Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Johnson & Johnson and Merck & Co., Inc. are competitors in the same line of business. Use the separate PDF which includes financial data for

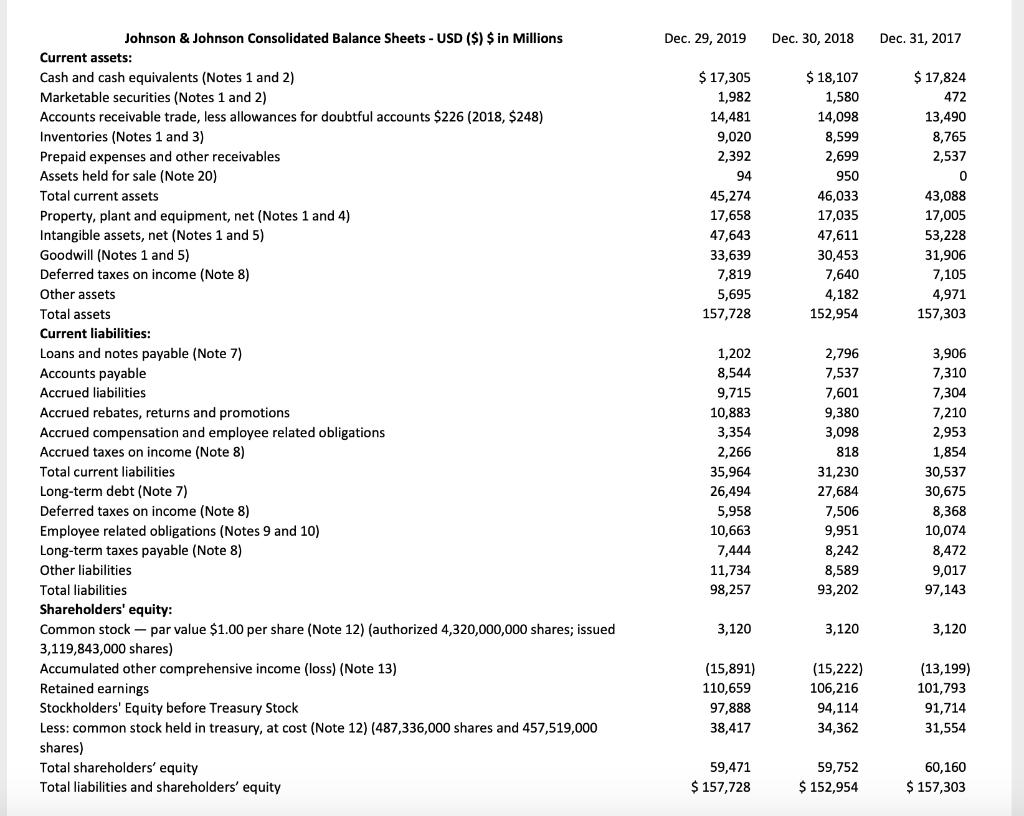

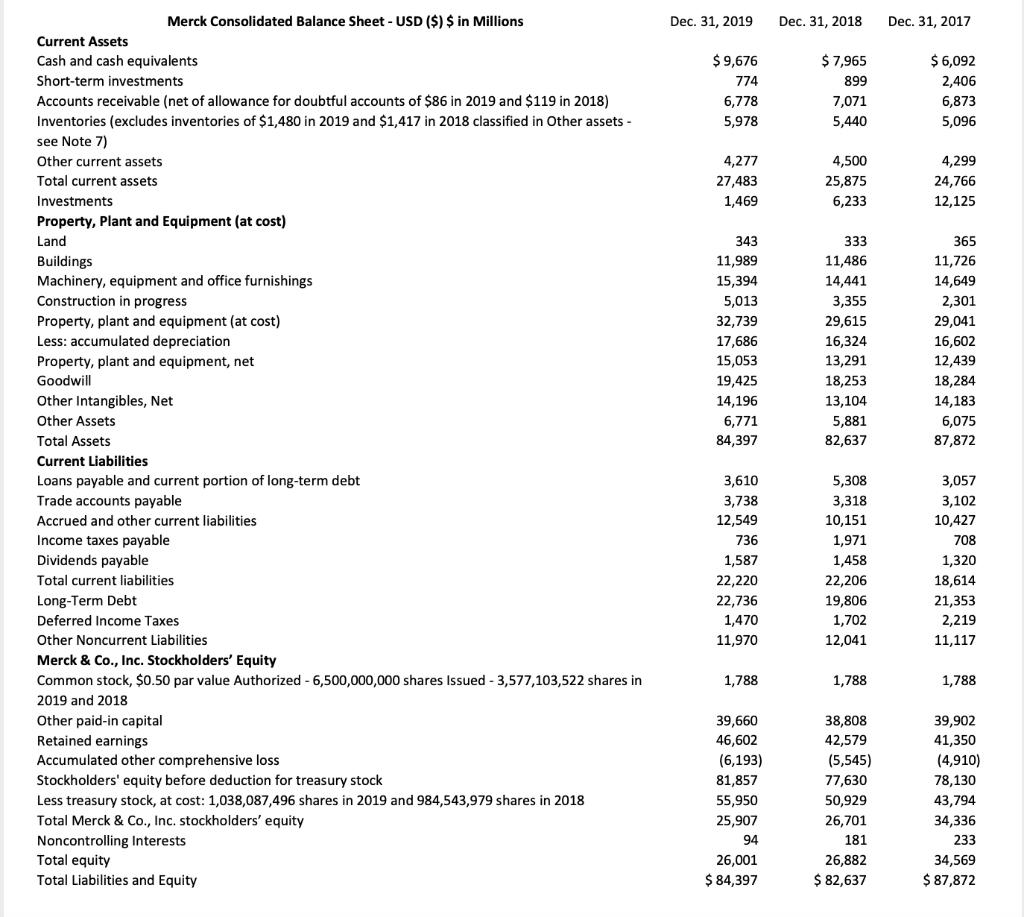

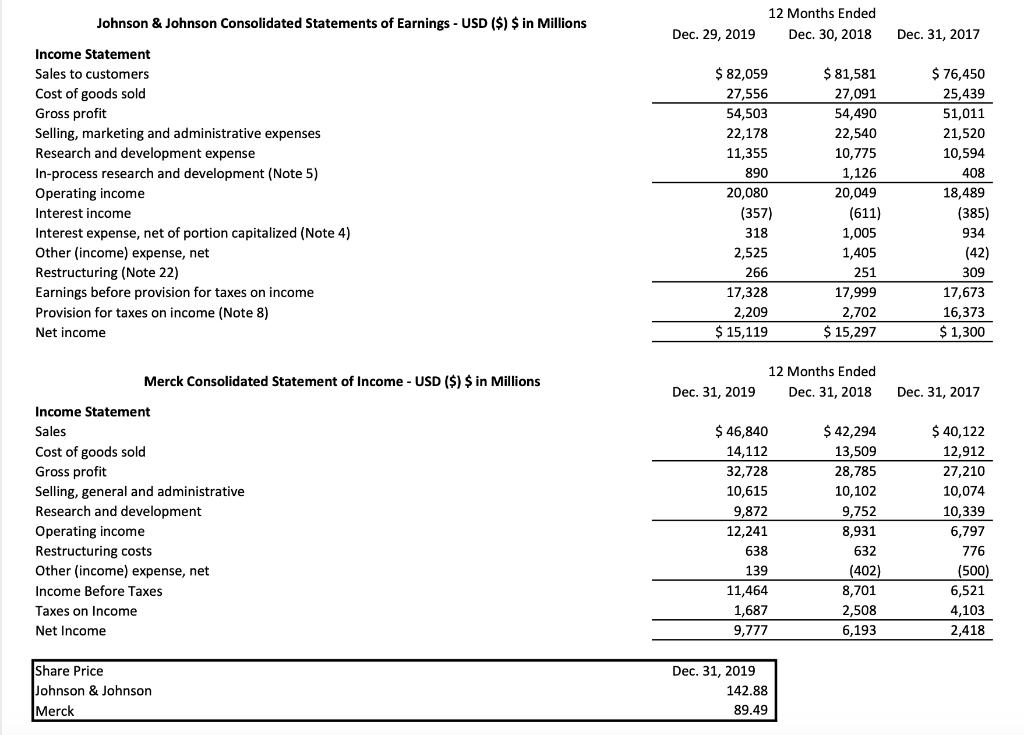

Johnson & Johnson and Merck & Co., Inc. are competitors in the same line of business. Use the separate PDF which includes financial data for 2017-2019. For Part I – calculate the listed trends and ratios. For Part II – use the information from Part I to answer the two scenarios.

Part I:

- Calculate the dollar and percentage changes from 2017-2019 for cash, total assets, sales revenue, and net income.

- Calculate the following ratios for 2 years (show your formulas and calculations)

- Working Capital

- Current Ratio

- Quick Ratio

- Debt Ratio

- Return on Assets

- Return on Equity

- Receivables Turnover

- Average Collection Period

- Inventory Turnover

- Earnings Per Share

- Gross Profit Percentage

- Net Income as a Percentage of Sales

- P/E Ratio

Part II: Decision Making:

- Assume that you are the credit manager for a national bank. Both companies are seeking a significant loan (10% of total assets). Assess which company would you consider to be the safer credit risk and why.

- Assume that you are an investment broker seeking to purchase 10% of the outstanding stock for one of the two companies. Assess which company’s stock would you purchase and why.

Johnson & Johnson Consolidated Balance Sheets - USD ($) $ in Millions Dec. 29, 2019 Dec. 30, 2018 Dec. 31, 2017 Current assets: $ 17,305 $ 18,107 $ 17,824 Cash and cash equivalents (Notes 1 and 2) Marketable securities (Notes 1 and 2) 1,982 1,580 472 Accounts receivable trade, less allowances for doubtful accounts $226 (2018, $248) 14,481 14,098 13,490 Inventories (Notes 1 and 3) 9,020 8,599 8,765 Prepaid expenses and other receivables Assets held for sale (Note 20) 2,392 2,699 2,537 94 950 Total current assets 45,274 46,033 43,088 Property, plant and equipment, net (Notes 1 and 4) 17,658 17,035 17,005 Intangible assets, net (Notes 1 and 5) Goodwill (Notes 1 and 5) 47,643 47,611 53,228 33,639 30,453 31,906 Deferred taxes on income (Note 8) 7,819 7,640 7,105 Other assets 5,695 4,182 4,971 Total assets 157,728 152,954 157,303 Current liabilities: Loans and notes payable (Note 7) Accounts payable 1,202 2,796 3,906 8,544 7,537 7,310 Accrued liabilities 9,715 7,601 7,304 Accrued rebates, returns and promotions 10,883 9,380 7,210 3,354 2,953 Accrued compensation and employee related obligations Accrued taxes on income (Note 8) 3,098 2,266 818 1,854 Total current liabilities 35,964 31,230 30,537 Long-term debt (Note 7) Deferred taxes on income (Note 8) 26,494 27,684 30,675 5,958 7,506 8,368 Employee related obligations (Notes 9 and 10) 10,663 9,951 10,074 Long-term taxes payable (Note 8) Other liabilities 7,444 8,242 8,472 11,734 8,589 9,017 Total liabilities 98,257 93,202 97,143 Shareholders' equity: Common stock par value $1.00 per share (Note 12) (authorized 4,320,000,000 shares; issued 3,120 3,120 3,120 3,119,843,000 shares) Accumulated other comprehensive income (loss) (Note 13) Retained earnings (15,891) (15,222) (13,199) 110,659 106,216 101,793 Stockholders' Equity before Treasury Stock 97,888 94,114 91,714 Less: common stock held in treasury, at cost (Note 12) (487,336,000 shares and 457,519,000 38,417 34,362 31,554 shares) Total shareholders' equity Total liabilities and shareholders' equity 59,471 59,752 60,160 $ 157,728 $ 152,954 $ 157,303

Step by Step Solution

★★★★★

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Change 1718 Change 1718 Change 1819 Change 1819 JJ Cash 283 159 802 443 4349 1873 5235 4774 1711 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started