Answered step by step

Verified Expert Solution

Question

1 Approved Answer

JOJO Foods Ltd. is one of subsidiaries of Noor group of industries that sell packaged food items. Noor group is in the process of

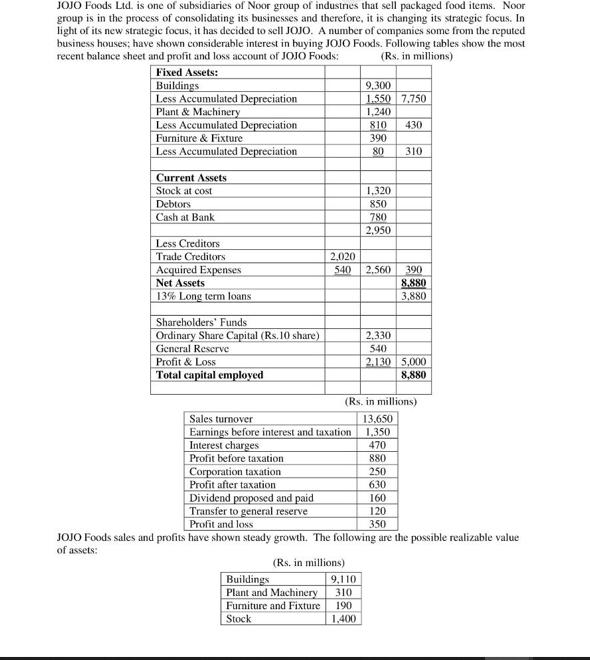

JOJO Foods Ltd. is one of subsidiaries of Noor group of industries that sell packaged food items. Noor group is in the process of consolidating its businesses and therefore, it is changing its strategic focus. In light of its new strategic focus, it has decided to sell JOJO. A number of companies some from the reputed business houses; have shown considerable interest in buying JOJO Foods. Following tables show the most recent balance sheet and profit and loss account of JOJO Foods: (Rs. in millions) Fixed Assets: Buildings Less Accumulated Depreciation Plant & Machinery Less Accumulated Depreciation Furniture & Fixture Less Accumulated Depreciation Current Assets Stock at cost Debtors Cash at Bank Less Creditors Trade Creditors Acquired Expenses Net Assets 13% Long term loans Shareholders' Funds Ordinary Share Capital (Rs.10 share) General Reserve Profit & Loss Total capital employed Sales turnover Earnings before interest and taxation Interest charges Profit before taxation Corporation taxation Profit after taxation Buildings Plant and Machinery Furniture and Fixture Stock 9,300 1.550 7.750 1,240 810 430 390 80 2,020 540 2.560 9,110 310 190 1,400 1,320 850 780 2,950 310 (Rs. in millions) 13,650 1.350 470 880 250 630 Dividend proposed and paid 160 120 Transfer to general reserve Profit and loss 350 JOJO Foods sales and profits have shown steady growth. The following are the possible realizable value of assets: (Rs. in millions) 390 8,880 3,880 2,330 540 2.130 5,000 8,880 The book values of other assets are close approximation of their realizable value. A close competitor of JOJO Foods has a price earnings ratio of 12.5 and dividend yield of 5.4 percent. The corporate income tax rate is 35 percent Required Calculate the value of JOJO Foods using alternative methods. Which method do you suggest as most appropriate? Why should Noor Group sell its subsidiary?

Step by Step Solution

★★★★★

3.49 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started