Answered step by step

Verified Expert Solution

Question

1 Approved Answer

journal entries a-k with calculations journal entries a-k with calculations P 7-6 Workpapers (constructive retirement of bonds, intercompany sales) Financial statements for Par Corporation and

journal entries a-k with calculations

journal entries a-k with calculations

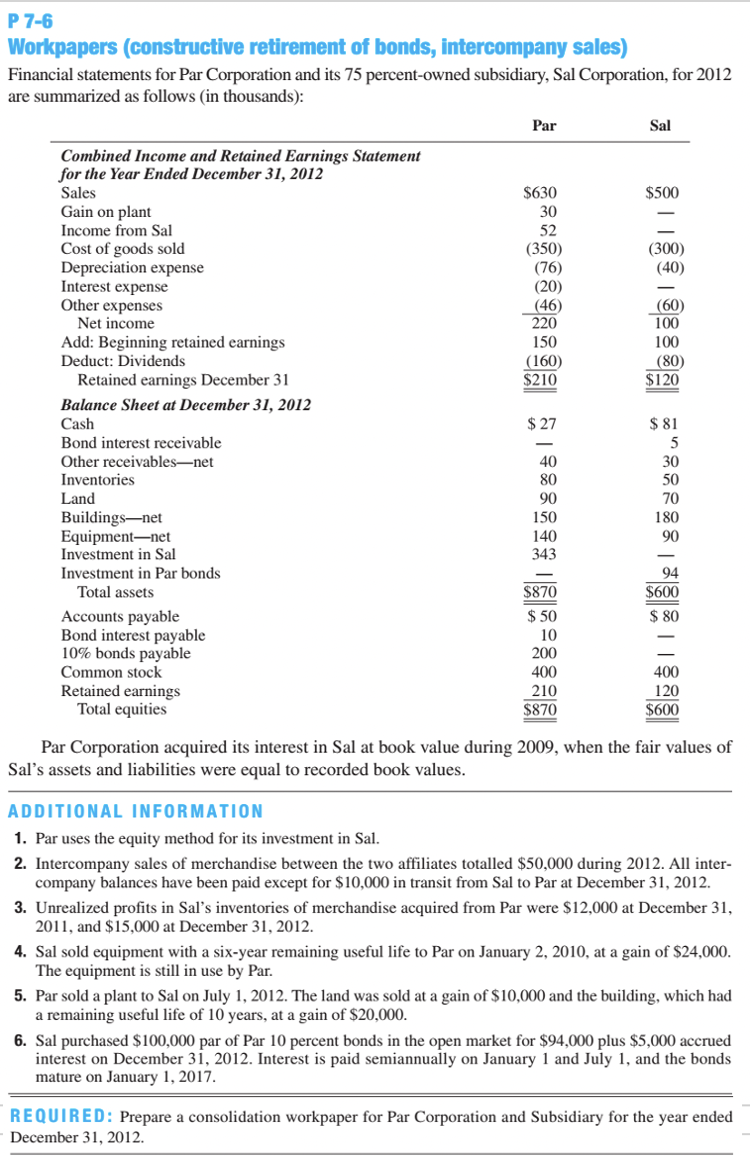

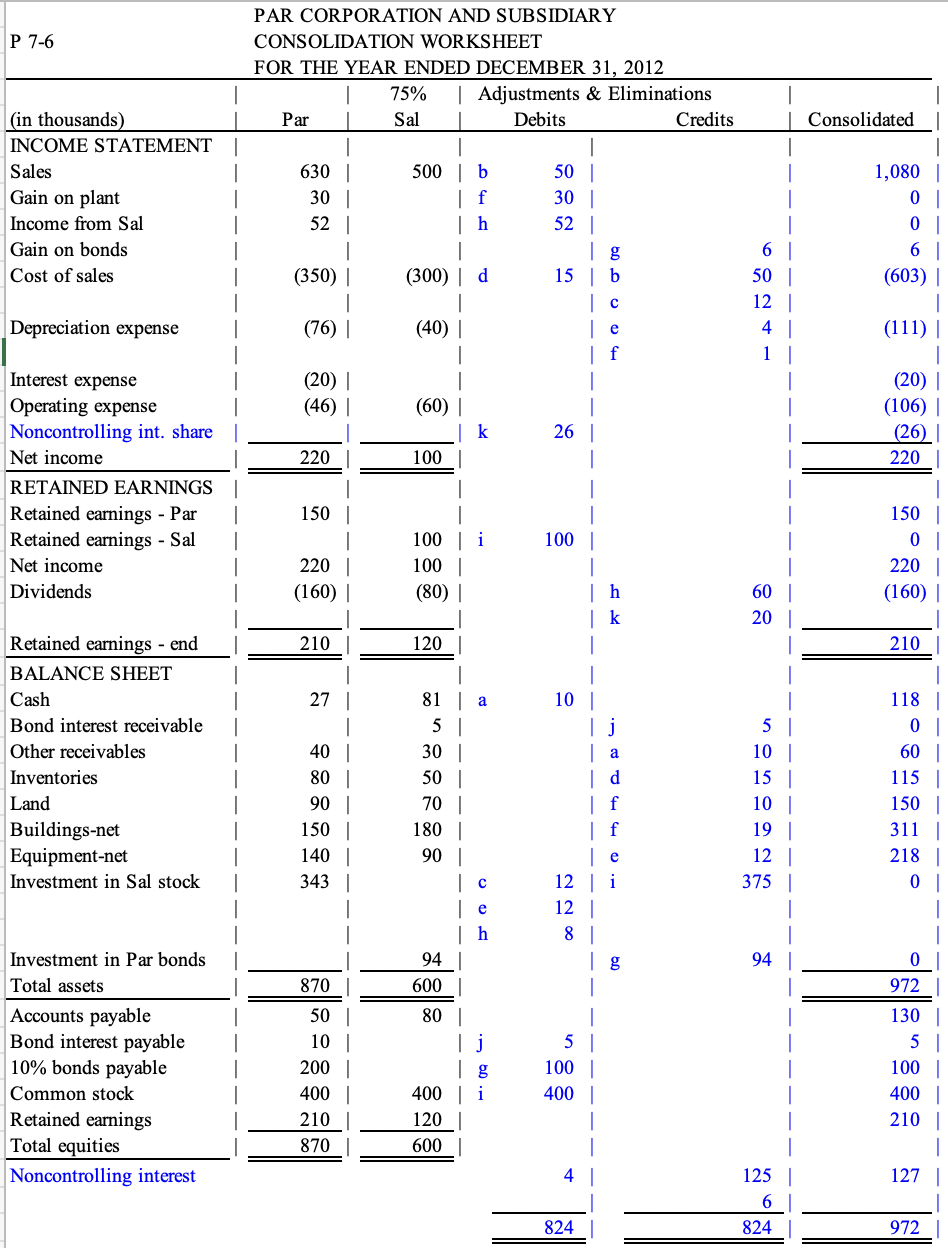

P 7-6 Workpapers (constructive retirement of bonds, intercompany sales) Financial statements for Par Corporation and its 75 percent-owned subsidiary, Sal Corporation, for 2012 are summarized as follows (in thousands): Par Sal $500 (300) (40) $630 30 52 (350) (76) (20) (46) 220 150 (160) $210 (60) 100 100 (80) $120 $ 27 Combined Income and Retained Earnings Statement for the Year Ended December 31, 2012 Sales Gain on plant Income from Sal Cost of goods sold Depreciation expense Interest expense Other expenses Net income Add: Beginning retained earnings Deduct: Dividends Retained earnings December 31 Balance Sheet at December 31, 2012 Cash Bond interest receivable Other receivables-net Inventories Land Buildings-net Equipment-net Investment in Sal Investment in Par bonds Total assets Accounts payable Bond interest payable 10% bonds payable Common stock Retained earnings Total equities 40 80 90 150 140 343 $ 81 5 30 50 70 180 90 $870 $ 50 10 94 $600 $ 80 200 400 210 $870 400 120 $600 Par Corporation acquired its interest in Sal at book value during 2009, when the fair values of Sal's assets and liabilities were equal to recorded book values. ADDITIONAL INFORMATION 1. Par uses the equity method for its investment in Sal. 2. Intercompany sales of merchandise between the two affiliates totalled $50,000 during 2012. All inter- company balances have been paid except for $10,000 in transit from Sal to Par at December 31, 2012. 3. Unrealized profits in Sal's inventories of merchandise acquired from Par were $12,000 at December 31, 2011, and $15,000 at December 31, 2012. 4. Sal sold equipment with a six-year remaining useful life to Par on January 2, 2010, at a gain of $24,000. The equipment is still in use by Par. 5. Par sold a plant to Sal on July 1, 2012. The land was sold at a gain of $10,000 and the building, which had a remaining useful life of 10 years, at a gain of $20,000. 6. Sal purchased $100,000 par of Par 10 percent bonds in the open market for $94,000 plus $5,000 accrued interest on December 31, 2012. Interest is paid semiannually on January 1 and July 1, and the bonds mature on January 1, 2017. REQUIRED: Prepare a consolidation workpaper for Par Corporation and Subsidiary for the year ended December 31, 2012. P 7-6 PAR CORPORATION AND SUBSIDIARY CONSOLIDATION WORKSHEET FOR THE YEAR ENDED DECEMBER 31, 2012 75% | Adjustments & Eliminations Par Sal Debits Credits Consolidated (in thousands) INCOME STATEMENT Sales Gain on plant Income from Sal Gain on bonds Cost of sales 6301 30 521 500 b | f | h 50 30 52 | 1,080 0 0 6 (603) | (350) (300) d 15 b I c | e 6 50 12 4 1 Depreciation expense (76) (40) (111) (20) (46) (60) (20) (106) (26) k 26 220 100 220 Interest expense Operating expense Noncontrolling int. share Net income RETAINED EARNINGS Retained earnings - Par Retained earnings - Sal Net income Dividends 150 150 i 100 0 100 100] (80) | 220 (160) 220 1 |h | k (160) | 60 20 210 120 210 27 a 10 Retained earnings - end BALANCE SHEET Cash Bond interest receivable Other receivables Inventories Land Buildings-net Equipment-net Investment in Sal stock 81 51 30 50 | 701 1801 90 Ij | a | d | f 401 80 | 901 1501 140 343 5 | 10 151 101 19 12 | 118 0 60 115 150 311 218 0 375 | e 12 | i 12 | 8 ] | e 1 h 94 94 0 870 600 | 801 Investment in Par bonds Total assets Accounts payable Bond interest payable 10% bonds payable Common stock Retained earnings Total equities Noncontrolling interest 50 101 2001 400 210 870 5 100 | 400 972 130 5 100 400 210 400 | i 120 600 4 127 125 6 824 824 972 P 7-6 Workpapers (constructive retirement of bonds, intercompany sales) Financial statements for Par Corporation and its 75 percent-owned subsidiary, Sal Corporation, for 2012 are summarized as follows (in thousands): Par Sal $500 (300) (40) $630 30 52 (350) (76) (20) (46) 220 150 (160) $210 (60) 100 100 (80) $120 $ 27 Combined Income and Retained Earnings Statement for the Year Ended December 31, 2012 Sales Gain on plant Income from Sal Cost of goods sold Depreciation expense Interest expense Other expenses Net income Add: Beginning retained earnings Deduct: Dividends Retained earnings December 31 Balance Sheet at December 31, 2012 Cash Bond interest receivable Other receivables-net Inventories Land Buildings-net Equipment-net Investment in Sal Investment in Par bonds Total assets Accounts payable Bond interest payable 10% bonds payable Common stock Retained earnings Total equities 40 80 90 150 140 343 $ 81 5 30 50 70 180 90 $870 $ 50 10 94 $600 $ 80 200 400 210 $870 400 120 $600 Par Corporation acquired its interest in Sal at book value during 2009, when the fair values of Sal's assets and liabilities were equal to recorded book values. ADDITIONAL INFORMATION 1. Par uses the equity method for its investment in Sal. 2. Intercompany sales of merchandise between the two affiliates totalled $50,000 during 2012. All inter- company balances have been paid except for $10,000 in transit from Sal to Par at December 31, 2012. 3. Unrealized profits in Sal's inventories of merchandise acquired from Par were $12,000 at December 31, 2011, and $15,000 at December 31, 2012. 4. Sal sold equipment with a six-year remaining useful life to Par on January 2, 2010, at a gain of $24,000. The equipment is still in use by Par. 5. Par sold a plant to Sal on July 1, 2012. The land was sold at a gain of $10,000 and the building, which had a remaining useful life of 10 years, at a gain of $20,000. 6. Sal purchased $100,000 par of Par 10 percent bonds in the open market for $94,000 plus $5,000 accrued interest on December 31, 2012. Interest is paid semiannually on January 1 and July 1, and the bonds mature on January 1, 2017. REQUIRED: Prepare a consolidation workpaper for Par Corporation and Subsidiary for the year ended December 31, 2012. P 7-6 PAR CORPORATION AND SUBSIDIARY CONSOLIDATION WORKSHEET FOR THE YEAR ENDED DECEMBER 31, 2012 75% | Adjustments & Eliminations Par Sal Debits Credits Consolidated (in thousands) INCOME STATEMENT Sales Gain on plant Income from Sal Gain on bonds Cost of sales 6301 30 521 500 b | f | h 50 30 52 | 1,080 0 0 6 (603) | (350) (300) d 15 b I c | e 6 50 12 4 1 Depreciation expense (76) (40) (111) (20) (46) (60) (20) (106) (26) k 26 220 100 220 Interest expense Operating expense Noncontrolling int. share Net income RETAINED EARNINGS Retained earnings - Par Retained earnings - Sal Net income Dividends 150 150 i 100 0 100 100] (80) | 220 (160) 220 1 |h | k (160) | 60 20 210 120 210 27 a 10 Retained earnings - end BALANCE SHEET Cash Bond interest receivable Other receivables Inventories Land Buildings-net Equipment-net Investment in Sal stock 81 51 30 50 | 701 1801 90 Ij | a | d | f 401 80 | 901 1501 140 343 5 | 10 151 101 19 12 | 118 0 60 115 150 311 218 0 375 | e 12 | i 12 | 8 ] | e 1 h 94 94 0 870 600 | 801 Investment in Par bonds Total assets Accounts payable Bond interest payable 10% bonds payable Common stock Retained earnings Total equities Noncontrolling interest 50 101 2001 400 210 870 5 100 | 400 972 130 5 100 400 210 400 | i 120 600 4 127 125 6 824 824 972Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started