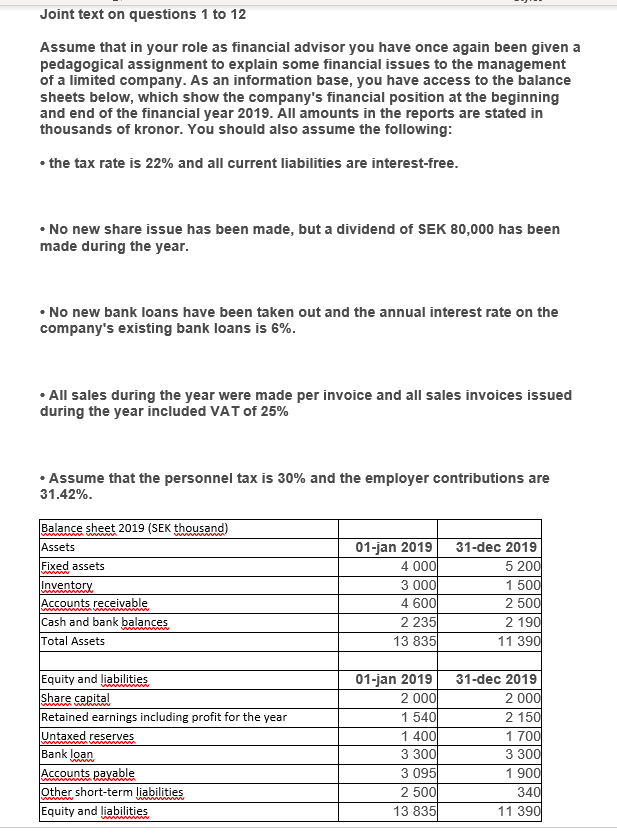

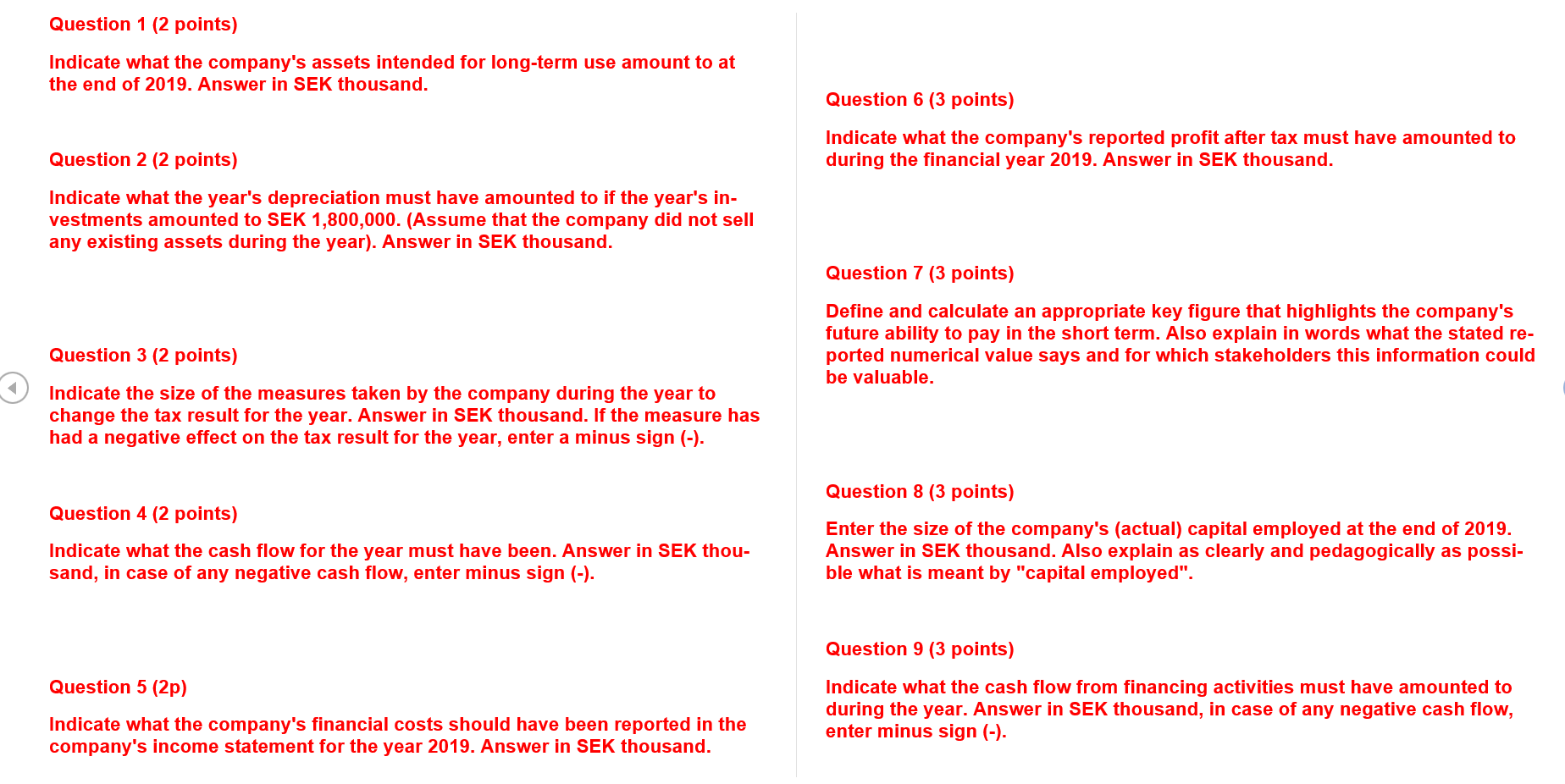

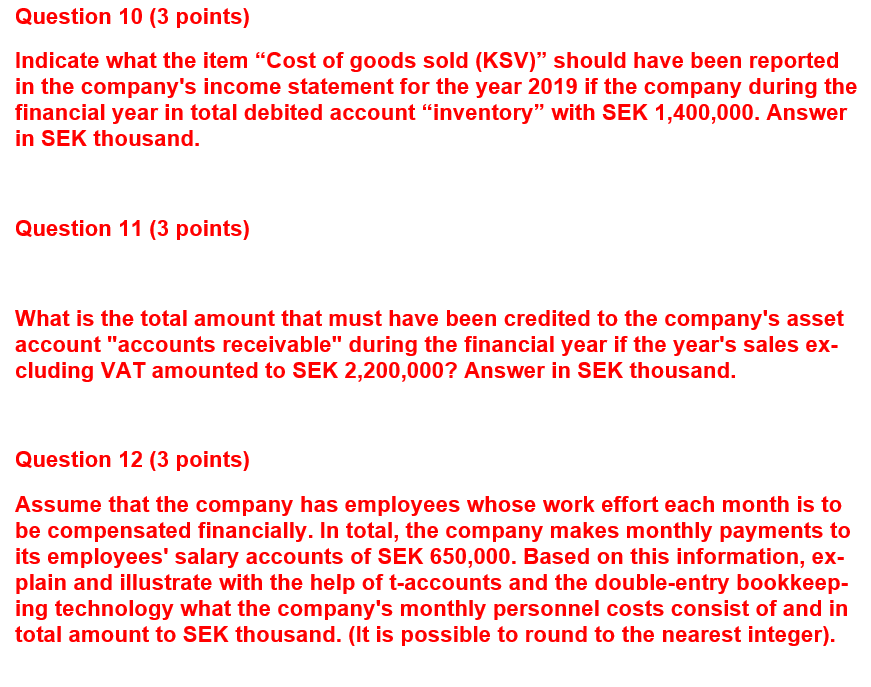

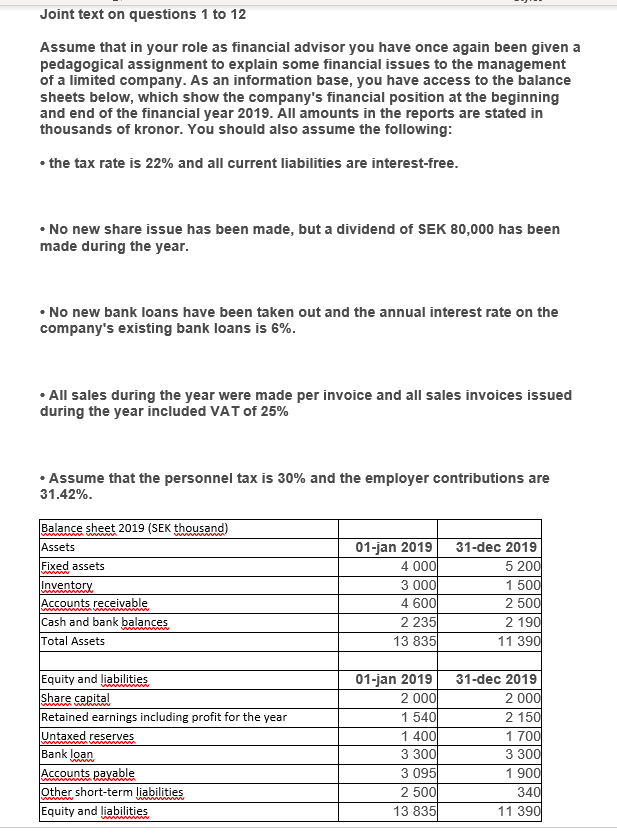

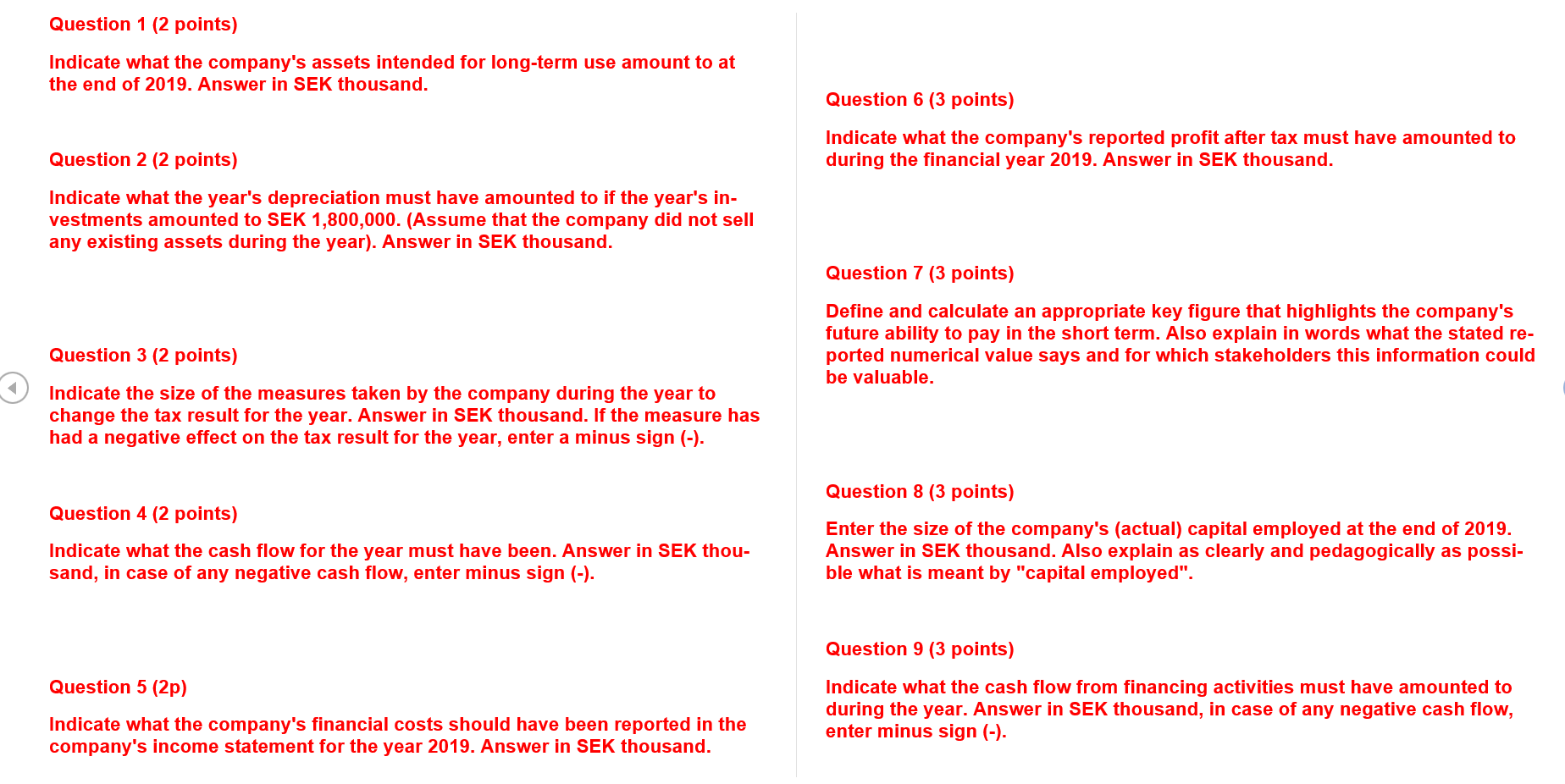

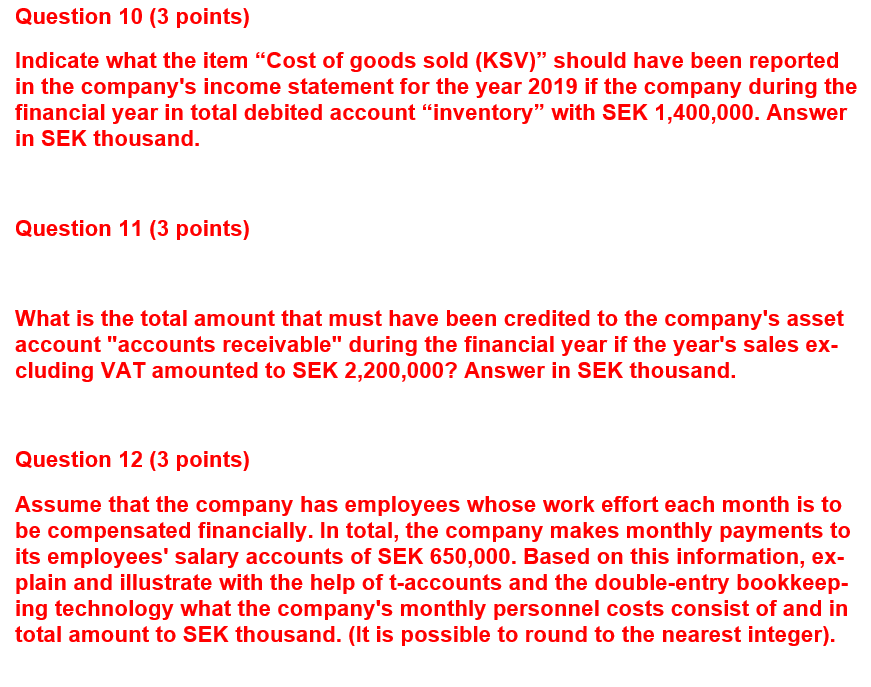

Joint text on questions 1 to 12 Assume that in your role as financial advisor you have once again been given a pedagogical assignment to explain some financial issues to the management of a limited company. As an information base, you have access to the balance sheets below, which show the company's financial position at the beginning and end of the financial year 2019. All amounts in the reports are stated in thousands of kronor. You should also assume the following: the tax rate is 22% and all current liabilities are interest-free. No new share issue has been made, but a dividend of SEK 80,000 has been made during the year. No new bank loans have been taken out and the annual interest rate on the company's existing bank loans is 6%. All sales during the year were made per invoice and all sales invoices issued during the year included VAT of 25% Assume that the personnel tax is 30% and the employer contributions are 31.42% VAATA Balance sheet 2019 (SEK thousand) Assets Fixed assets Inventory Accounts receivable Cash and bank balances Total Assets 01-jan 2019 4 000 3 000 4600 2 2351 13 835 31-dec 2019 5 2001 1 500 2 500 2 1901 11 390 w WWWWWW Equity and liabilities Share capital Retained earnings including profit for the year Untaxed reserves Bank loan Accounts payable Other short-term liabilities Equity and liabilities 01-jan 2019 2 000 1 5401 1 400 3 300 3 0951 2 5001 13 835 31 dec 2019 2 000 2 150 1 700 3 300 1 900 340 11 390 Question 1 (2 points) Indicate what the company's assets intended for long-term use amount to at the end of 2019. Answer in SEK thousand. Question 6 (3 points) Indicate what the company's reported profit after tax must have amounted to during the financial year 2019. Answer in SEK thousand. Question 2 (2 points) Indicate what the year's depreciation must have amounted to if the year's in- vestments amounted to SEK 1,800,000. (Assume that the company did not sell any existing assets during the year). Answer in SEK thousand. Question 7 (3 points) Define and calculate an appropriate key figure that highlights the company's future ability to pay in the short term. Also explain in words what the stated re- ported numerical value says and for which stakeholders this information could be valuable. Question 3 (2 points) Indicate the size of the measures taken by the company during the year to change the tax result for the year. Answer in SEK thousand. If the measure has had a negative effect on the tax result for the year, enter a minus sign (-). Question 4 (2 points) Indicate what the cash flow for the year must have been. Answer in SEK thou- sand, in case of any negative cash flow, enter minus sign (-). Question 8 (3 points) Enter the size of the company's (actual) capital employed at the end of 2019. Answer in SEK thousand. Also explain as clearly and pedagogically as possi- ble what is meant by "capital employed". Question 5 (2p) Question 9 (3 points) Indicate what the cash flow from financing activities must have amounted to during the year. Answer in SEK thousand, in case of any negative cash flow, enter minus sign (-). Indicate what the company's financial costs should have been reported in the company's income statement for the year 2019. Answer in SEK thousand. Question 10 (3 points) Indicate what the item "Cost of goods sold (KSV) should have been reported in the company's income statement for the year 2019 if the company during the financial year in total debited account "inventory" with SEK 1,400,000. Answer in SEK thousand. Question 11 (3 points) What is the total amount that must have been credited to the company's asset account "accounts receivable" during the financial year if the year's sales ex- cluding VAT amounted to SEK 2,200,000? Answer in SEK thousand. Question 12 (3 points) Assume that the company has employees whose work effort each month is to be compensated financially. In total, the company makes monthly payments to its employees' salary accounts of SEK 650,000. Based on this information, ex- plain and illustrate with the help of t-accounts and the double-entry bookkeep- ing technology what the company's monthly personnel costs consist of and in total amount to SEK thousand. (It is possible to round to the nearest integer)