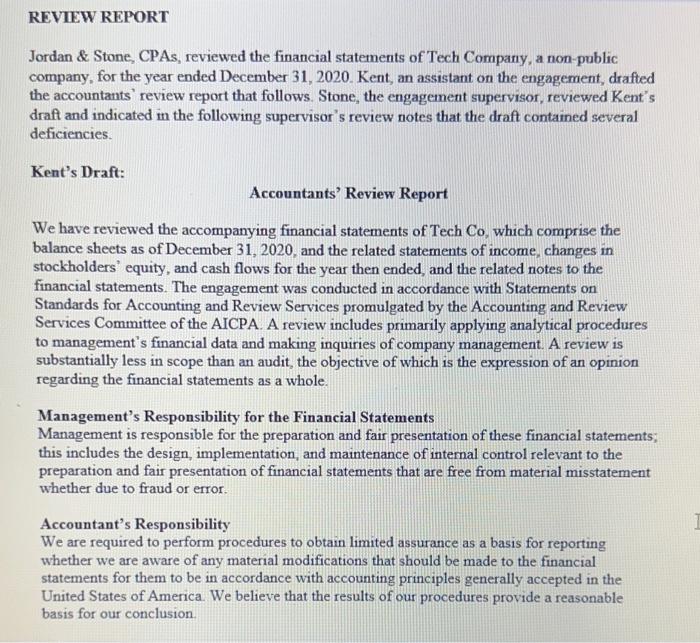

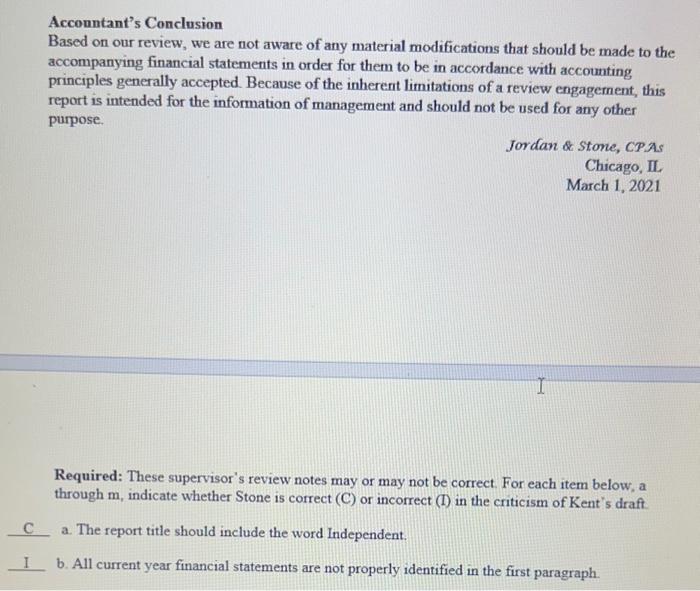

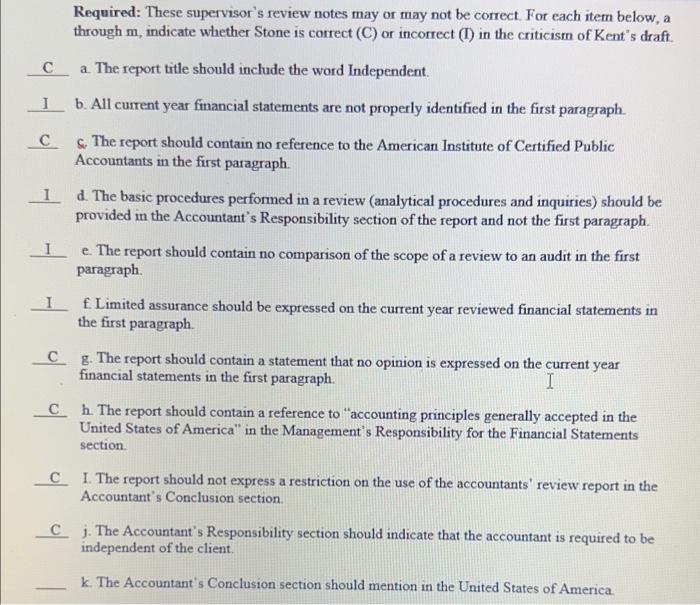

Jordan \& Stone, CPAs, reviewed the financial statements of Tech Company, a non-public company, for the year ended December 31, 2020. Kent, an assistant on the engagement, drafted the accountants' review report that follows. Stone, the engagement supervisor, reviewed Kent's draft and indicated in the following supervisor's review notes that the draft contained several deficiencies. Kent's Draft: Accountants' Review Report We have reviewed the accompanying financial statements of Tech Co, which comprise the balance sheets as of December 31, 2020, and the related statements of income, changes in stockholders' equity, and cash flows for the year then ended, and the related notes to the financial statements. The engagement was conducted in accordance with Statements on Standards for Accounting and Review Services promulgated by the Accounting and Review Services Committee of the AICPA. A review includes primarily applying analytical procedures to management's financial data and making inquiries of company management. A review is substantially less in scope than an audit, the objective of which is the expression of an opinion regarding the financial statements as a whole. Management's Responsibility for the Financial Statements Management is responsible for the preparation and fair presentation of these financial statements; this includes the design, implementation, and maintenance of internal control relevant to the preparation and fair presentation of financial statements that are free from material misstatement whether due to fraud or error. Accountant's Responsibility We are required to perform procedures to obtain limited assurance as a basis for reporting whether we are aware of any material modifications that should be made to the financial statements for them to be in accordance with accounting principles generally accepted in the United States of America. We believe that the results of our procedures provide a reasonable basis for our conclusion. Accountant's Conclusion Based on our review, we are not aware of any material modifications that should be made to the accompanying financial statements in order for them to be in accordance with accounting principles generally accepted. Because of the inherent limitations of a review engagement, this report is intended for the information of management and should not be used for any other purpose. Jordan&Stone,CP.AsChicago,II,March1,2021 Required: These supervisor's review notes may or may not be correct. For each item below, a through m, indicate whether Stone is correct (C) or incorrect (I) in the criticism of Kent's draft. C a. The report title should include the word Independent. I b. All current year financial statements are not properly identified in the first paragraph. Required: These supervisor's review notes may or may not be correct. For each item below, a through m, indicate whether Stone is correct (C) or incorrect (I) in the criticism of Kent's draft. C a. The report title should include the word Independent. I b. All current year financial statements are not properly identified in the first paragraph. C c. The report should contain no reference to the American Institute of Certified Public Accountants in the first paragraph. I d. The basic procedures performed in a review (analytical procedures and inquiries) should be provided in the Accountant's Responsibility section of the report and not the first paragraph. I e. The report should contain no comparison of the scope of a review to an audit in the first paragraph. I f. Limited assurance should be expressed on the current year reviewed financial statements in the first paragraph. C g. The report should contain a statement that no opinion is expressed on the current year financial statements in the first paragraph. C h. The report should contain a reference to "accounting principles generally accepted in the United States of America" in the Management's Responsibility for the Financial Statements section. C I. The report should not express a restriction on the use of the accountants' review report in the Accountant's Conclusion section. C j. The Accountant's Responsibility section should indicate that the accountant is required to be independent of the client. k. The Accountant's Conclusion section should mention in the United States of America