Question

Jonny Fairplay owns and operates Fairway Greenhouse, Inc. which sells lawn and garden supplies and equipment. Fairway Greenhouse, Inc. purchases inventory at a cost

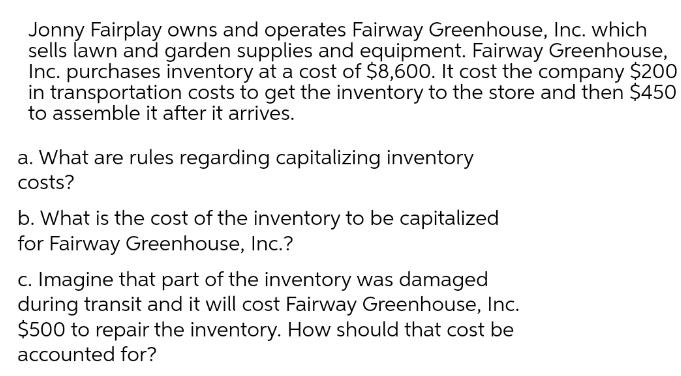

Jonny Fairplay owns and operates Fairway Greenhouse, Inc. which sells lawn and garden supplies and equipment. Fairway Greenhouse, Inc. purchases inventory at a cost of $8,600. It cost the company $200 in transportation costs to get the inventory to the store and then $450 to assemble it after it arrives. a. What are rules regarding capitalizing inventory costs? b. What is the cost of the inventory to be capitalized for Fairway Greenhouse, Inc.? c. Imagine that part of the inventory was damaged during transit and it will cost Fairway Greenhouse, Inc. $500 to repair the inventory. How should that cost be accounted for?

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Inventories are included as part of the ordinary course of business Other cost to be considered in a...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Modern Advanced Accounting In Canada

Authors: Hilton Murray, Herauf Darrell

7th Edition

1259066487, 978-1259066481

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App