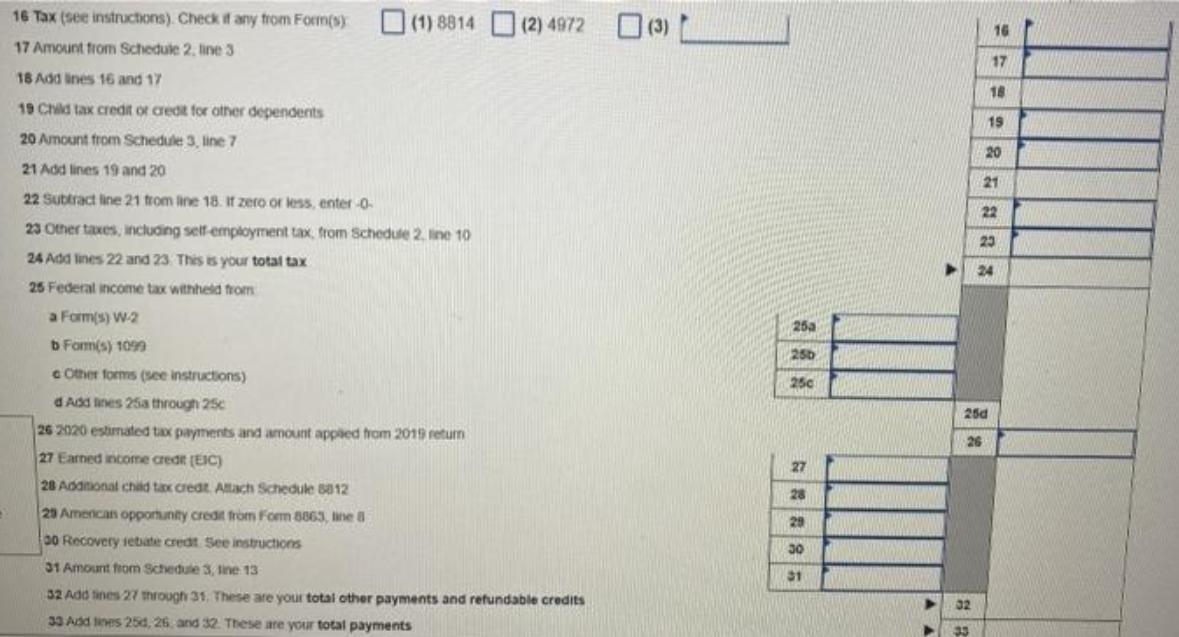

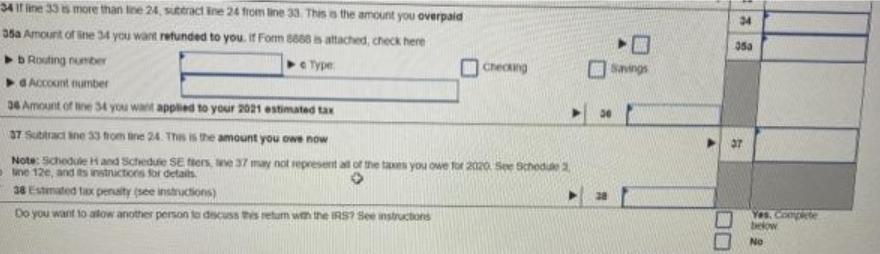

Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA

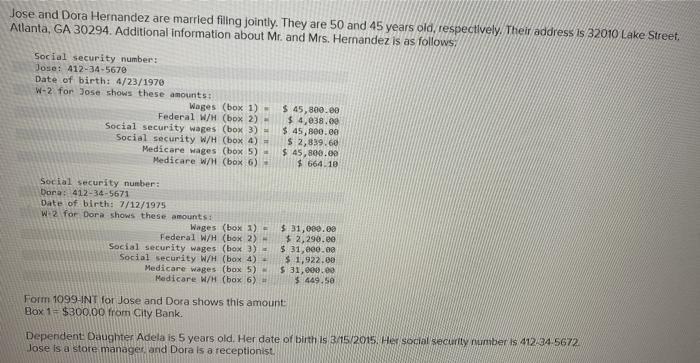

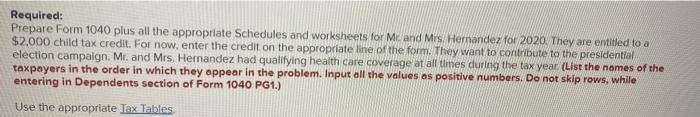

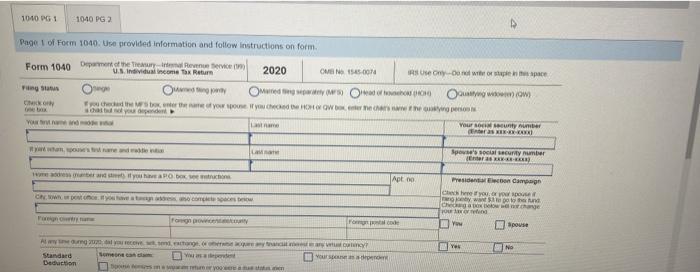

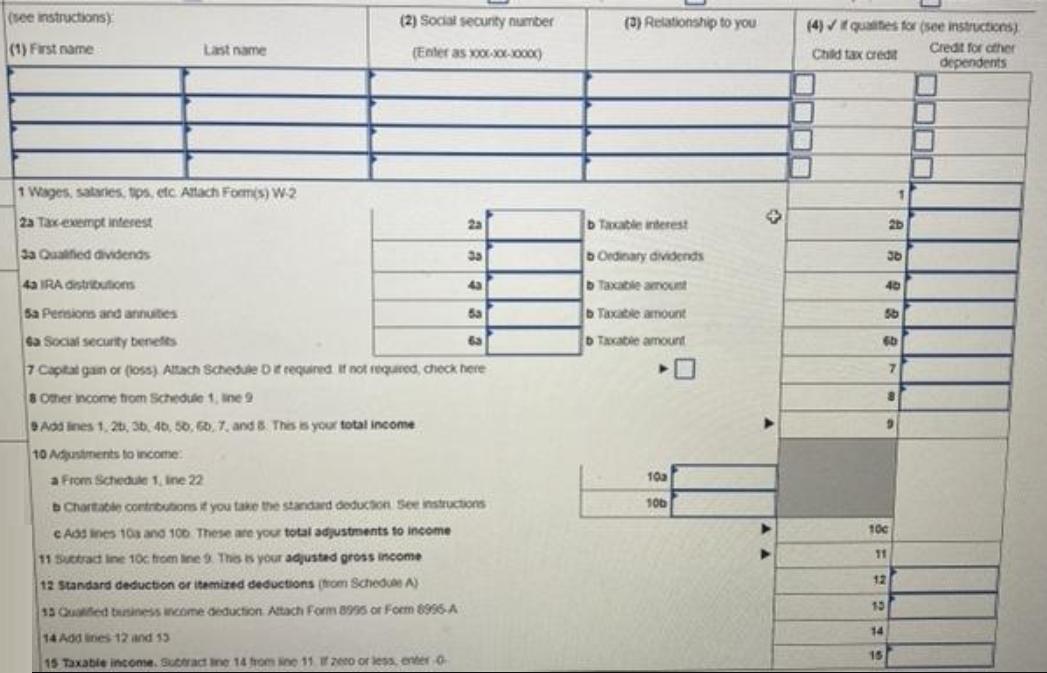

Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows, Social security number: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) - Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) $ 45,800.00 $ 4,038.00 $ 45,800.00 S 2,839.60 $ 45,800.00 $ 664.10 Social security nunber: Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = Federal W/H (box 2)- Social security wages (box 3) = Social security W/H (box 4) Medicare wages (box 5) H Medicare W/H (box 6) $ 31,000.00 $2,290.e0 $ 31,000.00 $ 1,922.00 $ 31,000.00 $ 449.50 Form 1099-INT for Jose and Dora shows this amount Box 1= $300.00 from City Bank. Dependent Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672 Jose is a store manager,and Dora is a receptionist. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr and Mrs. Hernandez for 2020 They are entitled to a $2,000 child tax credit. For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not skip rows, while entering in Dependents section of Form 1040 PG1.) Use the appropriate Tax Tables 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Depanment of the Treasuryintemal Revenue tervice () US. Individual income Tax Return 2020 OM N 5S-0074 IRS Use On-0onot writr or stapie hes apace Fng Staun ege Adng y OMared gspwty Oadof eho O Ooung wm (ow CN o ne bx Tou checed the MFS box, enter the name of your spouse ifr you Checed the HOHO QW b eter he hers ehe oyng pesonN has ot you dependent YO t nae and o al Last name Your social secunty number dnter as E- han, pos name and ae int Spovse's social security number (Enter as Lastname e addess ner and steet it you have aRO bo see tructon Apt no. Presidenta Electon Campgn Check here f you.oryou spouse i Tanjoety wwant S Checkeg a xeow e no.change rour trortena CN wn pet uceit you have a t aess ano compeaces besow the tund Fon cry na Fogn provecentty Fomgn ptal code Spouse Al my tie dung dal you receive st send achange, or oerwine acque ay tanc nesteany tt.cncy? Yes No Standard Deduction Someone can ta OW aepedent Dpos te s maw eumr yooeere a attn en V ne aapend (see instructions) (2) Social security number (3) Relationship to you (4)qualites for (see instructions) Credt for ather dependents (1) First name Last name (Enter as o-o-000) Child tax credit 1 Wages, sataries, tps, etc Attach Fomis) W2 2a Taxexempt interest 2a b Taxable interest 2b Ja Qualfied dividends 25 bOrdinary dividends 43 IRA distributions 43 D Taxable arrount 40 Sa Persions and annuites Taxatle amount sa Social security benefts 6a D Taxable amount 7 Capital gain or (loss) Atach Schedule D required if not requred, check here S Omer income trom Schedule 1, ine 9 Add ines 1, 20, 36, 40, 50, 0, 7, and 8 This is your total income 10 Adustments to income a From Schedule 1, ine 22 10a 10b BChartable contributons it you take the standard deduction See instructions 10c CAds ines 10a and 100 These are your total adjustments to income 11 11 Suctract ine 10c trom line 9 This is your adjusted gross income 12 12 Standard deduction or itemized deductions (trom Schedue A) 13 13 Qualed bniness income deduction Attach Form 8995 or Form 8996-A 14 14 Add lines 12 and 13 15 15 Taxable income. Subract Ine 14 hom ine 11 zeeo or less, enter 0 16 Tax (see instructions). Check ft any from Form(s) (1) 8814 (2) 4972 (3) 16 17 Amount from Schedule 2, line 3 17 16 Add lines 16 and 17 18 19 Child tax credit or credt for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter 0 22 23 Other taxes, including setf employment tax, from Schedule 2. line 10 23 24 Add lines 22 and 23 This is your total tax 24 25 Federal income tax withheld from a Form(s) w2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c dAdd ines 25a through 25c 25d 26 2020 estimated tax payments and amount applied from 2019 retum 26 27 Earned income credit (EIC) 27 28 Addtional child tax credt Alach Schedule 8812 28 29 Amenican opportunity credit from Fom 8863, ane 8 29 00 Recovery setate credt See instructions 30 31 Amount from Schedule 3, line 13 31 32 Add tines 27 through 31, These are your total other payments and refundable credits 32 33 Add tines 25d, 26. and 32. These are your total payments 33 4if ine 33 s more than line 24, suteract ine 24 from line 33. This s the amount you overpaid 34 35a Amount of ine 34 you want retunded to you. if Form 8668 attached, check here 05a b Routing number e Type Checng GACCount number staes O 36 Amount of ne 34 you want applied to your 2021 estimated tax 37 Subtrac ne 33 rom ine 24 Thes is the anmount you owe now Note: Schedule Hand Schedte SE tters ve 37 may not sepresent all of the taes you owe for 2020 See Bchede 2 une 12e, and its instructions for detaits 38 Estemated tax penaty (see instructions) Do you want to atow another person te dscuss thes retum wth the IRS? See nstructions Yes below No Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows, Social security number: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) - Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) $ 45,800.00 $ 4,038.00 $ 45,800.00 S 2,839.60 $ 45,800.00 $ 664.10 Social security nunber: Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = Federal W/H (box 2)- Social security wages (box 3) = Social security W/H (box 4) Medicare wages (box 5) H Medicare W/H (box 6) $ 31,000.00 $2,290.e0 $ 31,000.00 $ 1,922.00 $ 31,000.00 $ 449.50 Form 1099-INT for Jose and Dora shows this amount Box 1= $300.00 from City Bank. Dependent Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672 Jose is a store manager,and Dora is a receptionist. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr and Mrs. Hernandez for 2020 They are entitled to a $2,000 child tax credit. For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not skip rows, while entering in Dependents section of Form 1040 PG1.) Use the appropriate Tax Tables 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Depanment of the Treasuryintemal Revenue tervice () US. Individual income Tax Return 2020 OM N 5S-0074 IRS Use On-0onot writr or stapie hes apace Fng Staun ege Adng y OMared gspwty Oadof eho O Ooung wm (ow CN o ne bx Tou checed the MFS box, enter the name of your spouse ifr you Checed the HOHO QW b eter he hers ehe oyng pesonN has ot you dependent YO t nae and o al Last name Your social secunty number dnter as E- han, pos name and ae int Spovse's social security number (Enter as Lastname e addess ner and steet it you have aRO bo see tructon Apt no. Presidenta Electon Campgn Check here f you.oryou spouse i Tanjoety wwant S Checkeg a xeow e no.change rour trortena CN wn pet uceit you have a t aess ano compeaces besow the tund Fon cry na Fogn provecentty Fomgn ptal code Spouse Al my tie dung dal you receive st send achange, or oerwine acque ay tanc nesteany tt.cncy? Yes No Standard Deduction Someone can ta OW aepedent Dpos te s maw eumr yooeere a attn en V ne aapend (see instructions) (2) Social security number (3) Relationship to you (4)qualites for (see instructions) Credt for ather dependents (1) First name Last name (Enter as o-o-000) Child tax credit 1 Wages, sataries, tps, etc Attach Fomis) W2 2a Taxexempt interest 2a b Taxable interest 2b Ja Qualfied dividends 25 bOrdinary dividends 43 IRA distributions 43 D Taxable arrount 40 Sa Persions and annuites Taxatle amount sa Social security benefts 6a D Taxable amount 7 Capital gain or (loss) Atach Schedule D required if not requred, check here S Omer income trom Schedule 1, ine 9 Add ines 1, 20, 36, 40, 50, 0, 7, and 8 This is your total income 10 Adustments to income a From Schedule 1, ine 22 10a 10b BChartable contributons it you take the standard deduction See instructions 10c CAds ines 10a and 100 These are your total adjustments to income 11 11 Suctract ine 10c trom line 9 This is your adjusted gross income 12 12 Standard deduction or itemized deductions (trom Schedue A) 13 13 Qualed bniness income deduction Attach Form 8995 or Form 8996-A 14 14 Add lines 12 and 13 15 15 Taxable income. Subract Ine 14 hom ine 11 zeeo or less, enter 0 16 Tax (see instructions). Check ft any from Form(s) (1) 8814 (2) 4972 (3) 16 17 Amount from Schedule 2, line 3 17 16 Add lines 16 and 17 18 19 Child tax credit or credt for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter 0 22 23 Other taxes, including setf employment tax, from Schedule 2. line 10 23 24 Add lines 22 and 23 This is your total tax 24 25 Federal income tax withheld from a Form(s) w2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c dAdd ines 25a through 25c 25d 26 2020 estimated tax payments and amount applied from 2019 retum 26 27 Earned income credit (EIC) 27 28 Addtional child tax credt Alach Schedule 8812 28 29 Amenican opportunity credit from Fom 8863, ane 8 29 00 Recovery setate credt See instructions 30 31 Amount from Schedule 3, line 13 31 32 Add tines 27 through 31, These are your total other payments and refundable credits 32 33 Add tines 25d, 26. and 32. These are your total payments 33 4if ine 33 s more than line 24, suteract ine 24 from line 33. This s the amount you overpaid 34 35a Amount of ine 34 you want retunded to you. if Form 8668 attached, check here 05a b Routing number e Type Checng GACCount number staes O 36 Amount of ne 34 you want applied to your 2021 estimated tax 37 Subtrac ne 33 rom ine 24 Thes is the anmount you owe now Note: Schedule Hand Schedte SE tters ve 37 may not sepresent all of the taes you owe for 2020 See Bchede 2 une 12e, and its instructions for detaits 38 Estemated tax penaty (see instructions) Do you want to atow another person te dscuss thes retum wth the IRS? See nstructions Yes below No Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows, Social security number: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) - Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) $ 45,800.00 $ 4,038.00 $ 45,800.00 S 2,839.60 $ 45,800.00 $ 664.10 Social security nunber: Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = Federal W/H (box 2)- Social security wages (box 3) = Social security W/H (box 4) Medicare wages (box 5) H Medicare W/H (box 6) $ 31,000.00 $2,290.e0 $ 31,000.00 $ 1,922.00 $ 31,000.00 $ 449.50 Form 1099-INT for Jose and Dora shows this amount Box 1= $300.00 from City Bank. Dependent Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672 Jose is a store manager,and Dora is a receptionist. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr and Mrs. Hernandez for 2020 They are entitled to a $2,000 child tax credit. For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not skip rows, while entering in Dependents section of Form 1040 PG1.) Use the appropriate Tax Tables 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Depanment of the Treasuryintemal Revenue tervice () US. Individual income Tax Return 2020 OM N 5S-0074 IRS Use On-0onot writr or stapie hes apace Fng Staun ege Adng y OMared gspwty Oadof eho O Ooung wm (ow CN o ne bx Tou checed the MFS box, enter the name of your spouse ifr you Checed the HOHO QW b eter he hers ehe oyng pesonN has ot you dependent YO t nae and o al Last name Your social secunty number dnter as E- han, pos name and ae int Spovse's social security number (Enter as Lastname e addess ner and steet it you have aRO bo see tructon Apt no. Presidenta Electon Campgn Check here f you.oryou spouse i Tanjoety wwant S Checkeg a xeow e no.change rour trortena CN wn pet uceit you have a t aess ano compeaces besow the tund Fon cry na Fogn provecentty Fomgn ptal code Spouse Al my tie dung dal you receive st send achange, or oerwine acque ay tanc nesteany tt.cncy? Yes No Standard Deduction Someone can ta OW aepedent Dpos te s maw eumr yooeere a attn en V ne aapend (see instructions) (2) Social security number (3) Relationship to you (4)qualites for (see instructions) Credt for ather dependents (1) First name Last name (Enter as o-o-000) Child tax credit 1 Wages, sataries, tps, etc Attach Fomis) W2 2a Taxexempt interest 2a b Taxable interest 2b Ja Qualfied dividends 25 bOrdinary dividends 43 IRA distributions 43 D Taxable arrount 40 Sa Persions and annuites Taxatle amount sa Social security benefts 6a D Taxable amount 7 Capital gain or (loss) Atach Schedule D required if not requred, check here S Omer income trom Schedule 1, ine 9 Add ines 1, 20, 36, 40, 50, 0, 7, and 8 This is your total income 10 Adustments to income a From Schedule 1, ine 22 10a 10b BChartable contributons it you take the standard deduction See instructions 10c CAds ines 10a and 100 These are your total adjustments to income 11 11 Suctract ine 10c trom line 9 This is your adjusted gross income 12 12 Standard deduction or itemized deductions (trom Schedue A) 13 13 Qualed bniness income deduction Attach Form 8995 or Form 8996-A 14 14 Add lines 12 and 13 15 15 Taxable income. Subract Ine 14 hom ine 11 zeeo or less, enter 0 16 Tax (see instructions). Check ft any from Form(s) (1) 8814 (2) 4972 (3) 16 17 Amount from Schedule 2, line 3 17 16 Add lines 16 and 17 18 19 Child tax credit or credt for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter 0 22 23 Other taxes, including setf employment tax, from Schedule 2. line 10 23 24 Add lines 22 and 23 This is your total tax 24 25 Federal income tax withheld from a Form(s) w2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c dAdd ines 25a through 25c 25d 26 2020 estimated tax payments and amount applied from 2019 retum 26 27 Earned income credit (EIC) 27 28 Addtional child tax credt Alach Schedule 8812 28 29 Amenican opportunity credit from Fom 8863, ane 8 29 00 Recovery setate credt See instructions 30 31 Amount from Schedule 3, line 13 31 32 Add tines 27 through 31, These are your total other payments and refundable credits 32 33 Add tines 25d, 26. and 32. These are your total payments 33 4if ine 33 s more than line 24, suteract ine 24 from line 33. This s the amount you overpaid 34 35a Amount of ine 34 you want retunded to you. if Form 8668 attached, check here 05a b Routing number e Type Checng GACCount number staes O 36 Amount of ne 34 you want applied to your 2021 estimated tax 37 Subtrac ne 33 rom ine 24 Thes is the anmount you owe now Note: Schedule Hand Schedte SE tters ve 37 may not sepresent all of the taes you owe for 2020 See Bchede 2 une 12e, and its instructions for detaits 38 Estemated tax penaty (see instructions) Do you want to atow another person te dscuss thes retum wth the IRS? See nstructions Yes below No Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows, Social security number: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) - Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) $ 45,800.00 $ 4,038.00 $ 45,800.00 S 2,839.60 $ 45,800.00 $ 664.10 Social security nunber: Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = Federal W/H (box 2)- Social security wages (box 3) = Social security W/H (box 4) Medicare wages (box 5) H Medicare W/H (box 6) $ 31,000.00 $2,290.e0 $ 31,000.00 $ 1,922.00 $ 31,000.00 $ 449.50 Form 1099-INT for Jose and Dora shows this amount Box 1= $300.00 from City Bank. Dependent Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672 Jose is a store manager,and Dora is a receptionist. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr and Mrs. Hernandez for 2020 They are entitled to a $2,000 child tax credit. For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not skip rows, while entering in Dependents section of Form 1040 PG1.) Use the appropriate Tax Tables 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Depanment of the Treasuryintemal Revenue tervice () US. Individual income Tax Return 2020 OM N 5S-0074 IRS Use On-0onot writr or stapie hes apace Fng Staun ege Adng y OMared gspwty Oadof eho O Ooung wm (ow CN o ne bx Tou checed the MFS box, enter the name of your spouse ifr you Checed the HOHO QW b eter he hers ehe oyng pesonN has ot you dependent YO t nae and o al Last name Your social secunty number dnter as E- han, pos name and ae int Spovse's social security number (Enter as Lastname e addess ner and steet it you have aRO bo see tructon Apt no. Presidenta Electon Campgn Check here f you.oryou spouse i Tanjoety wwant S Checkeg a xeow e no.change rour trortena CN wn pet uceit you have a t aess ano compeaces besow the tund Fon cry na Fogn provecentty Fomgn ptal code Spouse Al my tie dung dal you receive st send achange, or oerwine acque ay tanc nesteany tt.cncy? Yes No Standard Deduction Someone can ta OW aepedent Dpos te s maw eumr yooeere a attn en V ne aapend (see instructions) (2) Social security number (3) Relationship to you (4)qualites for (see instructions) Credt for ather dependents (1) First name Last name (Enter as o-o-000) Child tax credit 1 Wages, sataries, tps, etc Attach Fomis) W2 2a Taxexempt interest 2a b Taxable interest 2b Ja Qualfied dividends 25 bOrdinary dividends 43 IRA distributions 43 D Taxable arrount 40 Sa Persions and annuites Taxatle amount sa Social security benefts 6a D Taxable amount 7 Capital gain or (loss) Atach Schedule D required if not requred, check here S Omer income trom Schedule 1, ine 9 Add ines 1, 20, 36, 40, 50, 0, 7, and 8 This is your total income 10 Adustments to income a From Schedule 1, ine 22 10a 10b BChartable contributons it you take the standard deduction See instructions 10c CAds ines 10a and 100 These are your total adjustments to income 11 11 Suctract ine 10c trom line 9 This is your adjusted gross income 12 12 Standard deduction or itemized deductions (trom Schedue A) 13 13 Qualed bniness income deduction Attach Form 8995 or Form 8996-A 14 14 Add lines 12 and 13 15 15 Taxable income. Subract Ine 14 hom ine 11 zeeo or less, enter 0 16 Tax (see instructions). Check ft any from Form(s) (1) 8814 (2) 4972 (3) 16 17 Amount from Schedule 2, line 3 17 16 Add lines 16 and 17 18 19 Child tax credit or credt for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter 0 22 23 Other taxes, including setf employment tax, from Schedule 2. line 10 23 24 Add lines 22 and 23 This is your total tax 24 25 Federal income tax withheld from a Form(s) w2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c dAdd ines 25a through 25c 25d 26 2020 estimated tax payments and amount applied from 2019 retum 26 27 Earned income credit (EIC) 27 28 Addtional child tax credt Alach Schedule 8812 28 29 Amenican opportunity credit from Fom 8863, ane 8 29 00 Recovery setate credt See instructions 30 31 Amount from Schedule 3, line 13 31 32 Add tines 27 through 31, These are your total other payments and refundable credits 32 33 Add tines 25d, 26. and 32. These are your total payments 33 4if ine 33 s more than line 24, suteract ine 24 from line 33. This s the amount you overpaid 34 35a Amount of ine 34 you want retunded to you. if Form 8668 attached, check here 05a b Routing number e Type Checng GACCount number staes O 36 Amount of ne 34 you want applied to your 2021 estimated tax 37 Subtrac ne 33 rom ine 24 Thes is the anmount you owe now Note: Schedule Hand Schedte SE tters ve 37 may not sepresent all of the taes you owe for 2020 See Bchede 2 une 12e, and its instructions for detaits 38 Estemated tax penaty (see instructions) Do you want to atow another person te dscuss thes retum wth the IRS? See nstructions Yes below No Jose and Dora Hernandez are marrled fillng jointly. They are 50 and 45 years old, respectively. Their address is 32010 Lake Street, Atlanta, GA 30294. Additional information about Mr. and Mrs. Hernandez is as follows, Social security number: Jose: 412-34-5670 Date of birth: 4/23/1970 W-2 for Jose shows these amounts: Wages (box 1) - Federal W/H (box 2) Social security wages (box 3) Social security W/H (box 4) Medicare wages (box 5) Medicare W/H (box 6) $ 45,800.00 $ 4,038.00 $ 45,800.00 S 2,839.60 $ 45,800.00 $ 664.10 Social security nunber: Dora: 412-34-5671 Date of birth: 7/12/1975 W-2 for Dora shows these amounts: Wages (box 1) = Federal W/H (box 2)- Social security wages (box 3) = Social security W/H (box 4) Medicare wages (box 5) H Medicare W/H (box 6) $ 31,000.00 $2,290.e0 $ 31,000.00 $ 1,922.00 $ 31,000.00 $ 449.50 Form 1099-INT for Jose and Dora shows this amount Box 1= $300.00 from City Bank. Dependent Daughter Adela is 5 years old. Her date of birth is 3/15/2015. Her social security number is 412-34-5672 Jose is a store manager,and Dora is a receptionist. Required: Prepare Form 1040 plus all the appropriate Schedules and worksheets for Mr and Mrs. Hernandez for 2020 They are entitled to a $2,000 child tax credit. For now, enter the credit on the appropriate line of the form. They want to contribute to the presidential election campaign. Mr. and Mrs. Hernandez had qualifying health care coverage at all times during the tax year (List the names of the taxpayers in the order in which they appear in the problem. Input all the values as positive numbers. Do not skip rows, while entering in Dependents section of Form 1040 PG1.) Use the appropriate Tax Tables 1040 PG 1 1040 PG 2 Page 1 of Form 1040. Use provided information and follow instructions on form. Form 1040 Depanment of the Treasuryintemal Revenue tervice () US. Individual income Tax Return 2020 OM N 5S-0074 IRS Use On-0onot writr or stapie hes apace Fng Staun ege Adng y OMared gspwty Oadof eho O Ooung wm (ow CN o ne bx Tou checed the MFS box, enter the name of your spouse ifr you Checed the HOHO QW b eter he hers ehe oyng pesonN has ot you dependent YO t nae and o al Last name Your social secunty number dnter as E- han, pos name and ae int Spovse's social security number (Enter as Lastname e addess ner and steet it you have aRO bo see tructon Apt no. Presidenta Electon Campgn Check here f you.oryou spouse i Tanjoety wwant S Checkeg a xeow e no.change rour trortena CN wn pet uceit you have a t aess ano compeaces besow the tund Fon cry na Fogn provecentty Fomgn ptal code Spouse Al my tie dung dal you receive st send achange, or oerwine acque ay tanc nesteany tt.cncy? Yes No Standard Deduction Someone can ta OW aepedent Dpos te s maw eumr yooeere a attn en V ne aapend (see instructions) (2) Social security number (3) Relationship to you (4)qualites for (see instructions) Credt for ather dependents (1) First name Last name (Enter as o-o-000) Child tax credit 1 Wages, sataries, tps, etc Attach Fomis) W2 2a Taxexempt interest 2a b Taxable interest 2b Ja Qualfied dividends 25 bOrdinary dividends 43 IRA distributions 43 D Taxable arrount 40 Sa Persions and annuites Taxatle amount sa Social security benefts 6a D Taxable amount 7 Capital gain or (loss) Atach Schedule D required if not requred, check here S Omer income trom Schedule 1, ine 9 Add ines 1, 20, 36, 40, 50, 0, 7, and 8 This is your total income 10 Adustments to income a From Schedule 1, ine 22 10a 10b BChartable contributons it you take the standard deduction See instructions 10c CAds ines 10a and 100 These are your total adjustments to income 11 11 Suctract ine 10c trom line 9 This is your adjusted gross income 12 12 Standard deduction or itemized deductions (trom Schedue A) 13 13 Qualed bniness income deduction Attach Form 8995 or Form 8996-A 14 14 Add lines 12 and 13 15 15 Taxable income. Subract Ine 14 hom ine 11 zeeo or less, enter 0 16 Tax (see instructions). Check ft any from Form(s) (1) 8814 (2) 4972 (3) 16 17 Amount from Schedule 2, line 3 17 16 Add lines 16 and 17 18 19 Child tax credit or credt for other dependents 19 20 Amount from Schedule 3, line 7 20 21 Add lines 19 and 20 21 22 Subtract line 21 from line 18. If zero or less, enter 0 22 23 Other taxes, including setf employment tax, from Schedule 2. line 10 23 24 Add lines 22 and 23 This is your total tax 24 25 Federal income tax withheld from a Form(s) w2 25a b Form(s) 1099 25b c Other forms (see instructions) 25c dAdd ines 25a through 25c 25d 26 2020 estimated tax payments and amount applied from 2019 retum 26 27 Earned income credit (EIC) 27 28 Addtional child tax credt Alach Schedule 8812 28 29 Amenican opportunity credit from Fom 8863, ane 8 29 00 Recovery setate credt See instructions 30 31 Amount from Schedule 3, line 13 31 32 Add tines 27 through 31, These are your total other payments and refundable credits 32 33 Add tines 25d, 26. and 32. These are your total payments 33 4if ine 33 s more than line 24, suteract ine 24 from line 33. This s the amount you overpaid 34 35a Amount of ine 34 you want retunded to you. if Form 8668 attached, check here 05a b Routing number e Type Checng GACCount number staes O 36 Amount of ne 34 you want applied to your 2021 estimated tax 37 Subtrac ne 33 rom ine 24 Thes is the anmount you owe now Note: Schedule Hand Schedte SE tters ve 37 may not sepresent all of the taes you owe for 2020 See Bchede 2 une 12e, and its instructions for detaits 38 Estemated tax penaty (see instructions) Do you want to atow another person te dscuss thes retum wth the IRS? See nstructions Yes below No

Step by Step Solution

3.61 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Stepbystep explanation Federal taxation as per 2019 D Federal taxation Particul...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started