Question

Journal 1: Record the adjusting entry required, if any, related to the July 31 cash balance. Journal 2: Record the adjusting entry required, if any,

Journal 1: Record the adjusting entry required, if any, related to the July 31 cash balance.

Journal 2: Record the adjusting entry required, if any, related to the outstanding checks.

Journal 3: Record the adjusting entry required, if any, related to Check No. 3056.

Journal 4: Record the adjusting entry required, if any, related to the non-interest-bearing note.

Journal 5: Record the adjusting entry required, if any, related to the NSF check.

Journal 6: Record the adjusting entry required, if any, related to bank service charges.

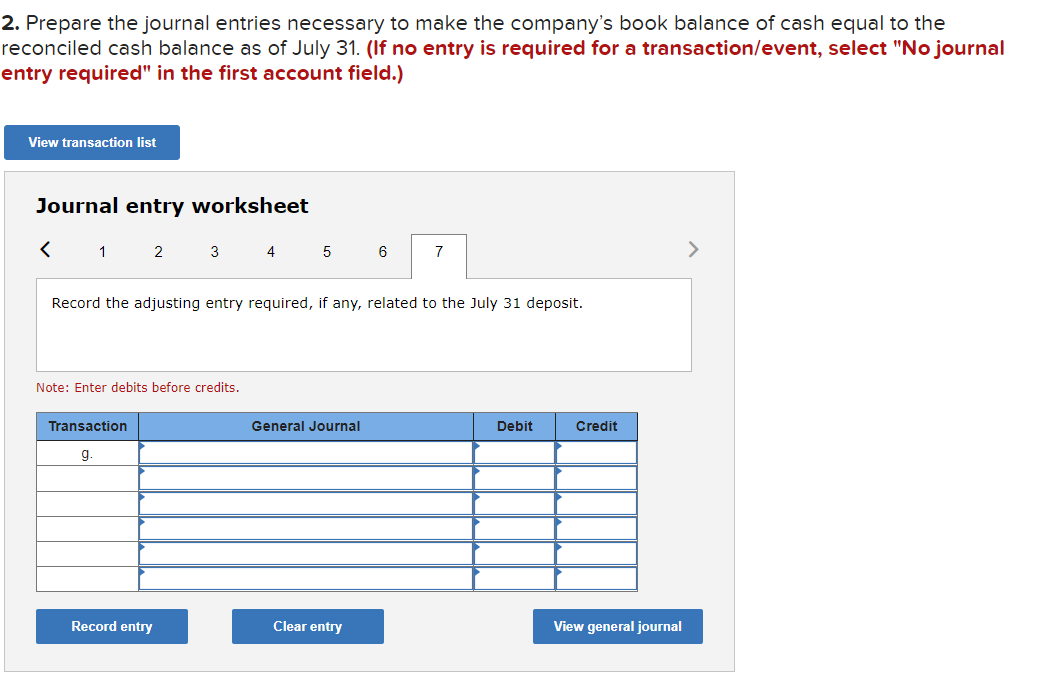

Journal 7: Record the adjusting entry required, if any, related to the July 31 deposit.

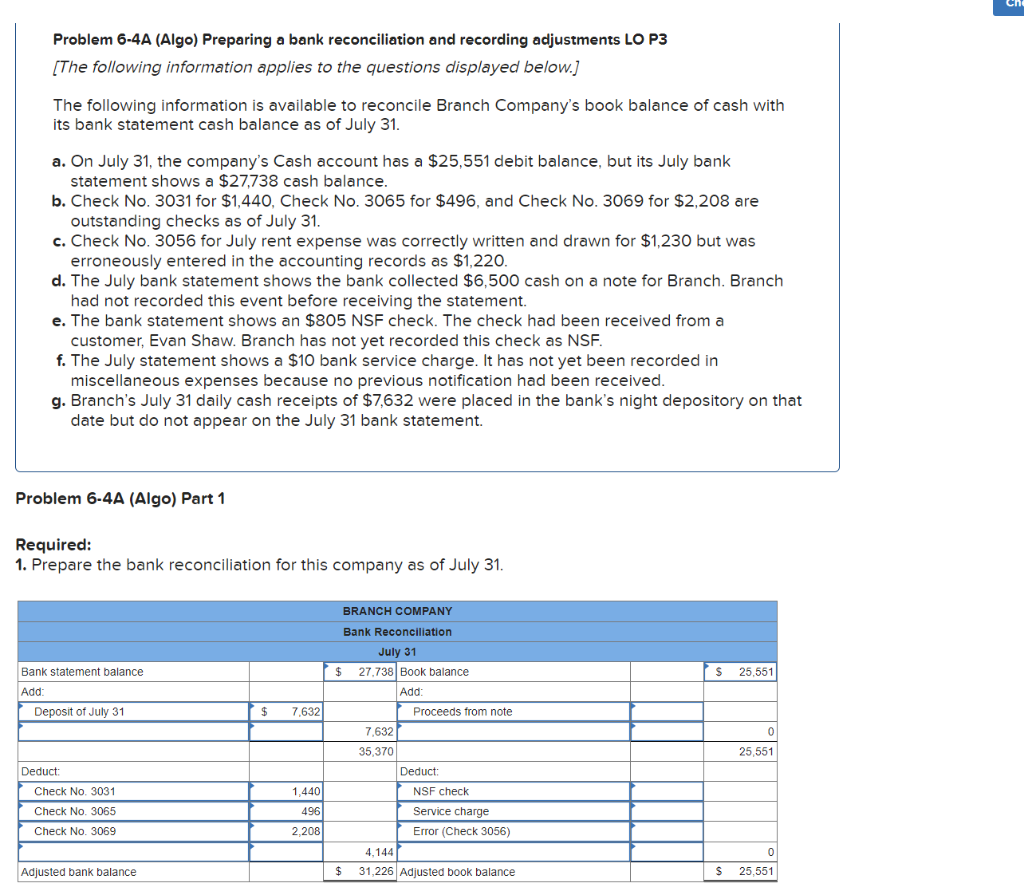

Problem 6-4A (Algo) Preparing a bank reconciliation and recording adjustments LO P3 (The following information applies to the questions displayed below.] The following information is available to reconcile Branch Company's book balance of cash with its bank statement cash balance as of July 31. a. On July 31, the company's Cash account has a $25,551 debit balance, but its July bank statement shows a $27,738 cash balance. b. Check No. 3031 for $1,440, Check No. 3065 for $496, and Check No. 3069 for $2,208 are outstanding checks as of July 31. c. Check No. 3056 for July rent expense was correctly written and drawn for $1,230 but was erroneously entered in the accounting records as $1,220. d. The July bank statement shows the bank collected $6,500 cash on a note for Branch. Branch had not recorded this event before receiving the statement. e. The bank statement shows an $805 NSF check. The check had been received from a customer, Evan Shaw. Branch has not yet recorded this check as NSF. f. The July statement shows a $10 bank service charge. It has not yet been recorded in miscellaneous expenses because no previous notification had been received. g. Branch's July 31 daily cash receipts of $7,632 were placed in the bank's night depository on that date but do not appear on the July 31 bank statement. Problem 6-4A (Algo) Part 1 Required: 1. Prepare the bank reconciliation for this company as of July 31. BRANCH COMPANY Bank Reconciliation July 31 $ $ 25.551 Bank statement balance Add: Deposit of July 31 27.738 Book balance Add: Proceeds from note $ 7,632 7.632 0 25,551 Deduct: Check No. 3031 Check No. 3065 Check No. 3069 1,440 496 2,208 35,370 Deduct: NSF check Service charge Error (Check 3056) 4,144 31,226 Adjusted book balance 0 25,551 Adjusted bank balance $ 2. Prepare the journal entries necessary to make the company's book balance of cash equal to the reconciled cash balance as of July 31. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheetStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started