Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jonathan recently sold his home and was able to take home $493,500 after paying the real estate broker's commission of 6%, if the buyer was

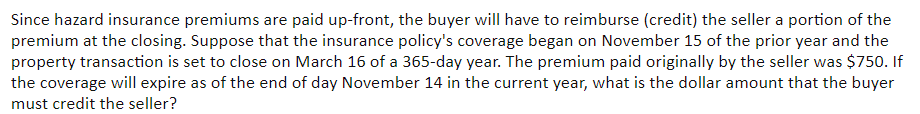

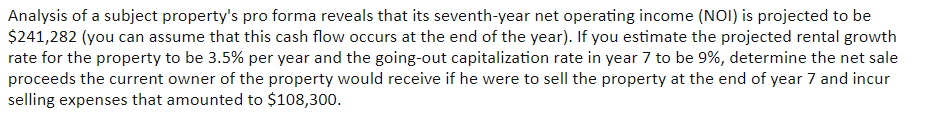

Jonathan recently sold his home and was able to take home $493,500 after paying the real estate broker's commission of 6%, if the buyer was ultimately found through a buyer broker, the dollar commission will need to be split between the listing broker and buyer broker. If the buyer broker is entitled to 50% of the commission, what is her share of the commission rounded to the nearest dollar? Suppose that you just sold a property that has annual property taxes of $7,445.20. If the closing occurred on February 13, calculate your share (seller's share) of the total property taxes. For this problem, assume that we are dealing with a 365-day calendar year. february r this problem, assume that we Suppose that examination of a pro forma reveals that the fifth-year net operating income (NOI) for an income-producing property that you are analyzing is $102,846 (you can assume that this cash flow occurs at the end of the year). If you estimate the projected rental growth rate for the property to be 4% per year, determine the projected sale price of the property at the end of year 5 if the going-out capitalization rate is 8%. Since hazard insurance premiums are paid up-front, the buyer will have to reimburse (credit) the seller a portion of the premium at the closing. Suppose that the insurance policy's coverage began on November 15 of the prior year and the property transaction is set to close on March 16 of a 365-day year. The premium paid originally by the seller was $750. If the coverage will expire as of the end of day November 14 in the current year, what is the dollar amount that the buyer must credit the seller? Analysis of a subject property's pro forma reveals that its seventh-year net operating income (NOI) is projected to be $241,282 (you can assume that this cash flow occurs at the end of the year). If you estimate the projected rental growth rate for the property to be 3.5% per year and the going-out capitalization rate in year 7 to be 9%, determine the net sale proceeds the current owner of the property would receive if he were to sell the property at the end of year 7 and incur selling expenses that amounted to $108,300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started