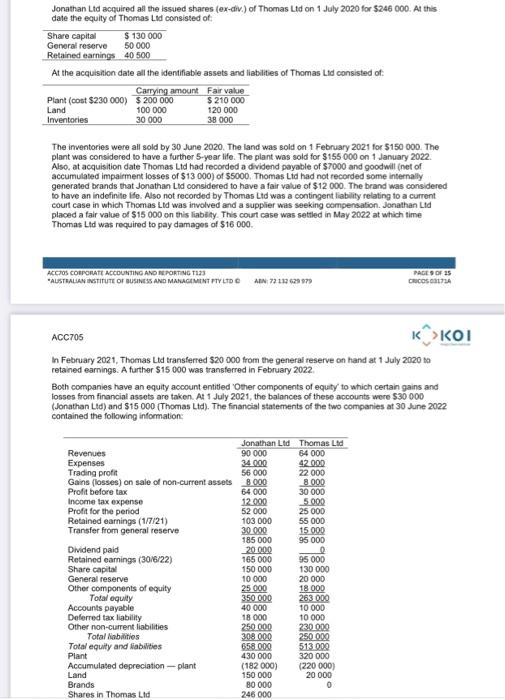

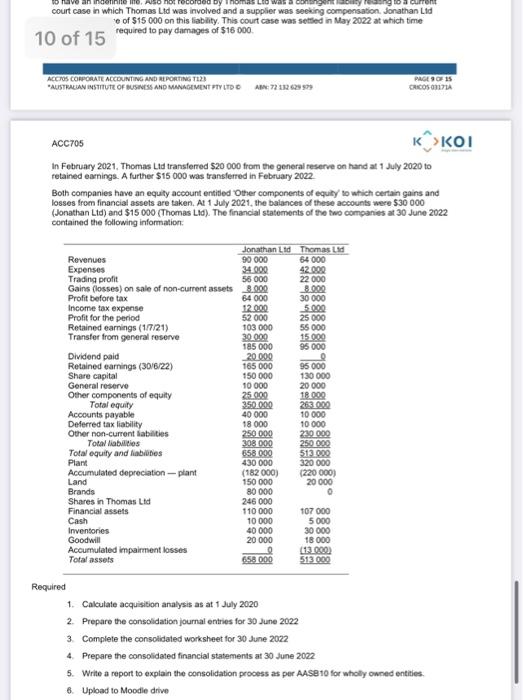

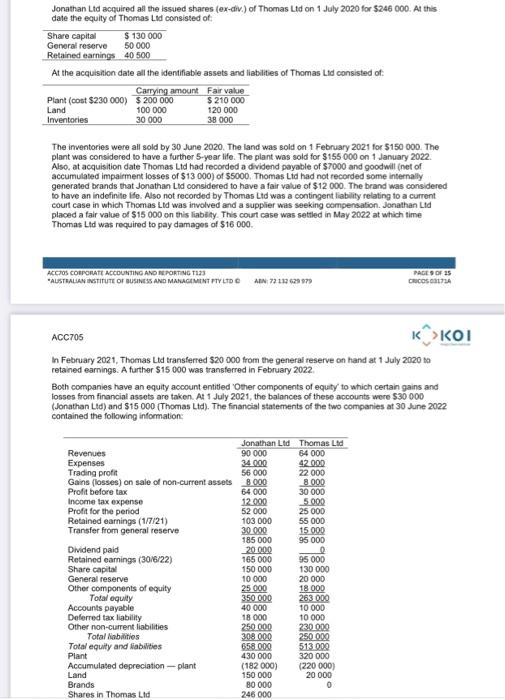

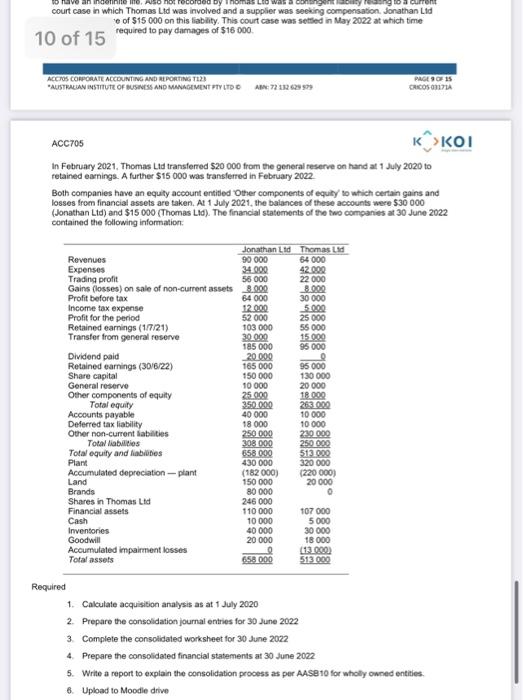

Jonathan Ltd acquired all the issued shares (ex-div.) of Thomas Ltd on 1 July 2020 for $246 000. At this date the equity of Thomas Ltd consisted of: Share capital $ 130 000 General reserve 50 000 Retained earnings 40 500 At the acquisition date all the identifiable assets and liabilities of Thomas Ltd consisted of: Carrying amount Fair value $ 210 000 120 000 38 000 Plant (cost $230 000) $200 000 Land 100 000 Inventories 30 000 The inventories were all sold by 30 June 2020. The land was sold on 1 February 2021 for $150 000. The plant was considered to have a further 5-year life. The plant was sold for $155 000 on 1 January 2022. Also, at acquisition date Thomas Ltd had recorded a dividend payable of $7000 and goodwill (net of accumulated impairment losses of $13 000) of $5000. Thomas Ltd had not recorded some internally generated brands that Jonathan Ltd considered to have a fair value of $12 000. The brand was considered to have an indefinite life. Also not recorded by Thomas Ltd was a contingent liability relating to a current court case in which Thomas Ltd was involved and a supplier was seeking compensation. Jonathan Ltd placed a fair value of $15 000 on this liability. This court case was settled in May 2022 at which time Thomas Ltd was required to pay damages of $16 000. ACC705 CORPORATE ACCOUNTING AND REPORTING T123 *AUSTRALIAN INSTITUTE OF BUSINESS AND MANAGEMENT PTY LTD ABN: 72 132 629 979 ACC705 In February 2021, Thomas Ltd transferred $20 000 from the general reserve on hand at 1 July 2020 to retained earnings. A further $15 000 was transferred in February 2022. Revenues Expenses Trading profit Gains (losses) on sale of non-current assets Profit before tax Both companies have an equity account entitled 'Other components of equity' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these accounts were $30 000 (Jonathan Ltd) and $15 000 (Thomas Ltd). The financial statements of the two companies at 30 June 2022 contained the following information: Income tax expense Profit for the period Retained earnings (1/7/21) Transfer from general reserve Dividend paid Retained earnings (30/6/22) Share capital General reserve Other components of equity Total equity Accounts payable Deferred tax liability Other non-current liabilities Total liabilities Total equity and liabilities Plant Accumulated depreciation - plant Land Brands Shares in Thomas Ltd Jonathan Ltd 90 000 34 000 56 000 8 000 64 000 12 000 52 000 103 000 30 000 185 000 20 000 165 000 150 000 10 000 25 000 350 000 40 000 18 000 250 000 308 000 658 000 430 000 (182 000) 150 000 80 000 246 000 Thomas Ltd 64 000 42 000 22 000 8 000 30 000 5 000 25 000 PAGE 9 OF 15 CRICOS 03171A 55 000 15 000 95 000 0 95 000 130 000 20 000 18 000 K >KOI 263 000 10 000 10 000 230 000 250 000 513 000 320 000 (220 000) 20 000 0

Jonathan Ltd acquired all the issued shares (ex-div.) of Thomas Lid on 1 duly 2020 for $246000. At this date the equity of Thomas Lid consisted of: At the acquisition date all the identifiable assets and liabilties of Thomas Lid consisted of: The imventories were all sold by 30 June 2020. The land was sold on 1 February 2021 for $150000. The plant was considered to have a further 5 -year life. The plant was sold for $155000 on 1 danuary 2022. Also. at acquisition date Thomas Ltd had recorded a dividend payable of $7000 and goodwilt (net of accumulated impairment losses of $13000 ) of $5000. Thomas Lid had not recorded some internally generated brands that Jonathan Lid considered to have a fair value of $12000. The brand was considered to have an indefinite Re. Also not recorded by Thomas Ltd was a contingent liability relating to a current court case in which Thomas Lbd was involved and a supplier was seeking compensation. Jonathan Lid placed a fair value of 515000 on this liabity. This court case was settled in May 2022 at which time Thomas Ld was required to pay damages of 516000 . ACctos CoEporaft Mccouktho ANO Re haknuL t123 bact 5 or 15 crocoschtim ACC705 K>KO In February 2021, Thomas Ltd transferred 320 ooo from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022. Both companies have an equity account entitled 'Oter components of equity' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these accounts were $30000 (Jonathan Ltd) and $15000 (Thomas Ltd). The financial statements of the two companies at 30 June 2022 contained the folkwing information: court case in which Thomas Ltd was involved and a supplier was seeiing compensation. Jonathan Lid e of $15000 on this liablity. This court case was setthed in May 2022 at which time 10 of 15 requires to pay dammaes of 156 0on. pact 9 cin is. ABs: 7? 114 64w stof ACC705 In February 2021. Thomas Ltd transferred $20000 from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022. Both companies have an equity acoount entited Other components of equily' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these acoounts were 530000 (Jonathan Ltd) and $15000 (Thomas Lid). The financial statements of the two companies at 30 June 2022 contained the following information. Recuired 1. Calculate acquisition analysis as at 1 July 2020 2. Prepare the consolidation journal entries for 30 June 2022 3. Complete the consolidated worksheet for 30 June 2022 4. Prepare the consolidated financial statements at 30 June 2022 5. Write a report to explain the consolidation prooess as per AASB10 for wholy owned entities. 6. Upload to Moodle drive Jonathan Ltd acquired all the issued shares (ex-div.) of Thomas Lid on 1 duly 2020 for $246000. At this date the equity of Thomas Lid consisted of: At the acquisition date all the identifiable assets and liabilties of Thomas Lid consisted of: The imventories were all sold by 30 June 2020. The land was sold on 1 February 2021 for $150000. The plant was considered to have a further 5 -year life. The plant was sold for $155000 on 1 danuary 2022. Also. at acquisition date Thomas Ltd had recorded a dividend payable of $7000 and goodwilt (net of accumulated impairment losses of $13000 ) of $5000. Thomas Lid had not recorded some internally generated brands that Jonathan Lid considered to have a fair value of $12000. The brand was considered to have an indefinite Re. Also not recorded by Thomas Ltd was a contingent liability relating to a current court case in which Thomas Lbd was involved and a supplier was seeking compensation. Jonathan Lid placed a fair value of 515000 on this liabity. This court case was settled in May 2022 at which time Thomas Ld was required to pay damages of 516000 . ACctos CoEporaft Mccouktho ANO Re haknuL t123 bact 5 or 15 crocoschtim ACC705 K>KO In February 2021, Thomas Ltd transferred 320 ooo from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022. Both companies have an equity account entitled 'Oter components of equity' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these accounts were $30000 (Jonathan Ltd) and $15000 (Thomas Ltd). The financial statements of the two companies at 30 June 2022 contained the folkwing information: court case in which Thomas Ltd was involved and a supplier was seeiing compensation. Jonathan Lid e of $15000 on this liablity. This court case was setthed in May 2022 at which time 10 of 15 requires to pay dammaes of 156 0on. pact 9 cin is. ABs: 7? 114 64w stof ACC705 In February 2021. Thomas Ltd transferred $20000 from the general reserve on hand at 1 July 2020 to retained earnings. A further $15000 was transferred in February 2022. Both companies have an equity acoount entited Other components of equily' to which certain gains and losses from financial assets are taken. At 1 July 2021, the balances of these acoounts were 530000 (Jonathan Ltd) and $15000 (Thomas Lid). The financial statements of the two companies at 30 June 2022 contained the following information. Recuired 1. Calculate acquisition analysis as at 1 July 2020 2. Prepare the consolidation journal entries for 30 June 2022 3. Complete the consolidated worksheet for 30 June 2022 4. Prepare the consolidated financial statements at 30 June 2022 5. Write a report to explain the consolidation prooess as per AASB10 for wholy owned entities. 6. Upload to Moodle drive