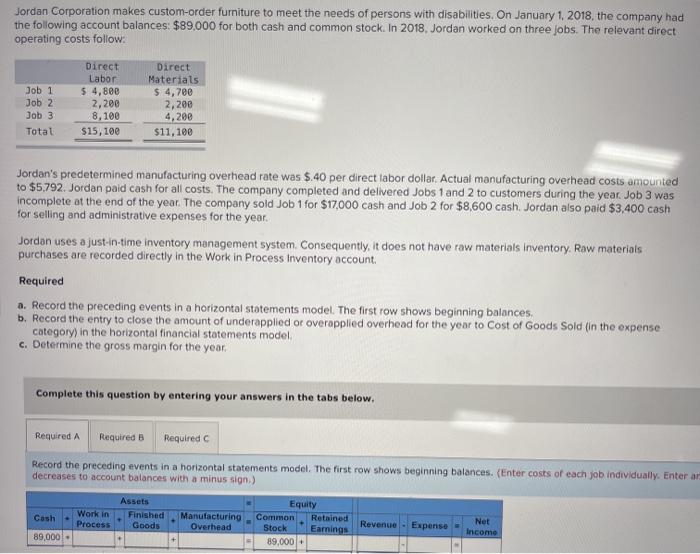

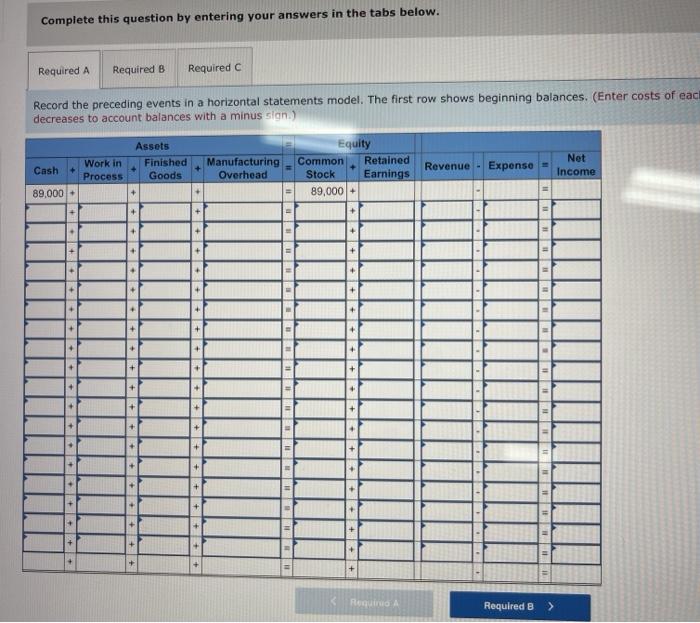

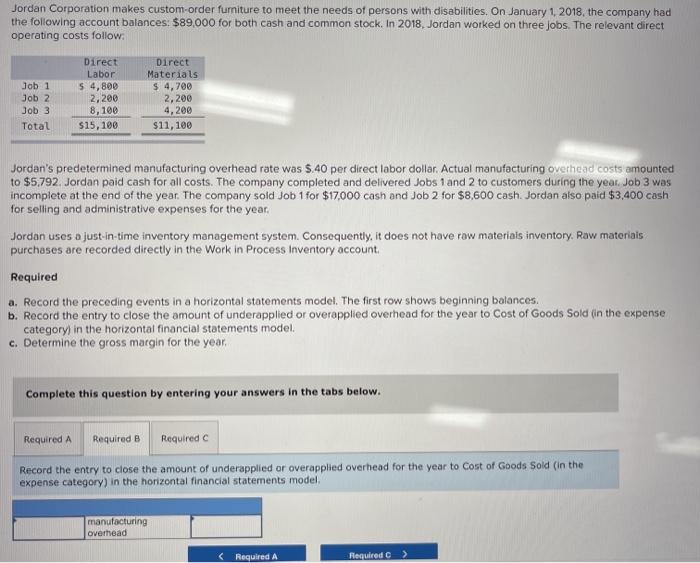

Jordan Corporation makes custom-order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company had the following account balances: $89,000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow: Job 1 Job 2 Job 3 Total Direct Labor $ 4,800 2,200 8,100 $15, 100 Direct Materials $ 4,700 2,200 4,200 $11, 100 Jordan's predetermined manufacturing overhead rate was $.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5,792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $8,600 cash. Jordan also paid $3,400 cash for selling and administrative expenses for the year. Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials Inventory. Raw materials purchases are recorded directly in the Work in Process Inventory account Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (In the expense category) in the horizontal financial statements model c. Determine the gross margin for the year Complete this question by entering your answers in the tabs below. Required A Required B Required Record the preceding events in a horizontal statements model. The first row shows beginning balances. (Enter costs of each job individually. Enter an decreases to account balances with a minus sign.) Assets Equity Cosh Work in Finished Manufacturing Common Retained Net Process Goods Overhead Revenue Stock Earnings Expense Income 89.0001 89,000+ Complete this question by entering your answers in the tabs below. Required A Required B Required C Record the preceding events in a horizontal statements model. The first row shows beginning balances. (Enter costs of each decreases to account balances with a minus sign) Assets Finished Goods Work in Process Cash Manufacturing Overhead Equity Common Retained Stock Earnings 89,000 + Revenue - Expense Net Income 89,000 + HI 1180 ++ Reino Required B > Jordan Corporation makes custom-order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company had the following account balances: $89,000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow: Job 1 Job 2 Job 3 Total Direct Labor 54,800 2,200 8, 100 $15, 100 Direct Materials $ 4,700 2,200 4,200 $11, 100 Jordan's predetermined manufacturing overhead rate was 5.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5,792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17.000 cash and Job 2 for $8,600 cash. Jordan also paid $3,400 cash for selling and administrative expenses for the year, Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory. Raw materiais purchases are recorded directly in the Work in Process Inventory account Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold in the expense category) in the horizontal financial statements model. c. Determine the gross margin for the year Complete this question by entering your answers in the tabs below. Required A Required B Required Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense category) in the horizontal financial statements model manufacturing Overhead Required A Required C > Jordan Corporation makes custom-order furniture to meet the needs of persons with disabilities. On January 1, 2018, the company had the following account balances $89.000 for both cash and common stock. In 2018, Jordan worked on three jobs. The relevant direct operating costs follow: Job 1 Job 2 Job 3 Total Direct Labor 5 4,800 2,200 8,100 $15,100 Direct Materials $ 4,700 2,200 4,200 $11,100 Jordan's predetermined manufacturing overhead rate was $.40 per direct labor dollar. Actual manufacturing overhead costs amounted to $5.792. Jordan paid cash for all costs. The company completed and delivered Jobs 1 and 2 to customers during the year. Job 3 was incomplete at the end of the year. The company sold Job 1 for $17,000 cash and Job 2 for $8,600 cash. Jordan also paid $3,400 cash for selling and administrative expenses for the year, Jordan uses a just-in-time inventory management system. Consequently, it does not have raw materials inventory, Raw materials purchases are recorded directly in the Work in Process Inventory account Required a. Record the preceding events in a horizontal statements model. The first row shows beginning balances b. Record the entry to close the amount of underapplied or overapplied overhead for the year to Cost of Goods Sold (in the expense category) in the horizontal financial statements model. c. Determine the gross margin for the year Complete this question by entering your answers in the tabs below. Required A Required B Required Determine the gross margin for the year. Gross margin