Question

Jordan Sales Company (organized as a corporation on April 1, 2014) has completed the accounting cycle for the second year, ended March 31, 2016. Jordan

Jordan Sales Company (organized as a corporation on April 1, 2014) has completed the accounting cycle for the second year, ended March 31, 2016. Jordan also has completed a correct trial balance as follows:

| JORDAN SALES COMPANY Trial Balance At March 31, 2016 | ||||

| Account Titles | Debit | Credit | ||

| Cash | $ | 58,100 | ||

| Accounts receivable | 49,500 | |||

| Office supplies inventory | 1,300 | |||

| Automobiles (company cars) | 34,100 | |||

| Accumulated depreciation, automobiles | $ | 13,300 | ||

| Office equipment | 3,000 | |||

| Accumulated depreciation, office equipment | 1,200 | |||

| Accounts payable | 21,700 | |||

| Income taxes payable | 0 | |||

| Salaries and commissions payable | 1,100 | |||

| Note payable, long-term | 32,600 | |||

| Capital stock (par $1; 32,600 shares) | 32,600 | |||

| Paid-in capital | 4,100 | |||

| Retained earnings (on April 1, 2015) | 6,700 | |||

| Dividends declared and paid during the current year | 10,900 | |||

| Sales revenue | 103,800 | |||

| Cost of goods sold | 32,900 | |||

| Operating expenses (detail omitted to conserve time) | 18,800 | |||

| Depreciation expense (on autos and including $600 on office equipment) | 7,600 | |||

| Interest expense | 900 | |||

| Income tax expense (not yet computed) | ||||

| Totals | $ | 217,100 | $ | 217,100 |

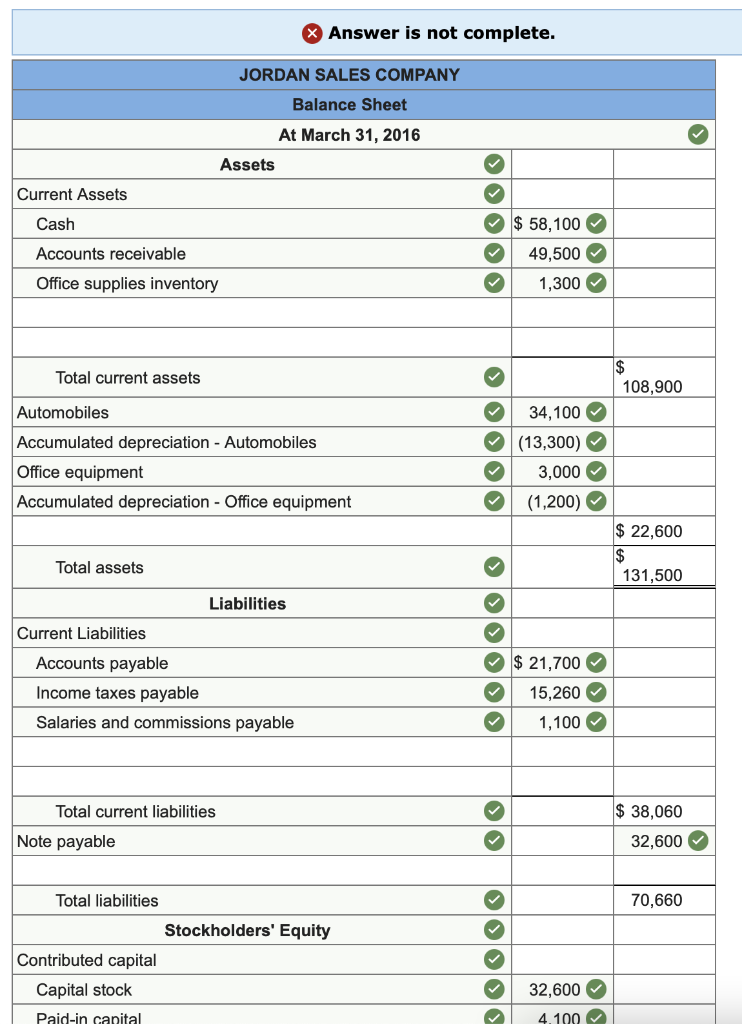

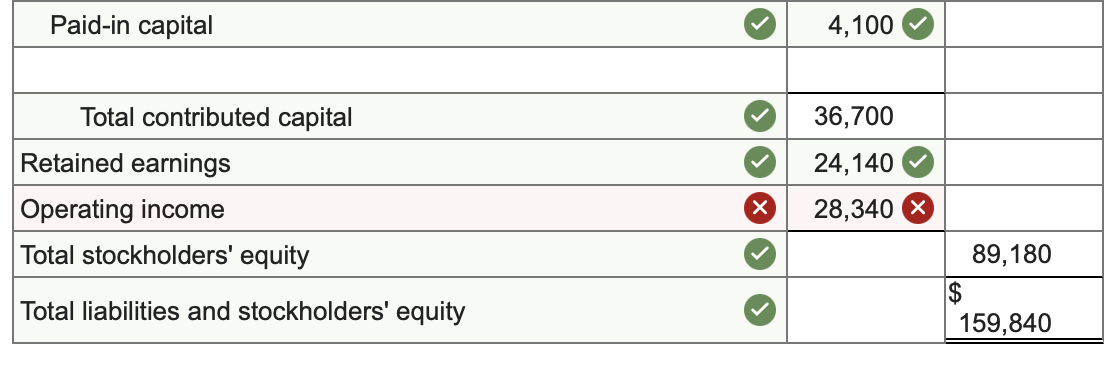

b. Classified balance sheet at the end of the reporting year, March 31, 2016. Include (1) income taxes for the current year in Income Taxes payable and (2) dividends in Retained earnings. (Amounts to be deducted should be indicated by a minus sign.)

I am confused on what I am missing, and if there is any other parts to this question?

thank you so much in advance!!

Answer is not complete. JORDAN SALES COMPANY Balance Sheet At March 31, 2016 Assets Current Assets Cash Accounts receivable $ 58,100 49,500 1,300 Office supplies inventory Total current assets 108,900 Automobiles Accumulated depreciation - Automobiles Office equipment Accumulated depreciation - Office equipment 34,100 (13,300) 3,000 (1,200) $ 22,600 $ 131,500 Total assets Liabilities Current Liabilities Accounts payable Income taxes payable Salaries and commissions payable $ 21,700 15,260 1,100 Total current liabilities $ 38,060 32,600 Note payable 70,660 Total liabilities Stockholders' Equity Contributed capital Capital stock Paid-in canital 32,600 4.100 Paid-in capital 4,100 Total contributed capital Retained earnings Operating income Total stockholders' equity 36,700 24,140 28,340 89,180 $ 159,840 Total liabilities and stockholders' equityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started