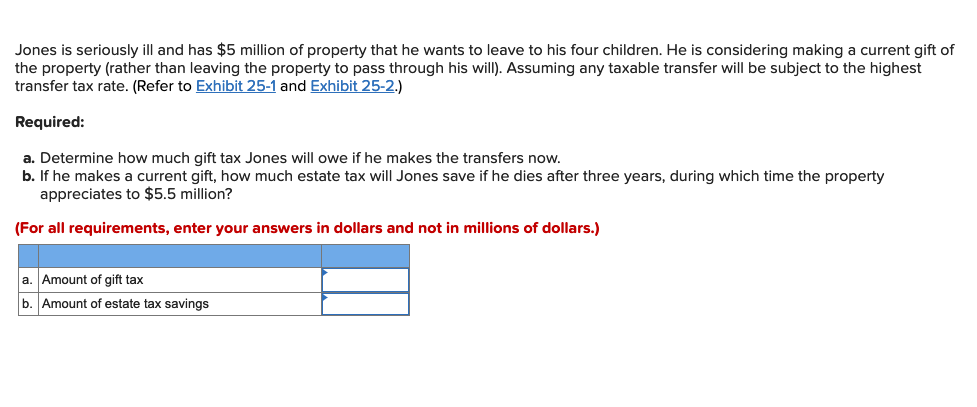

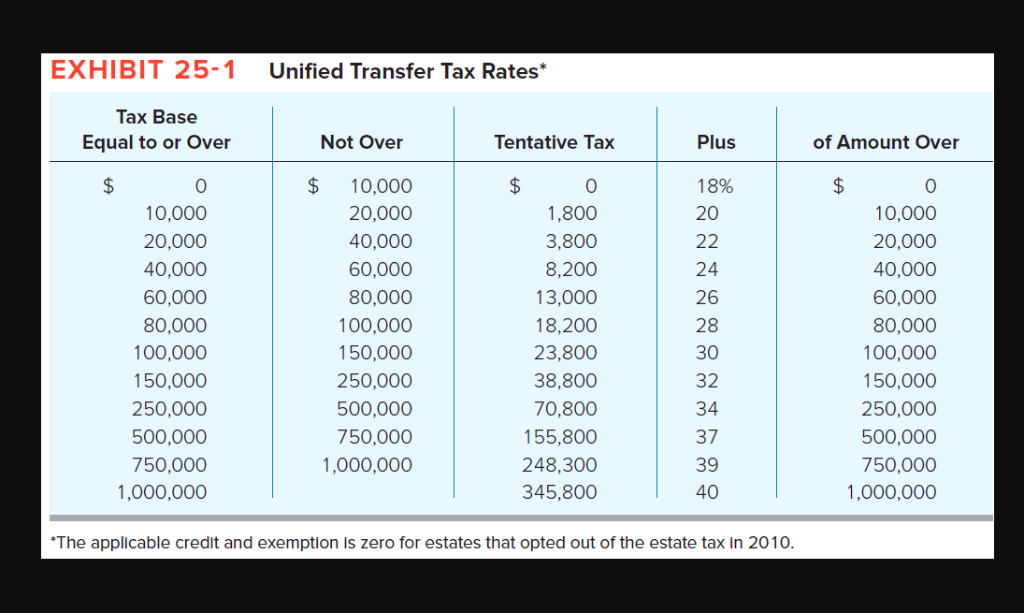

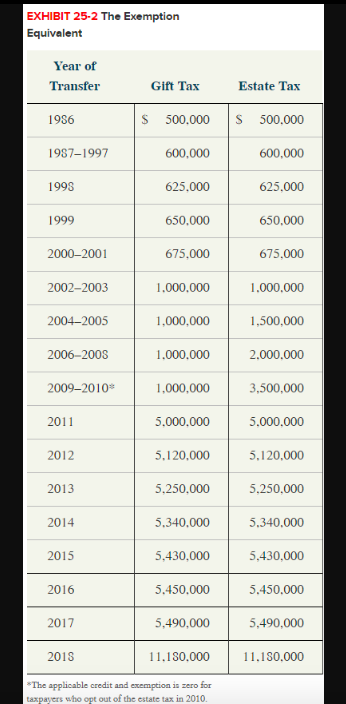

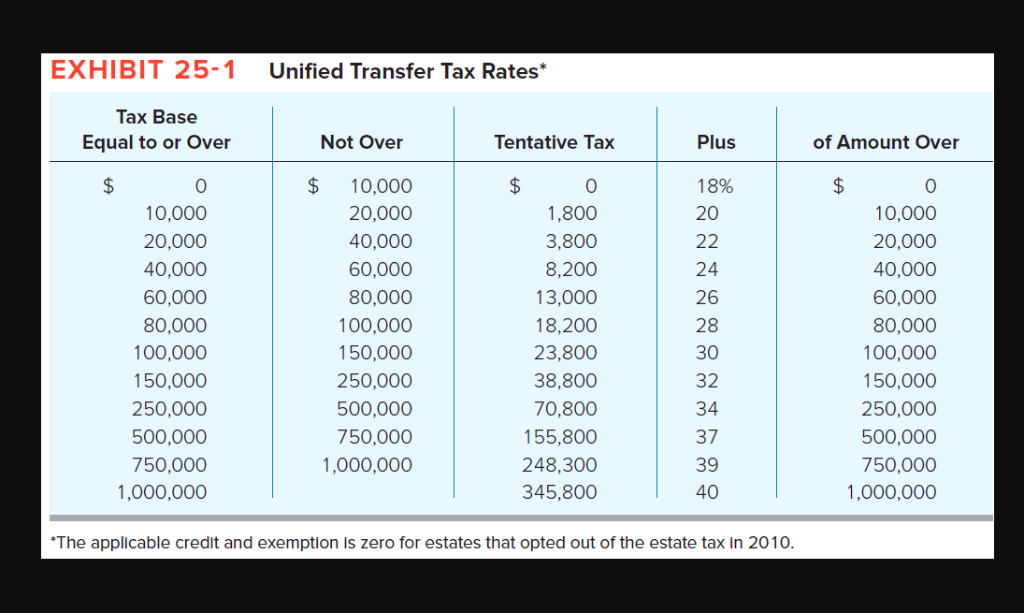

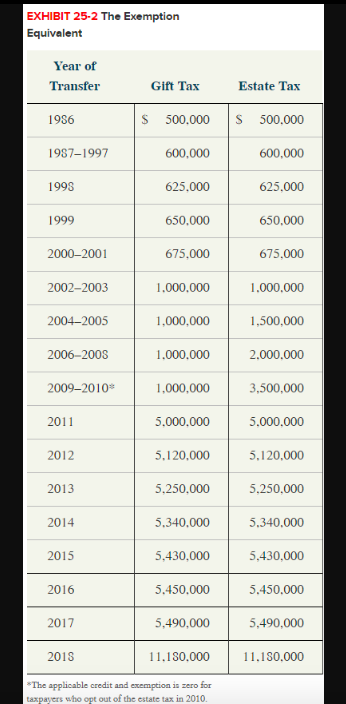

Jones is seriously ill and has $5 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Assuming any taxable transfer will be subject to the highest transfer tax rate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Required: a. Determine how much gift tax Jones will owe if he makes the transfers now. b. If he makes a current gift, how much estate tax will Jones save if he dies after three years, during which time the property appreciates to $5.5 million? For all requirements, enter your answers in dollars and not in millions of dollars.) a. Amount of gift tax b. Amount of estate tax savings EXHIBIT 25-1 Unified Transfer Tax Rates* Tax Base Equal to or Over Not Over Plus Tentative Tax of Amount Over 18% 20 $10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 ,000,000 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 ,000,000 0 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 24 26 28 30 32 34 37 39 40 The applicable credit and exemption Is zero for estates that opted out of the estate tax in 2010 EXHIBIT 25-2 The Exemption Equivalent 1987-1997 2000-2001 2002-2003 2 2009-2010 2011 2012 2013 2014 2015 5 5 5 5 5 2016 5 2017 2018 11.180.000 The applicable credit and exemption is zero for taxpayers who opt out of the estate tax in 2010 Jones is seriously ill and has $5 million of property that he wants to leave to his four children. He is considering making a current gift of the property (rather than leaving the property to pass through his will). Assuming any taxable transfer will be subject to the highest transfer tax rate. (Refer to Exhibit 25-1 and Exhibit 25-2.) Required: a. Determine how much gift tax Jones will owe if he makes the transfers now. b. If he makes a current gift, how much estate tax will Jones save if he dies after three years, during which time the property appreciates to $5.5 million? For all requirements, enter your answers in dollars and not in millions of dollars.) a. Amount of gift tax b. Amount of estate tax savings EXHIBIT 25-1 Unified Transfer Tax Rates* Tax Base Equal to or Over Not Over Plus Tentative Tax of Amount Over 18% 20 $10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 ,000,000 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 ,000,000 0 1,800 3,800 8,200 13,000 18,200 23,800 38,800 70,800 155,800 248,300 345,800 0 10,000 20,000 40,000 60,000 80,000 100,000 150,000 250,000 500,000 750,000 1,000,000 24 26 28 30 32 34 37 39 40 The applicable credit and exemption Is zero for estates that opted out of the estate tax in 2010 EXHIBIT 25-2 The Exemption Equivalent 1987-1997 2000-2001 2002-2003 2 2009-2010 2011 2012 2013 2014 2015 5 5 5 5 5 2016 5 2017 2018 11.180.000 The applicable credit and exemption is zero for taxpayers who opt out of the estate tax in 2010