Answered step by step

Verified Expert Solution

Question

1 Approved Answer

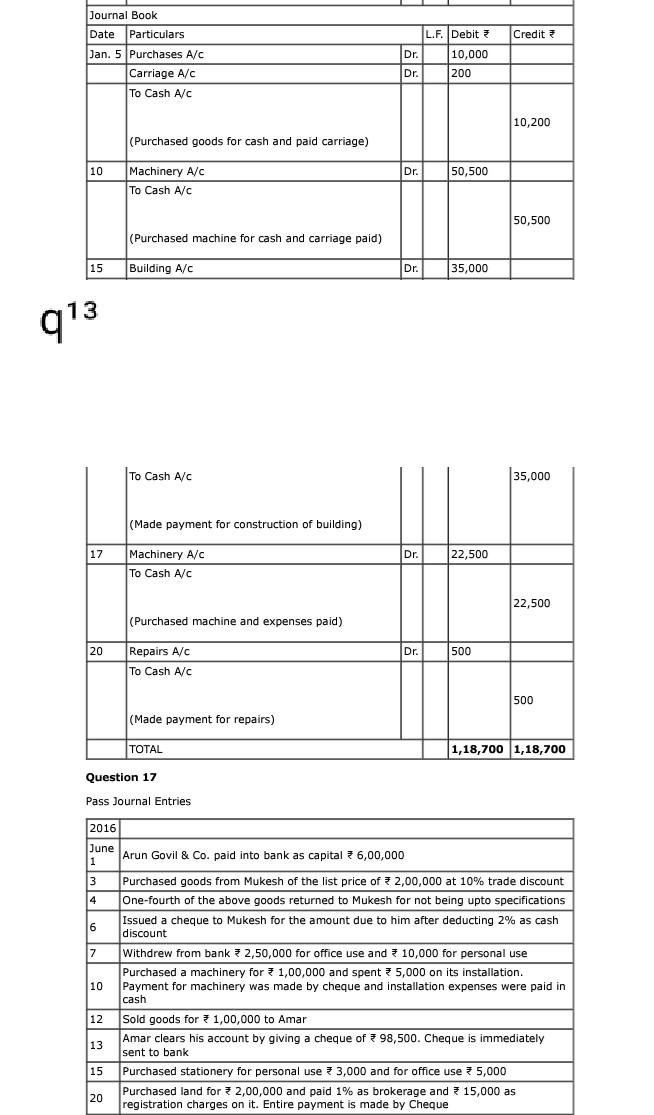

Journal Book Credit L.F. Debit 10,000 Dr. Date Particulars Jan. 5 Purchases A/C Carriage A/C To Cash A/C Dr. 200 10,200 (Purchased goods for cash

Journal Book Credit L.F. Debit 10,000 Dr. Date Particulars Jan. 5 Purchases A/C Carriage A/C To Cash A/C Dr. 200 10,200 (Purchased goods for cash and paid carriage) 10 Dr. 50,500 Machinery A/C To Cash A/C 50,500 (Purchased machine for cash and carriage paid) 15 Building A/C Dr. 35,000 913 To Cash A/C 35,000 (Made payment for construction of building) 17 Dr. 22,500 Machinery A/C To Cash A/C 22,500 (Purchased machine and expenses paid) 20 Dr. 500 Repairs A/C To Cash A/C 500 (Made payment for repairs) TOTAL 1,18,700 1,18,700 Question 17 Pass Journal Entries 4 2016 June 1 Arun Govil & Co. paid into bank as capital 36,00,000 3 Purchased goods from Mukesh of the list price of 2,00,000 at 10% trade discount One-fourth of the above goods returned to Mukesh for not being upto specifications Issued a cheque to Mukesh for the amount due to him after deducting 2% as cash 6 discount 7 Withdrew from bank 2,50,000 for office use and 10,000 for personal use Purchased a machinery for 1,00,000 and spent 5,000 on its installation. 10 Payment for machinery was made by cheque and installation expenses were paid in cash 12 Sold goods for 3 1,00,000 to Amar 13 Amar clears his account by giving a cheque of 98,500. Cheque is immediately sent to bank 15 Purchased stationery for personal use 7 3,000 and for office use * 5,000 20 Purchased land for 2,00,000 and paid 1% as brokerage and 715,000 as registration charges on it. Entire payment is made by Cheque

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started