Answered step by step

Verified Expert Solution

Question

1 Approved Answer

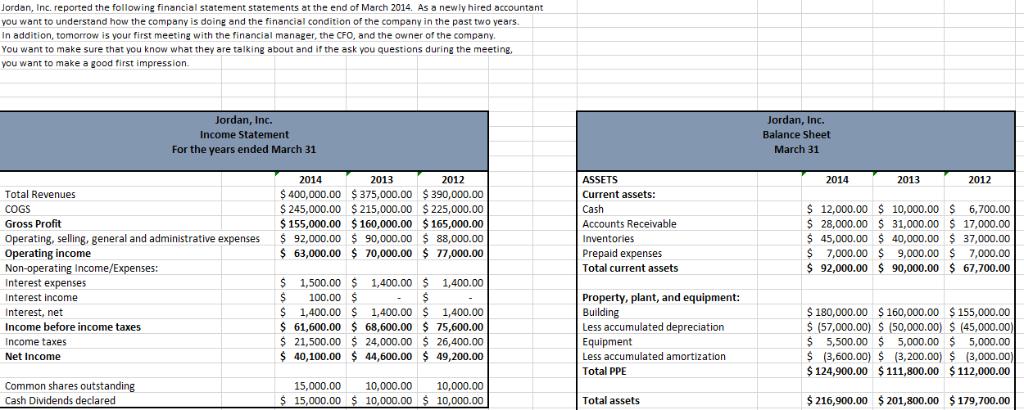

Jordan, Inc. reported the following financial statement statements at the end of March 2014. As a newly hired accountant you want to understand how

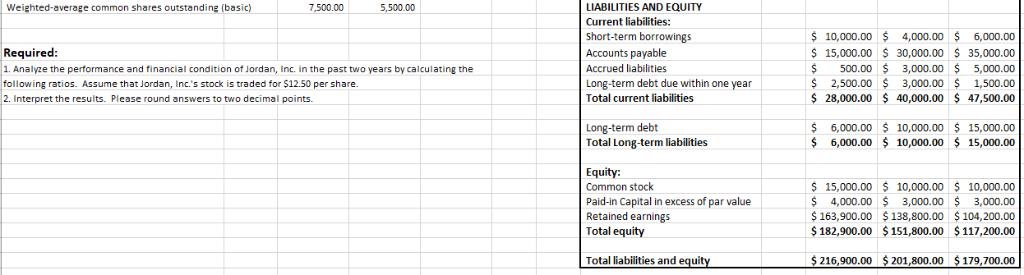

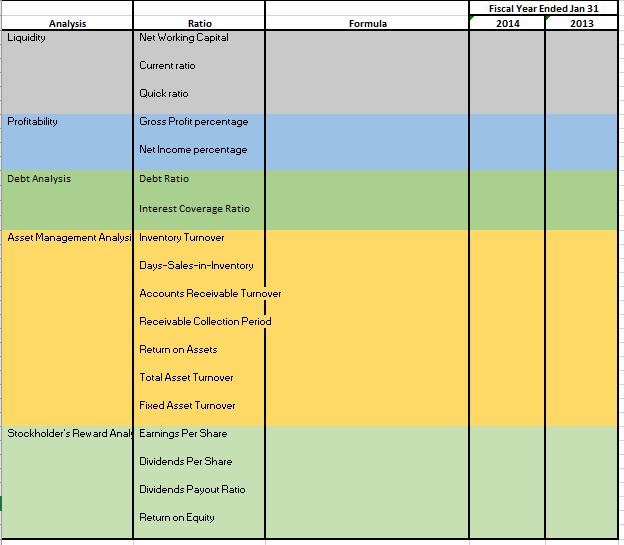

Jordan, Inc. reported the following financial statement statements at the end of March 2014. As a newly hired accountant you want to understand how the company is doing and the financial condition of the company in the past two years. In addition, tomorrow is your first meeting with the financial manager, the CFO, and the owner of the company. You want to make sure that you know what they are talking about and if the ask you questions during the meeting, you want to make a good first impression. Jordan, Inc. Balance Sheet Jordan, Inc. Income Statement For the years ended March 31 March 31 2014 2013 2012 ASSETS 2014 2013 2012 $ 400,000.00 $ 375,000.00 $ 390,000.00 $ 245,000.00 $ 215,000.00 $ 225,000.00 $ 155,000.00 $ 160,000.00 $ 165,000.00 $ 92,000.00 $ 90,000.00 $ 88,000.00 $ 63,000.00 $ 70,000.00 $ 77,000.00 Total Revenues Current assets: COGS Gross Profit Operating, selling, general and administrative expenses Operating income $ 12,000.00 $ 10,000.00 $ 6,700.00 $ 28,000.00 $ 31,000.00 $ 17,000.00 $ 45,000.00 $ 40,000.00 $ 37,000.00 $ 7,000.00 $ 9,000.00 $ 7,000.00 $ 92,000.00 $ 90,000.00 $ 67,700.00 Cash Accounts Receivable Inventories Prepaid expenses Total current assets Non-operating Income/Expenses: Interest expenses 1,400.00 $ 1,400.00 $4 $ 1,500.00 $ 100.00 $ $ 1,400.00 $ 1,400.00 $ 1,400.00 $ 61,600.00 $ 68,600.00 $ 75,600.00 $ 21,500.00 $ 24,000.00 $ 26,400.00 $ 40,100.00 $ 44,600.00 $ 49,200.00 Property, plant, and equipment: Building Less accumulated depreciation Equipment Interest income $ 180,000.00 $ 160,000.00 $155,000.00 $ (57,000.00) $ (50,000.00) $ (45,000.00) $ 5,500.00 $ 5,000.00 $ 5,000.00 $ (3,600.00) $ (3,200.00) $ (3,000.00) $ 124,900.00 $ 111,800.00 $112,000.00 Interest, net Income before income taxes Income taxes Net Income Less accumulated amortization Total PPE Common shares outstanding 15,000.00 10,000.00 10,000.00 Cash Dividends declared $ 15,000.00 $ 10,000.00 $ 10,000.00 Total assets $ 216,900.00 $ 201,800.00 $ 179,700.00 LIABILITIES AND EQUITY Current liabilities: Short-term borrowings Weighted-average common shares outstanding (basic) 7,500.00 5,500.00 $ 10,000.00 $ $ 15,000.00 S 30,000.00 $ 35,000.00 500.00 $ 3,000.00 $ 2,500.00 $ 3,000.00 $ $ 28,000.00 $ 40,000.00 $ 47,500.00 4,000.00 $ 6,000.00 Required: Accounts payable 5,000.00 1,500.00 1. Analyze the performance and financial condition of Jordan, Inc. in the past two years by calculating the Accrued liabilities following ratios. Assume that Jordan, Inc.'s stock is traded for $12.50 per share. Long-term debt due within one year 2. Interpret the results. Please round answers to two decimal points. Total current liabilities Long-term debt Total Long-term liabilities 6,000.00 $ 10,000.00 $ 15,000.00 2$ 6,000.00 $ 10,000.00 $ 15,000.00 Equity: $ 15,000.00 $ 10,000.00 $ 10,000.00 $ 4,000.00 $ 3,000.00 $ 3,000.00 $ 163,900.00 $ 138,800.00 $ 104,200.00 $ 182,900.00 $ 151,800.00 $ 117,200.00 Common stock Paid-in Capital in excess of par value Retained earnings Total equity Total liabilities and equity $ 216,900.00 $ 201,800.00 $ 179,700.00 Fiscal Year Ended Jan 31 Analysis Ratio Formula 2014 2013 Liquidity Net Working Capital Current ratio Quick ratio Profitability Gross Profit percentage Net Income peroentage Debt Analysis Debt Ratio Interest Coverage Ratio Asset Management Analysi Inventory Turnover Days-Sales-in-Inventory Accounts Receivable Turnover Receivable Collection Period Return on Assets Total Asset Turnover Fixed Asset Turnover Stockholder's Reward Anal Earnings Per Share Dividends Per Share Dividends Payout Ratio Return on Equity

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Answer Analysis Ratio Formula Fiscal Year Ended Jan 31 2014 2013 Remarks Liquidity Net working capital Current assets Current liabilities 6400000 5000000 Liquidity of company has improved in 2014 Curr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started