Answered step by step

Verified Expert Solution

Question

1 Approved Answer

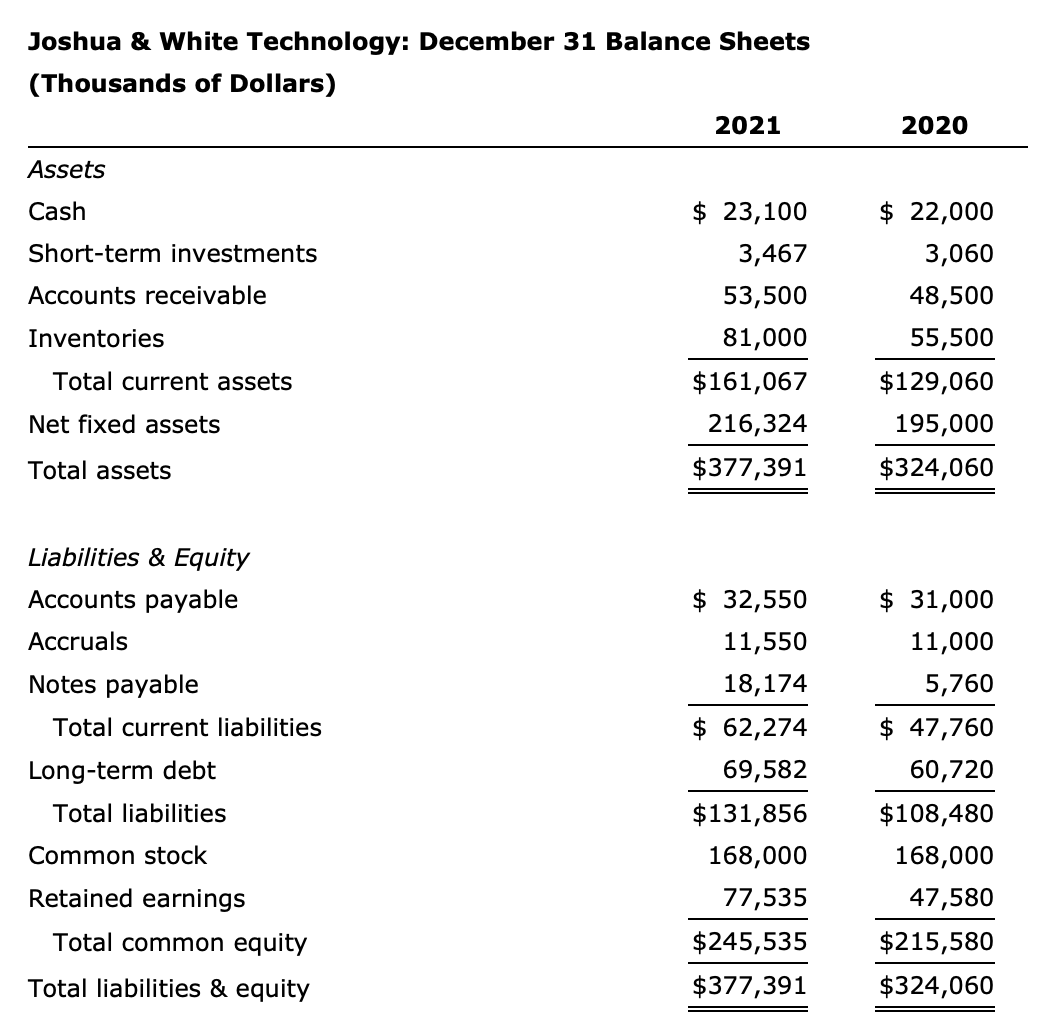

Joshua & White Technology: December 31 Balance Sheets (Thousands of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets

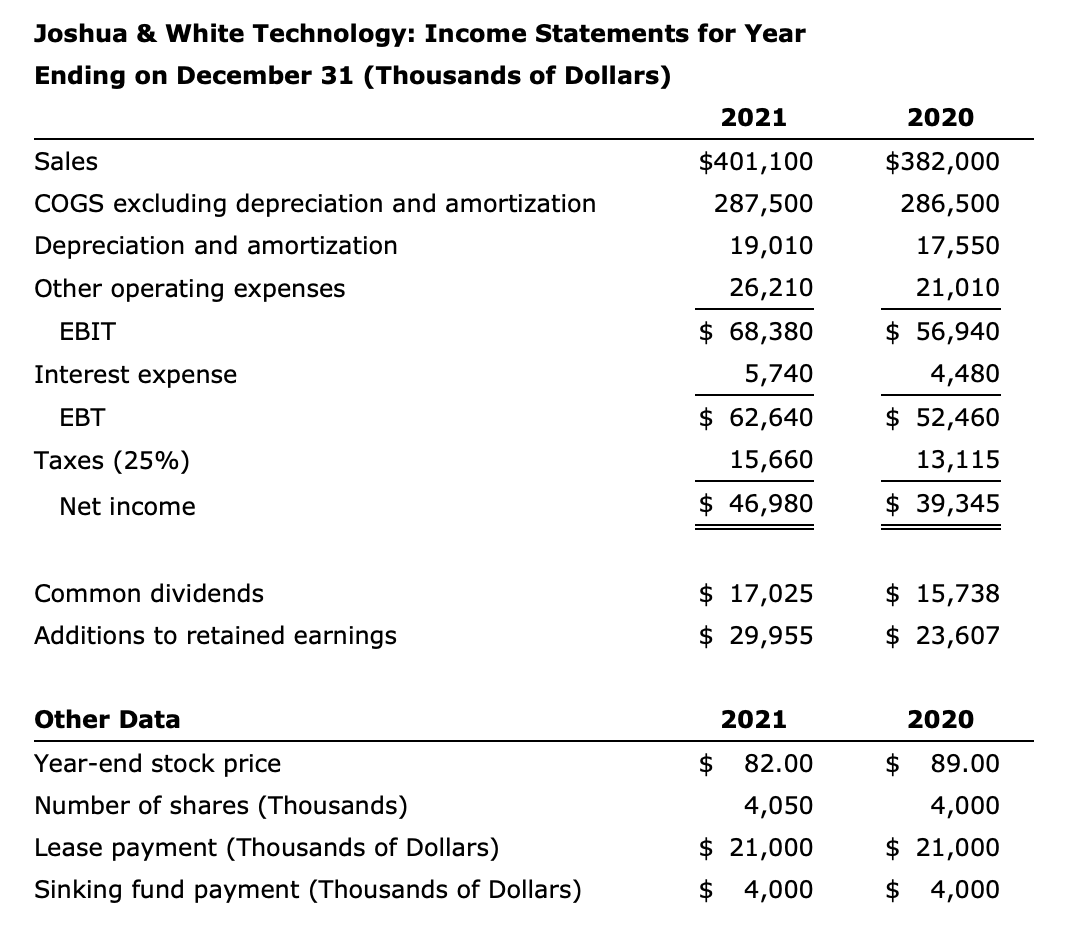

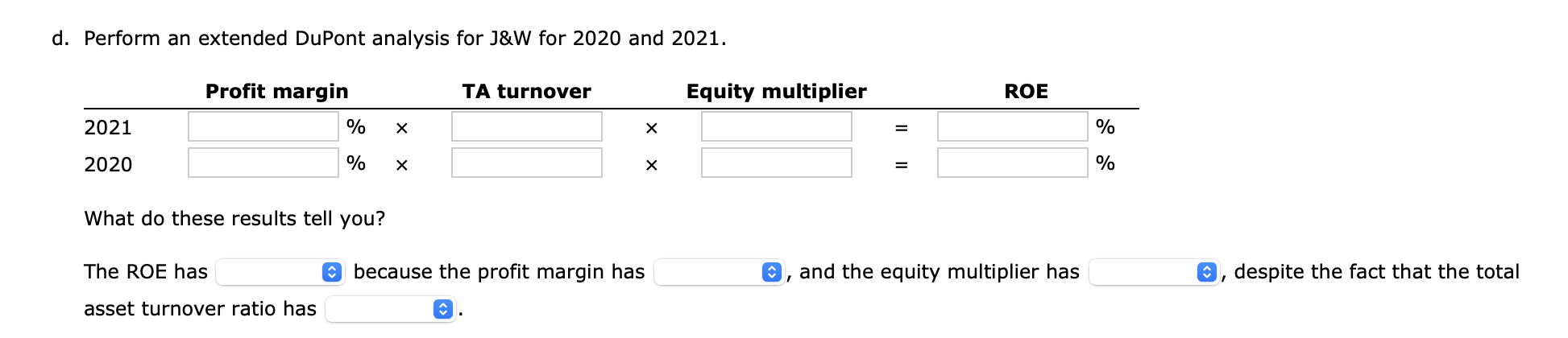

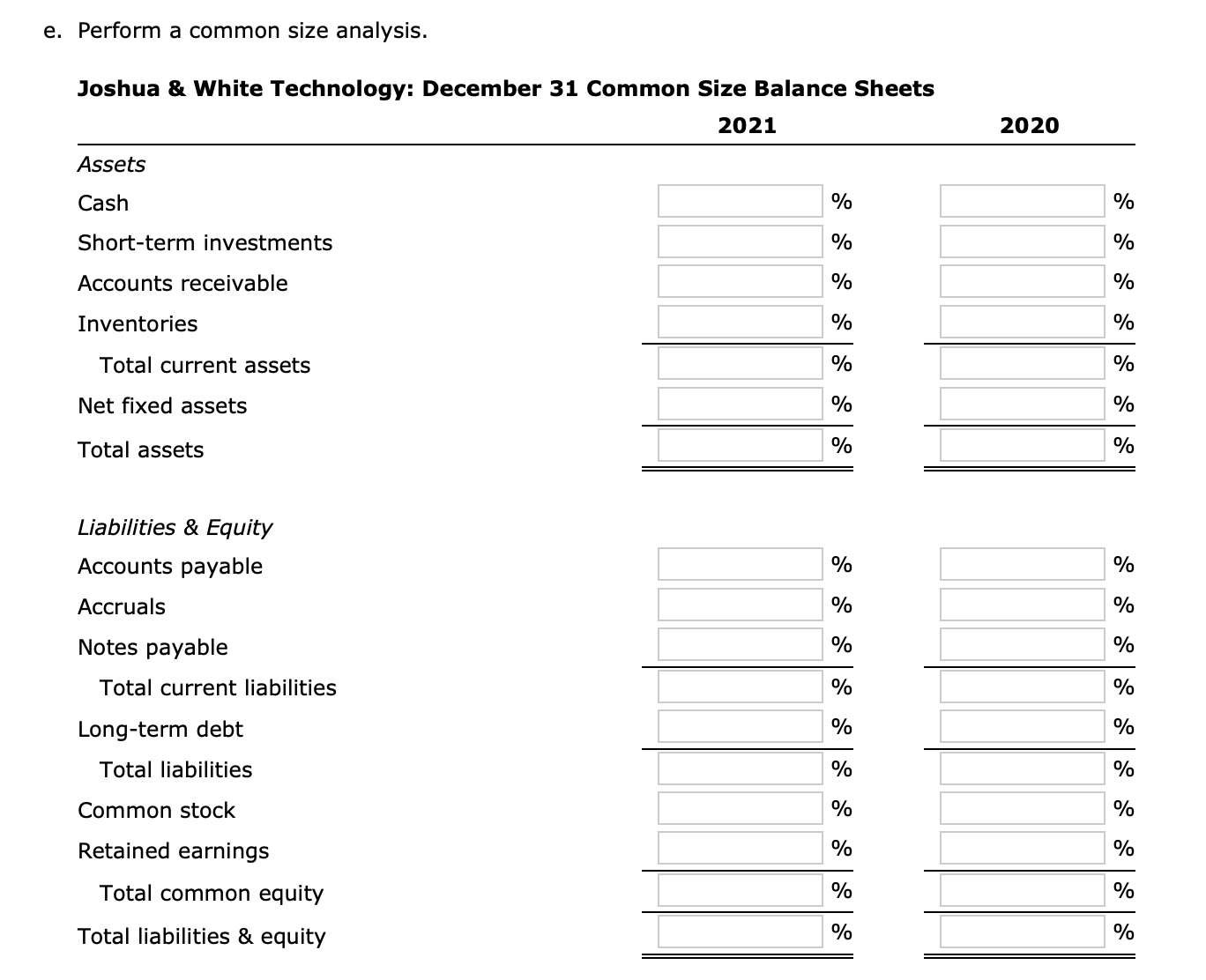

Joshua & White Technology: December 31 Balance Sheets (Thousands of Dollars) Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities & equity 2021 $ 23,100 3,467 53,500 81,000 $161,067 216,324 $377,391 $ 32,550 11,550 18,174 $ 62,274 69,582 $131,856 168,000 77,535 $245,535 $377,391 2020 $ 22,000 3,060 48,500 55,500 $129,060 195,000 $324,060 $ 31,000 11,000 5,760 $ 47,760 60,720 $108,480 168,000 47,580 $215,580 $324,060 Joshua & White Technology: Income Statements for Year Ending on December 31 (Thousands of Dollars) Sales COGS excluding depreciation and amortization Depreciation and amortization Other operating expenses EBIT Interest expense EBT Taxes (25%) Net income Common dividends Additions to retained earnings Other Data Year-end stock price Number of shares (Thousands) Lease payment (Thousands of Dollars) Sinking fund payment (Thousands of Dollars) 2021 $401,100 287,500 19,010 26,210 $ 68,380 5,740 $ 62,640 15,660 $ 46,980 $ 17,025 $ 29,955 2021 $ 82.00 4,050 $ 21,000 $ 4,000 2020 $382,000 286,500 17,550 21,010 $ 56,940 4,480 $ 52,460 13,115 $ 39,345 $ 15,738 $ 23,607 2020 $89.00 4,000 $ 21,000 $ 4,000 d. Perform an extended DuPont analysis for J&W for 2020 and 2021. Profit margin 2021 2020 % % What do these results tell you? The ROE has asset turnover ratio has X X TA turnover X X because the profit margin has Equity multiplier = = ROE and the equity multiplier has 7 % % , despite the fact that the total e. Perform a common size analysis. Joshua & White Technology: December 31 Common Size Balance Sheets 2021 Assets Cash Short-term investments Accounts receivable Inventories Total current assets Net fixed assets Total assets Liabilities & Equity Accounts payable Accruals Notes payable Total current liabilities Long-term debt Total liabilities Common stock Retained earnings Total common equity Total liabilities & equity % % % % % % % do do do do d d d d 88 % % % % % % % % % % 2020 % % % % % % % do do do d do d do do S % % % % % % % % % %

Step by Step Solution

★★★★★

3.34 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer Ratio Ratio Formula 2013 2012 Industry LIQUIDITY RATIO Current Ratio Current Assets Current Liabilities 16125966129 243 12724050480 252 258 Quick Ratio Current Assets Inventory Current Liabilit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started