Answered step by step

Verified Expert Solution

Question

1 Approved Answer

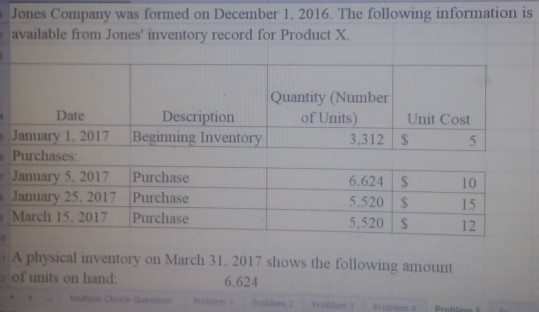

Jones Company was formed on December 1, 2016. The following information is available from Jones' inventory record for Product X Quantity (Number Date Description of

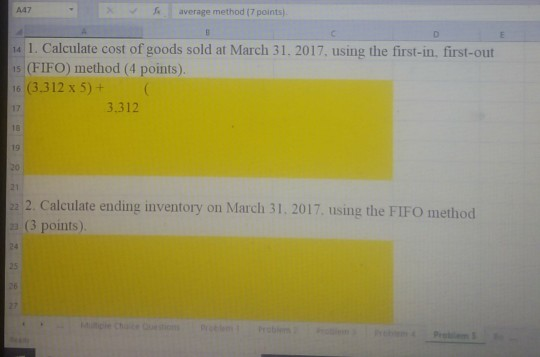

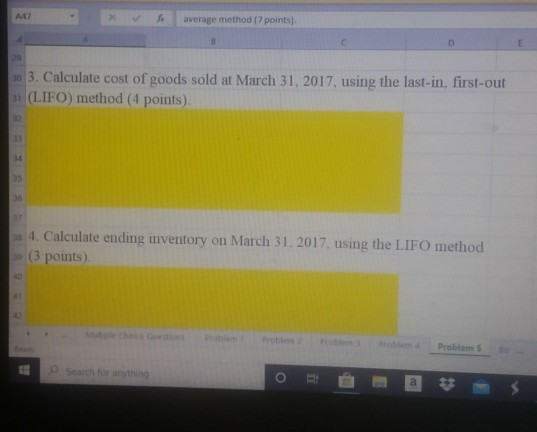

Jones Company was formed on December 1, 2016. The following information is available from Jones' inventory record for Product X Quantity (Number Date Description of Units) Unit Cost January 1, 2017 Beginning Inventory 3,312 $ 5 Purchases January 5, 2017 Purchase 6.624 10 January 25, 2017 Purchase 5.520 $ 15 March 15, 2017 Purchase 5.520 S 12 A physical inventory on March 31. 2017 shows the following amount of units on hand 6,624 A47 average method 17 points) D E 14 1. Calculate cost of goods sold at March 31, 2017, using the first-in, first-out 1 (FIFO) method (4 points) 16 (3.312 x 5) + 3.312 19 20 21 22 2. Calculate ending inventory on March 31. 2017. using the FIFO method (3 points). 24 25 A4 uverage method (7 points) D 30 3. Calculate cost of goods sold at March 31, 2017, using the last-in, first-out (LIFO) method (4 points) 4. Calculate ending inventory on March 31. 2017 using the LIFO method (3 points) Problems o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started