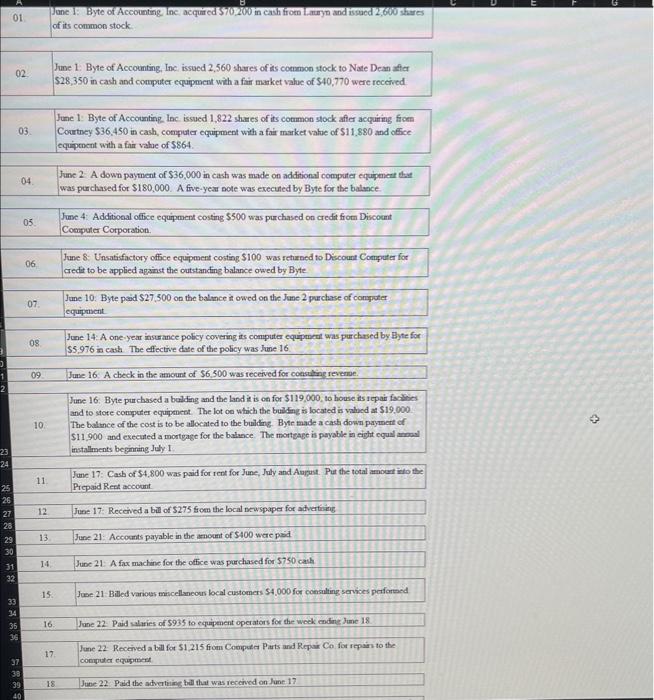

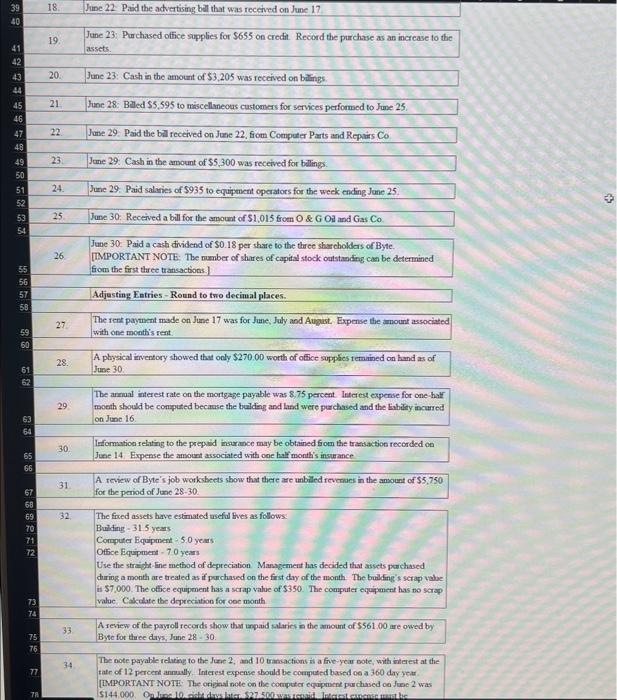

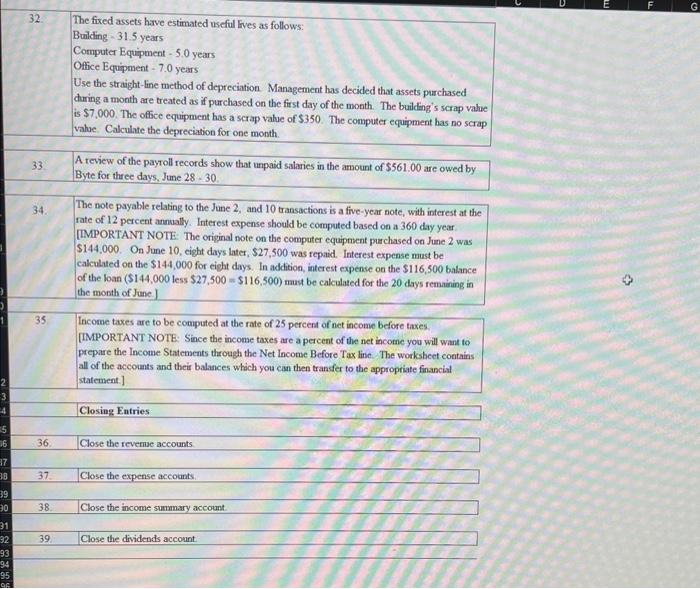

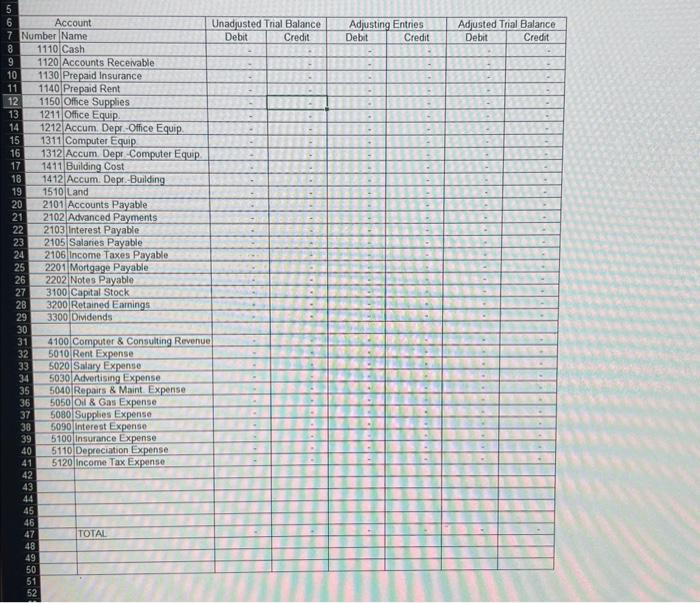

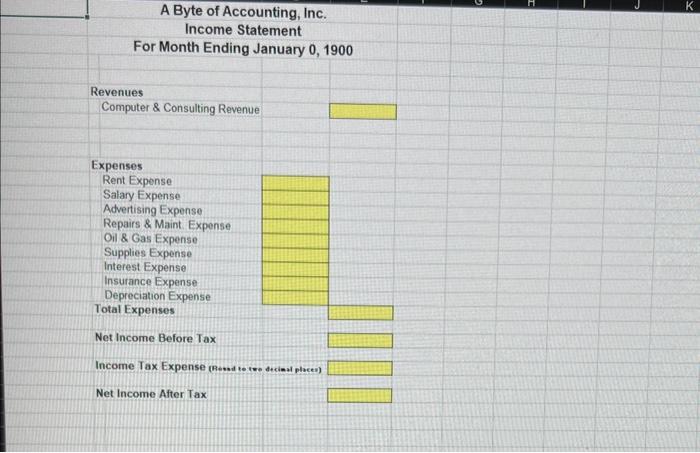

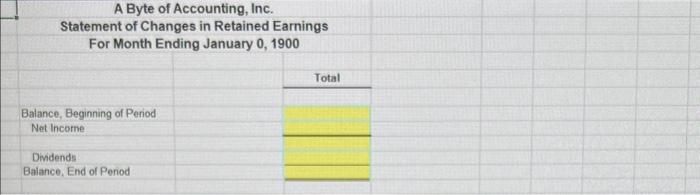

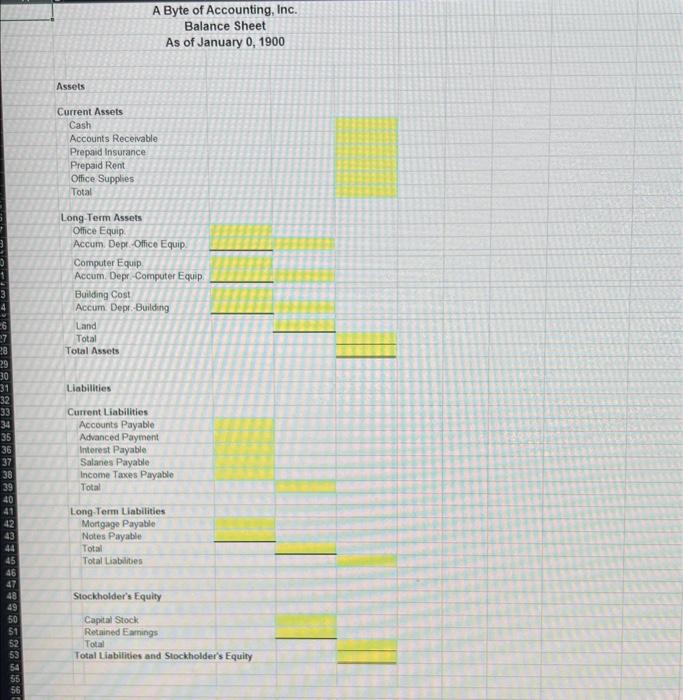

Jone I: Byte of Accounting, lic, acquired 570,200 in cash from larryn and ispod 2,600 shares of its common stock. 02 June 1: Byte of Accounting, Ine, issued 2,560 shares of its common stock to Nate Dean affer 528, 350 in cash and coulputer equipment with a fair market value of $40,770 were recetived June 1: Byte of Accounting lac. issued 1,822 shares of its conmon stock affer acquiring ficen 03. Courtey $36,450 in cash, computer equipment with a fair market vahe of $11,880 and office equipment with a fair value of 5864. 04. June 2. A down payment of $36,000 in cash was made on additional computer equipment tate was purchased for $180,000. A five-year note was execued by Byte for the balance. 05. Jume 4: Additional office equipment costing $500 was purchased on crefit from Discoent Computer Corporation. 06 June 8: Unsatifictory office equipment costing $100 was rechirned to Discount Computer for credt to be applied against the cutstanding balance owed by Byte 07. June 10: Byte paid $27,300 on the balmee in owed on the June 2 purchase of computer equipment. 08. Juse 14: A one year insurance pobcy covering its computer equipenert was purchrsed by Byte for $5,976 in cash. The effective dxe of the policy was hune 16 09. June 16 A check in the amount of 56,500 was recetived for conguting reveme. June 16. Byte purchased a balding and the land it is on for $119,000,10 house is sepair facilibes and to store conputer equipaned. The lot oo which the builing is located is valued at $19,000. 10. The balence of the cost is to be allocated to the building. Byte made a castidown payment of $11,900 and executed a mortgage for the baluce. The monteabe is payable in eight cogul anoal installments begining July 1 11. June 17: Casb of 54.800 was paid for rent for June, July and Aupate. Put the total amourt into the Prepaid Rent account 12. June 17. Recetived a bill of 5275 fom the local newspape for advertiais 13. Juoe 21: Accounts payable in the amount of 5400 wae psid 14. Juie 21: A fax machine for the office was purchased for 5750cahh 16. June 22. Paid saluies of 5935 to equipenent operators for the wock endine hume 18 17. June 22 Rectived a bill for 51,215 from Coolpude Parts and Repuir Co for repsisi to the conputa equigerese 18 Jube 22 P Pad the advatiing tod that was reccived on fune 17 18. Jine 22 Paid the advertising bil that was received on June 17 19. June 23: Purchased office supplies for $655 on credit. Record the purchase as an increase to the assets. 20. June 23: Cash in the amount of $3,205 was received on bulings. 21. June 28: Belled \$5,595 to miscellaneous customers for services performod to June 25 22. June 29. Paid the bill received on Jane 22, fiom Computer Parts and Repuirs Co 23. Jcme 29. Cash in the amount of $5,300 was received for bellings. 24. June 29. Paid salhies of $935 to equipment operators for the week ending June 25. 54 June 30: Paid a cash dividend of 50.18 per share to the three shmeholdars of Byte. 26. [IMPORTANT NOTE: The number of shares of capidal stock outstasding can be deternined from the first three transactions.] Adjesting Entries - Round to two decimal places. 27. The rent payment made on June 17 was for June. July and August. Expense the amount associated with one month's rent. 28. A physical inventory showed that ocly $270.00 worth of oftice supphes temained on band as of Juse 30 . The anmal interest rate on the mortgage payable was 8.75 percent. linerest expense for one-half 29. moeth should be compted becanse the bulding and land were purchased and the Eabiliry incurrod on June 16 30. Lrformation rehating to the prepabd insurance may be obtained fiom the transaction recorded on June 14 Expense the amount associated with one half month's insurance 31. A review of Byte's job worksbeets show that there are unbled reveraes in the anount of $5.750 for the period of June 28-30. 32. The fired assets have estinated wefil thes as follows: Buling -31.5 years Computer Equipment 5.0 years Office Equipment -7.0 years Use the straight- line method of depreciation. Masagement has decided that assets parchased during a month are treated as if parchased on the fiss dry of the month. The brilling's scrap vabe is 57,000 . The otfice equipment has a scaap value of 5350 . The computer equipment has no scrap value. Calculate the drpreciution for ooc month The note payable relatiog to the June 2, and 10 trancactions is a five-year bote, with inlerent at the tatr of 12 percent annwally. Interest expense should be coupeted based oo a 360 day year . [TMPORTANT NOTE: The orighal note co the comiputer equipment parchased on Jue 2 was 32. The fixed assets have estimated useful lives as follows: Brulding - 31.5 years Computer Equipment - 5.0 years Office Equipment - 7.0 years Use the straight-ine method of depreciation. Management has decided that assets purchased during a month are treated as if purchased on the first day of the month. The building's scrap value is $7,000. The offce equipment has a scrap value of $350. The computer equipment has no scrap value. Calculate the depreciation for one month. 33. A review of the payroll records show that unpaid salaries in the amount of $561.00 are owed by Byte for three days, June 28 - 30 34. The note payable relating to the June 2, and 10 transactions is a five-year note, with interest at the rate of 12 percent annually. Interest expense should be computed based on a 360 day year [IMPORTANT NOTE: The original note on the computer equipment purchased on June 2 was $144,000. On June 10 , eight days later, $27,500 was repaid. Interest expense must be calculated on the $144,000 for eight days. In addition, interest expense on the $116,500 balance of the loan ($144,000 less $27,500=$116,500) must be calculated for the 20 days remaining in the month of June.) 35 Income taxes are to be computed at the rate of 25 percent of net income before taxes. IMMPORTANT NOTE: Since the income taxes are a percent of the net income you will want to prepare the Income Statements through the Net lncome Before Tax line. The worksbeet contains all of the accounts and their balances which you can then trander to the appropriate financial statement] Closing Entries 36. Close the revenuse accounts 37. Close the expense accounts. 38. Close the income summary account. 39. Close the dividends account A Byte of Accounting, Inc. Income Statement For Month Ending January 0,1900 Revenues Computer \& Consulting Revenue Expenses Rent Expense Salary Expense Advertising Expenso Repairs \& Maint Expense Oil \& Gas Expense Supplies Expense Interest Expense Insurance Expense Depreciation Expense Total Expenses Net Income Before Tax Income Tax Expense (Re.edto Io. decied place]) Net Income After Tax A Byte of Accounting, Inc. Statement of Changes in Retained Earnings For Month Ending January 0, 1900 A Byte of Accounting, Inc. Balance Sheet As of January 0,1900 Assets Current Assets Cash Accounts Receivable Prepaid Insurance Prepaid Rent Office Supplies Total Long-Term Assets Office Equip. Accum. Dept.Office Equip. Computer Equip Accum. Depr-Computer Equip. Building Cost Accum. Depr-Building Land Total Total Assets Liabilities Cument Liabilities Accounts Payable Advanced Payment Interest Payable Salanes Payable Income Taxes Payable Total Long-Term Liabilities Mortgage Payable Notes Payable Total Total Liabilises Stockholder's-Equity Cagitat Stock Retained Earnings Total Total Liabitities and Stockholder's Equity Data for General Ledger Ledger