Answered step by step

Verified Expert Solution

Question

1 Approved Answer

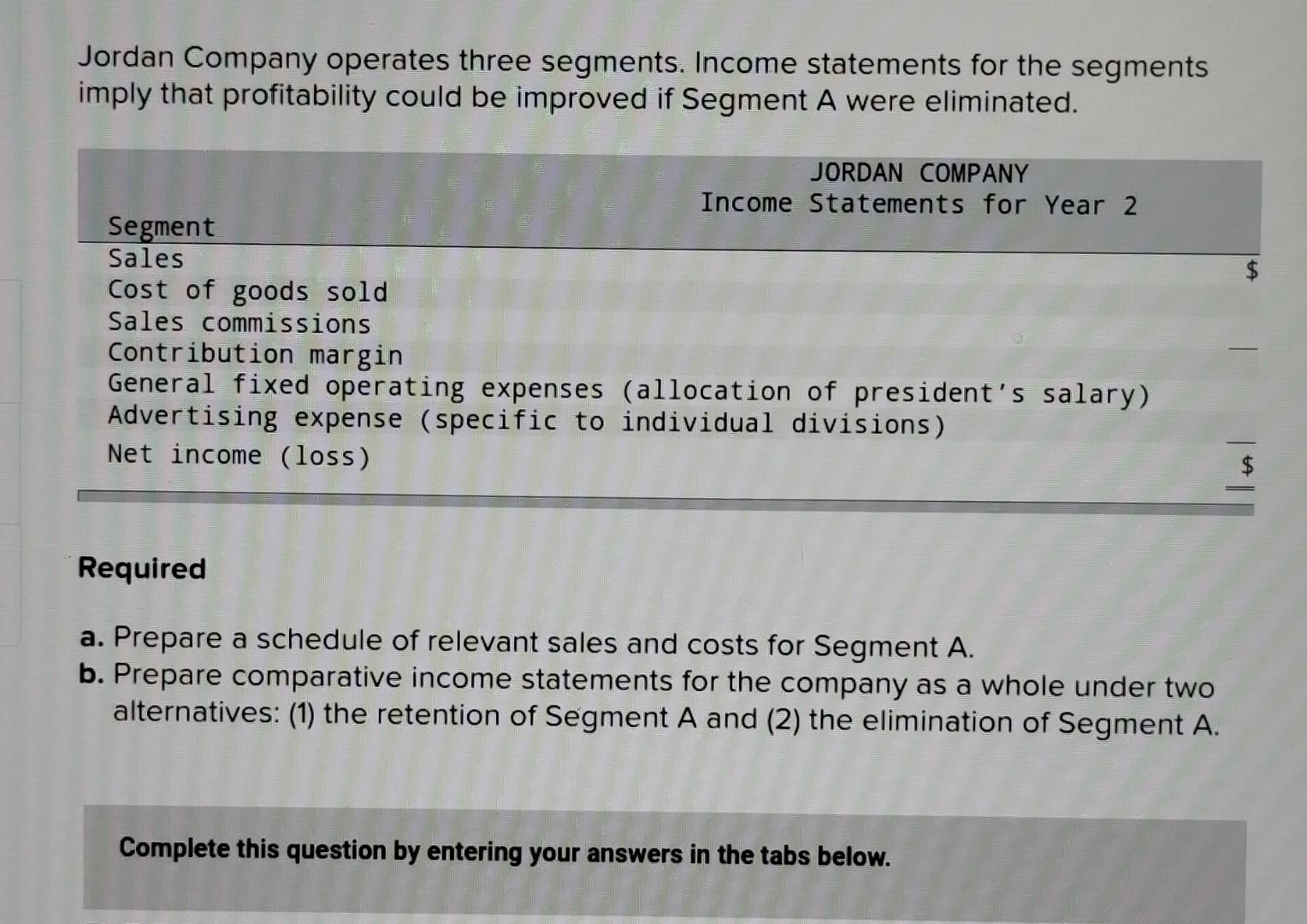

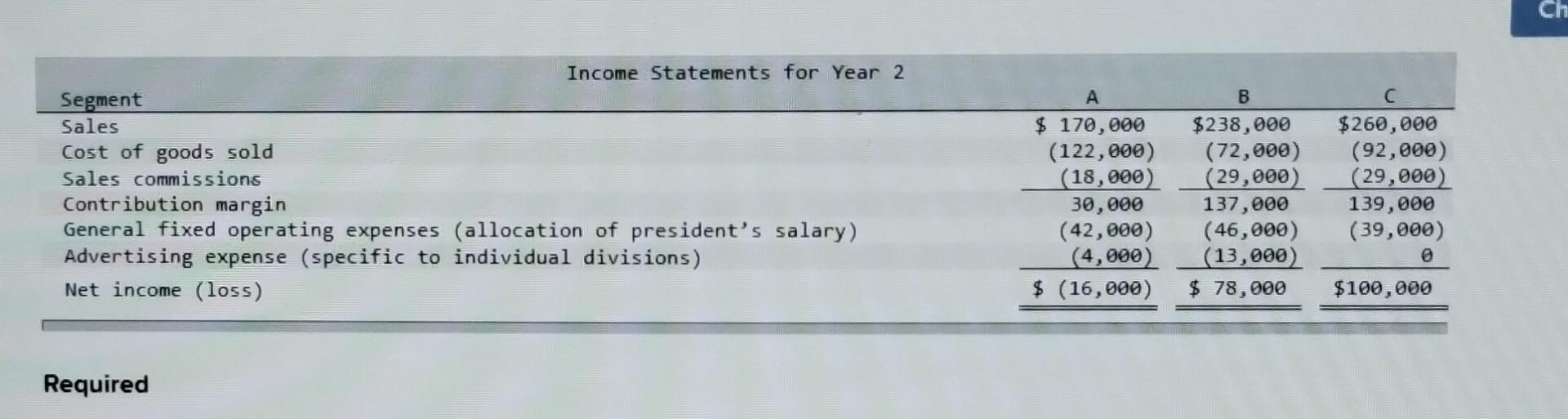

Jordan Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Required a. Prepare a

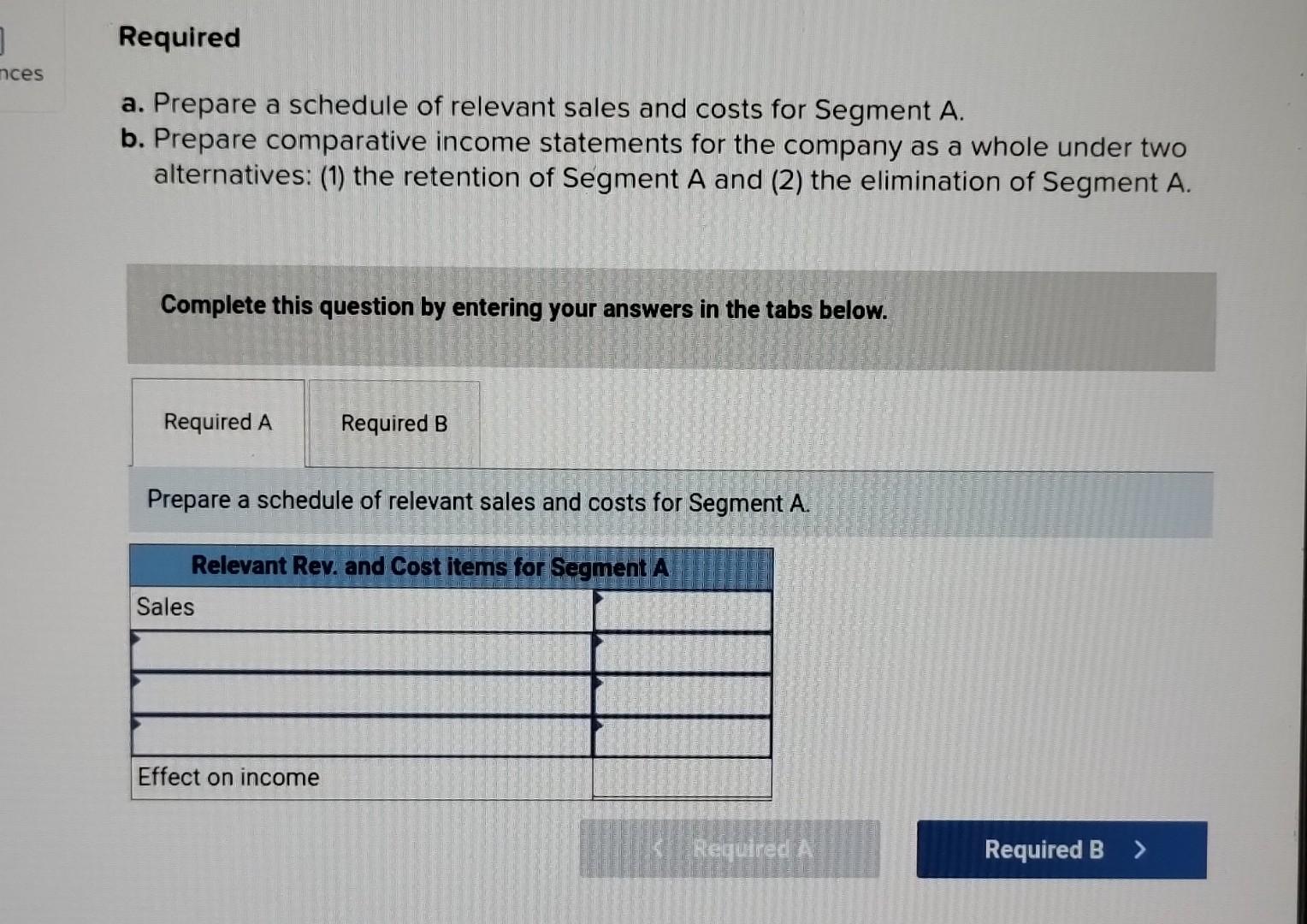

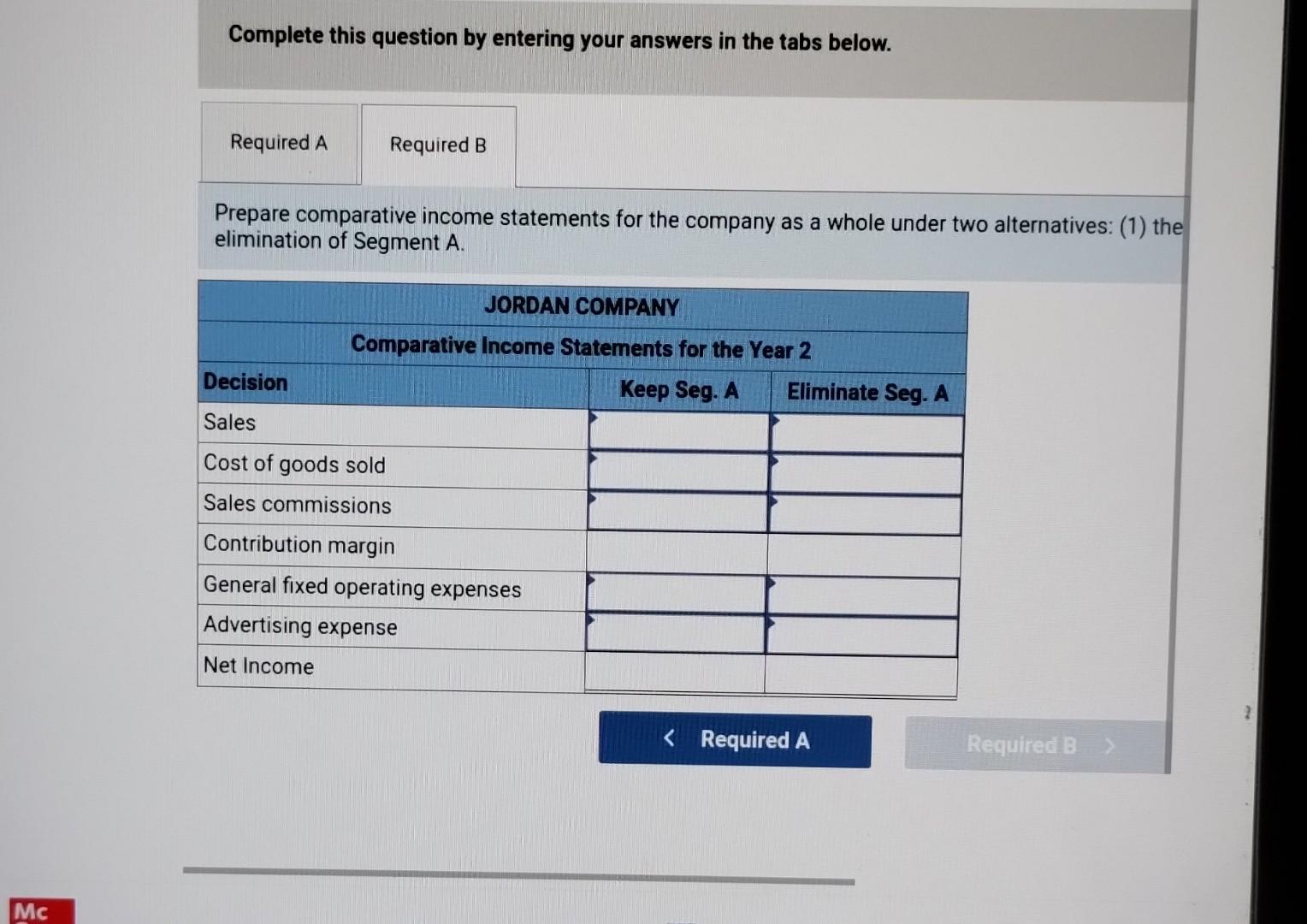

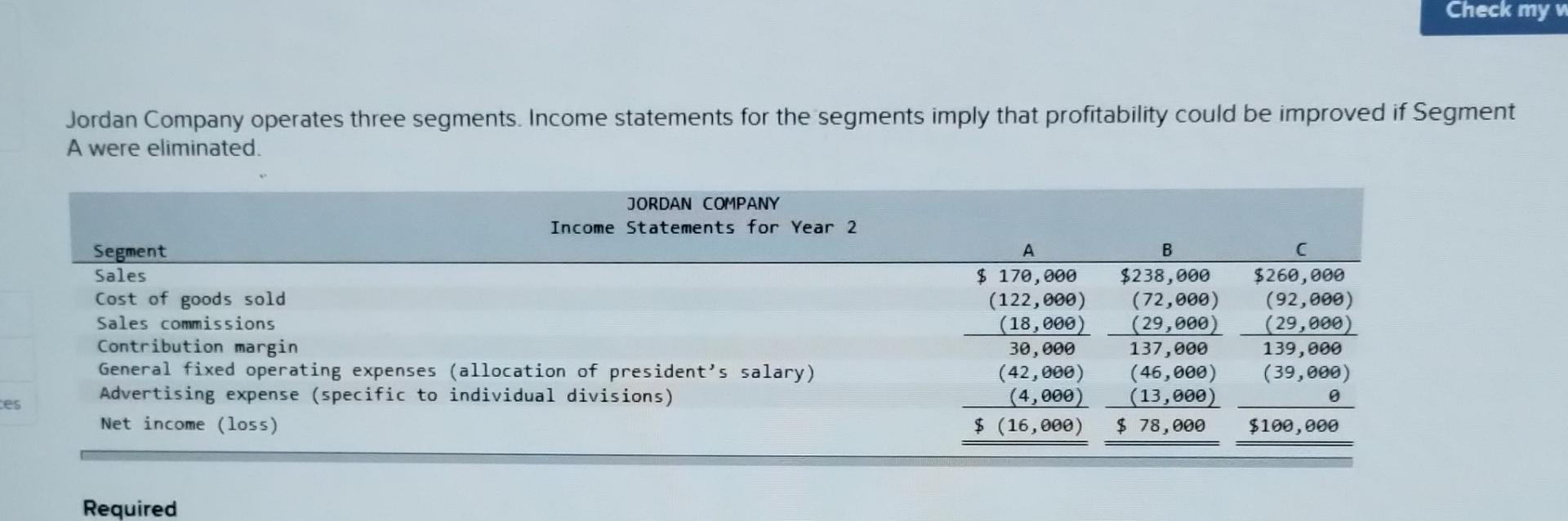

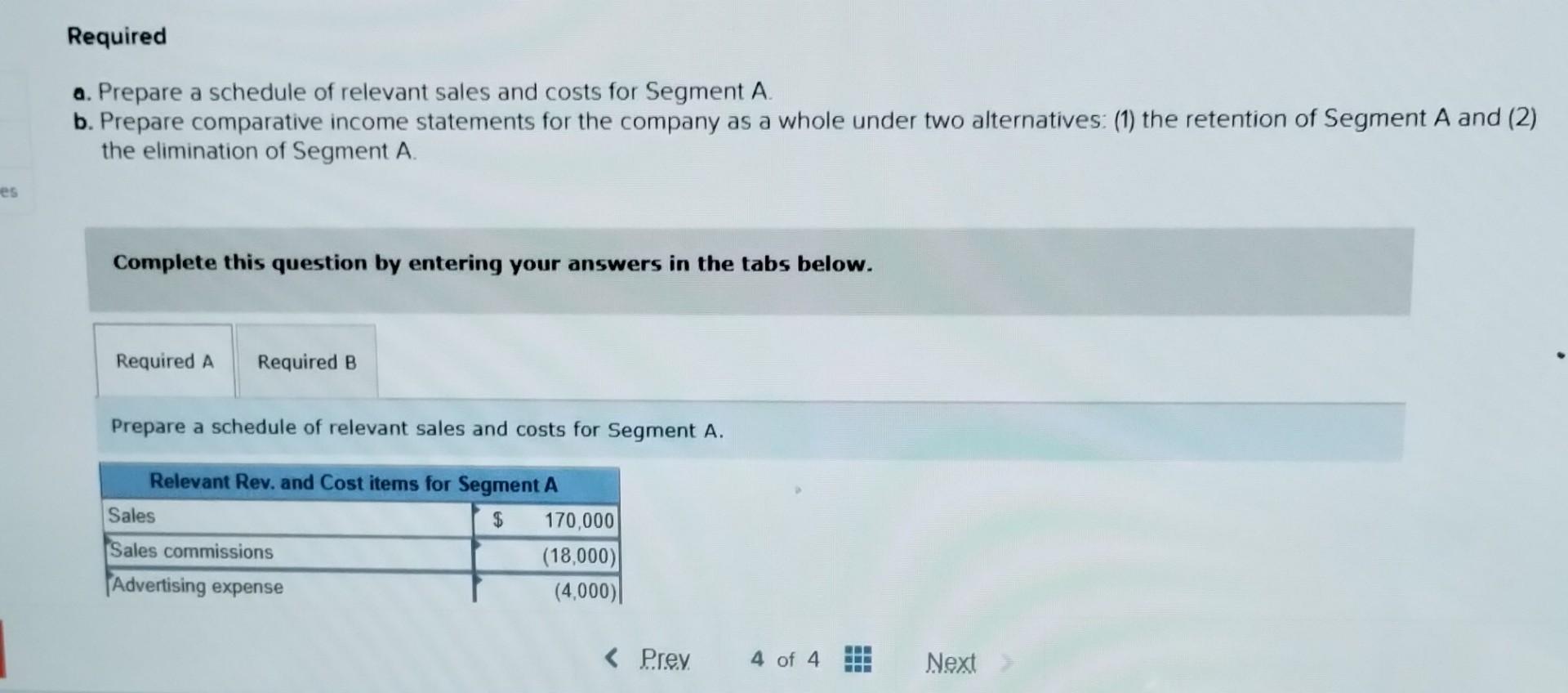

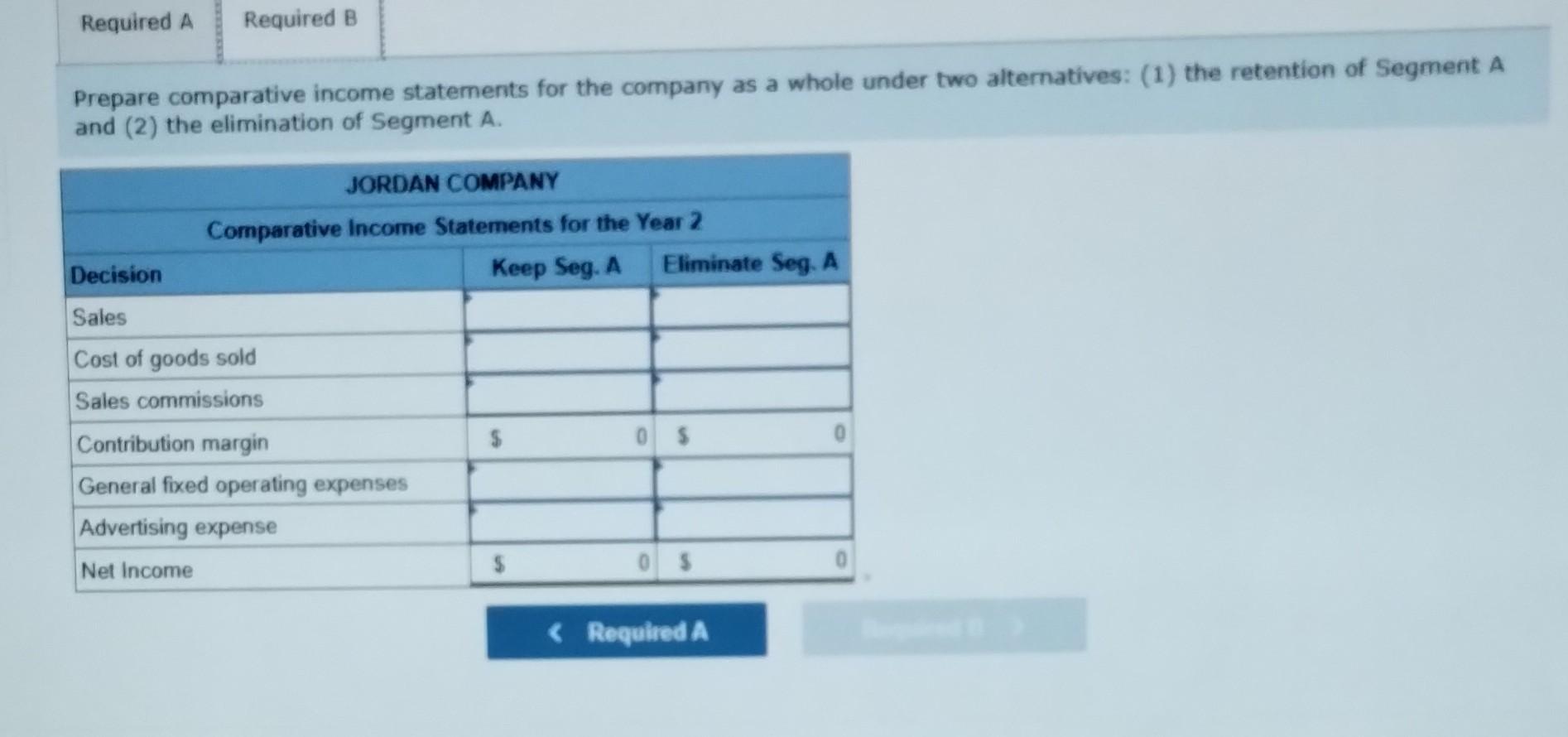

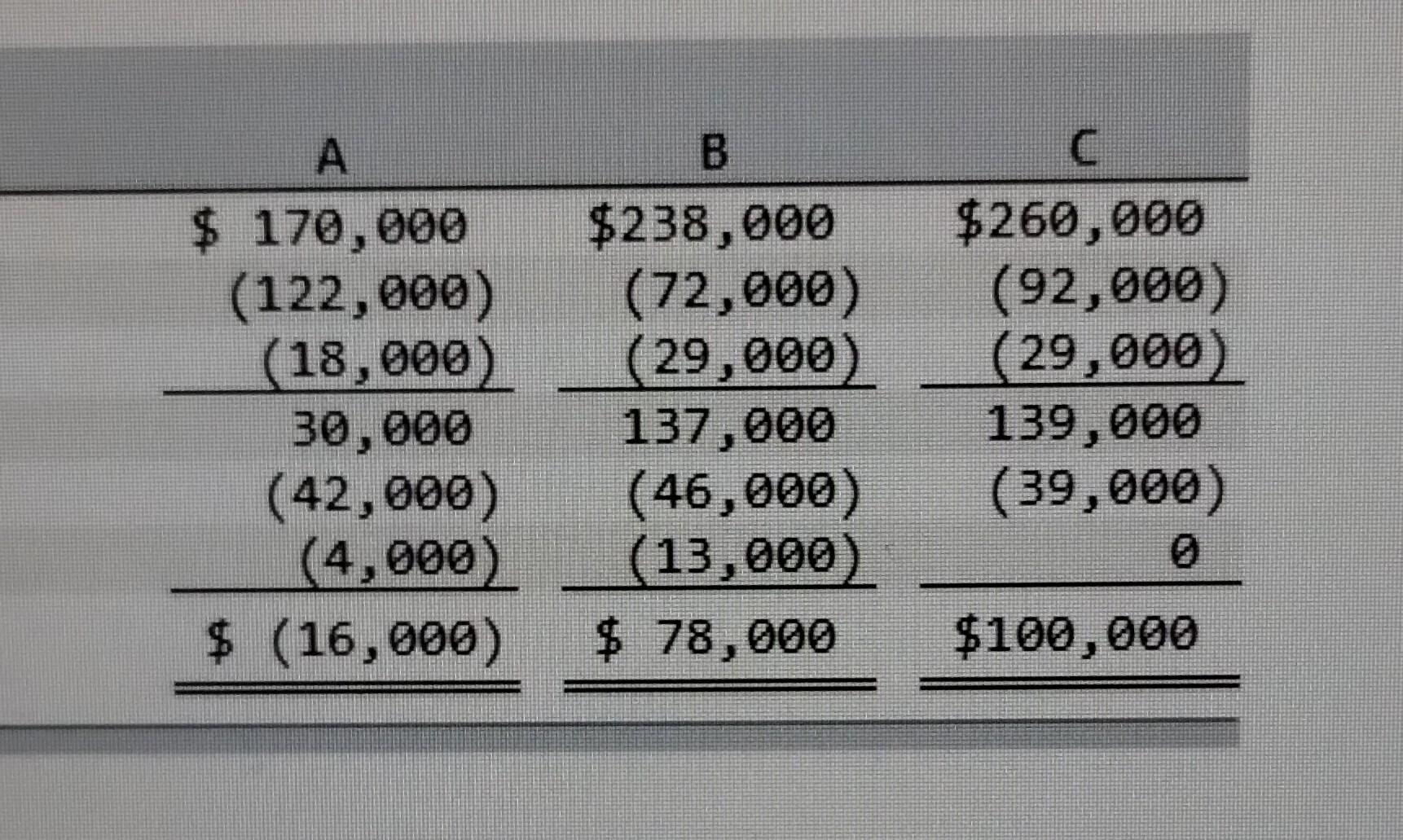

Jordan Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Complete this question by entering your answers in the tabs below. Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Complete this question by entering your answers in the tabs below. Prepare a schedule of relevant sales and costs for Segment A. Complete this question by entering your answers in the tabs below. Prepare comparative income statements for the company as a whole under two alternatives: (1) the elimination of Segment A. Jordan Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2 the elimination of Segment A. Complete this question by entering your answers in the tabs below. Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. \begin{tabular}{|c|c|c|} \hline A & B & C \\ \hline \begin{tabular}{r} $170,000 \\ (122,000) \\ (18,000) \end{tabular} & \begin{tabular}{r} $238,000 \\ (72,000) \\ (29,000) \end{tabular} & \begin{tabular}{r} $260,000 \\ (92,000) \end{tabular} \\ \hline \begin{tabular}{c} (10,000) \\ 30,000 \\ (42,000) \\ (4,000) \end{tabular} & \begin{tabular}{l} 137,000(29,000) \\ (46,000) \\ (13,000) \end{tabular} & \begin{tabular}{c} 139,000 \\ (39,000) \\ 0 \end{tabular} \\ \hline$(16,000) & $78,000 & $100,000 \\ \hline \end{tabular} Required Jordan Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Complete this question by entering your answers in the tabs below. Required a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Complete this question by entering your answers in the tabs below. Prepare a schedule of relevant sales and costs for Segment A. Complete this question by entering your answers in the tabs below. Prepare comparative income statements for the company as a whole under two alternatives: (1) the elimination of Segment A. Jordan Company operates three segments. Income statements for the segments imply that profitability could be improved if Segment A were eliminated. a. Prepare a schedule of relevant sales and costs for Segment A. b. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2 the elimination of Segment A. Complete this question by entering your answers in the tabs below. Prepare a schedule of relevant sales and costs for Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. Prepare comparative income statements for the company as a whole under two alternatives: (1) the retention of Segment A and (2) the elimination of Segment A. \begin{tabular}{|c|c|c|} \hline A & B & C \\ \hline \begin{tabular}{r} $170,000 \\ (122,000) \\ (18,000) \end{tabular} & \begin{tabular}{r} $238,000 \\ (72,000) \\ (29,000) \end{tabular} & \begin{tabular}{r} $260,000 \\ (92,000) \end{tabular} \\ \hline \begin{tabular}{c} (10,000) \\ 30,000 \\ (42,000) \\ (4,000) \end{tabular} & \begin{tabular}{l} 137,000(29,000) \\ (46,000) \\ (13,000) \end{tabular} & \begin{tabular}{c} 139,000 \\ (39,000) \\ 0 \end{tabular} \\ \hline$(16,000) & $78,000 & $100,000 \\ \hline \end{tabular} Required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started