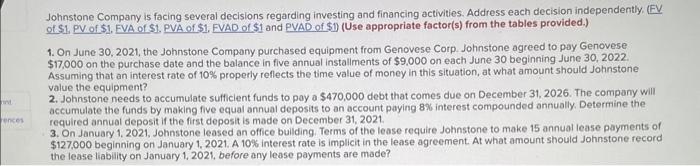

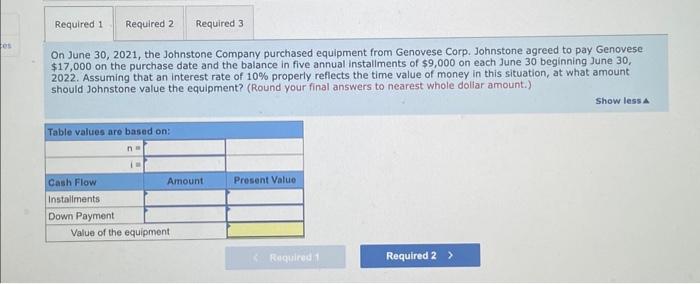

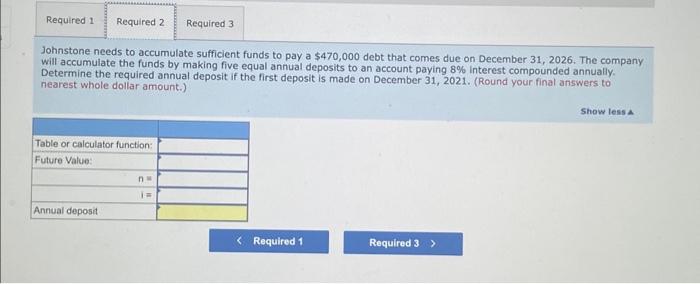

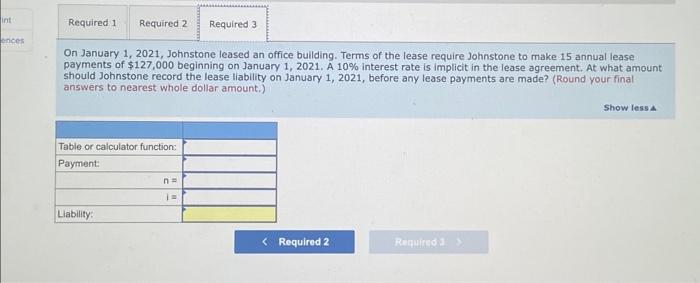

Johnstone Company is facing several decisions regarding investing and financing activities. Address each decision independently. (FV of \$1. PV of \$1. EVA of S1. PVA. of \$1, EVAD of \$1 and PVAD of \$1) (Use appropriate factor(s) from the tables provided.) 1. On June 30, 2021, the Johnstone Compony purchased equipment from Genovese Corp. Johnstone agreed to poy Genovese $17,000 on the purchase date and the balance in flve annual instaliments of $9.000 on each June 30 beginning June 30,2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? 2. Johnstone needs to accumulate sufficient funds to pay a $470,000 debt that comes due on December 31,2026 . The company will accumulate the funds by making five equal annual deposits to an account paying 8% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31,2021 . 3. On January 1, 2021. Johnstone leased an office buliding. Terms of the lease require Johnstone to make 15 annual lease payments of $127,000 beginning on January 1,2021. A 10% interest rate is implicit in the lease agreement. At what amount should Johnstone record the lease liability on January 1,2021 , before any lease payments are made? On June 30, 2021, the Johnstone Company purchased equipment from Genovese Corp. Johnstone agreed to pay Genovese $17,000 on the purchase date and the balance in five annual instaliments of $9,000 on each June 30 beginning June 30 , 2022. Assuming that an interest rate of 10% properly reflects the time value of money in this situation, at what amount should Johnstone value the equipment? (Round your final answers to nearest whole doliar amount.) Johnstone needs to accumulate sufficient funds to pay a $470,000 debt that comes due on December 31,2026. The company will accumulate the funds by making five equal annual deposits to an account paying 8% interest compounded annually. Determine the required annual deposit if the first deposit is made on December 31,2021 . (Round your final answers to nearest whole dollar amount.) On January 1, 2021, Johnstone leased an office buliding. Terms of the lease require Johnstone to make 15 annual lease payments of $127,000 beginning on January 1,2021 . A 10% interest rate is implicit in the lease agreement. At what amount should Johnstone record the lease liability on January 1, 2021, before any lease payments are made? (Round your final answers to nearest whole dollar amount.)