Jona Kenson, your good friend, has come to you for financial advice regarding their retirement which will occur in (20 + E) years. They

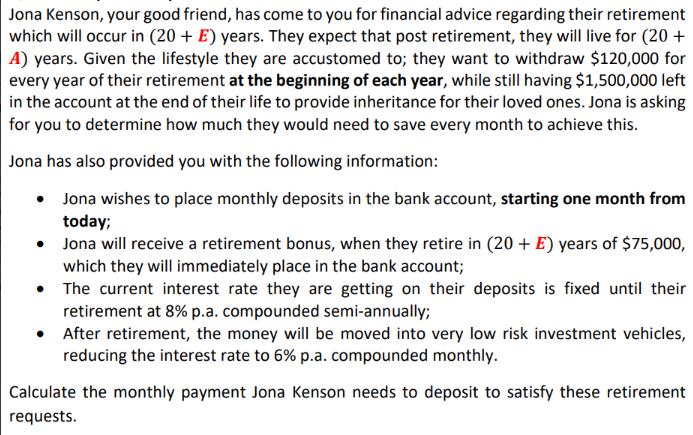

Jona Kenson, your good friend, has come to you for financial advice regarding their retirement which will occur in (20 + E) years. They expect that post retirement, they will live for (20 + A) years. Given the lifestyle they are accustomed to; they want to withdraw $120,000 for every year of their retirement at the beginning of each year, while still having $1,500,000 left in the account at the end of their life to provide inheritance for their loved ones. Jona is asking for you to determine how much they would need to save every month to achieve this. Jona has also provided you with the following information: Jona wishes to place monthly deposits in the bank account, starting one month from today; Jona will receive a retirement bonus, when they retire in (20 + E) years of $75,000, which they will immediately place in the bank account; The current interest rate they are getting on their deposits is fixed until their retirement at 8% p.a. compounded semi-annually; After retirement, the money will be moved into very low risk investment vehicles, reducing the interest rate to 6% p.a. compounded monthly. Calculate the monthly payment Jona Kenson needs to deposit to satisfy these retirement requests.

Step by Step Solution

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To determine the monthly payment Jona needs to deposit to achieve their retirement goals we can use ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started