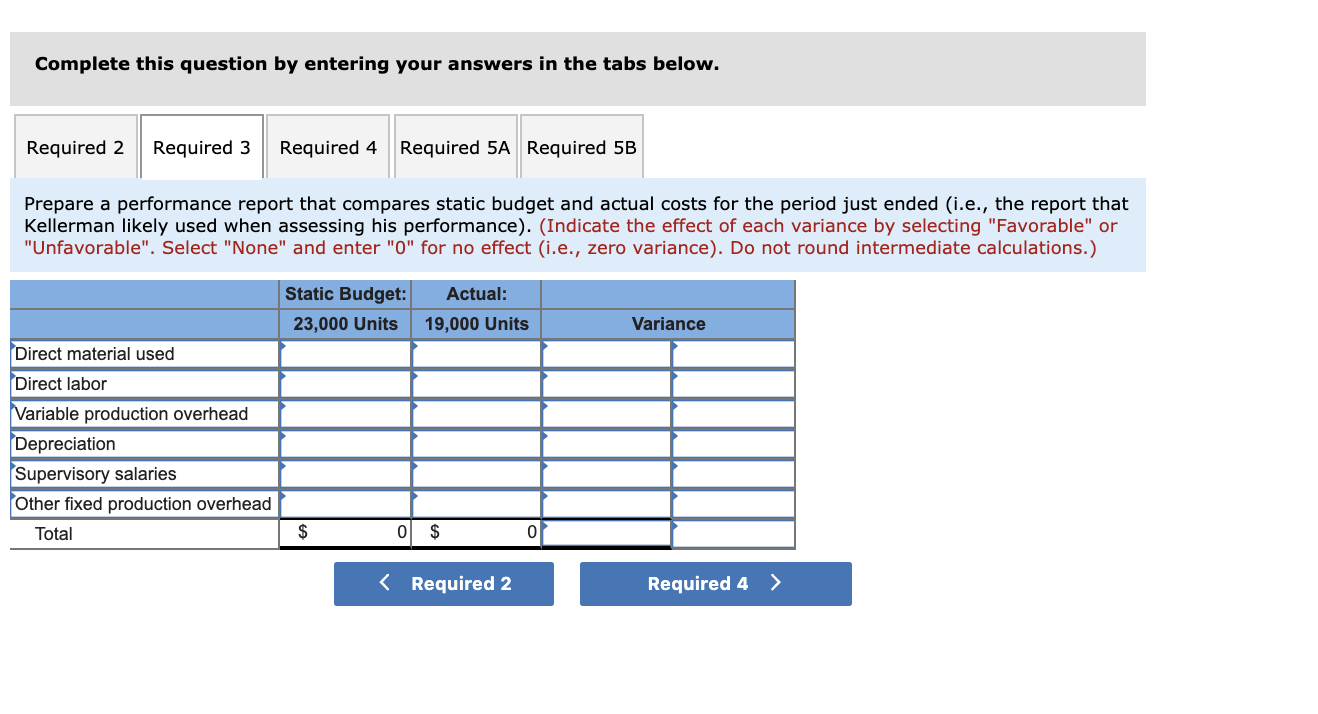

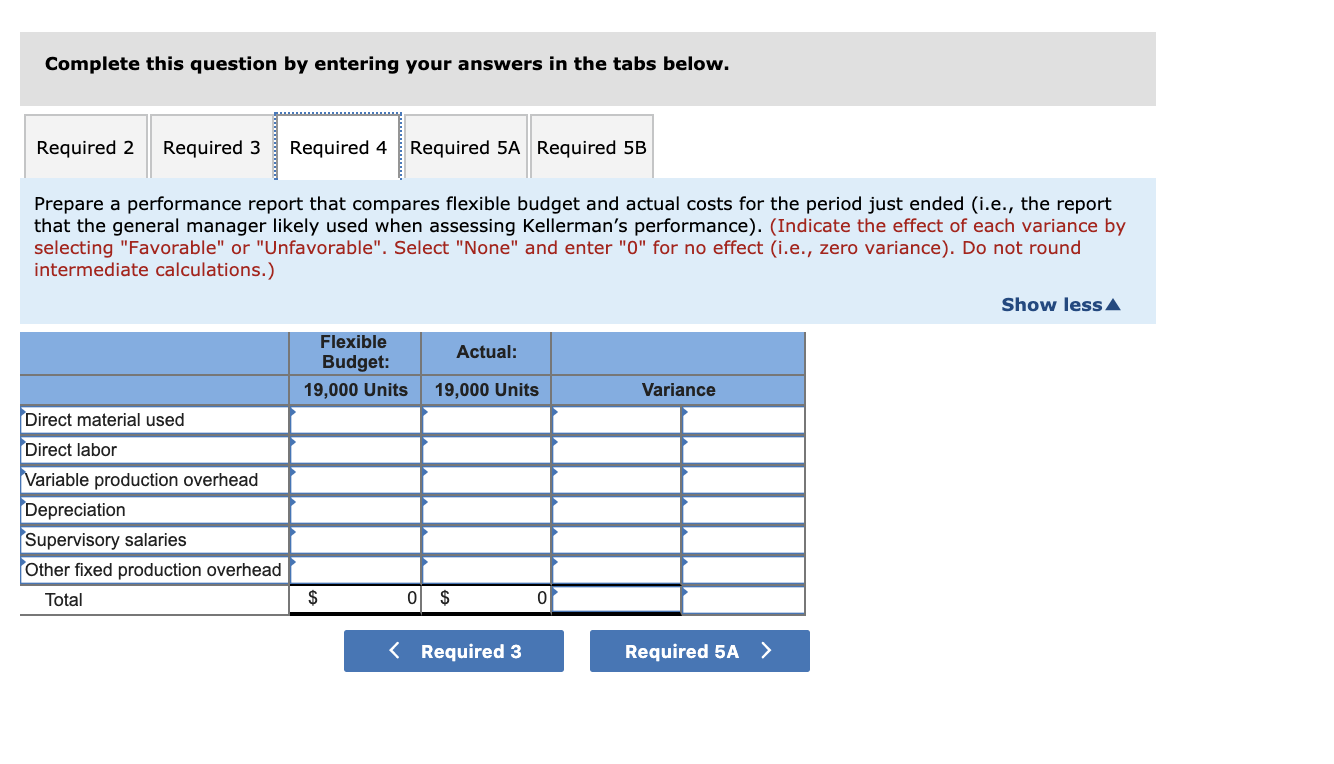

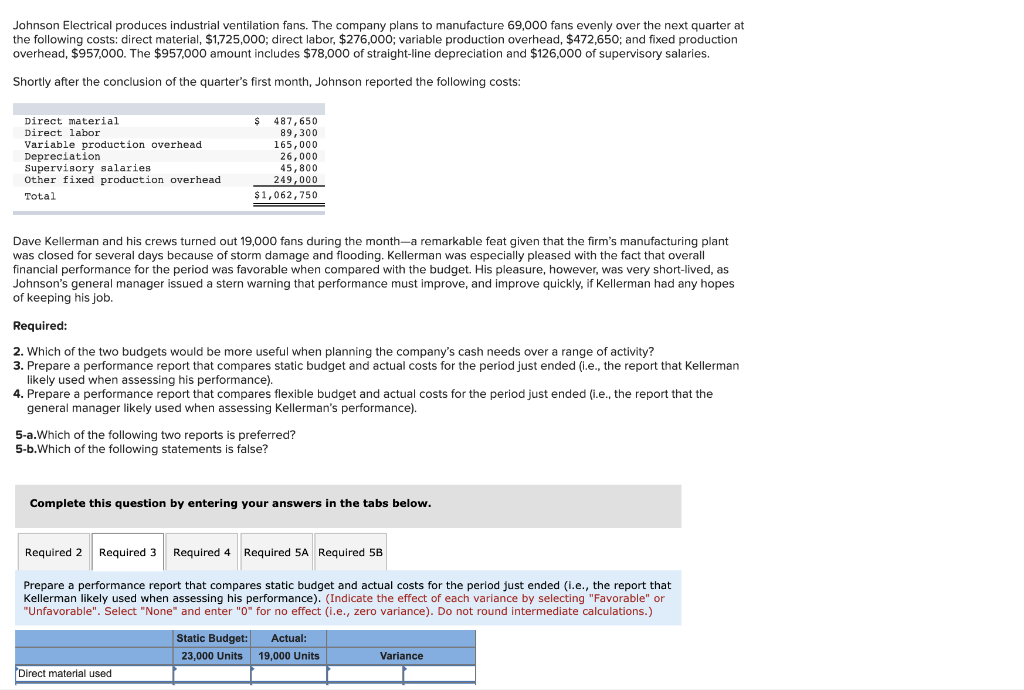

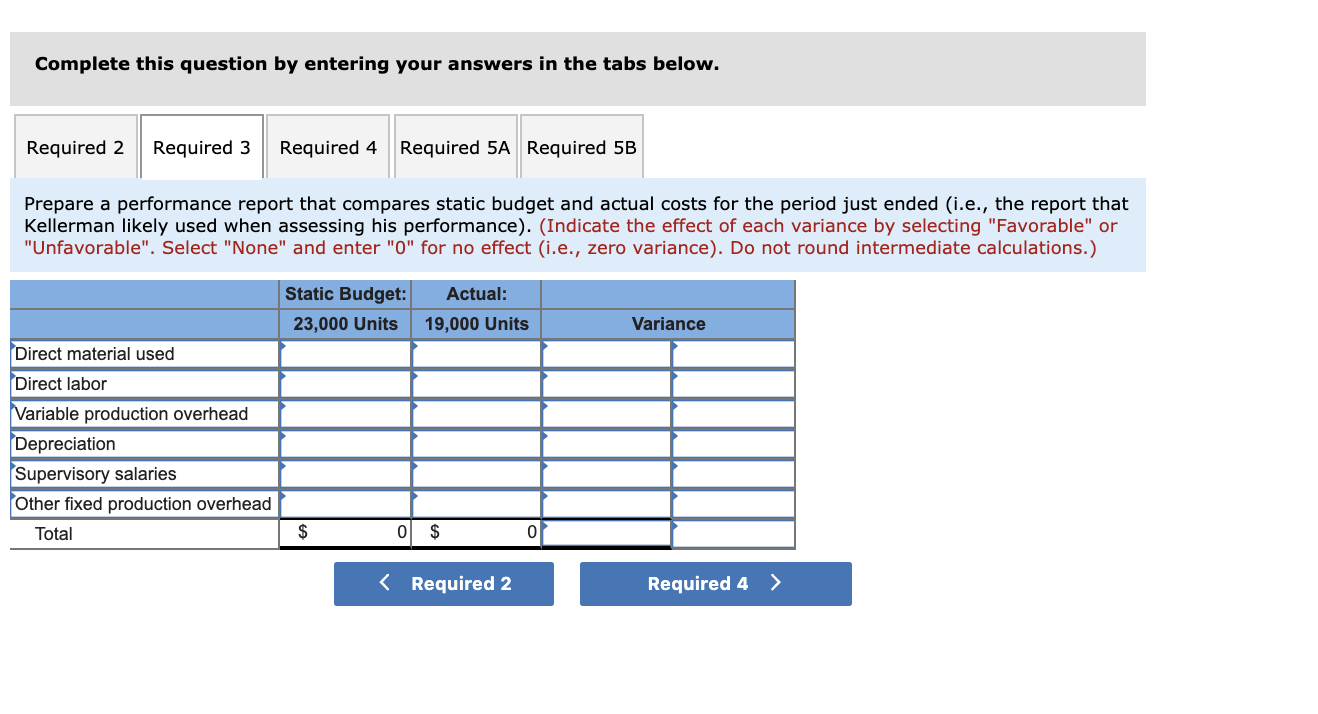

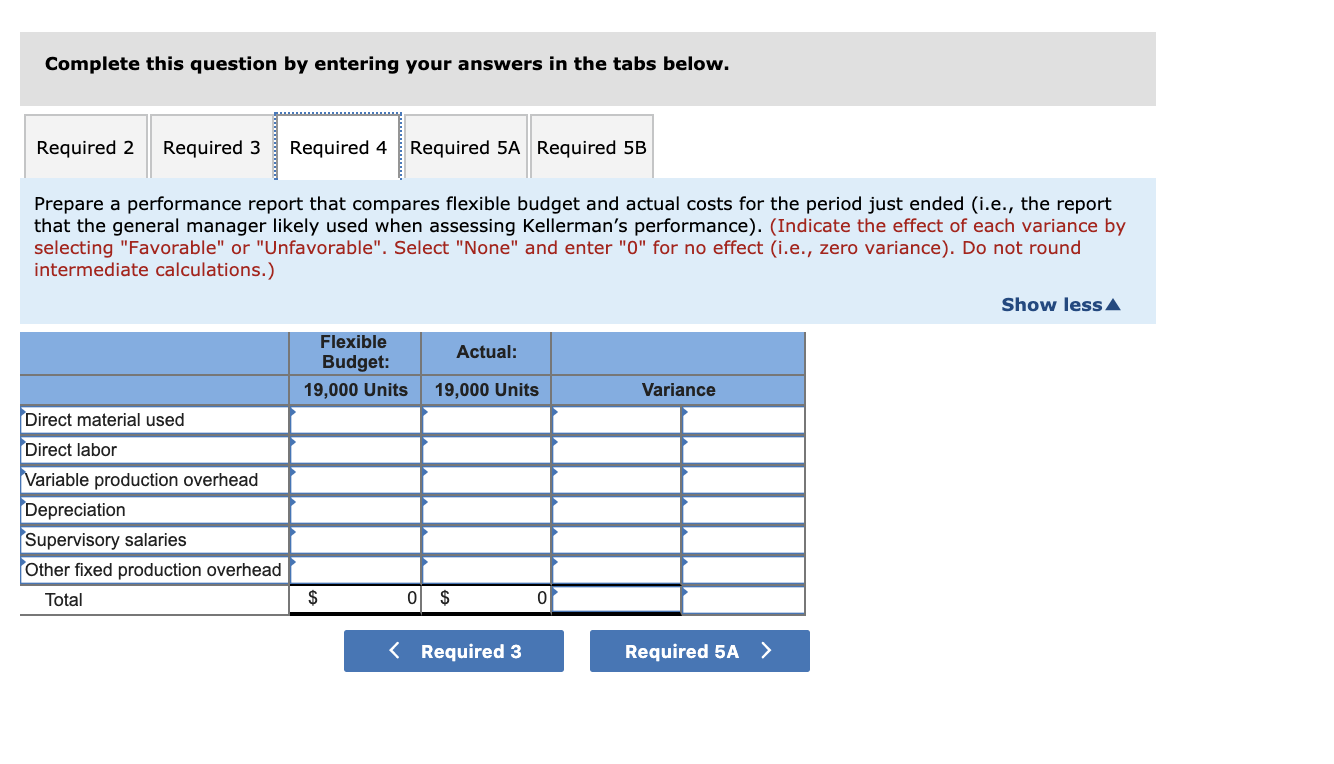

Johnson Electrical produces industrial ventilation fans. The company plans to manufacture 69,000 fans evenly over the next quarter at the following costs: direct material, $1,725,000; direct labor, $276,000; variable production overhead, $472,650; and fixed production overhead, $957,000. The $957,000 amount includes $78,000 of straight-line depreciation and $126,000 of supervisory salaries. Shortly after the conclusion of the quarter's first month, Johnson reported the following costs: Direct material Direct labor Variable production overhead Depreciation Supervisory salaries Other fixed production overhead Total $ 487,650 89, 300 165,000 26,000 45,800 249,000 $1,062,750 Dave Kellerman and his crews turned out 19,000 fans during the month-a remarkable feat given that the firm's manufacturing plant was closed for several days because of storm damage and flooding. Kellerman was especially pleased with the fact that overall financial performance for the period was favorable when compared with the budget. His pleasure, however, was very short-lived, as Johnson's general manager issued a stern warning that performance must improve, and improve quickly, if Kellerman had any hopes of keeping his job. Required: 2. Which of the two budgets would be more useful when planning the company's cash needs over a range of activity? 3. Prepare a performance report that compares static budget and actual costs for the period just ended (.e., the report that Kellerman likely used when assessing his performance). 4. Prepare a performance report that compares flexible budget and actual costs for the period just ended (i.e., the report that the general manager likely used when assessing Kellerman's performance). 5-a.Which of the following two reports is preferred? 5-b.Which of the following statements is false? Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Required 5A Required 5B Prepare a performance report that compares static budget and actual costs for the period just ended (i.e., the report that Kellerman likely used when assessing his performance). (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Do not round intermediate calculations.) Static Budget: 23,000 Units Actual: 19,000 Units Variance Direct material used Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Required 5A Required 5B Prepare a performance report that compares static budget and actual costs for the period just ended (i.e., the report that Kellerman likely used when assessing his performance). (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Do not round intermediate calculations.) Static Budget: 23,000 Units Actual: 19,000 Units Variance Direct material used Direct labor Variable production overhead Depreciation Supervisory salaries Other fixed production overhead Total $ 0 $ 0 Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Required 5A Required 5B Prepare a performance report that compares flexible budget and actual costs for the period just ended (i.e., the report that the general manager likely used when assessing Kellerman's performance). (Indicate the effect of each variance by selecting "Favorable" or "Unfavorable". Select "None" and enter "0" for no effect (i.e., zero variance). Do not round intermediate calculations.) Show less Actual: Flexible Budget: 19,000 Units 19,000 Units Variance Direct material used Direct labor Variable production overhead Depreciation Supervisory salaries Other fixed production overhead Total $ 0 $ 0