Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joseph Berio is a loan ofticer with the First Bank of Tennessee. Red Brick, Inc., a major produces building material through applied for a short

Joseph Berio is a loan ofticer with the First Bank of Tennessee. Red Brick, Inc., a major produces building material through applied for a shortterm loan. Red Brick suppted in Tennessee, Alabama, Georgia, southern states, with brick plants

Mr Berio knows that brick production ia and Indiana. of energy and the state of the building industry. Fi thected by two factors: the cost a significant amount of energy. Red Brick, Inc. has recently cucturing bricks uses fired kilns to coal kilns, which are cheaper to operate. To finverted many oilsions, the company has recently issued a substantial To finance these converthat must be retired over the next years.

Second, brick sales are very sensitive to activity in the building industry, especially new housing starts. The industry frequently follows a pattern of boom and bust, with sales and earnings responding to changes in the demand for building products.

Currently the economy is experiencing a severe recession, and housing starts have fallen more than percent from the previous year. While the south and southwest have not experienced such a severe decline, housing starts there have declined percent.

Red Brick, Inc. has not been immune to the economic environment. Sales have declined, and although the firm has reduced production, inventory has increased. The firm needs the shortterm loan to finance its inventory. Mr Berio must decide whether to grant or deny the loan. Such loans have been made to Red Brick in the past and have always been repaid when the economic picture improved.

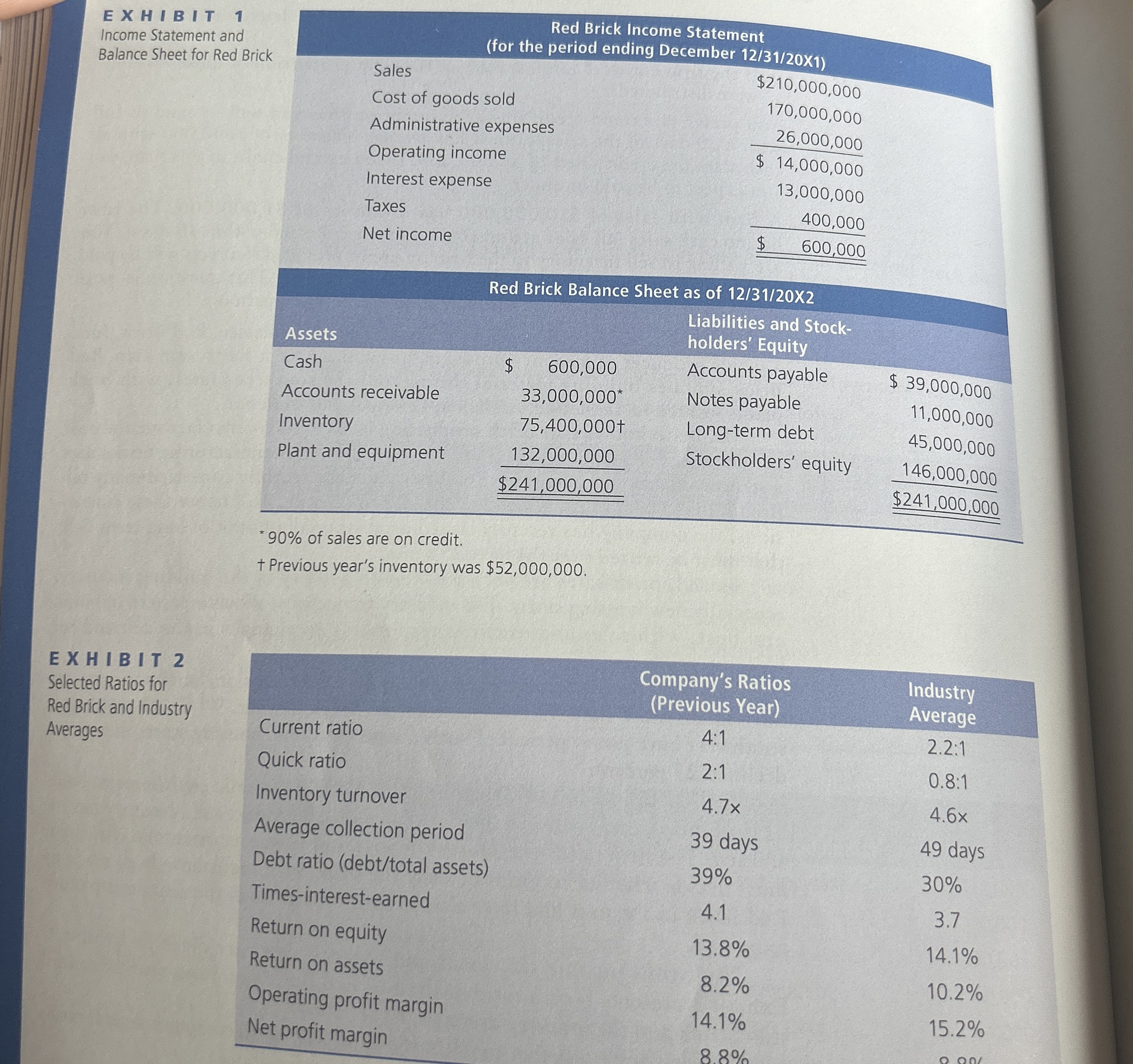

The firm's income statement and balance sheet are given in Exhibit Exhibit presents both a ratio analysis of Red Brick's previous year's financial statements and the industry averages of the ratios.

To help decide whether to grant the loan, Mr Berio computes several ratios and compares the results with the ratios given in Exhibit

a What strengths and weaknesses are indicated by this analysis?

b What may explain why the debt ratio exceeds the industry average? Is that necessarily a weakness in this case?

c As a banker, is Mr Berio more concerned with the firm's liquidity or its re

d Based on the above analysis, should Mr Berio grant the loan? Justify your turn on equity? position.XHIBIT Income Statement and Balance Sheet for Red Brick

tabletableSalesCost of goods soldAdministrative expensesOperating incomeInterest expenseTaxesNet income$$ $Red Brick Balance Sheet as of XAssetstableLiabilities and Stockholders EquityAccounts payabletableCashAccounts receivableInventoryPlant and equipmentAccounts payable,$ Notes payable,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started