Answered step by step

Verified Expert Solution

Question

1 Approved Answer

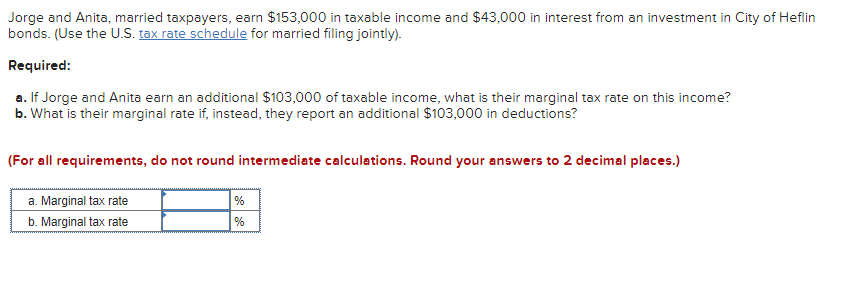

Jorge and Anita, married taxpayers, earn $153,000 in taxable income and $43,000 in interest from an investment in City of Heflin bonds. (Use the U.S.

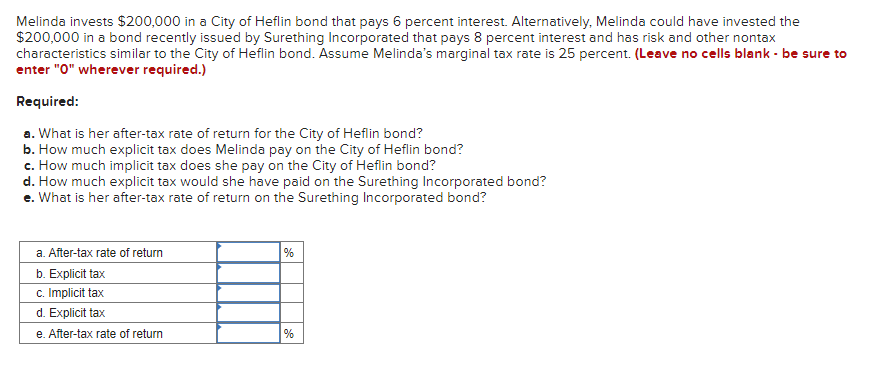

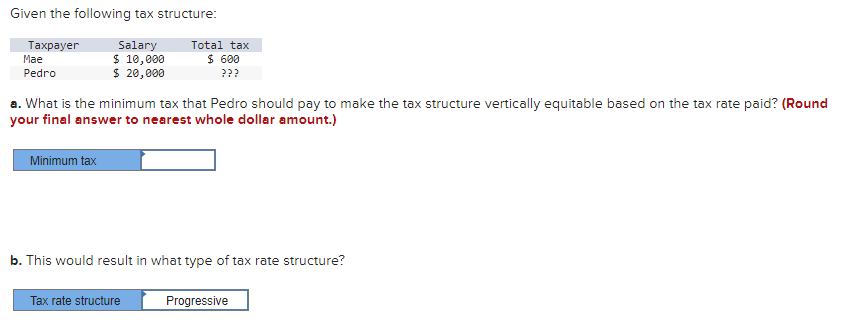

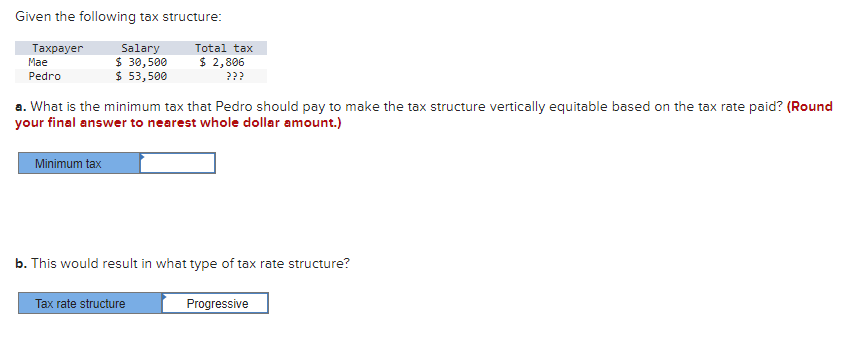

Jorge and Anita, married taxpayers, earn $153,000 in taxable income and $43,000 in interest from an investment in City of Heflin bonds. (Use the U.S. for married filing jointly). Required: a. If Jorge and Anita earn an additional $103,000 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $103,000 in deductions? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) Melinda invests $200,000 in a City of Heflin bond that pays 6 percent interest. Alternatively, Melinda could have invested the $200,000 in a bond recently issued by Surething Incorporated that pays 8 percent interest and has risk and other nontax characteristics similar to the City of Heflin bond. Assume Melinda's marginal tax rate is 25 percent. (Leave no cells blank - be sure to enter " 0 " wherever required.) Required: a. What is her after-tax rate of return for the City of Heflin bond? b. How much explicit tax does Melinda pay on the City of Heflin bond? c. How much implicit tax does she pay on the City of Heflin bond? d. How much explicit tax would she have paid on the Surething Incorporated bond? e. What is her after-tax rate of return on the Surething Incorporated bond? Given the following tax structure: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) b. This would result in what type of tax rate structure? Given the following tax structure: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) b. This would result in what type of tax rate structure

Jorge and Anita, married taxpayers, earn $153,000 in taxable income and $43,000 in interest from an investment in City of Heflin bonds. (Use the U.S. for married filing jointly). Required: a. If Jorge and Anita earn an additional $103,000 of taxable income, what is their marginal tax rate on this income? b. What is their marginal rate if, instead, they report an additional $103,000 in deductions? (For all requirements, do not round intermediate calculations. Round your answers to 2 decimal places.) Melinda invests $200,000 in a City of Heflin bond that pays 6 percent interest. Alternatively, Melinda could have invested the $200,000 in a bond recently issued by Surething Incorporated that pays 8 percent interest and has risk and other nontax characteristics similar to the City of Heflin bond. Assume Melinda's marginal tax rate is 25 percent. (Leave no cells blank - be sure to enter " 0 " wherever required.) Required: a. What is her after-tax rate of return for the City of Heflin bond? b. How much explicit tax does Melinda pay on the City of Heflin bond? c. How much implicit tax does she pay on the City of Heflin bond? d. How much explicit tax would she have paid on the Surething Incorporated bond? e. What is her after-tax rate of return on the Surething Incorporated bond? Given the following tax structure: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) b. This would result in what type of tax rate structure? Given the following tax structure: a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? (Round your final answer to nearest whole dollar amount.) b. This would result in what type of tax rate structure Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started