Answered step by step

Verified Expert Solution

Question

1 Approved Answer

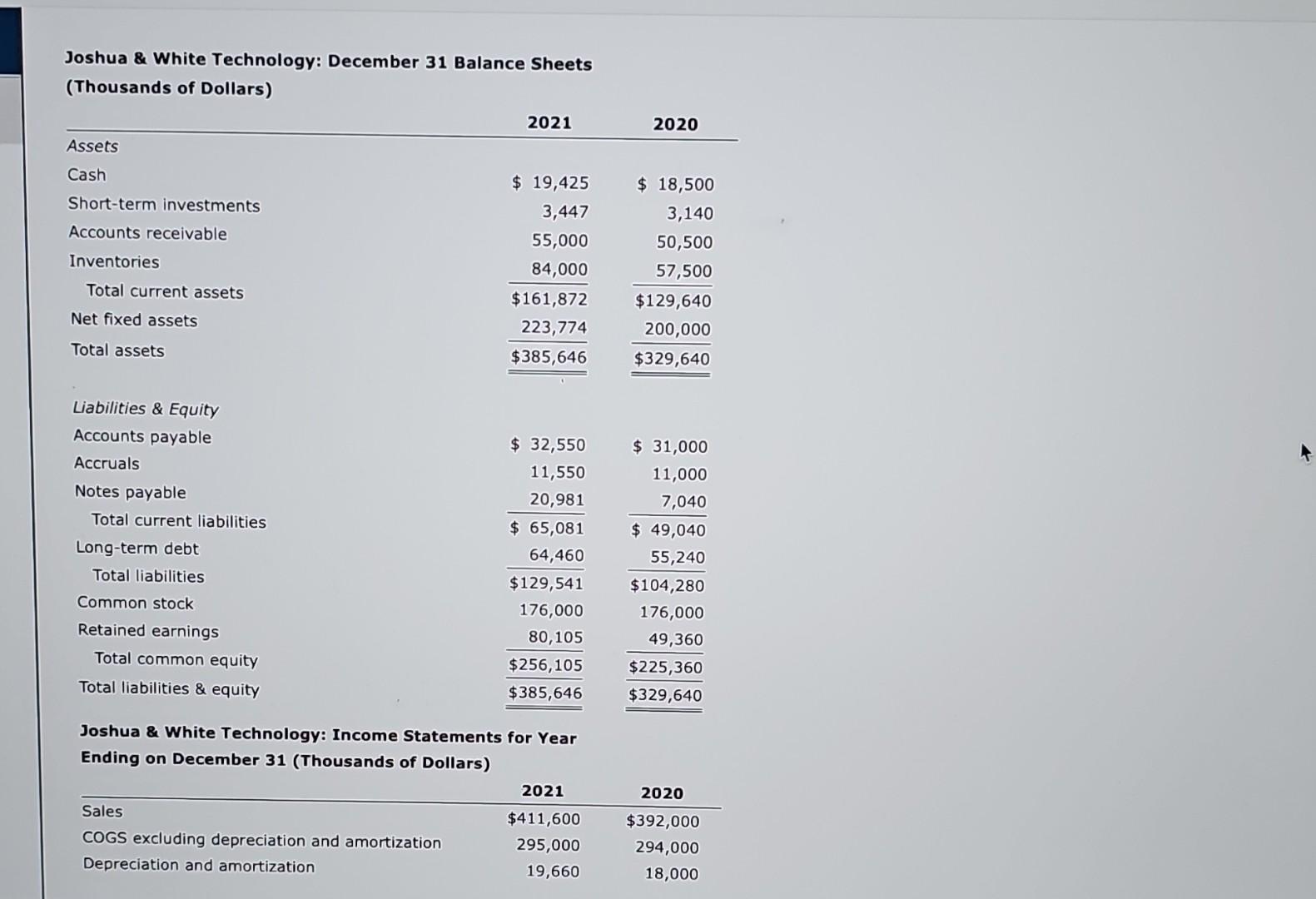

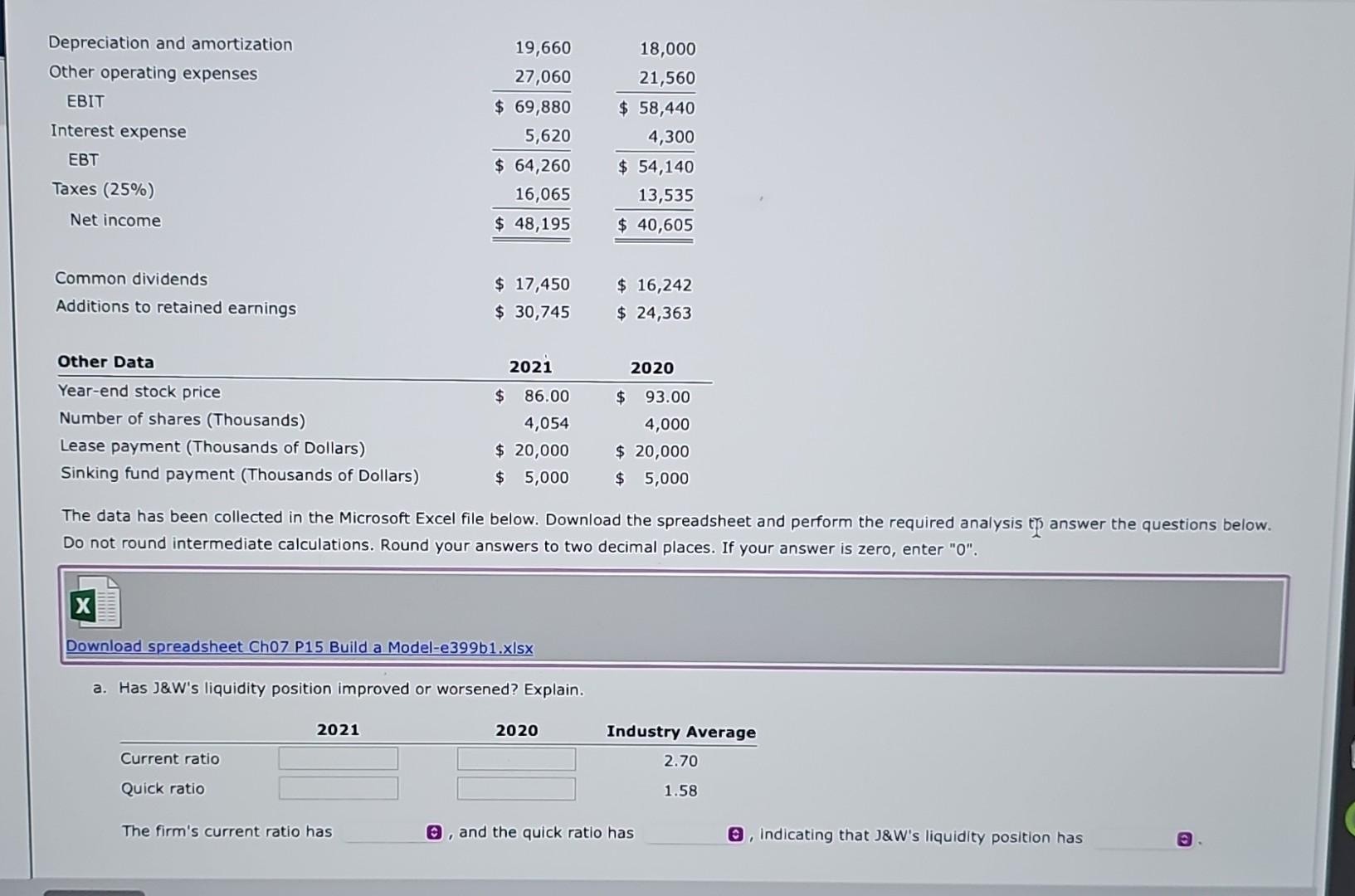

Joshua & White Technology: December 31 Balance Sheets (Thousande of nollare) Joshua & White Technology: Income Statements for Year Ending on December 31 (Thousands of

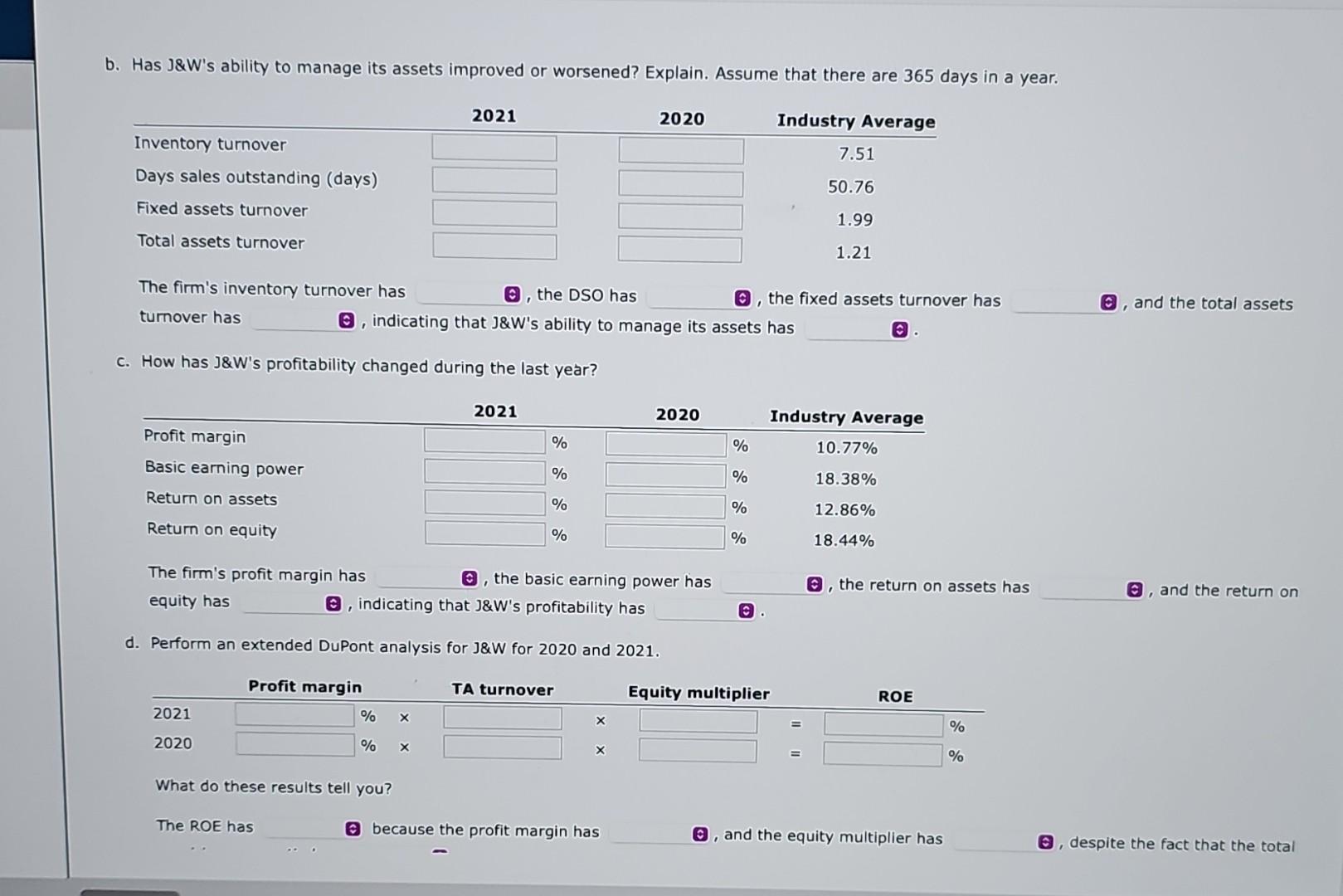

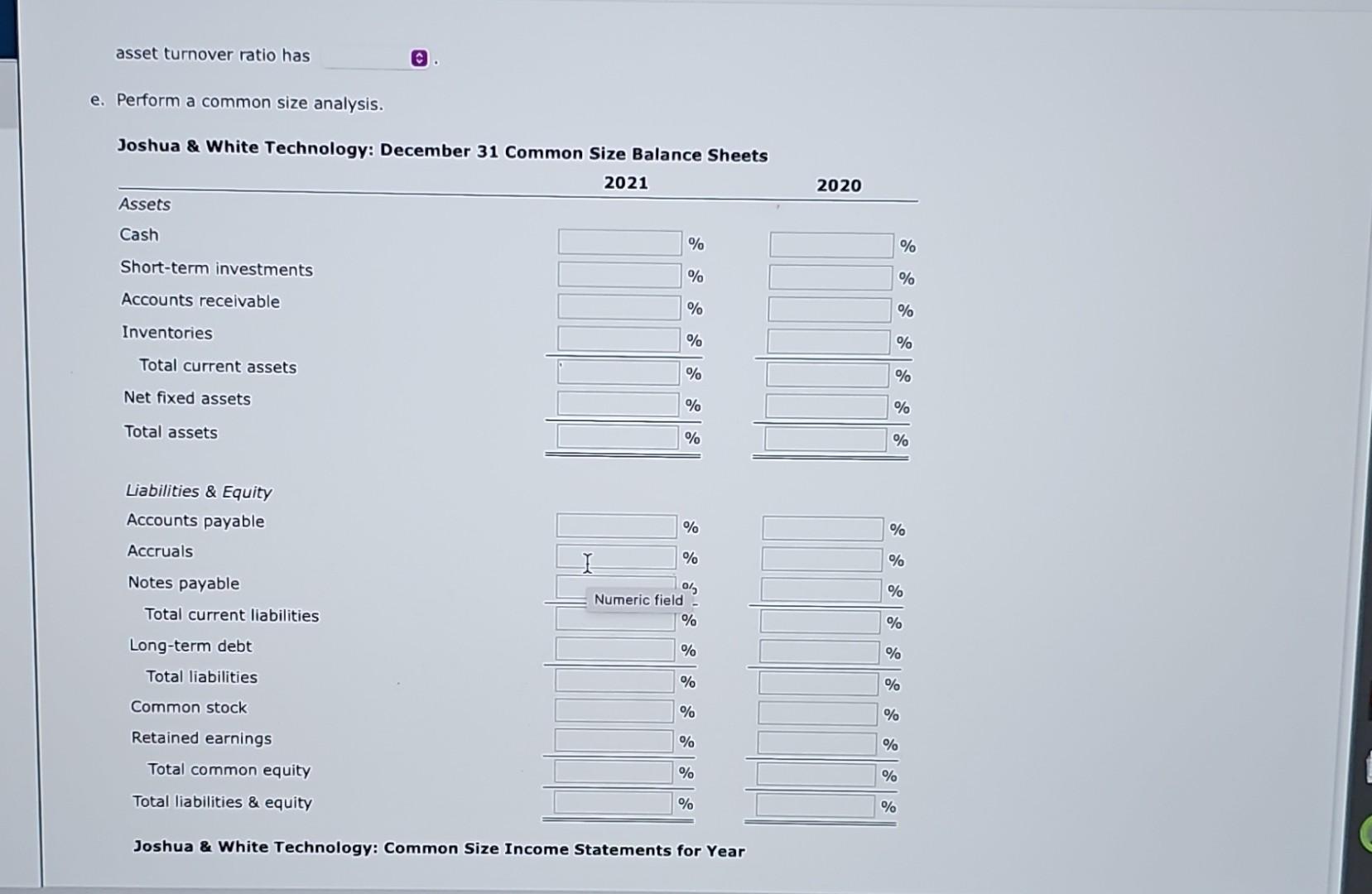

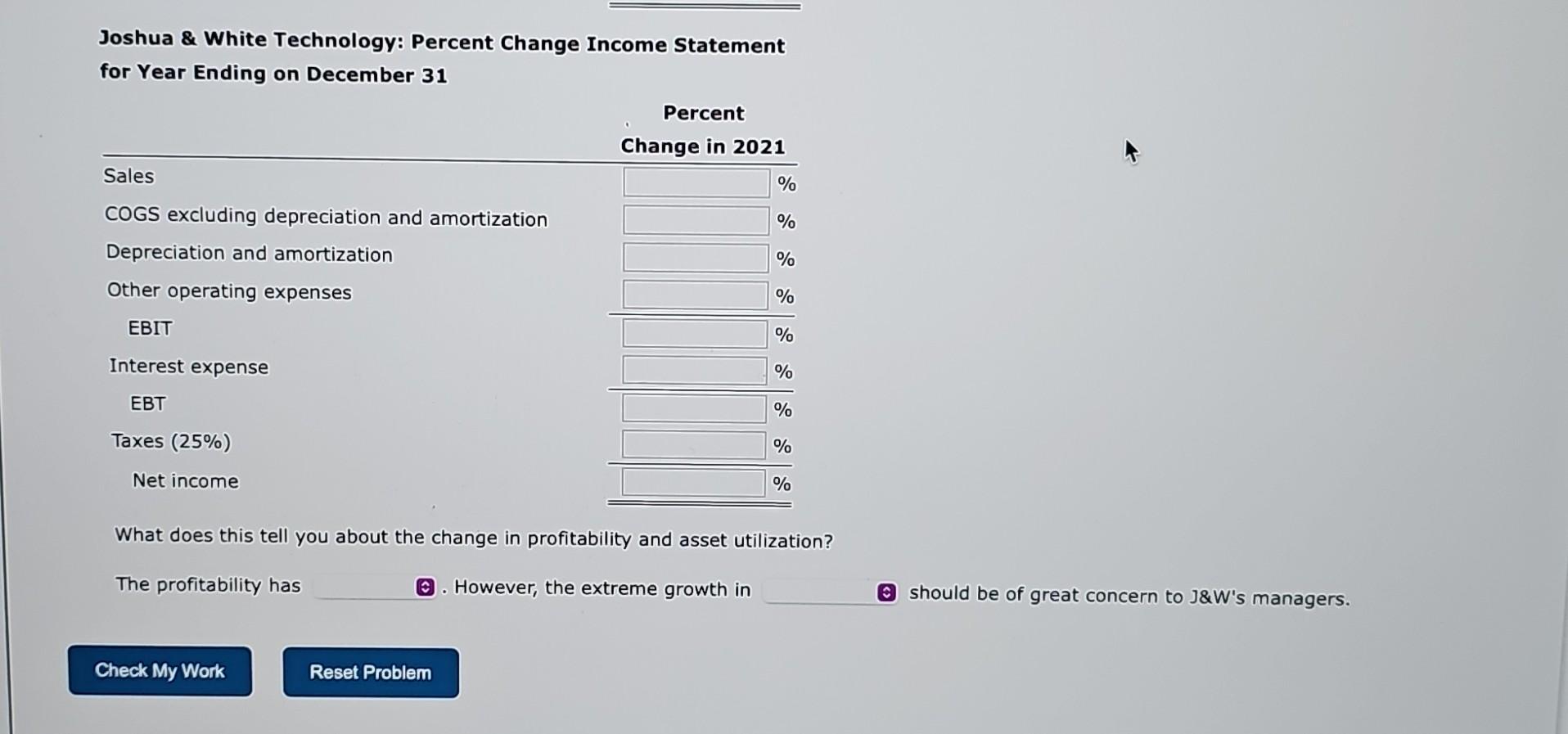

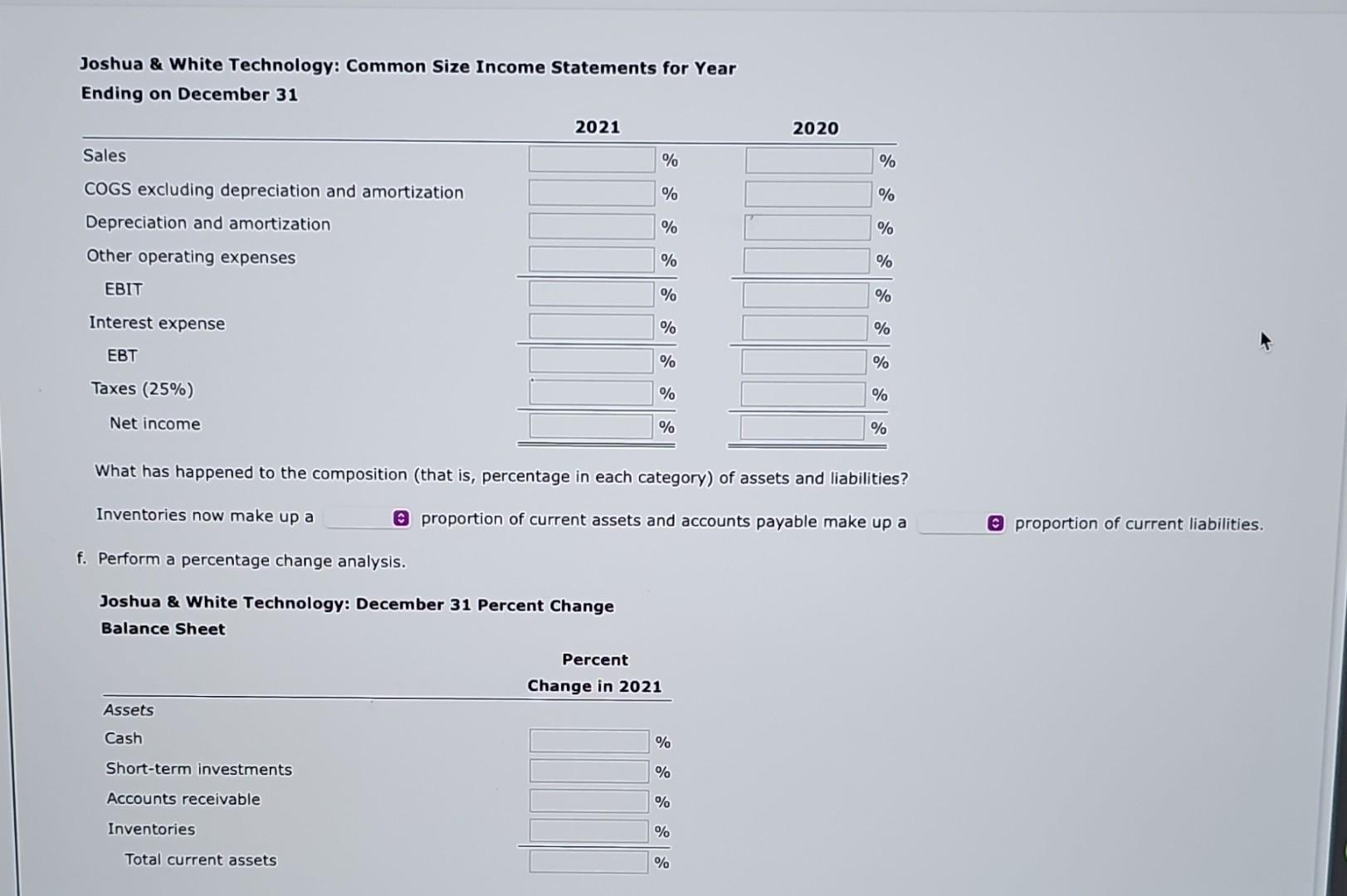

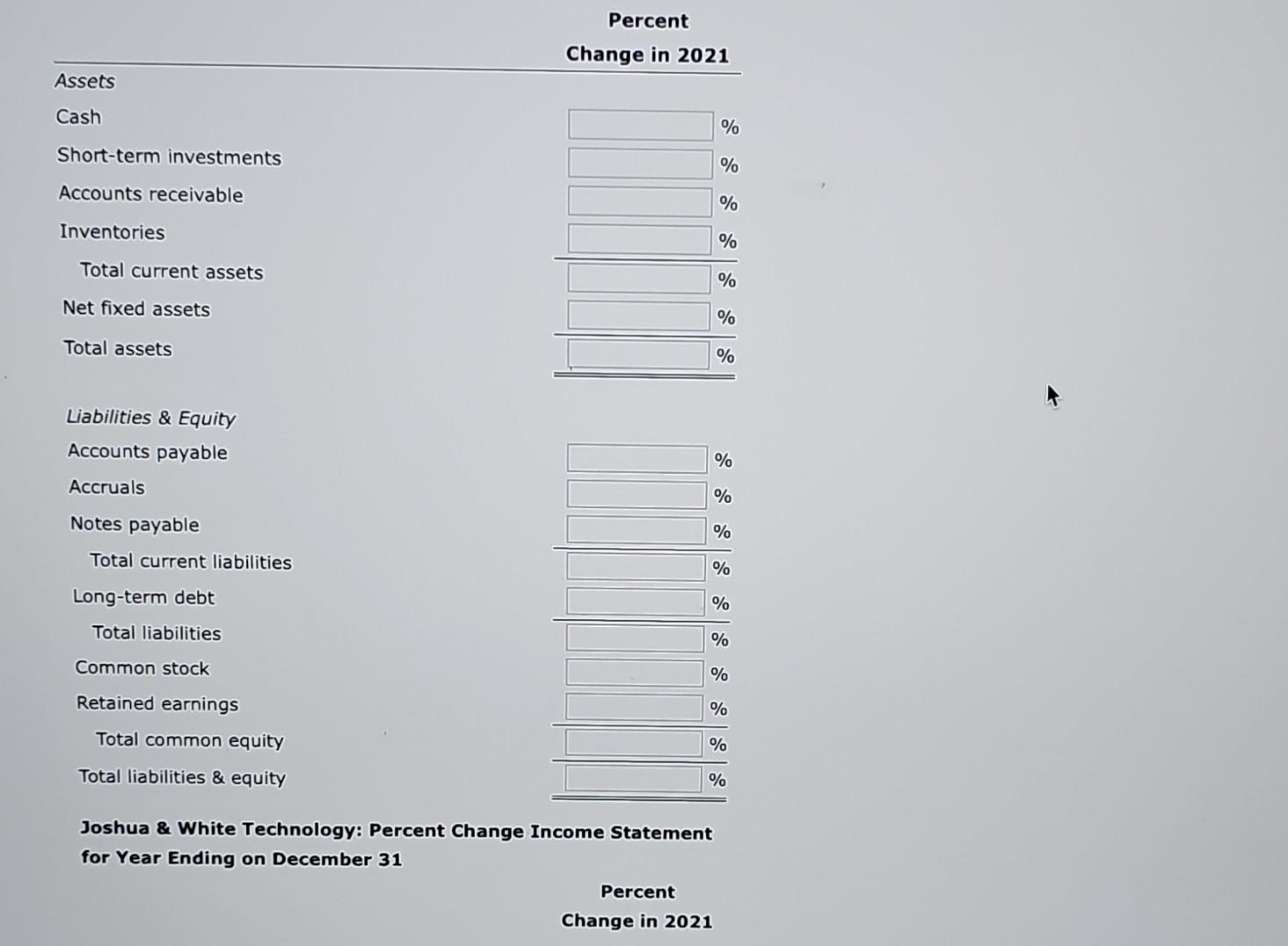

Joshua \& White Technology: December 31 Balance Sheets (Thousande of nollare) Joshua \& White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis tr, answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places. If your answer is zero, enter "0". Download spreadsheet Ch07 P15 Build a Model-e399b1.xlsx a. Has J\&W's liquidity position improved or worsened? Explain. b. Has J\&W's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has , the DSO has , the fixed assets turnover has , and the total assets turnover has , indicating that J\&W's ability to manage its assets has c. How has J\&W's profitability changed during the last year? The firm's profit margin has , the basic earning power has , the return on assets has , and the return on equity has , indicating that J\&W's profitability has d. Perform an extended DuPont analysis for J\&W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has asset turnover ratio has e. Perform a common size analysis. Inshua \& Wh Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 What does this tell you about the change in profitability and asset utilization? The profitability has However, the extreme growth in should be of great concern to J\&W's managers. Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? Inventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. f. Perform a percentage change analysis. Joshua \& White Technology: December 31 Percent Change Balance Sheet Percent Change in 2021 Assets Cash % Short-term investments % Accounts receivable % Inventories Total current assets Net fixed assets Total assets Liabilities \& Equity Accounts payable % Accruals % Notes payable Total current liabilities % Long-term debt Total liabilities Common stock % Retained earnings Total common equity Total liabilities \& equity Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 Percent Change in 2021 Joshua \& White Technology: December 31 Balance Sheets (Thousande of nollare) Joshua \& White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis tr, answer the questions below. Do not round intermediate calculations. Round your answers to two decimal places. If your answer is zero, enter "0". Download spreadsheet Ch07 P15 Build a Model-e399b1.xlsx a. Has J\&W's liquidity position improved or worsened? Explain. b. Has J\&W's ability to manage its assets improved or worsened? Explain. Assume that there are 365 days in a year. The firm's inventory turnover has , the DSO has , the fixed assets turnover has , and the total assets turnover has , indicating that J\&W's ability to manage its assets has c. How has J\&W's profitability changed during the last year? The firm's profit margin has , the basic earning power has , the return on assets has , and the return on equity has , indicating that J\&W's profitability has d. Perform an extended DuPont analysis for J\&W for 2020 and 2021. What do these results tell you? The ROE has because the profit margin has , and the equity multiplier has asset turnover ratio has e. Perform a common size analysis. Inshua \& Wh Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 What does this tell you about the change in profitability and asset utilization? The profitability has However, the extreme growth in should be of great concern to J\&W's managers. Joshua \& White Technology: Common Size Income Statements for Year Ending on December 31 What has happened to the composition (that is, percentage in each category) of assets and liabilities? Inventories now make up a proportion of current assets and accounts payable make up a proportion of current liabilities. f. Perform a percentage change analysis. Joshua \& White Technology: December 31 Percent Change Balance Sheet Percent Change in 2021 Assets Cash % Short-term investments % Accounts receivable % Inventories Total current assets Net fixed assets Total assets Liabilities \& Equity Accounts payable % Accruals % Notes payable Total current liabilities % Long-term debt Total liabilities Common stock % Retained earnings Total common equity Total liabilities \& equity Joshua \& White Technology: Percent Change Income Statement for Year Ending on December 31 Percent Change in 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started