Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Journal Entries 30 June 2020 from a to e On 1 July 2018, Mallee Ltd acquired allof the issued shares (cum div.) of Fowl Ltd

Journal Entries 30 June 2020 from a to e

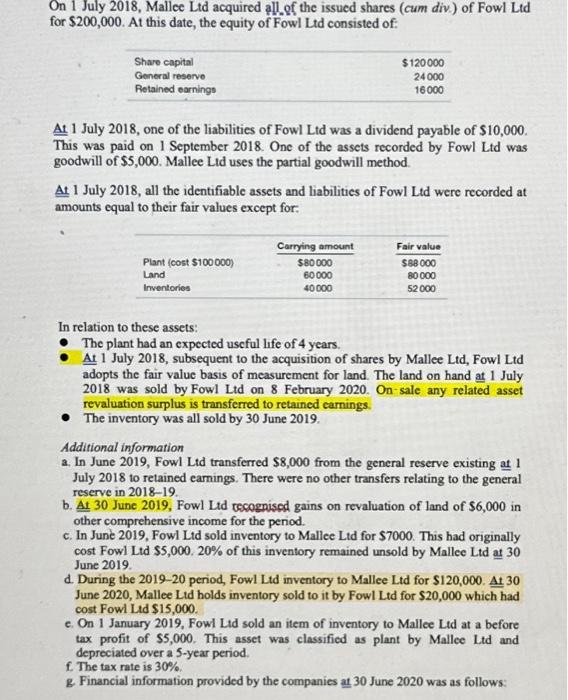

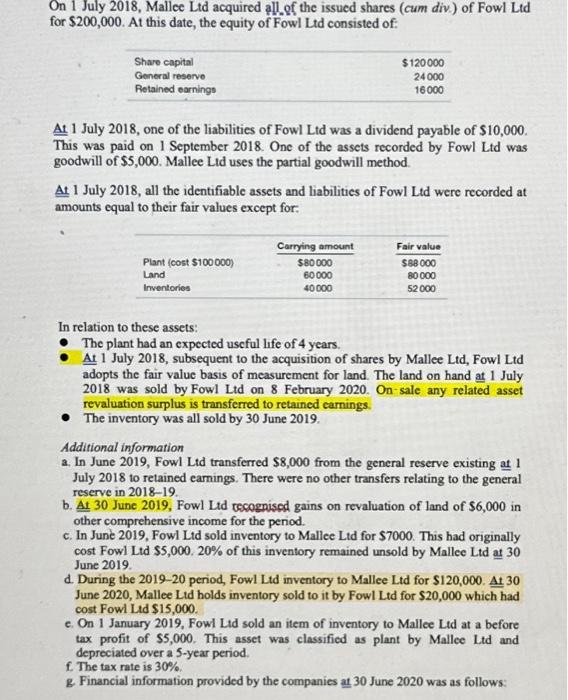

On 1 July 2018, Mallee Ltd acquired allof the issued shares (cum div.) of Fowl Ltd for $200,000. At this date, the equity of Fowl Ltd consisted of: At 1 July 2018 , one of the liabilities of Fowl Ltd was a dividend payable of $10,000. This was paid on 1 September 2018. One of the assets recorded by Fowl Ltd was goodwill of $5,000. Mallee Lid uses the partial goodwill method. At 1 July 2018 , all the identifiable assets and liabilities of Fowl Ltd were recorded at amounts equal to their fair values except for: In relation to these assets: - The plant had an expected uscful life of 4 years. - At 1 July 2018, subsequent to the acquisition of shares by Mallee Ltd, Fowl Ltd adopts the fair value basis of measurement for land. The land on hand at 1 July 2018 was sold by Fowl Ltd on 8 February 2020. On-sale any related asset revaluation surplus is transferred to retained carnings. - The inventory was all sold by 30 June 2019. Additional information a. In June 2019, Fowl Ltd transferred $8,000 from the general reserve existing at 1 July 2018 to retained earnings. There were no other transfers relating to the general reserve in 201819 b. At 30 June 2019, Fowl Ltd recognised gains on revaluation of land of $6,000 in other comprehensive income for the period. c. In June 2019. Fowi Ltd sold inventory to Mallee Ltd for $7000. This had originally cost Fowl Ltd $5,000.20% of this inventory remained unsold by Mallee Ltd at 30 June 2019. d. During the 2019-20 period, Fowl Ltd inventory to Mallee Ltd for S120,000. At 30 June 2020, Mallee Lid holds inventory sold to it by Fowl Ltd for $20,000 which had cost Fowl Lid $15,000. c. On 1 January 2019, Fowl Lid sold an item of inventory to Mallee Ltd at a before tax profit of $5,000. This asset was classified as plant by Mallee Ltd and depreciated over a 5-year period. . The tax rate is 30%. g. Financial information provided by the companies at 30 June 2020 was as follows

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started