Question

Johnsons Printing Industries is considering replacing a 10-year-old manual pressing machine with a new automated one. The present and the expected situation resulting from the

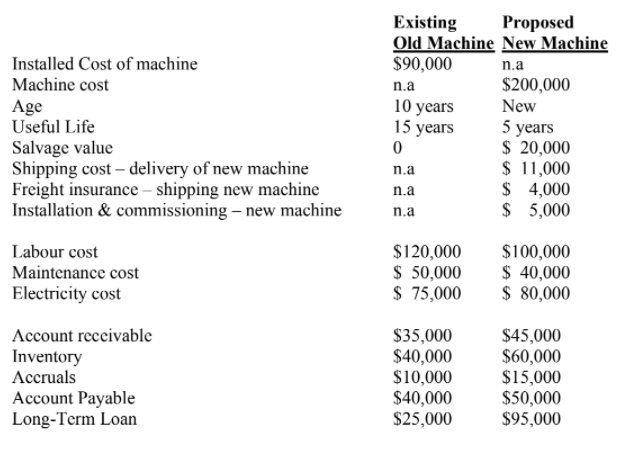

Johnsons Printing Industries is considering replacing a 10-year-old manual pressing machine with a new automated one. The present and the expected situation resulting from the replacement is as follows:

Other information available are: 1. Incremental increase in sales is expected to be $40,000 yearly for the next 5 years. 2. Depreciation is based on a straight-line method. 3. The existing old machine can be sold today for $20,000 and will be worthless at the end of its useful life. 4. Tax rate is 25% 5. Risk-adjusted hurdle rate = 13.50% Using NPV and IRR, determine whether the company should proceed with the replacement? Explain briefly.

Installed Cost of machine Machine cost Age Useful Life Salvage value Shipping cost delivery of new machine Freight insurance shipping new machine Installation & commissioning - new machine Existing Proposed Old Machine New Machine $90,000 n.a n.a $200,000 10 years New 15 years 5 years 0 $ 20,000 na $ 11,000 na $ 4,000 n.a $ 5,000 Labour cost Maintenance cost Electricity cost $120,000 $ 50,000 $ 75,000 $100,000 $ 40,000 $ 80,000 Account receivable Inventory Accruals Account Payable Long-Term Loan $35,000 $40,000 $10,000 $40,000 $25,000 $45,000 $60,000 $15,000 $50,000 $95,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started