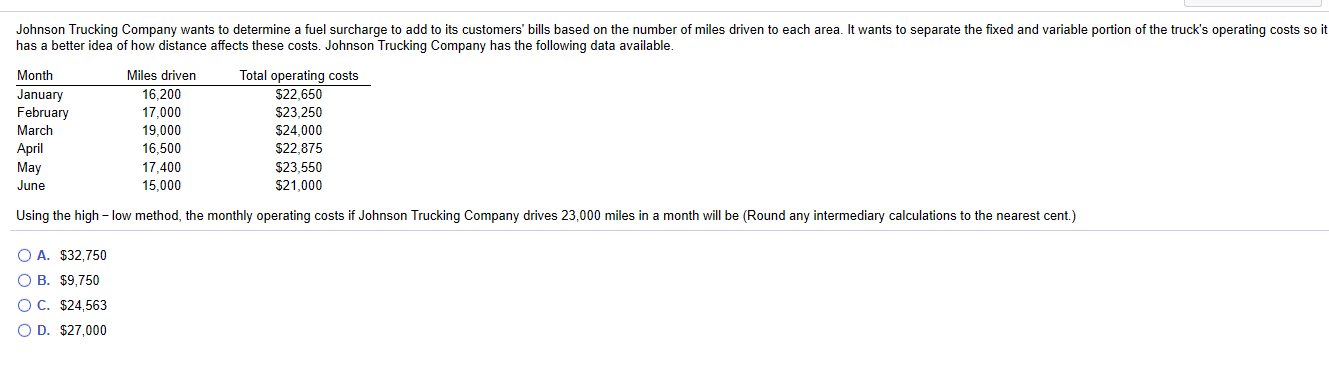

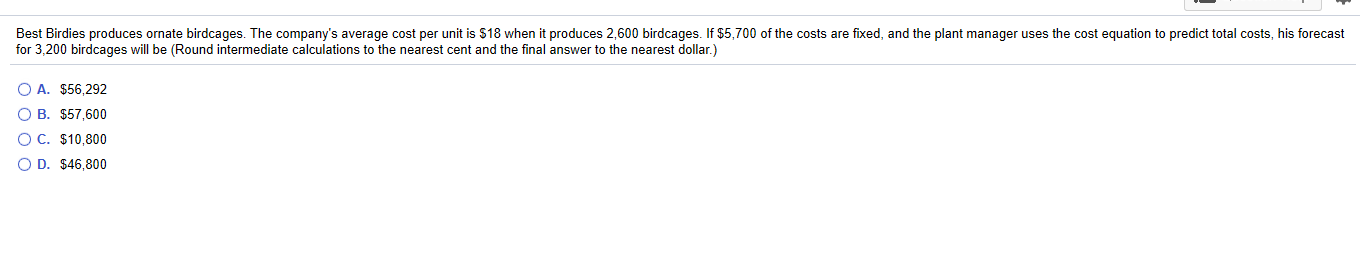

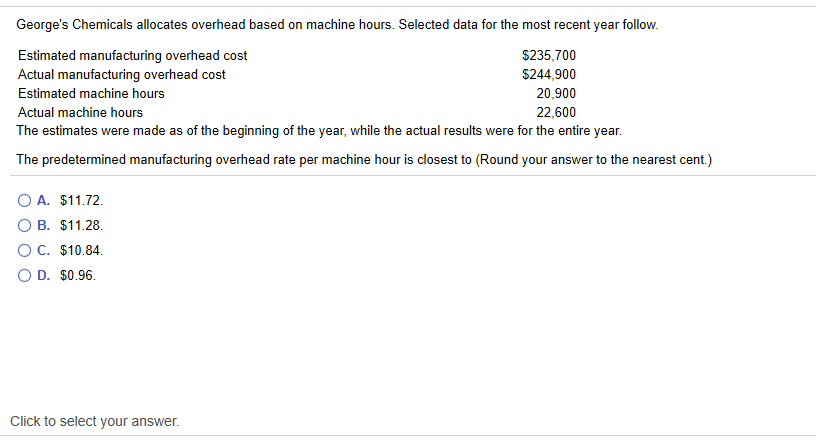

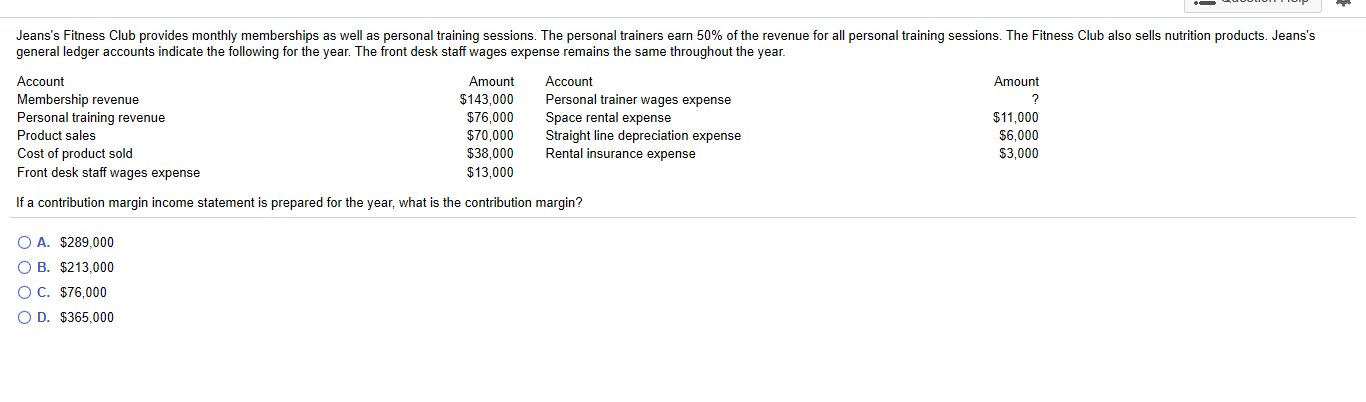

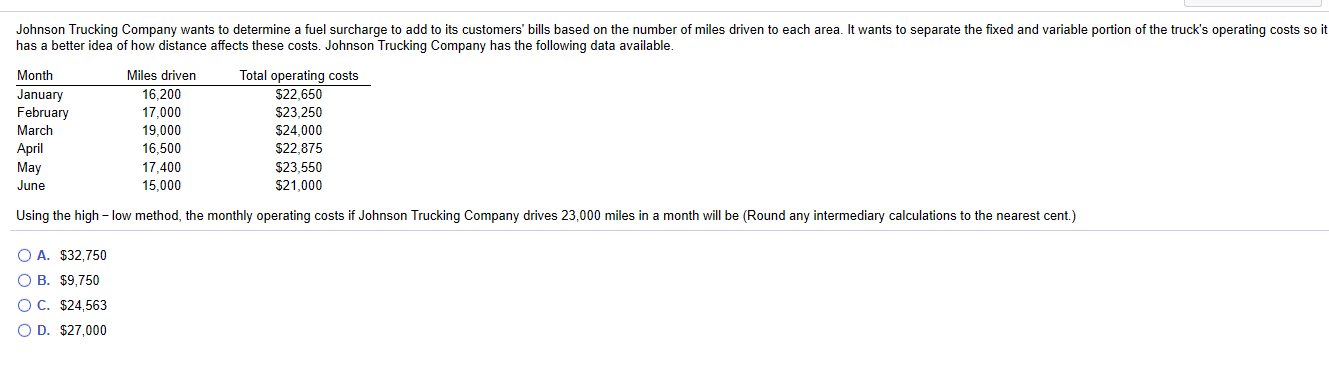

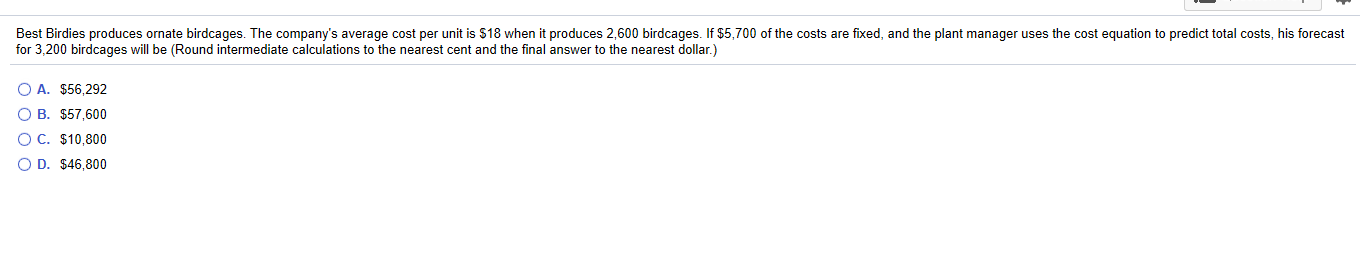

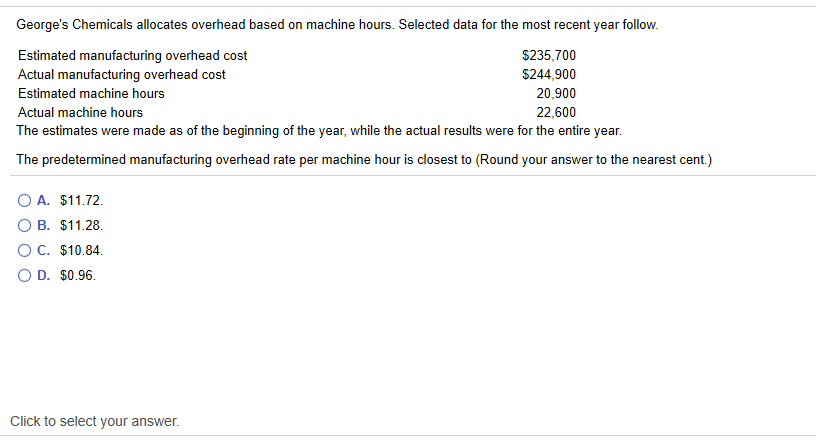

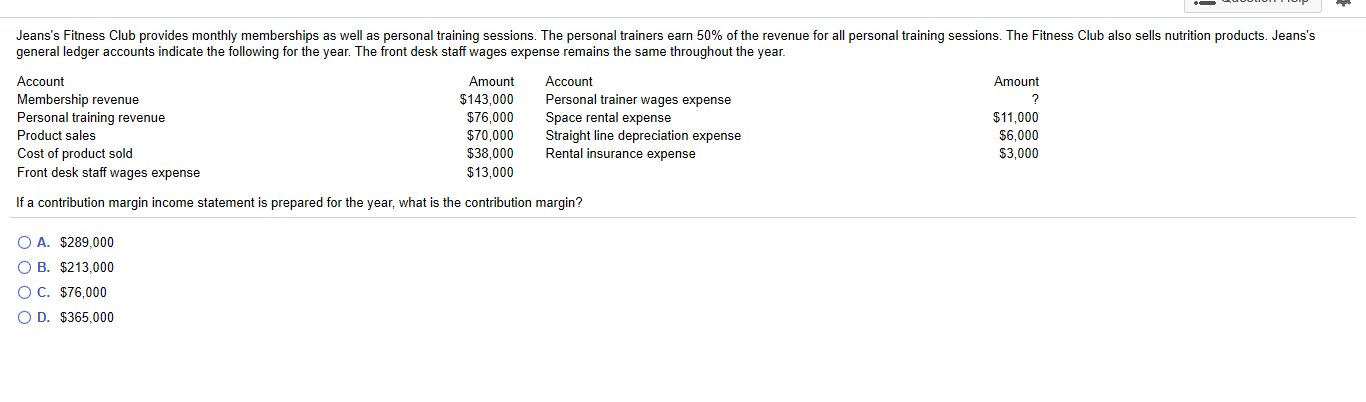

Johnson Trucking Company wants to determine a fuel surcharge to add to its customers' bills based on the number of miles driven to each area. It wants to separate the fixed and variable portion of the truck's operating costs so it has a better idea of how distance affects these costs. Johnson Trucking Company has the following data available. Month January February March April Miles driven 16.200 17,000 19,000 16,500 17.400 15.000 Total operating costs $22,650 $23,250 $24,000 $22.875 $23,550 $21,000 May June Using the high-low method, the monthly operating costs if Johnson Trucking Company drives 23,000 miles in a month will be (Round any intermediary calculations to the nearest cent.) O A. $32,750 OB. $9,750 OC. $24,563 OD. $27,000 Best Birdies produces ornate birdcages. The company's average cost per unit is $18 when it produces 2,600 birdcages. If $5,700 of the costs are fixed, and the plant manager uses the cost equation to predict total costs, his forecast for 3,200 birdcages will be (Round intermediate calculations to the nearest cent and the final answer to the nearest dollar.) O A. $56,292 OB. $57,600 O C. $10,800 OD. $46,800 George's Chemicals allocates overhead based on machine hours. Selected data for the most recent year follow. Estimated manufacturing overhead cost $235,700 Actual manufacturing overhead cost $244,900 Estimated machine hours 20,900 Actual machine hours 22,600 The estimates were made as of the beginning of the year, while the actual results were for the entire year. The predetermined manufacturing overhead rate per machine hour is closest to (Round your answer to the nearest cent.) O A. $11.72 OB. $11.28. O C. $10.84. OD. $0.96. Click to select your answer. Jeans's Fitness Club provides monthly memberships as well as personal training sessions. The personal trainers earn 50% of the revenue for all personal training sessions. The Fitness Club also sells nutrition products. Jeans's general ledger accounts indicate the following for the year. The front desk staff wages expense remains the same throughout the year. Account Membership revenue Personal training revenue Product sales Cost of product sold Front desk staff wages expense Amount $143,000 $76,000 $70.000 $38,000 $13,000 Account Personal trainer wages expense Space rental expense Straight line depreciation expense Rental insurance expense Amount ? $11,000 $6,000 $3,000 If a contribution margin income statement is prepared for the year, what is the contribution margin? O A. $289,000 O B. $213,000 O C. $76,000 OD. $365,000