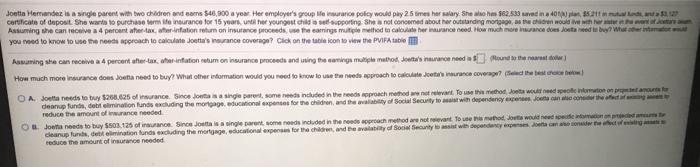

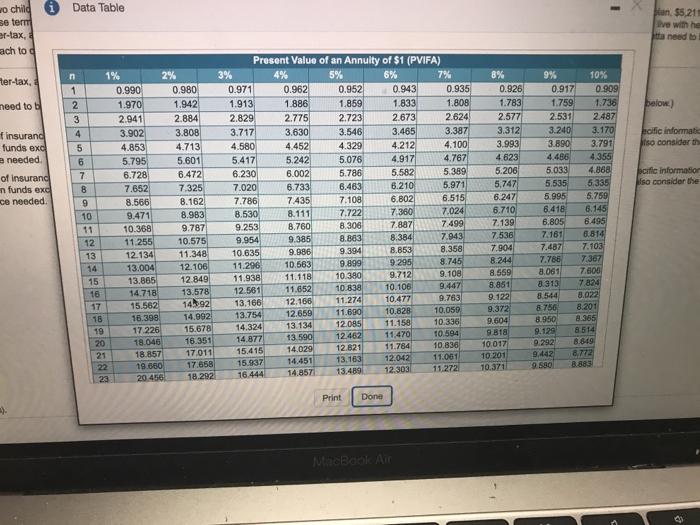

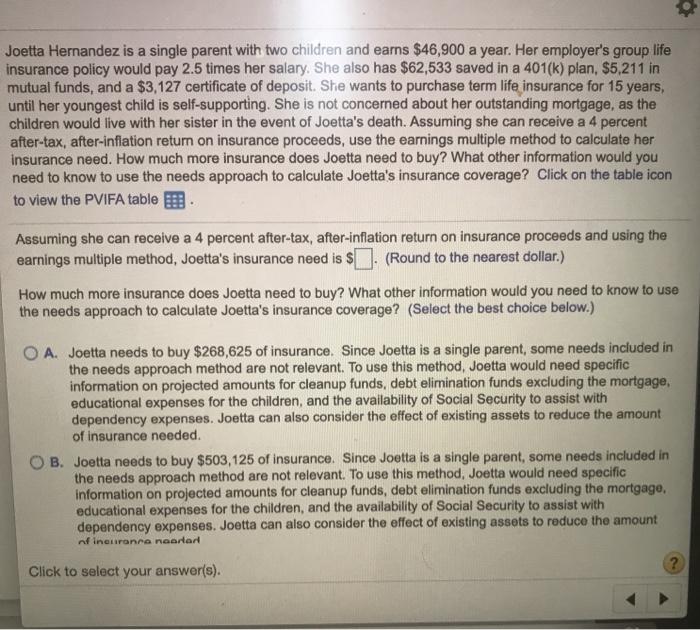

Jotta Hemandez is a single parent with two children and am 546,800 a year. Her employer's group and policy would pay 25 times her salary. She has 62.533 din 05:20 certificate of deposit. She wants to purchase orientrance for 15 years, the youngest child to supporting She not concerned about her outstanding morgos e re would be Assuming she can receive a 4 percentate tax after inflation return an insurance proceeds use the earnings multiple method to colate her hawance neod. How much more neance des jota need boy Water you need to know to use the proach to call Jotas nuance coverage? Click on the table icon to view the PFA Assuming she can receive a 4 percent after-taso infation retum on Insurance proceeds and using the coming multiple method, Jo's inace need to war How much more durante dos Jotta need to buy? What other information would you need to know to use the need approach to cal Jourance coverage OA Jout needs to buy $200.625 of race. Since Jota sa single parent, some needs included in the reeds proach method we net revent. To use the tweede om op te deanup funde, dettemination funds excluding the mortgage educational expenses for the children and the way of Social Security with dependency Jonched reduce the amount of wrance meded Ou Joe needs to buy 5503.125 of Since Jotta a single parent womends included in the neede aproach method are no meant to see hod Jouts would need to deanup fundet imination funds excluding the motor dacional expenses for the children and the availy Social Security sist with dependentemente educe the amount of insurance needed Data Table un $5,211 wo child se term er-lax, ach to ter-lax, need to below) finsurand funds exc needed Bcific informatie iso consider the acific Information Iso consider the of insuranc n funds exc ce needed n 1% 2% 1 0.990 0.980 2 1.970 1.942 3 2.941 2.884 4 3.902 3.808 5 4.853 4.713 6 5.795 5.601 7 6.728 6.472 8 7.652 7.325 9 8.566 B.162 10 9.471 8.983 11 10.368 9.787 12 11.255 10.575 13 12.134 11.348 13.004 12.106 15 13.885 12.849 16 14.718 13.578 17 15,562 14.92 18 16.398 14.092 19 17.226 15.678 20 18.046 16.351 21 18.857 17.011 22 19.680 17 658 23 20.456 18.292 Present Value of an Annuity of $1 (PVIFA) 3% 4% 5% 6% 7% 0.971 0.962 0.952 0.943 0.935 1.913 1.886 1.859 1.833 1.808 2.829 2.775 2.723 2.673 2.624 3.717 3.630 3.546 3.465 3.387 4.580 4.452 4.329 4.212 4.100 5.417 5.242 5.076 4.917 4.767 6.230 6.002 5.786 5.582 5.389 7.020 6.733 6.463 6.210 5.971 7.786 7.435 7.108 6.802 6.515 8.530 8.111 7.722 7360 7.024 9.253 8.760 8.306 7.887 7.499 9.954 9.38.5 8.883 8.384 7.943 10.635 9.986 9.394 8.653 8.358 11.296 10.563 9.899 9.295 8.745 11.938 11.118 10.380 9.712 9.108 12.581 11.652 10.838 10.106 9.447 13.166 12.166 11.274 10.477 9.783 13.754 12.659 11.690 10.828 10.059 14.324 13.134 12.085 11.158 10.336 14.877 13.590 12 462 11,470 10.594 15.415 14.029 12 821 11.784 10.836 15.937 14.451 13.163 12.042 11.061 14.857 16.444 13.489 11,272 12.303 8% 9% 10% 0.926 0.917 0.909 1.783 1.759 1.736 2.577 2.531 2.487 3.312 3.240 3.170 3.993 3.890 3.791 4.623 4.486 4355 5.206 5.033 4.888 5.747 5.535 5.335 6.247 5.995 6.759 6.710 8.418 6.145 7.139 6.805 8.495 7 536 7.161 6.814 7.904 7.487 7.103 8.244 7.786 7.367 8.559 8,061 7.600 8.851 8.313 7824 9.122 8.544 8.022 9.372 8.750 8.201 9.604 8.950 8.385 9.B 9.129 8.514 10.017 9.292 8.849 10 201 9.442 8.772 10.371 9.530 8.883 Print Done MacBook Air Joetta Hernandez is a single parent with two children and earns $46,900 a year. Her employer's group life insurance policy would pay 2.5 times her salary. She also has $62,533 saved in a 401(k) plan, $5,211 in mutual funds, and a $3,127 certificate of deposit. She wants to purchase term life insurance for 15 years, until her youngest child is self-supporting. She is not concerned about her outstanding mortgage, as the children would live with her sister in the event of Joetta's death. Assuming she can receive a 4 percent after-tax, after-inflation return on insurance proceeds, use the earnings multiple method to calculate her insurance need. How much more insurance does Joetta need to buy? What other information would you need to know to use the needs approach to calculate Joetta's insurance coverage? Click on the table icon to view the PVIFA table Assuming she can receive a 4 percent after-tax, after-inflation return on insurance proceeds and using the earnings multiple method, Joetta's insurance need is $. (Round to the nearest dollar.) How much more insurance does Joetta need to buy? What other information would you need to know to use the needs approach to calculate Joetta's insurance coverage? (Select the best choice below.) O A. Joetta needs to buy $268,625 of insurance. Since Joetta is a single parent, some needs included in the needs approach method are not relevant. To use this method, Joetta would need specific information on projected amounts for cleanup funds, debt elimination funds excluding the mortgage, educational expenses for the children, and the availability of Social Security to assist with dependency expenses. Joetta can also consider the effect of existing assets to reduce the amount of insurance needed. B. Joetta needs to buy $503,125 of insurance. Since Joetta is a single parent, some needs included in the needs approach method are not relevant. To use this method, Joetta would need specific information on projected amounts for cleanup funds, debt elimination funds excluding the mortgago, educational expenses for the children, and the availability of Social Security to assist with dependency expenses. Joetta can also consider the effect of existing assets to reduce the amount nfine ironra noorten ? Click to select your answer(s). Jotta Hemandez is a single parent with two children and am 546,800 a year. Her employer's group and policy would pay 25 times her salary. She has 62.533 din 05:20 certificate of deposit. She wants to purchase orientrance for 15 years, the youngest child to supporting She not concerned about her outstanding morgos e re would be Assuming she can receive a 4 percentate tax after inflation return an insurance proceeds use the earnings multiple method to colate her hawance neod. How much more neance des jota need boy Water you need to know to use the proach to call Jotas nuance coverage? Click on the table icon to view the PFA Assuming she can receive a 4 percent after-taso infation retum on Insurance proceeds and using the coming multiple method, Jo's inace need to war How much more durante dos Jotta need to buy? What other information would you need to know to use the need approach to cal Jourance coverage OA Jout needs to buy $200.625 of race. Since Jota sa single parent, some needs included in the reeds proach method we net revent. To use the tweede om op te deanup funde, dettemination funds excluding the mortgage educational expenses for the children and the way of Social Security with dependency Jonched reduce the amount of wrance meded Ou Joe needs to buy 5503.125 of Since Jotta a single parent womends included in the neede aproach method are no meant to see hod Jouts would need to deanup fundet imination funds excluding the motor dacional expenses for the children and the availy Social Security sist with dependentemente educe the amount of insurance needed Data Table un $5,211 wo child se term er-lax, ach to ter-lax, need to below) finsurand funds exc needed Bcific informatie iso consider the acific Information Iso consider the of insuranc n funds exc ce needed n 1% 2% 1 0.990 0.980 2 1.970 1.942 3 2.941 2.884 4 3.902 3.808 5 4.853 4.713 6 5.795 5.601 7 6.728 6.472 8 7.652 7.325 9 8.566 B.162 10 9.471 8.983 11 10.368 9.787 12 11.255 10.575 13 12.134 11.348 13.004 12.106 15 13.885 12.849 16 14.718 13.578 17 15,562 14.92 18 16.398 14.092 19 17.226 15.678 20 18.046 16.351 21 18.857 17.011 22 19.680 17 658 23 20.456 18.292 Present Value of an Annuity of $1 (PVIFA) 3% 4% 5% 6% 7% 0.971 0.962 0.952 0.943 0.935 1.913 1.886 1.859 1.833 1.808 2.829 2.775 2.723 2.673 2.624 3.717 3.630 3.546 3.465 3.387 4.580 4.452 4.329 4.212 4.100 5.417 5.242 5.076 4.917 4.767 6.230 6.002 5.786 5.582 5.389 7.020 6.733 6.463 6.210 5.971 7.786 7.435 7.108 6.802 6.515 8.530 8.111 7.722 7360 7.024 9.253 8.760 8.306 7.887 7.499 9.954 9.38.5 8.883 8.384 7.943 10.635 9.986 9.394 8.653 8.358 11.296 10.563 9.899 9.295 8.745 11.938 11.118 10.380 9.712 9.108 12.581 11.652 10.838 10.106 9.447 13.166 12.166 11.274 10.477 9.783 13.754 12.659 11.690 10.828 10.059 14.324 13.134 12.085 11.158 10.336 14.877 13.590 12 462 11,470 10.594 15.415 14.029 12 821 11.784 10.836 15.937 14.451 13.163 12.042 11.061 14.857 16.444 13.489 11,272 12.303 8% 9% 10% 0.926 0.917 0.909 1.783 1.759 1.736 2.577 2.531 2.487 3.312 3.240 3.170 3.993 3.890 3.791 4.623 4.486 4355 5.206 5.033 4.888 5.747 5.535 5.335 6.247 5.995 6.759 6.710 8.418 6.145 7.139 6.805 8.495 7 536 7.161 6.814 7.904 7.487 7.103 8.244 7.786 7.367 8.559 8,061 7.600 8.851 8.313 7824 9.122 8.544 8.022 9.372 8.750 8.201 9.604 8.950 8.385 9.B 9.129 8.514 10.017 9.292 8.849 10 201 9.442 8.772 10.371 9.530 8.883 Print Done MacBook Air Joetta Hernandez is a single parent with two children and earns $46,900 a year. Her employer's group life insurance policy would pay 2.5 times her salary. She also has $62,533 saved in a 401(k) plan, $5,211 in mutual funds, and a $3,127 certificate of deposit. She wants to purchase term life insurance for 15 years, until her youngest child is self-supporting. She is not concerned about her outstanding mortgage, as the children would live with her sister in the event of Joetta's death. Assuming she can receive a 4 percent after-tax, after-inflation return on insurance proceeds, use the earnings multiple method to calculate her insurance need. How much more insurance does Joetta need to buy? What other information would you need to know to use the needs approach to calculate Joetta's insurance coverage? Click on the table icon to view the PVIFA table Assuming she can receive a 4 percent after-tax, after-inflation return on insurance proceeds and using the earnings multiple method, Joetta's insurance need is $. (Round to the nearest dollar.) How much more insurance does Joetta need to buy? What other information would you need to know to use the needs approach to calculate Joetta's insurance coverage? (Select the best choice below.) O A. Joetta needs to buy $268,625 of insurance. Since Joetta is a single parent, some needs included in the needs approach method are not relevant. To use this method, Joetta would need specific information on projected amounts for cleanup funds, debt elimination funds excluding the mortgage, educational expenses for the children, and the availability of Social Security to assist with dependency expenses. Joetta can also consider the effect of existing assets to reduce the amount of insurance needed. B. Joetta needs to buy $503,125 of insurance. Since Joetta is a single parent, some needs included in the needs approach method are not relevant. To use this method, Joetta would need specific information on projected amounts for cleanup funds, debt elimination funds excluding the mortgago, educational expenses for the children, and the availability of Social Security to assist with dependency expenses. Joetta can also consider the effect of existing assets to reduce the amount nfine ironra noorten ? Click to select your answer(s)