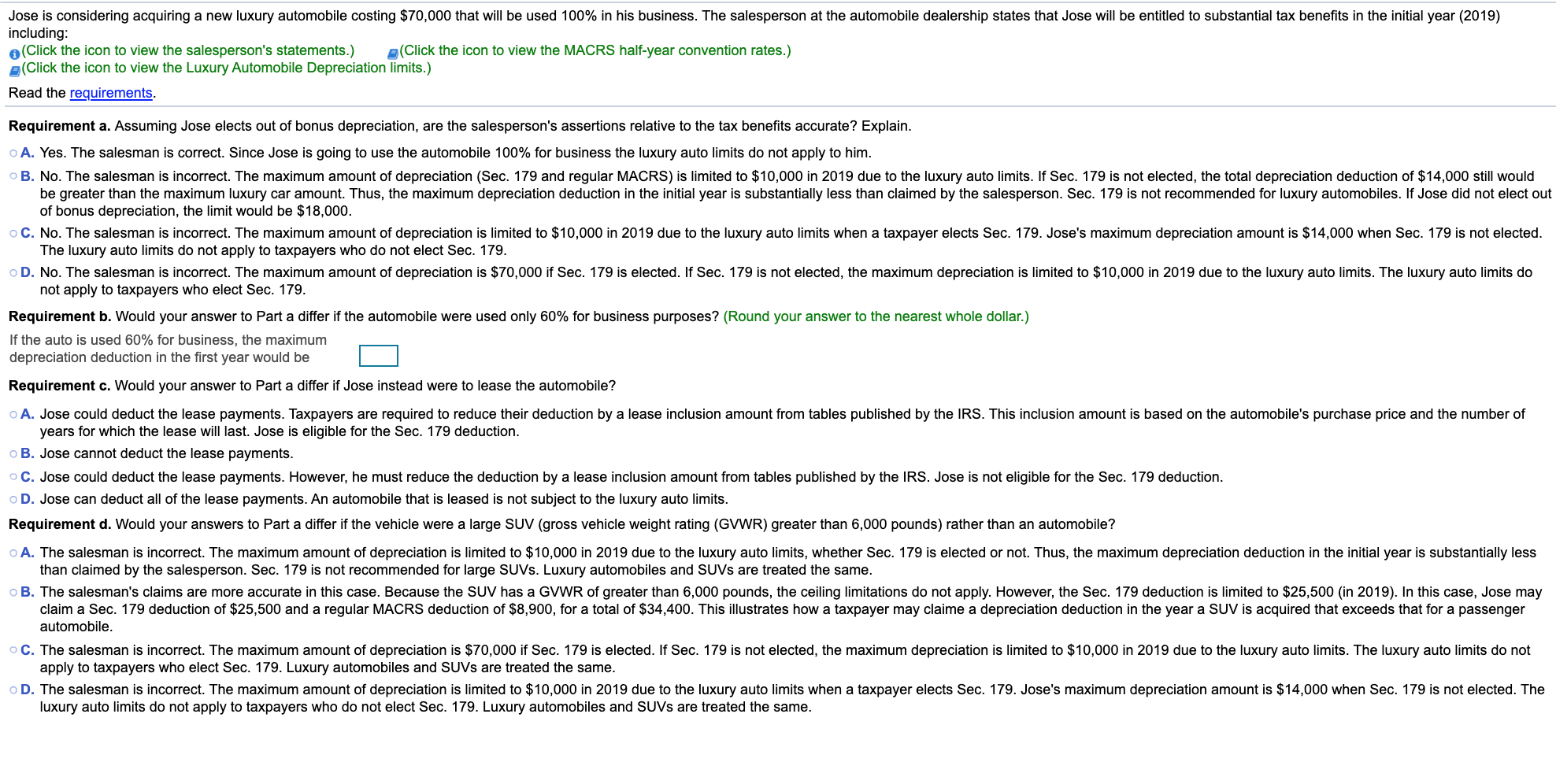

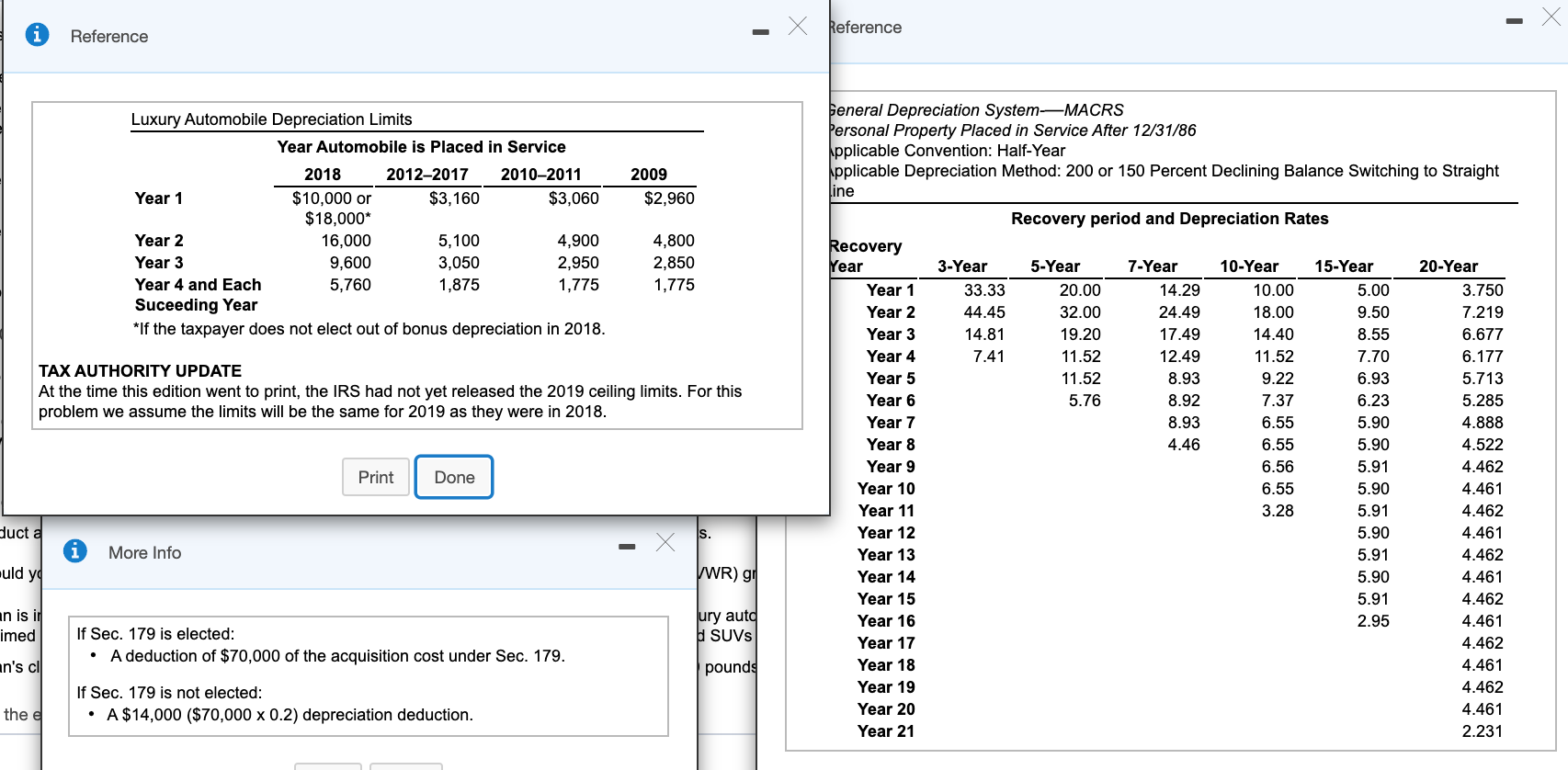

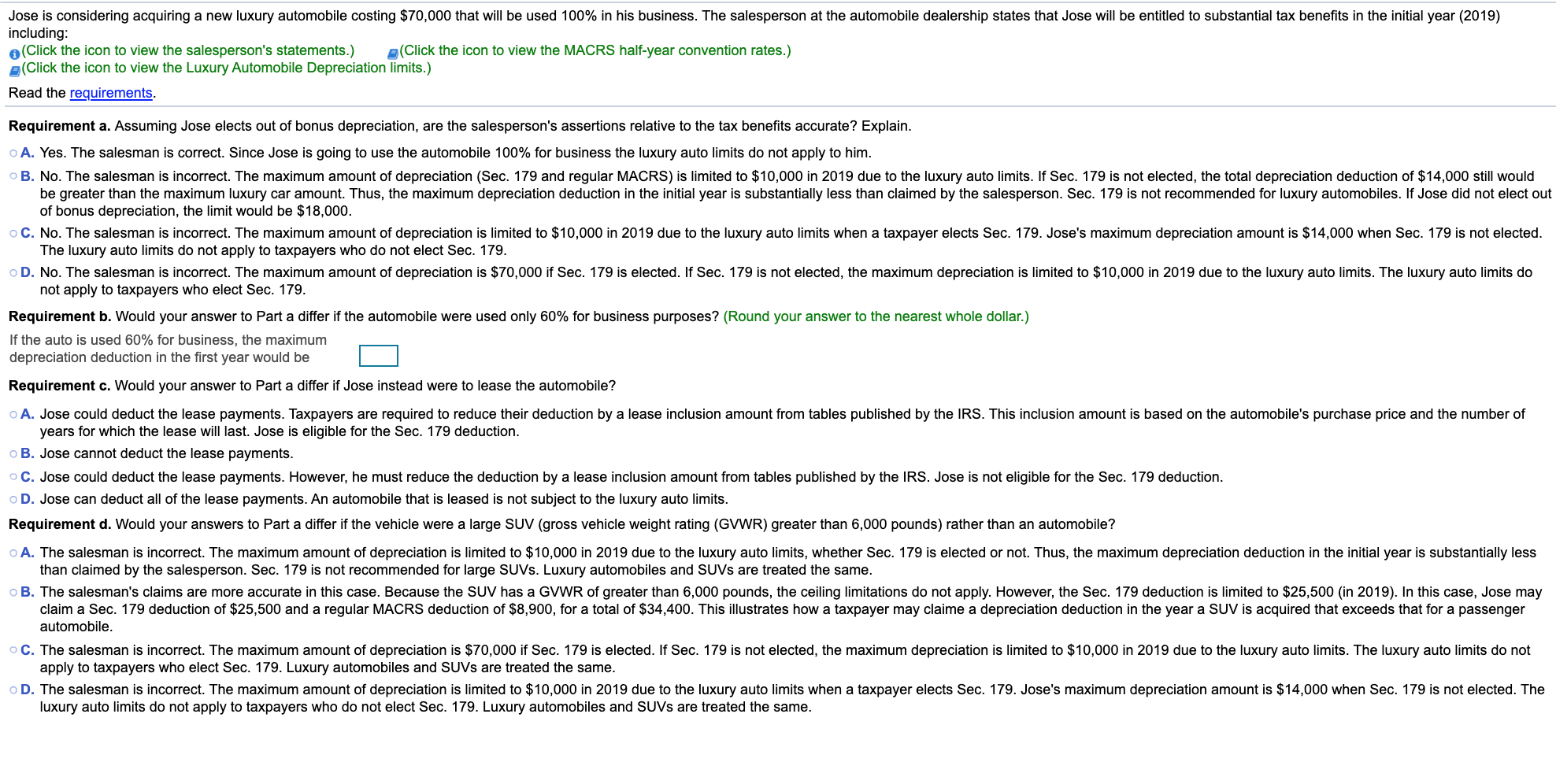

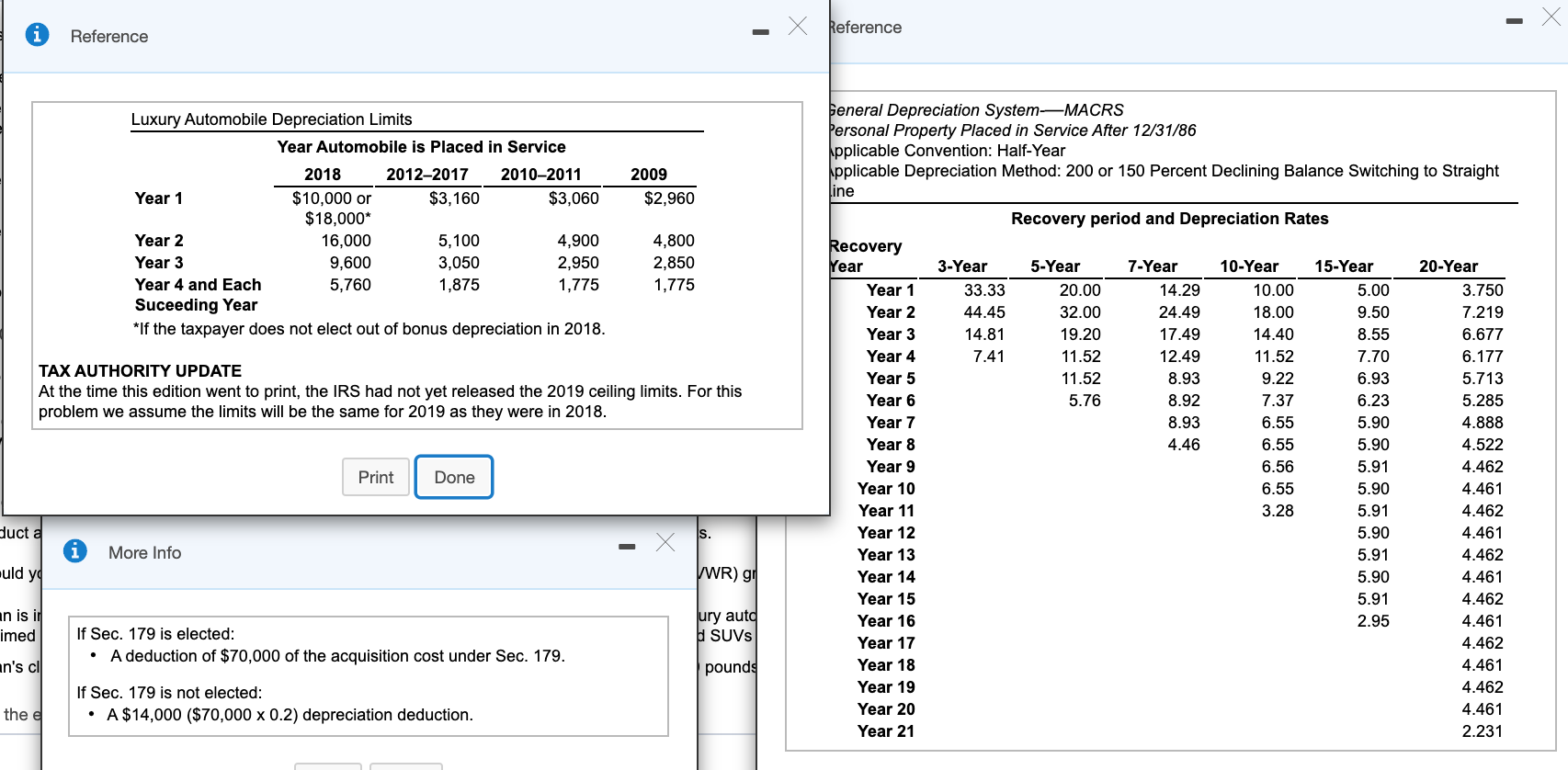

Jose is considering acquiring a new luxury automobile costing $70,000 that will be used 100% in his business. The salesperson at the automobile dealership states that Jose will be entitled to substantial tax benefits in the initial year (2019) including: (Click the icon to view the salesperson's statements.) (Click the icon to view the MACRS half-year convention rates.) 2 (Click the icon to view the Luxury Automobile Depreciation limits.) Read the requirements. Requirement a. Assuming Jose elects out of bonus depreciation, are the salesperson's assertions relative to the tax benefits accurate? Explain. A. Yes. The salesman is correct. Since Jose is going to use the automobile 100% for business the luxury auto limits do not apply to him. B. No. The salesman is incorrect. The maximum amount of depreciation (Sec. 179 and regular MACRS) is limited to $10,000 in 2019 due to the luxury auto limits. If Sec. 179 is not elected, the total depreciation deduction of $14,000 still would be greater than the maximum luxury car amount. Thus, the maximum depreciation deduction in the initial year is substantially less than claimed by the salesperson. Sec. 179 is not recommended for luxury automobiles. If Jose did not elect out of bonus depreciation, the limit would be $18,000. C. No. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits when a taxpayer elects Sec. 179. Jose's maximum depreciation amount is $14,000 when Sec. 179 is not elected. The luxury auto limits do not apply to taxpayers who do not elect Sec. 179. D. No. The salesman is incorrect. The maximum amount of depreciation is $70,000 if Sec. 179 is elected. If Sec. 179 is not elected, the maximum depreciation is limited to $10,000 in 2019 due to the luxury auto limits. The luxury auto limits do not apply to taxpayers who elect Sec. 179. Requirement b. Would your answer to Part a differ if the automobile were used only 60% for business purposes? (Round your answer to the nearest whole dollar.) If the auto is used 60% for business, the maximum depreciation deduction in the first year would be Requirement c. Would your answer to Part a differ if Jose instead were to lease the automobile? A. Jose could deduct the lease payments. Taxpayers are required to reduce their deduction by a lease inclusion amount from tables published by the IRS. This inclusion amount is based on the automobile's purchase price and the number of years for which the lease will last. Jose is eligible for the Sec. 179 deduction. B. Jose cannot deduct the lease payments. C. Jose could deduct the lease payments. However, he must reduce the deduction by a lease inclusion amount from tables published by the IRS. Jose is not eligible for the Sec. 179 deduction. D. Jose can deduct all of the lease payments. An automobile that is leased is not subject to the luxury auto limits. Requirement d. Would your answers to Part a differ if the vehicle were a large SUV (gross vehicle weight rating (GVWR) greater than 6,000 pounds) rather than an automobile? A. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits, whether Sec. 179 is elected or not. Thus, the maximum depreciation deduction in the initial year is substantially less than claimed by the salesperson. Sec. 179 is not recommended for large SUVs. Luxury automobiles and SUVs are treated the same. B. The salesman's claims are more accurate in this case. Because the SUV has a GVWR of greater than 6,000 pounds, the ceiling limitations do not apply. However, the Sec. 179 deduction is limited to $25,500 (in 2019). In this case, Jose may claim a Sec. 179 deduction of $25,500 and a regular MACRS deduction of $8,900, for a total of $34,400. This illustrates how a taxpayer may claime a depreciation deduction in the year a SUV is acquired that exceeds that for a passenger automobile. C. The salesman is incorrect. The maximum amount of depreciation is $70,000 if Sec. 179 is elected. If Sec. 179 is not elected, the maximum depreciation is limited to $10,000 in 2019 due to the luxury auto limits. The luxury auto limits do not apply to taxpayers who elect Sec. 179. Luxury automobiles and SUVs are treated the same. D. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits when a taxpayer elects Sec. 179. Jose's maximum depreciation amount is $14,000 when Sec. 179 is not elected. The luxury auto limits do not apply to taxpayers who do not elect Sec. 179. Luxury automobiles and SUVs are treated the same. X Reference Reference General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight 2009 $2,960 line Luxury Automobile Depreciation Limits Year Automobile is placed in Service 2018 2012-2017 2010-2011 Year 1 $10,000 or $3,160 $3,060 $18,000* Year 2 16,000 5,100 4,900 Year 3 9,600 3,050 2,950 Year 4 and Each 5,760 1,875 1,775 Suceeding Year *If the taxpayer does not elect out of bonus depreciation in 2018. Recovery period and Depreciation Rates 4,800 2,850 1,775 3-Year 33.33 44.45 14.81 7.41 5-Year 20.00 32.00 19.20 11.52 11.52 5.76 7-Year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 TAX AUTHORITY UPDATE At the time this edition went to print, the IRS had not yet released the 2019 ceiling limits. For this problem we assume the limits will be the same for 2019 as they were in 2018. 10-Year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 15-Year 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 Print Done 20-Year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 ducto s. More Info uld yo VWR) an is in Jury autd imed I SUVs If Sec. 179 is elected: A deduction of $70,000 of the acquisition cost under Sec. 179. . an's cl pounds If Sec. 179 is not elected: A $14,000 ($70,000 x 0.2) depreciation deduction. the e Jose is considering acquiring a new luxury automobile costing $70,000 that will be used 100% in his business. The salesperson at the automobile dealership states that Jose will be entitled to substantial tax benefits in the initial year (2019) including: (Click the icon to view the salesperson's statements.) (Click the icon to view the MACRS half-year convention rates.) 2 (Click the icon to view the Luxury Automobile Depreciation limits.) Read the requirements. Requirement a. Assuming Jose elects out of bonus depreciation, are the salesperson's assertions relative to the tax benefits accurate? Explain. A. Yes. The salesman is correct. Since Jose is going to use the automobile 100% for business the luxury auto limits do not apply to him. B. No. The salesman is incorrect. The maximum amount of depreciation (Sec. 179 and regular MACRS) is limited to $10,000 in 2019 due to the luxury auto limits. If Sec. 179 is not elected, the total depreciation deduction of $14,000 still would be greater than the maximum luxury car amount. Thus, the maximum depreciation deduction in the initial year is substantially less than claimed by the salesperson. Sec. 179 is not recommended for luxury automobiles. If Jose did not elect out of bonus depreciation, the limit would be $18,000. C. No. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits when a taxpayer elects Sec. 179. Jose's maximum depreciation amount is $14,000 when Sec. 179 is not elected. The luxury auto limits do not apply to taxpayers who do not elect Sec. 179. D. No. The salesman is incorrect. The maximum amount of depreciation is $70,000 if Sec. 179 is elected. If Sec. 179 is not elected, the maximum depreciation is limited to $10,000 in 2019 due to the luxury auto limits. The luxury auto limits do not apply to taxpayers who elect Sec. 179. Requirement b. Would your answer to Part a differ if the automobile were used only 60% for business purposes? (Round your answer to the nearest whole dollar.) If the auto is used 60% for business, the maximum depreciation deduction in the first year would be Requirement c. Would your answer to Part a differ if Jose instead were to lease the automobile? A. Jose could deduct the lease payments. Taxpayers are required to reduce their deduction by a lease inclusion amount from tables published by the IRS. This inclusion amount is based on the automobile's purchase price and the number of years for which the lease will last. Jose is eligible for the Sec. 179 deduction. B. Jose cannot deduct the lease payments. C. Jose could deduct the lease payments. However, he must reduce the deduction by a lease inclusion amount from tables published by the IRS. Jose is not eligible for the Sec. 179 deduction. D. Jose can deduct all of the lease payments. An automobile that is leased is not subject to the luxury auto limits. Requirement d. Would your answers to Part a differ if the vehicle were a large SUV (gross vehicle weight rating (GVWR) greater than 6,000 pounds) rather than an automobile? A. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits, whether Sec. 179 is elected or not. Thus, the maximum depreciation deduction in the initial year is substantially less than claimed by the salesperson. Sec. 179 is not recommended for large SUVs. Luxury automobiles and SUVs are treated the same. B. The salesman's claims are more accurate in this case. Because the SUV has a GVWR of greater than 6,000 pounds, the ceiling limitations do not apply. However, the Sec. 179 deduction is limited to $25,500 (in 2019). In this case, Jose may claim a Sec. 179 deduction of $25,500 and a regular MACRS deduction of $8,900, for a total of $34,400. This illustrates how a taxpayer may claime a depreciation deduction in the year a SUV is acquired that exceeds that for a passenger automobile. C. The salesman is incorrect. The maximum amount of depreciation is $70,000 if Sec. 179 is elected. If Sec. 179 is not elected, the maximum depreciation is limited to $10,000 in 2019 due to the luxury auto limits. The luxury auto limits do not apply to taxpayers who elect Sec. 179. Luxury automobiles and SUVs are treated the same. D. The salesman is incorrect. The maximum amount of depreciation is limited to $10,000 in 2019 due to the luxury auto limits when a taxpayer elects Sec. 179. Jose's maximum depreciation amount is $14,000 when Sec. 179 is not elected. The luxury auto limits do not apply to taxpayers who do not elect Sec. 179. Luxury automobiles and SUVs are treated the same. X Reference Reference General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight 2009 $2,960 line Luxury Automobile Depreciation Limits Year Automobile is placed in Service 2018 2012-2017 2010-2011 Year 1 $10,000 or $3,160 $3,060 $18,000* Year 2 16,000 5,100 4,900 Year 3 9,600 3,050 2,950 Year 4 and Each 5,760 1,875 1,775 Suceeding Year *If the taxpayer does not elect out of bonus depreciation in 2018. Recovery period and Depreciation Rates 4,800 2,850 1,775 3-Year 33.33 44.45 14.81 7.41 5-Year 20.00 32.00 19.20 11.52 11.52 5.76 7-Year 14.29 24.49 17.49 12.49 8.93 8.92 8.93 4.46 TAX AUTHORITY UPDATE At the time this edition went to print, the IRS had not yet released the 2019 ceiling limits. For this problem we assume the limits will be the same for 2019 as they were in 2018. 10-Year 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 3.28 Recovery Year Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 11 Year 12 Year 13 Year 14 Year 15 Year 16 Year 17 Year 18 Year 19 Year 20 Year 21 15-Year 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 Print Done 20-Year 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 ducto s. More Info uld yo VWR) an is in Jury autd imed I SUVs If Sec. 179 is elected: A deduction of $70,000 of the acquisition cost under Sec. 179. . an's cl pounds If Sec. 179 is not elected: A $14,000 ($70,000 x 0.2) depreciation deduction. the e