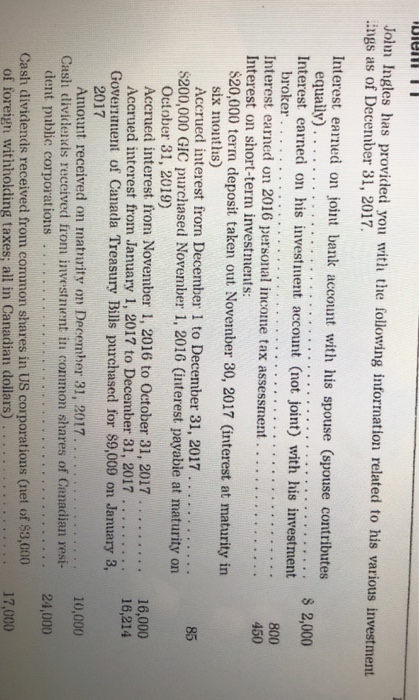

Join Ingles has provided you with the following information related to his various investment ings as of December 31, 2017. Interest earned on joint bank account with his spouse (spouse contributes Interest earned on his investment account (not joint) with his investment Interest earned on 2016 petrsonal income tax assessment 8 2,000 800 450 Interest on short-term investments: $20,000 term deposit taken out November 30, 2017 (interest at maturity in six months) Accrued interest frorn December 1 to December 31, 2017. 2 85 $200,000 GIC purchased November 1, 2016 (interest payable at maturity on October 31, 2019) Accrued interest from November 1, 2016 to October 31, 2017 . Accrued interest from January 1, 2017 to December 31, 2017 . .. 16,000 16,214 Govermuent of Canada Treasury Bills purchased for S9,009 on January 3, 2017 Amount received on matnrity on Decemher 31, 2017. . 10,000 24,000 17,000 Cash divideds received from investment in common shares of Canadian resi- dent public corporations Cash dividends received from common shares in US corporations (net of $3,000 of foreign withholding taxes; all in Canadian dollars) Join Ingles has provided you with the following information related to his various investment ings as of December 31, 2017. Interest earned on joint bank account with his spouse (spouse contributes Interest earned on his investment account (not joint) with his investment Interest earned on 2016 petrsonal income tax assessment 8 2,000 800 450 Interest on short-term investments: $20,000 term deposit taken out November 30, 2017 (interest at maturity in six months) Accrued interest frorn December 1 to December 31, 2017. 2 85 $200,000 GIC purchased November 1, 2016 (interest payable at maturity on October 31, 2019) Accrued interest from November 1, 2016 to October 31, 2017 . Accrued interest from January 1, 2017 to December 31, 2017 . .. 16,000 16,214 Govermuent of Canada Treasury Bills purchased for S9,009 on January 3, 2017 Amount received on matnrity on Decemher 31, 2017. . 10,000 24,000 17,000 Cash divideds received from investment in common shares of Canadian resi- dent public corporations Cash dividends received from common shares in US corporations (net of $3,000 of foreign withholding taxes; all in Canadian dollars)