Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Jose Company sells a wide range of goods through two retail stores operated in adjoining cities. Jose purchases most of the goods it sells in

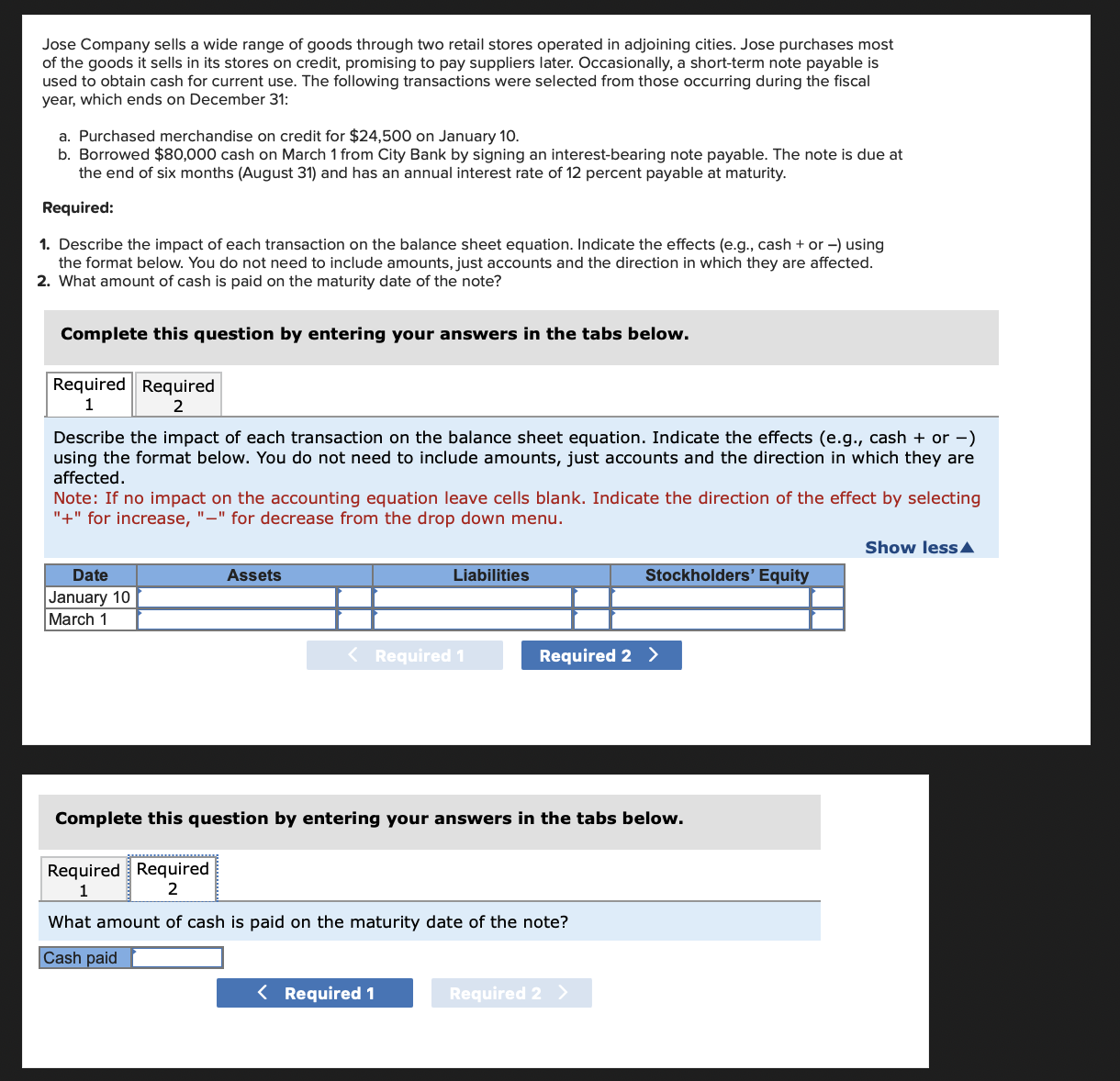

Jose Company sells a wide range of goods through two retail stores operated in adjoining cities. Jose purchases most of the goods it sells in its stores on credit, promising to pay suppliers later. Occasionally, a short-term note payable is used to obtain cash for current use. The following transactions were selected from those occurring during the fiscal year, which ends on December 31: a. Purchased merchandise on credit for $24,500 on January 10 . b. Borrowed $80,000 cash on March 1 from City Bank by signing an interest-bearing note payable. The note is due at the end of six months (August 31) and has an annual interest rate of 12 percent payable at maturity. Required: 1. Describe the impact of each transaction on the balance sheet equation. Indicate the effects (e.g., cash + or - ) using the format below. You do not need to include amounts, just accounts and the direction in which they are affected. 2. What amount of cash is paid on the maturity date of the note? Complete this question by entering your answers in the tabs below. Describe the impact of each transaction on the balance sheet equation. Indicate the effects (e.g., cash + or -) using the format below. You do not need to include amounts, just accounts and the direction in which they are affected. Note: If no impact on the accounting equation leave cells blank. Indicate the direction of the effect by selecting "+" for increase, "-" for decrease from the drop down menu. Show less Complete this question by entering your answers in the tabs below. What amount of cash is paid on the maturity date of the

Jose Company sells a wide range of goods through two retail stores operated in adjoining cities. Jose purchases most of the goods it sells in its stores on credit, promising to pay suppliers later. Occasionally, a short-term note payable is used to obtain cash for current use. The following transactions were selected from those occurring during the fiscal year, which ends on December 31: a. Purchased merchandise on credit for $24,500 on January 10 . b. Borrowed $80,000 cash on March 1 from City Bank by signing an interest-bearing note payable. The note is due at the end of six months (August 31) and has an annual interest rate of 12 percent payable at maturity. Required: 1. Describe the impact of each transaction on the balance sheet equation. Indicate the effects (e.g., cash + or - ) using the format below. You do not need to include amounts, just accounts and the direction in which they are affected. 2. What amount of cash is paid on the maturity date of the note? Complete this question by entering your answers in the tabs below. Describe the impact of each transaction on the balance sheet equation. Indicate the effects (e.g., cash + or -) using the format below. You do not need to include amounts, just accounts and the direction in which they are affected. Note: If no impact on the accounting equation leave cells blank. Indicate the direction of the effect by selecting "+" for increase, "-" for decrease from the drop down menu. Show less Complete this question by entering your answers in the tabs below. What amount of cash is paid on the maturity date of the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started