Answered step by step

Verified Expert Solution

Question

1 Approved Answer

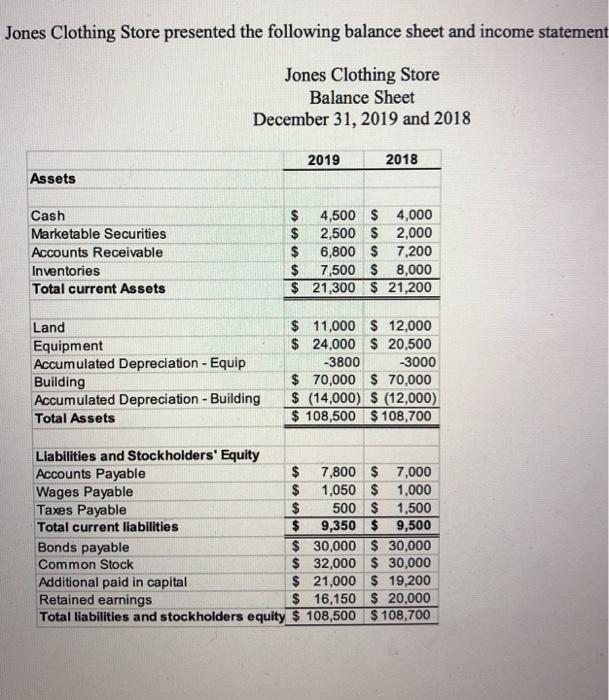

Jones Clothing Store presented the following balance sheet and income statement Jones Clothing Store Balance Sheet December 31, 2019 and 2018 2019 2018 Assets

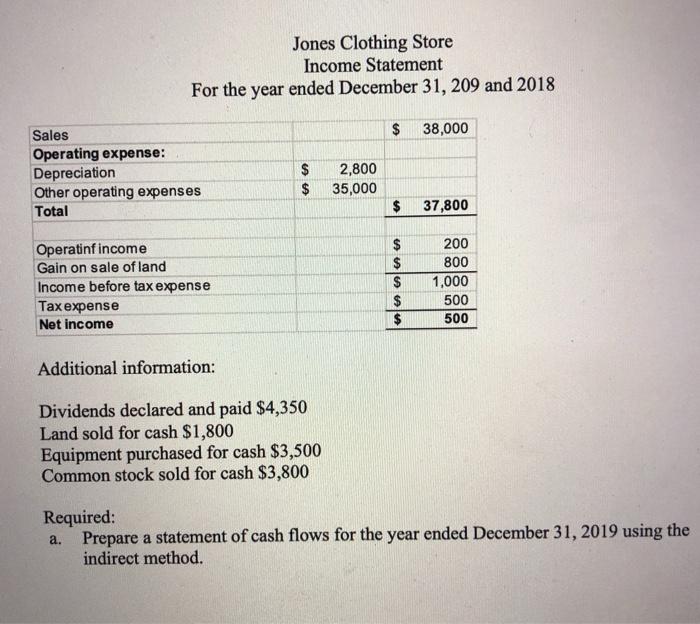

Jones Clothing Store presented the following balance sheet and income statement Jones Clothing Store Balance Sheet December 31, 2019 and 2018 2019 2018 Assets Cash $ 4,500 $4,000 2,500 $2,000 Marketable Securities $ Accounts Receivable $ 6,800 $ 7,200 Inventories $ 7,500 $ 8,000 Total current Assets $ 21,300 $ 21,200 Land $ Equipment $ 24,000 11,000 $ 12,000 $20,500 -3000 -3800 Accumulated Depreciation - Equip Building $ 70,000 $ 70,000 $(14,000) S (12,000) Accumulated Depreciation - Building Total Assets $ 108,500 $108,700 Liabilities and Stockholders' Equity Accounts Payable $ 7,800 $ 7,000 Wages Payable $ 1,050 $1,000 Taxes Payable $ 500 $1,500 9,350 $9,500 Total current liabilities $ Bonds payable Common Stock $ 30,000 $ 30,000 $32,000 $ 30,000 $ 21,000 $ 19,200 $ 16,150 $ 20,000 Additional paid in capital Retained earnings Total liabilities and stockholders equity $ 108,500 $ 108,700 LASA Jones Clothing Store Income Statement For the year ended December 31, 209 and 2018 Sales $ 38,000 Operating expense: Depreciation $ 2,800 $ 35,000 Other operating expenses Total $ 37,800 200 Operatinf income Gain on sale of land 800 Income before tax expense 1,000 Tax expense 500 Net income 500 Additional information: Dividends declared and paid $4,350 Land sold for cash $1,800 Equipment purchased for cash $3,500 Common stock sold for cash $3,800 Required: a. Prepare a statement of cash flows for the year ended December 31, 2019 using the indirect method. SS SSSSS $ $

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Answera JONES CLOTHING STORE STATEMENT OF CASH FLOWS USING INDIRECT METHOD FOR THE YEAR ENDED DEC...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started