Answered step by step

Verified Expert Solution

Question

1 Approved Answer

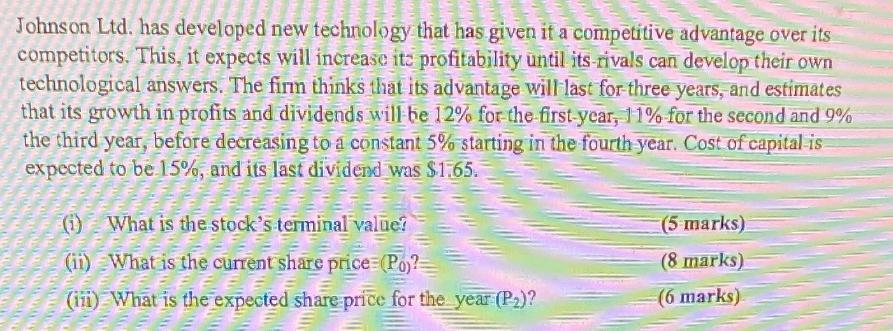

Johnson Ltd. has developed new technology that has given if a competitive advantage over its competitors. This, it expects will increase its profitability until

Johnson Ltd. has developed new technology that has given if a competitive advantage over its competitors. This, it expects will increase its profitability until its-rivals can develop their own technological answers. The firm thinks that its advantage will last for three years, and estimates that its growth in profits and dividends will be 12% for the first year, 11% for the second and 9% the third year, before decreasing to a constant 5% starting in the fourth year. Cost of capital is expected to be 15%, and its last dividend was $1.65. (1) What is the stock's terminal value? (ii) What is the current share price (Po)? (iii) What is the expected share price for the year (P)? (5 marks) (8 marks) (6 marks)

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION 1 Terminal Value Dividend in Year 3 1 gk g 165 1 00...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started