Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Joseph has several types of capital property, including an interest in a general partnership, shares in a private corporation, a rental property and some mutual

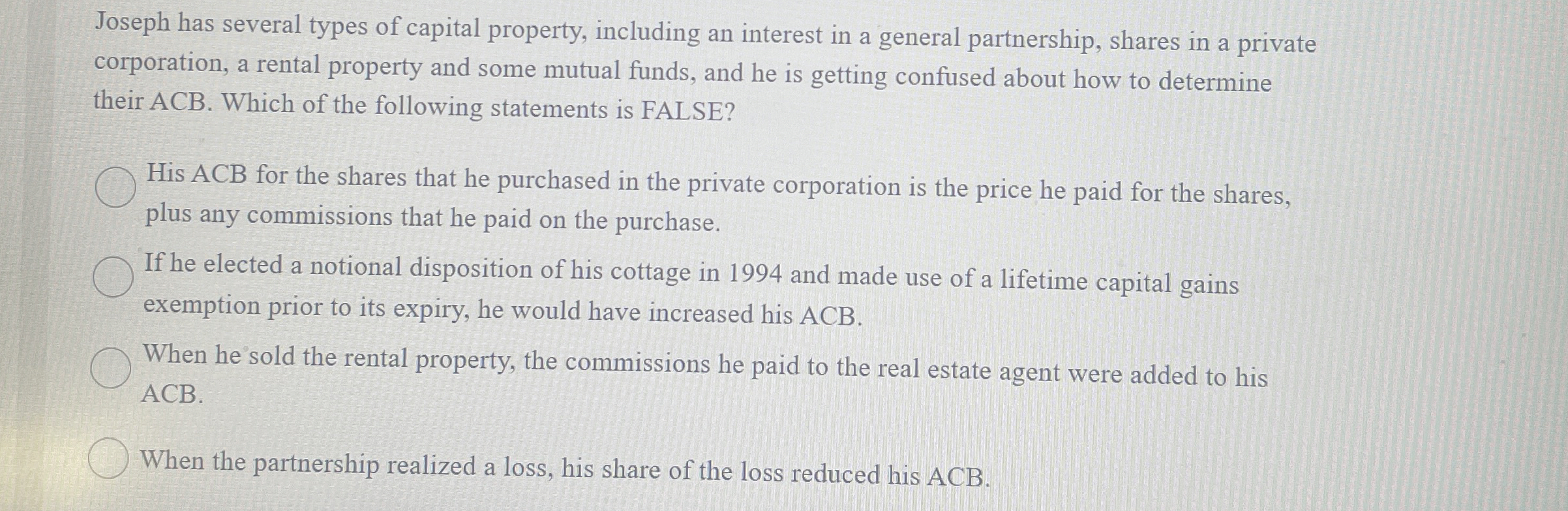

Joseph has several types of capital property, including an interest in a general partnership, shares in a private corporation, a rental property and some mutual funds, and he is getting confused about how to determine their ACB. Which of the following statements is FALSE?

His ACB for the shares that he purchased in the private corporation is the price he paid for the shares, plus any commissions that he paid on the purchase.

If he elected a notional disposition of his cottage in and made use of a lifetime capital gains exemption prior to its expiry, he would have increased his ACB

When he sold the rental property, the commissions he paid to the real estate agent were added to his ACB

When the partnership realized a loss, his share of the loss reduced his ACB.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started