Jonathan Smith will be headed to college in the fall, provide an overview of the various education tax credits they may be able to take advantage of on next years return. Words 300 +

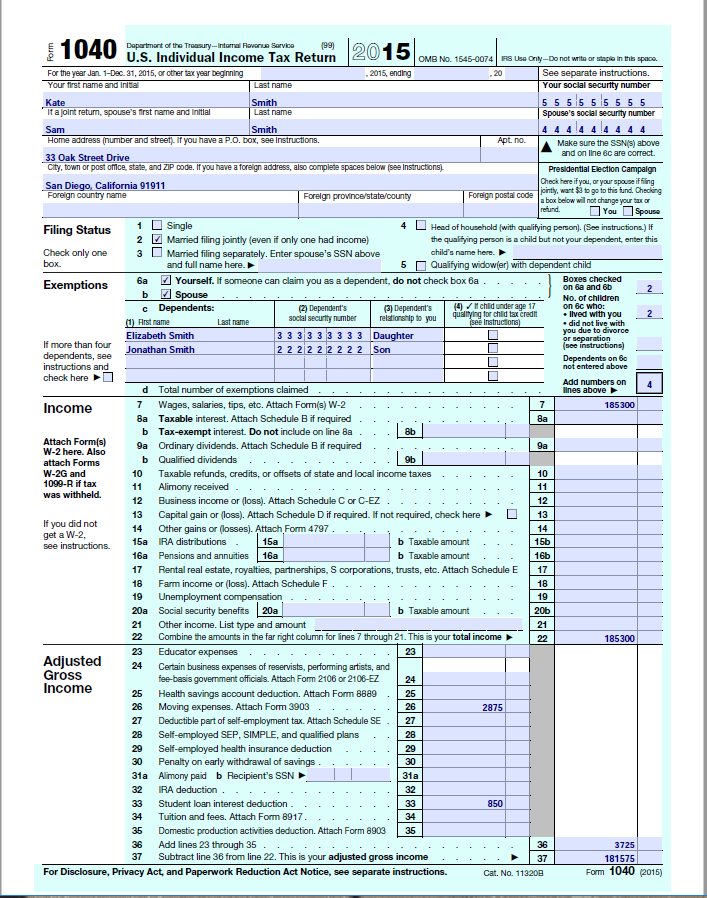

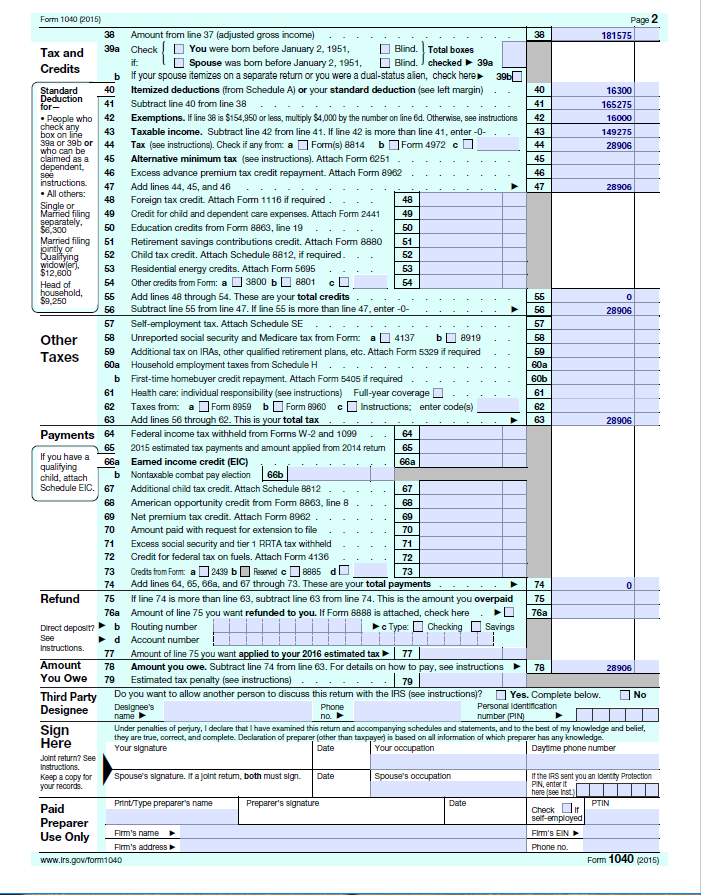

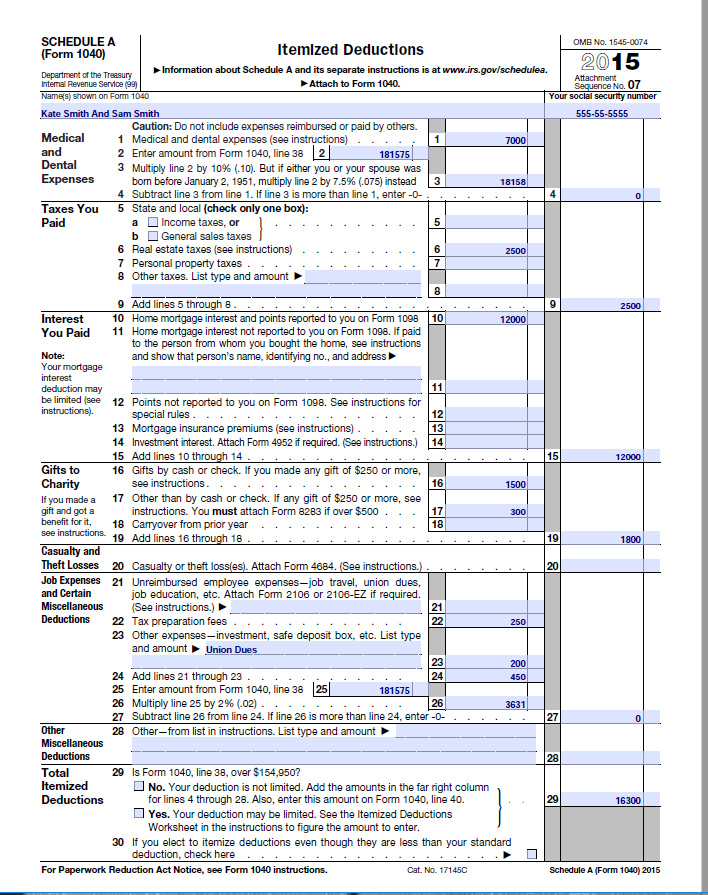

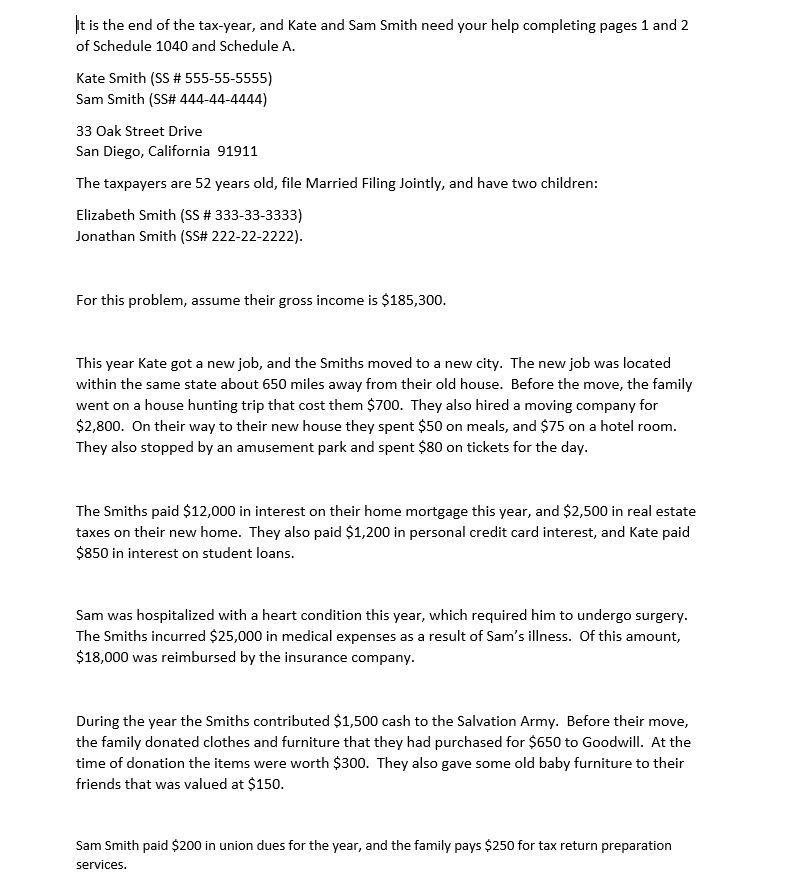

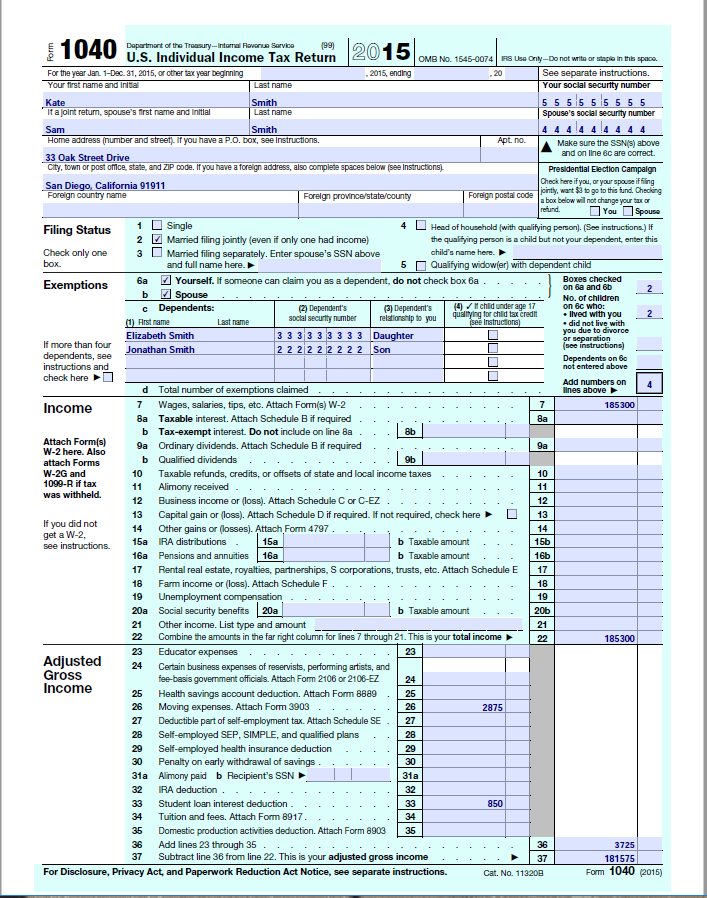

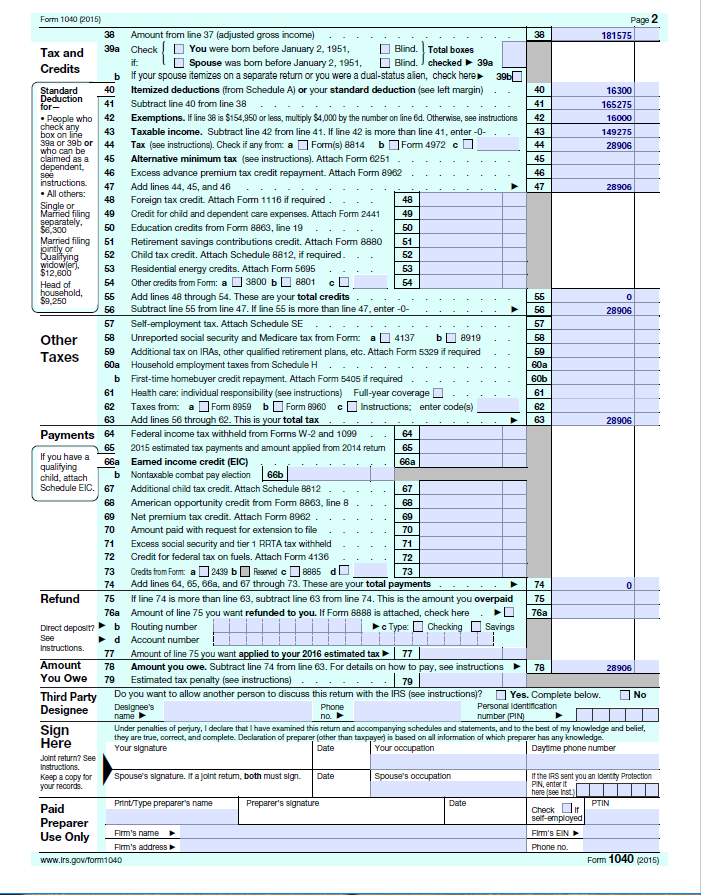

t is the end of the tax-year, and Kate and Sam Smith need your help completing pages 1 and 2 of Schedule 1040 and Schedule A. Kate Smith (SS #555-55-5555) Sam Smith (SS# 444-44-4444) 33 Oak Street Drive San Diego, California 91911 The taxpayers are 52 years old, file Married Filing Jointly, and have two children: Elizabeth Smith (SS# 333-33-3333) Jonathan Smith (SS# 222-22-2222). For this problem, assume their gross income is $185,300. This year Kate got a new job, and the Smiths moved to a new city. The new job was located within the same state about 650 miles away from their old house. Before the move, the family went on a house hunting trip that cost them $700. They also hired a moving company for $2,800. On their way to their new house they spent $50 on meals, and $75 on a hotel room. They also stopped by an amusement park and spent $80 on tickets for the day The Smiths paid $12,000 in interest on their home mortgage this year, and $2,500 in real estate taxes on their new home. They also paid $1,200 in personal credit card interest, and Kate paid $850 in interest on student loans Sam was hospitalized with a heart condition this year, which required him to undergo surgery The Smiths incurred $25,000 in medical expenses as a result of Sam's illness. Of this amount, $18,000 was reimbursed by the insurance company. During the year the Smiths contributed $1,500 cash to the Salvation Army Before their move, the family donated clothes and furniture that they had purchased for $650 to Goodwill. At the time of donation the items were worth $300. They also gave some old baby furniture to their friends that was valued at $150. Sam Smith paid $200 in union dues for the year, and the family pays $250 for tax return preparation Services t is the end of the tax-year, and Kate and Sam Smith need your help completing pages 1 and 2 of Schedule 1040 and Schedule A. Kate Smith (SS #555-55-5555) Sam Smith (SS# 444-44-4444) 33 Oak Street Drive San Diego, California 91911 The taxpayers are 52 years old, file Married Filing Jointly, and have two children: Elizabeth Smith (SS# 333-33-3333) Jonathan Smith (SS# 222-22-2222). For this problem, assume their gross income is $185,300. This year Kate got a new job, and the Smiths moved to a new city. The new job was located within the same state about 650 miles away from their old house. Before the move, the family went on a house hunting trip that cost them $700. They also hired a moving company for $2,800. On their way to their new house they spent $50 on meals, and $75 on a hotel room. They also stopped by an amusement park and spent $80 on tickets for the day The Smiths paid $12,000 in interest on their home mortgage this year, and $2,500 in real estate taxes on their new home. They also paid $1,200 in personal credit card interest, and Kate paid $850 in interest on student loans Sam was hospitalized with a heart condition this year, which required him to undergo surgery The Smiths incurred $25,000 in medical expenses as a result of Sam's illness. Of this amount, $18,000 was reimbursed by the insurance company. During the year the Smiths contributed $1,500 cash to the Salvation Army Before their move, the family donated clothes and furniture that they had purchased for $650 to Goodwill. At the time of donation the items were worth $300. They also gave some old baby furniture to their friends that was valued at $150. Sam Smith paid $200 in union dues for the year, and the family pays $250 for tax return preparation Services