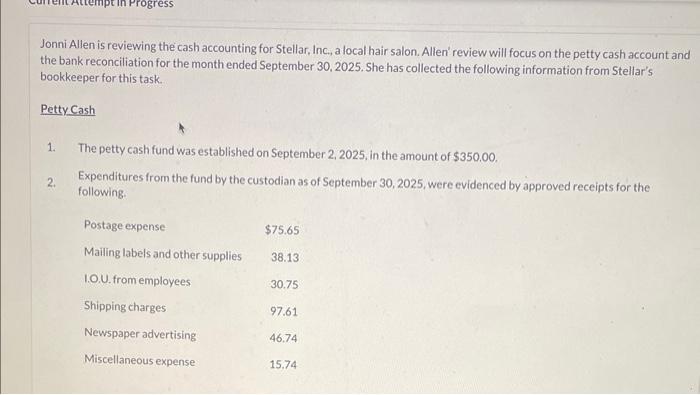

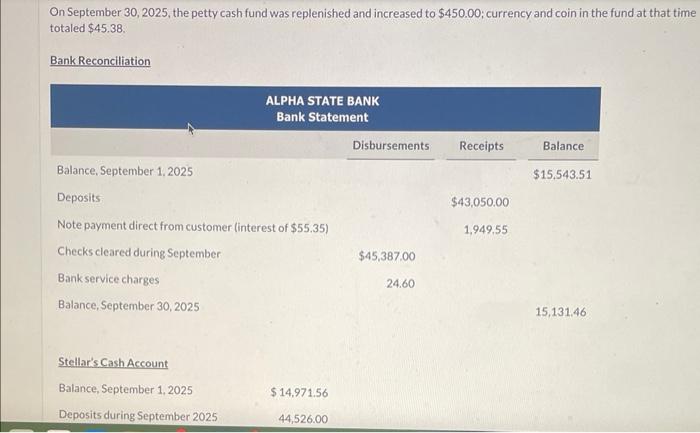

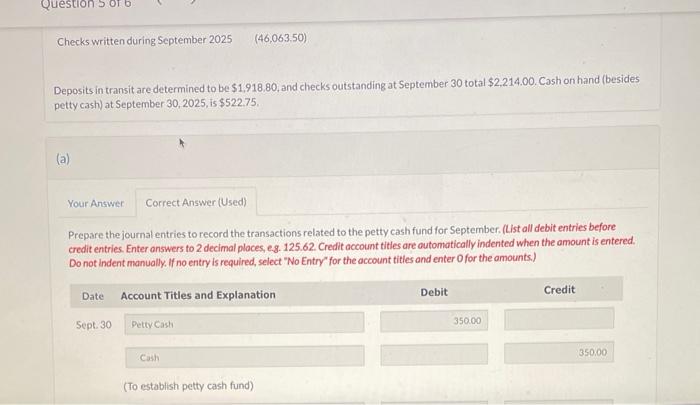

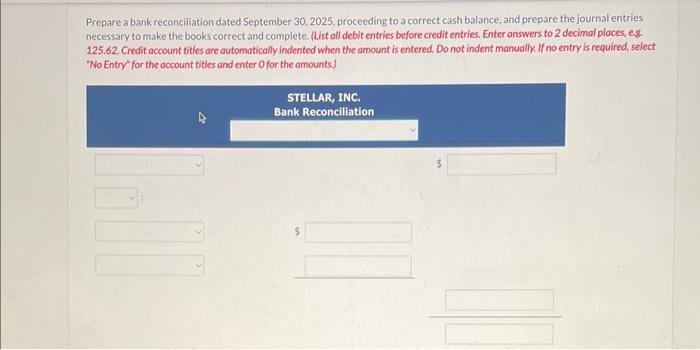

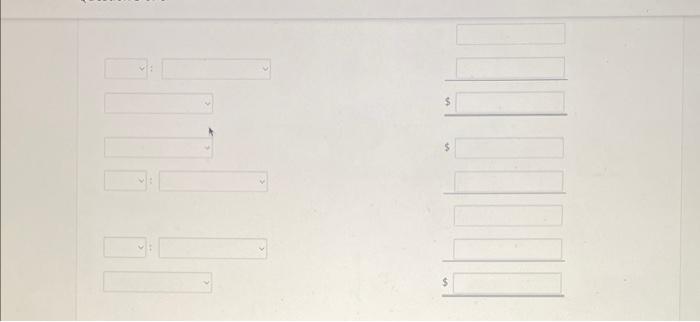

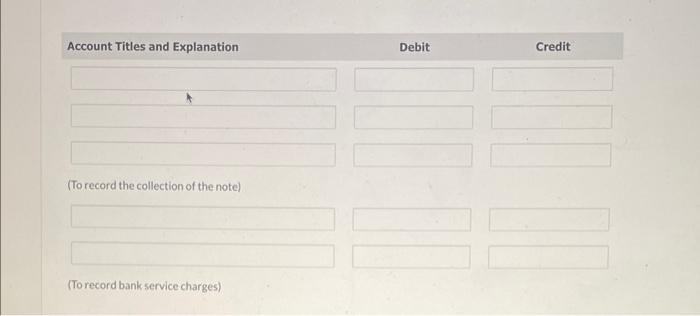

Jonni Allen is reviewing the cash accounting for Stellar, Inc, a local hair salon. Allen review will focus on the petty cash account and the bank reconciliation for the month ended September 30,2025 . She has collected the following information from Stellar's bookkeeper for this task. Petty Cash 1. The petty cash fund was established on September 2, 2025, in the amount of $350.00. 2. Expenditures from the fund by the custodian as of September 30,2025 , were evidenced by approved receipts for the following. On September 30,2025 , the petty cash fund was replenished and increased to $450.00; currency and coin in the fund at that time totaled $45.38. Bank Reconciliation Deposits in transit are determined to be $1,918,80, and checks outstanding at September 30 total $2,214,00, Cash on hand (besides petty cash at September 30,2025 , is $522.75. (a) Prepare the journalentries to record the transactions related to the petty cash fund for September. (List all debit entries before credit entries. Enter answers to 2 decimal ploces, eg. 125.62. Credit account tities are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Of for the amounts.) Sept. 30 Postage Expense Supplies Accounts Receivable Freight-Out Advertising Expense Miscellancous Expenses 15.74 (To record expenditures from the fund) Sept 30 Petty Cash Prepare a bank reconciliation dated September 30,2025. proceeding to a correct cash balance, and prepare the journal entries necessary to make the books correct and complete. (List all debit entries before credit entries. Enter answers to 2 decimal places, es. 125.62. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the collection of the note) (To record bank service charges) Jonni Allen is reviewing the cash accounting for Stellar, Inc, a local hair salon. Allen review will focus on the petty cash account and the bank reconciliation for the month ended September 30,2025 . She has collected the following information from Stellar's bookkeeper for this task. Petty Cash 1. The petty cash fund was established on September 2, 2025, in the amount of $350.00. 2. Expenditures from the fund by the custodian as of September 30,2025 , were evidenced by approved receipts for the following. On September 30,2025 , the petty cash fund was replenished and increased to $450.00; currency and coin in the fund at that time totaled $45.38. Bank Reconciliation Deposits in transit are determined to be $1,918,80, and checks outstanding at September 30 total $2,214,00, Cash on hand (besides petty cash at September 30,2025 , is $522.75. (a) Prepare the journalentries to record the transactions related to the petty cash fund for September. (List all debit entries before credit entries. Enter answers to 2 decimal ploces, eg. 125.62. Credit account tities are outomatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter Of for the amounts.) Sept. 30 Postage Expense Supplies Accounts Receivable Freight-Out Advertising Expense Miscellancous Expenses 15.74 (To record expenditures from the fund) Sept 30 Petty Cash Prepare a bank reconciliation dated September 30,2025. proceeding to a correct cash balance, and prepare the journal entries necessary to make the books correct and complete. (List all debit entries before credit entries. Enter answers to 2 decimal places, es. 125.62. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit (To record the collection of the note) (To record bank service charges)